AI-Powered Data Management and Analytics Platform for a Large Financial Holding

An AI-based Assistant and Knowledge Keeper with comprehensive knowledge of IT systems, capable of providing essential information during the development and maintenance of software products. It can answer questions about the products, monitor task and project execution, anticipate potential issues, and ensure efficient team and resource management.

About the Client

Our client is one of the largest national financial holding comprising a full-service investment bank, retail bank with more than 100 branches in more than 50 cities national-wide, private banking UHNW firm, real estate fund, asset management company and insurance company. The holding has a number of products with more than 5 million annual downloads that involve more 1500 software developers.

Project Background

To tackle these problems, the client aims to streamline their maintenance processes. They want to reduce costs significantly while ensuring that their software products remain high-quality and reliable. By improving how knowledge is shared among team members and using AI technologies, the client believes they can achieve better efficiency. This initiative is vital. It will boost their software team’s productivity. It will also ensure long-term success in maintaining their products.

After carefully evaluating several vendors, the client chose Itexus for our expertise in artificial intelligence and software development management, as well as our strong technical skills in financial analytical systems. Our proficiency in machine learning and natural language processing also caught their attention!

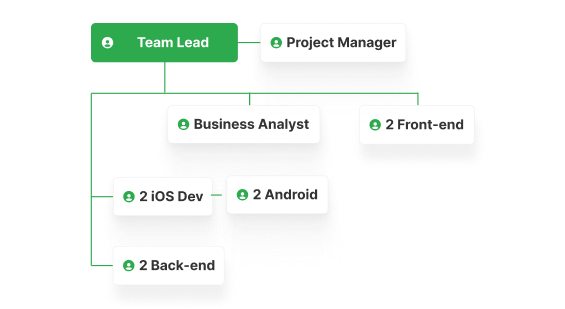

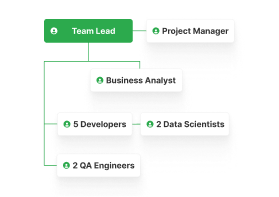

Project Team

Engagement Model

Time & Materials

Tech stack

Project Approach

Overall, the results at the client surpassed expectations. The AI Assistant spots hidden problems buried in numbers and reports. It also offers solutions.

By automating routine tasks previously managed by managers, the AI Assistant effectively reduced the workload on managers by 80%. It freed up time for strategic planning and decisions. Project management got smoother. Fewer delays. Improved team productivity.

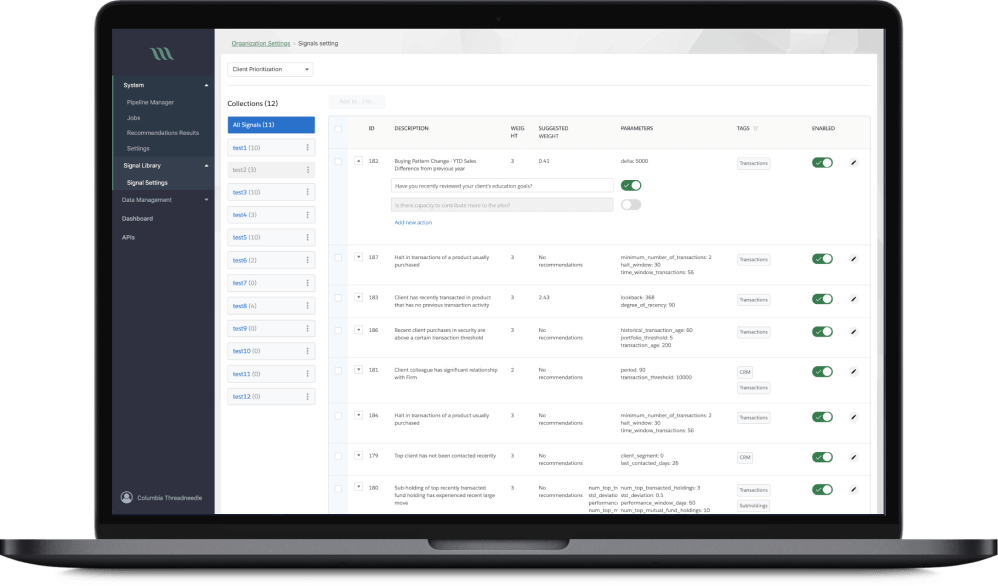

Interacting with AI-Assistant. The manager can ask questions in a free form and receive quick answers. The assistant also informs about tasks that require attention.

Third-party Integrations

The AI Assistant is integrated with a wide range of corporate platforms to ensure seamless collaboration and efficient workflow monitoring:

-

Jira – Tracks project issues, sprints, and development progress automatically, keeping stakeholders informed in real time.

-

Confluence – Monitors documentation updates and knowledge sharing, making sure no critical changes are missed.

-

GitHub – Observes code commits, pull requests, and repository activity to provide development insights and maintain code quality.

-

Slack – Sends instant alerts, summaries, and reminders directly to team channels, keeping everyone aligned and proactive.

-

Other Platforms – The system can be extended to integrate with additional tools used within the organization to ensure complete visibility across workflows.

Results

Key Achievements:

-

Removes 80% of routine tasks on control and management from the manager.

-

Identifies and shows problems that are usually hidden under many numbers and reports, and also offers options for solving them.

-

Increase productivity by 24%.

-

Reduce development costs by 19%.