Itexus delivered the app according to the requirements. The team met all development milestones and deliverables. They were efficient, friendly, and cooperative. Itexus team was very timely with updates, a regular meeting cadence, and ad-hoc questions and answers via Slack. The team was very responsive and still is.

Trading Platform Development Company

Trading platform software development services for hedge funds, brokerages, exchanges, futures commission merchants, and others.

Trading Software Solutions We Develop

From simple trading mobile apps to enterprise‑grade, AI‑powered trading platforms.

- Custom Online Trading Platforms

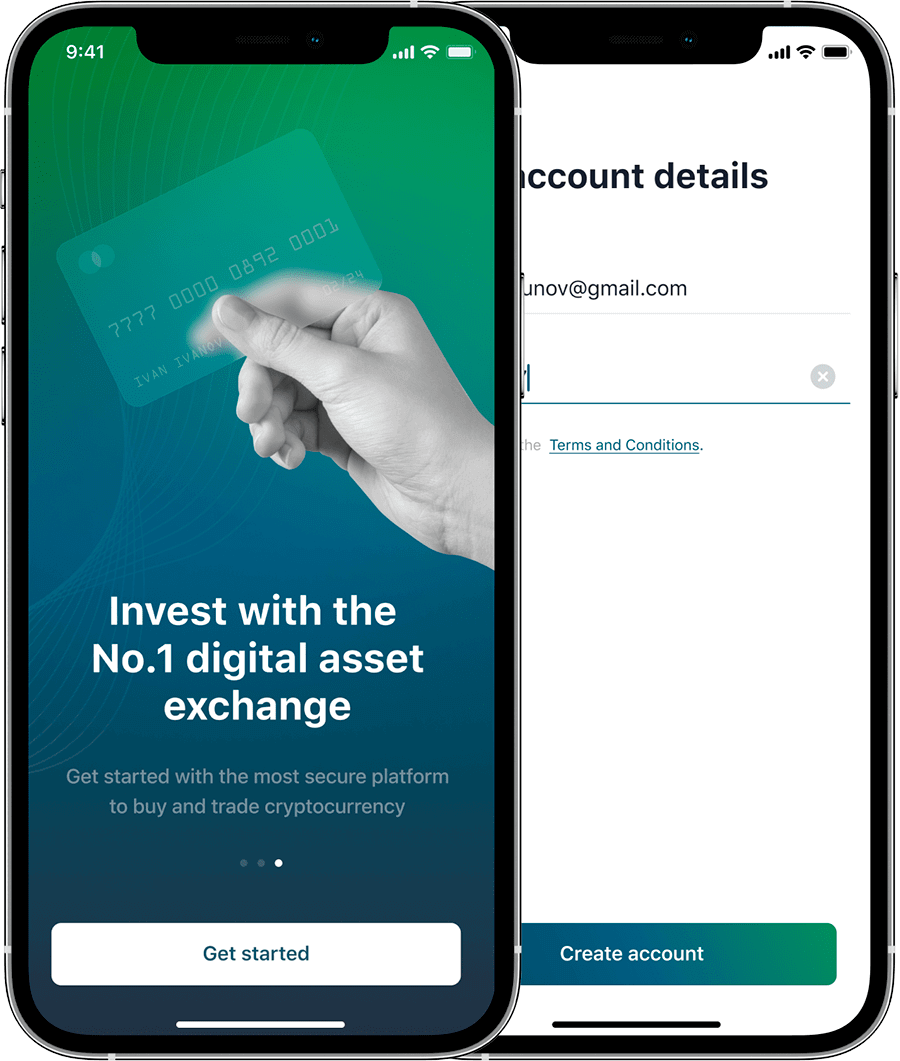

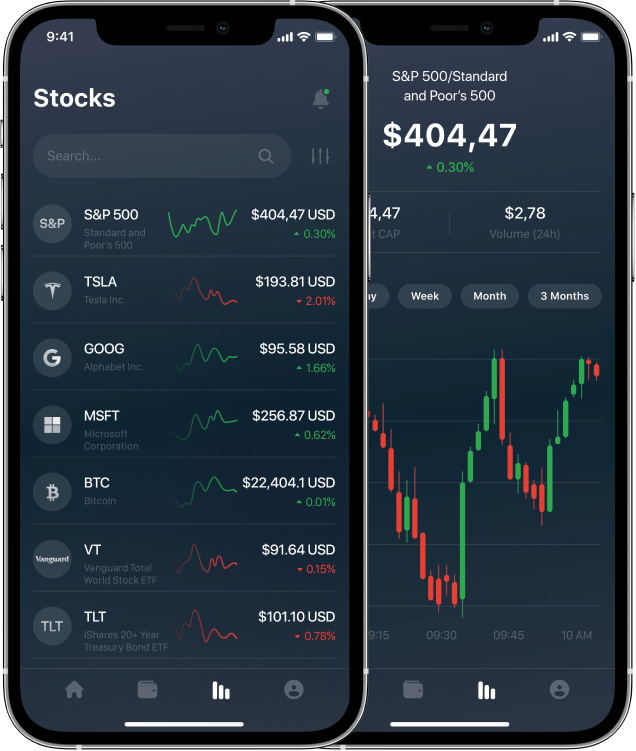

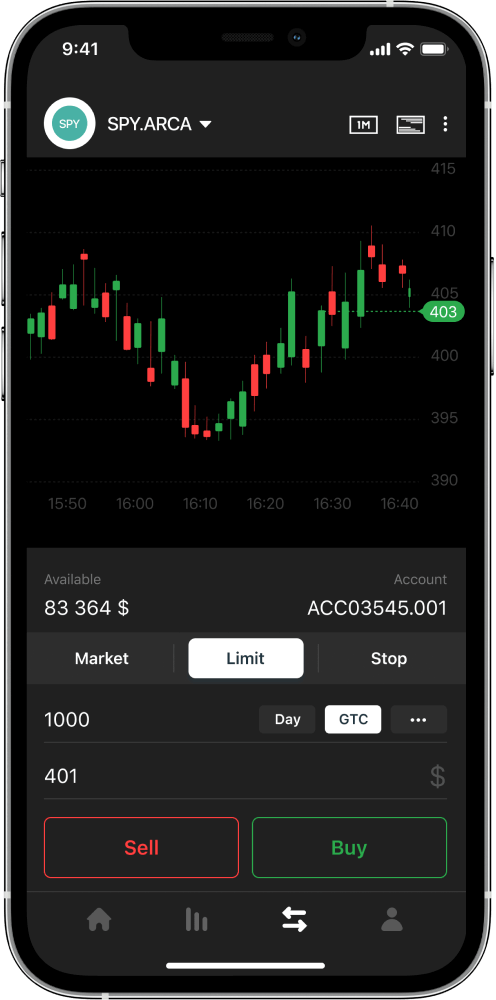

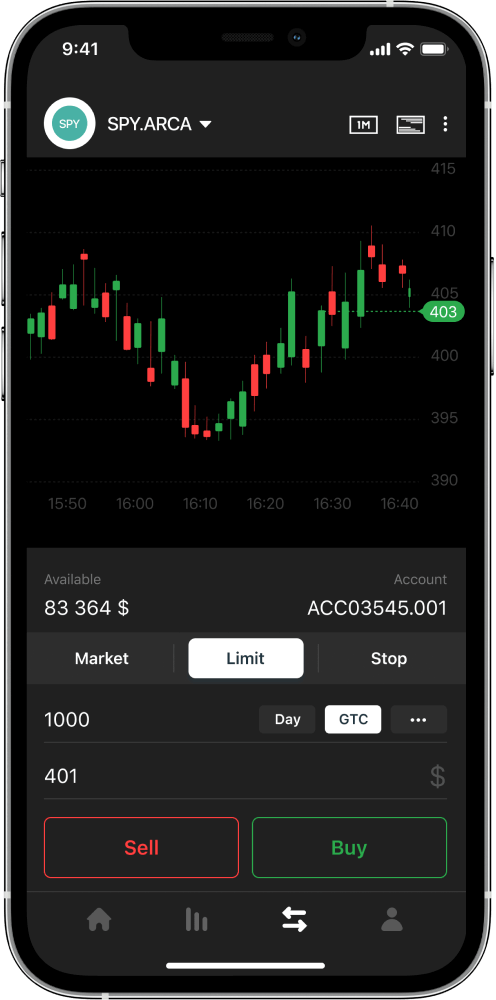

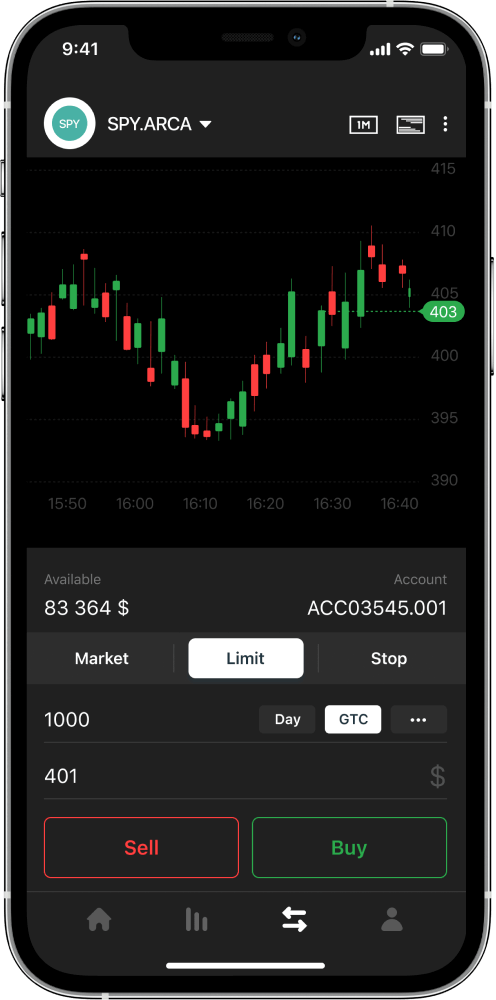

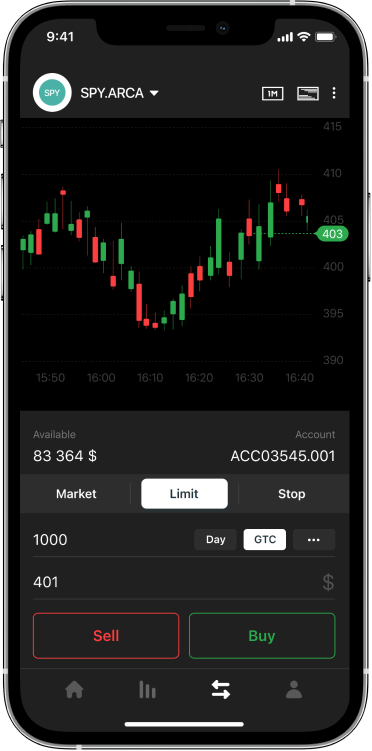

- Mobile Trading Apps

- OTC Trading Platforms

- Assets and Equities Trading Software

- High-Frequency Trading Systems

- Trading Data Analysis Solutions

- Market Monitoring Software

- Market News Tracking Software

- Trading Execution Middleware

- Liquidity Management Platforms

- Brokerage Systems

- Investment Management Front-end Systems

- Hedging Software

- Currency Exchange Software

- User Account and Role Management

- KYC/AML Compliance Modules

- Risk Management Dashboards

- Trade Surveillance Systems

- Audit Trail & Activity Logging

Must-haves for Automated Trading Platform Development

Integration With Brokers

We will help you select a suitable broker for integration based on your requirements and their data quality, latency, and API capabilities.

Trading Execution Middleware

Messaging, market data distribution, FIX, and proprietary protocols packaged together in a low-latency trading execution middleware to ensure inter-process communications between various software components in the trading chain.

Investor Interfaces

In trading software development, we prioritize creating seamless interfaces for web, mobile, and desktop platforms, delivering an intuitive and smooth experience for all users.

Trading Algorithms

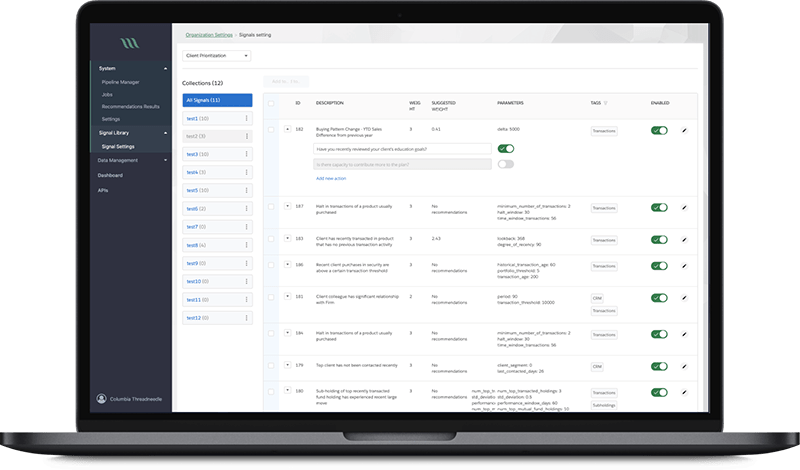

Stock trading software development is closely tightened with custom trading algorithms and strategies. We implement your trading strategy and create a convenient no-code UI-based builder for users to choose the most suitable strategies for them.

Market Data Storage

Enable users to backtest their strategies with a market database that collects market data from multiple sources via their APIs, and includes historical intraday data for global equities, futures, forex, options, cash indices and market indicators.

Other Features

Extend the functionality of the broker by implementing user portfolio management, FIX gateways, scalable and low-latency matching engine systems and other key features.

Our projects

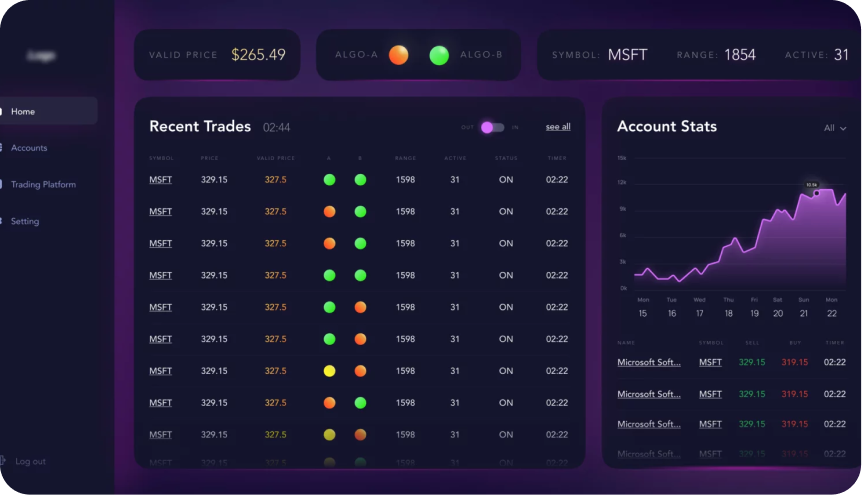

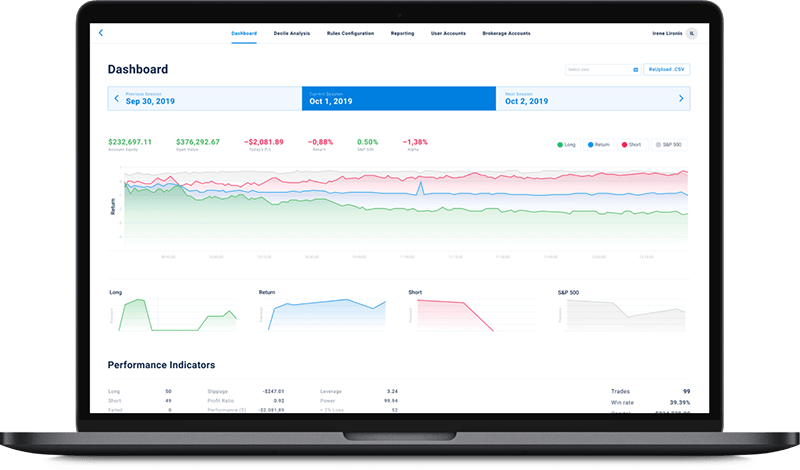

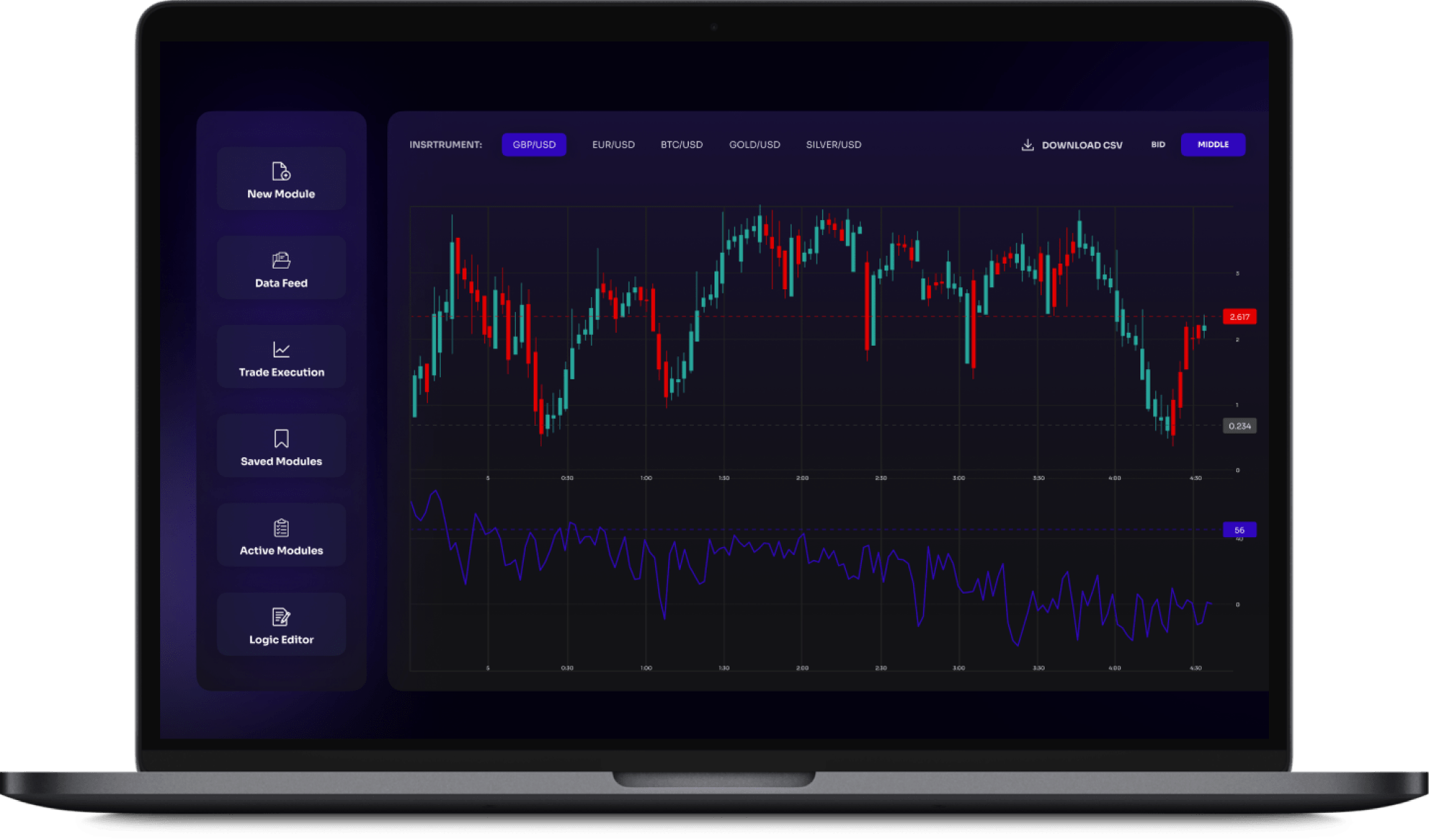

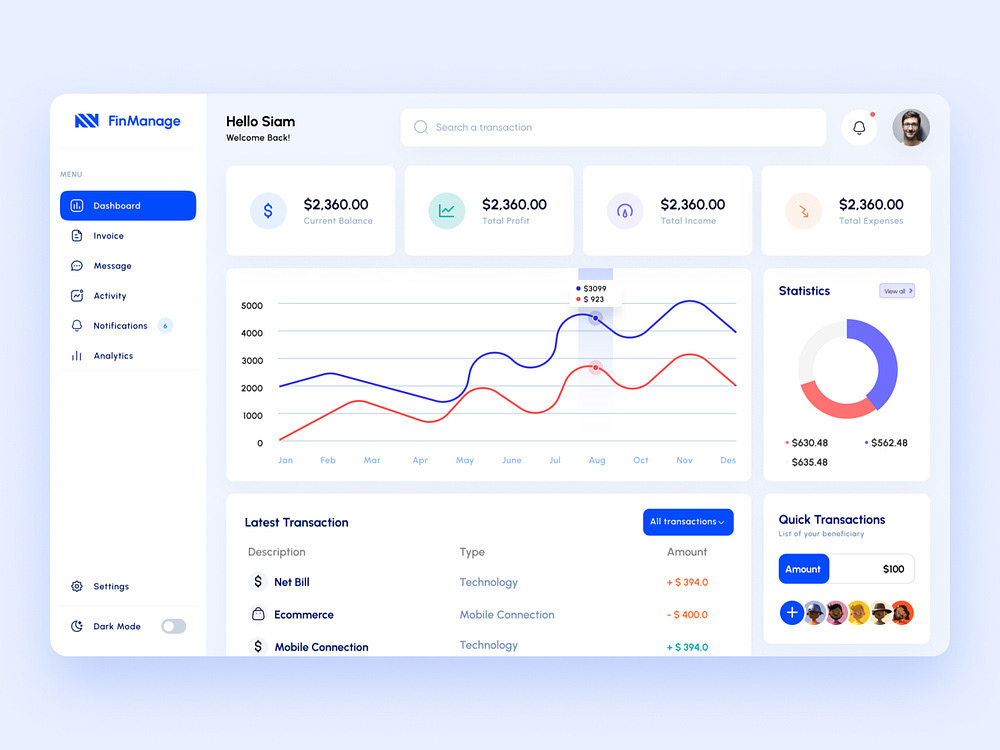

An automated, real-time trading system that allows administrators to configure trading strategies based on various technical indicators, and investors to invest their money in a selected strategy.

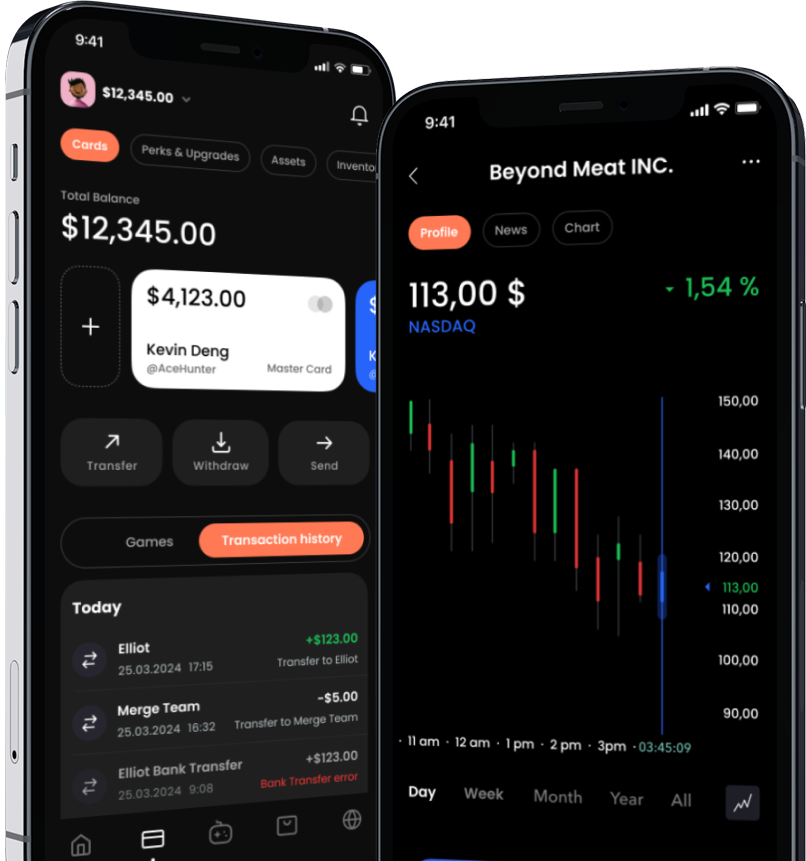

A mobile banking app that allows its users to access all banking services in a secure, convenient and fast way without having to visit bank branches.

Need to talk to a trading solution architect?

We’re here to contribute our expertise and can take over the entire project, from discovery to design, coding, and scaling.

Trading Software Development Solutions We Provide

Our backend developers design, build, and maintain the server-side code to ensure the high performance of your platform.

We develop custom trading software for web, mobile, and desktop that aligns with your business strategy and delivers a seamless experience for pro traders and investors.

We can connect your custom trading solution with exchanges, brokerages, back-office, KYC providers, payment providers, and other systems.

Programming and implementation of custom algorithmic strategies.

Comprehensive testing and building of a test automation environment to ensure the performance, stability, and security of your application.

Your trading platform is a high-load system that processes large volumes of data. To ensure that it functions normally and remains reliable, we design the platform infrastructure according to your requirements and optimize the platform’s source code, database, and I/O system.

Trading Platforms Core Features

Registration

A signup process should include KYC and bank account verification without compromising the user experience. As part of AML (Anti-Money Laundering), these procedures enable the market to remain transparent and regulated.

Onboarding

Onboarding implies that users go through another KYC process on the broker side to open an account and connect it to your system to trade assets. In this regard, user experiences vary as some brokers allow account opening via APIs while others require KYC verification. Depending on your requirements, we can implement the most suitable onboarding solution.

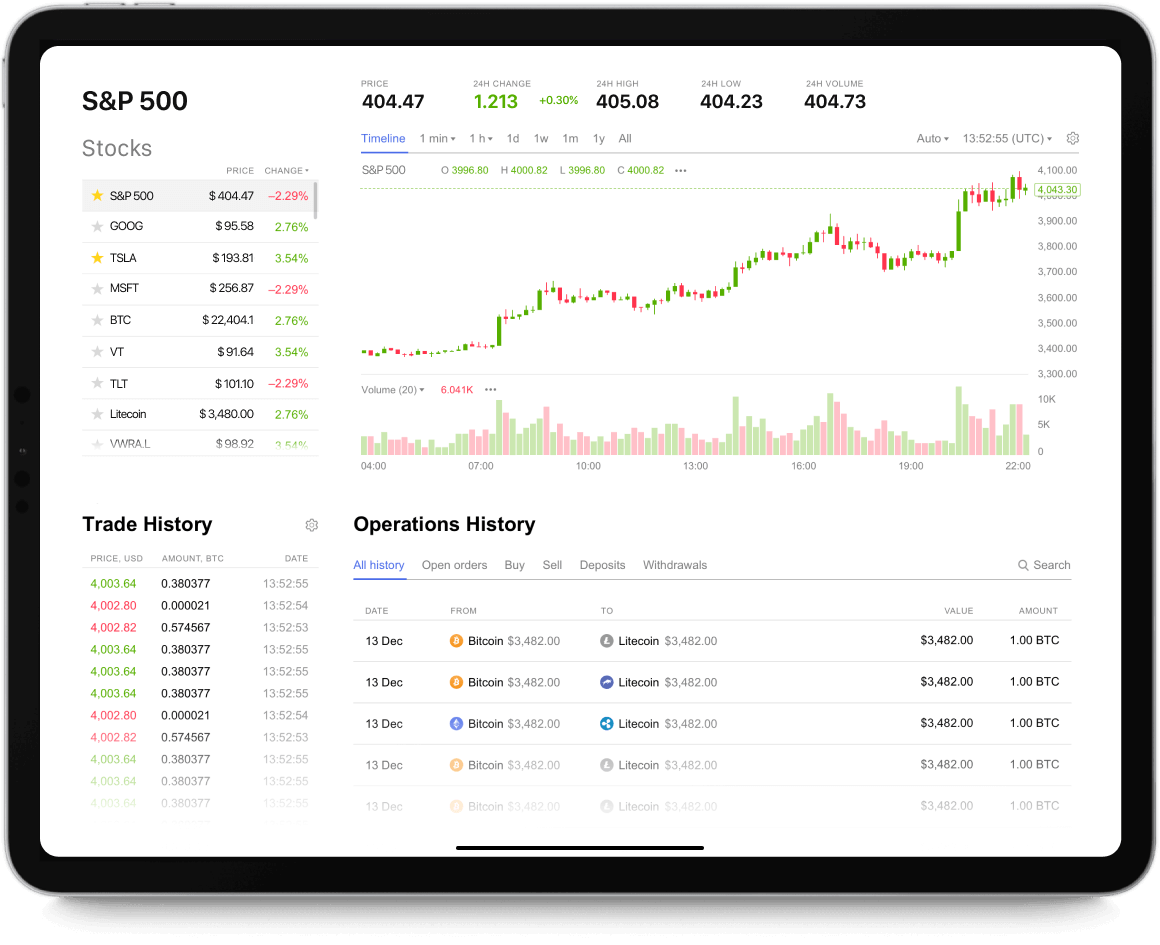

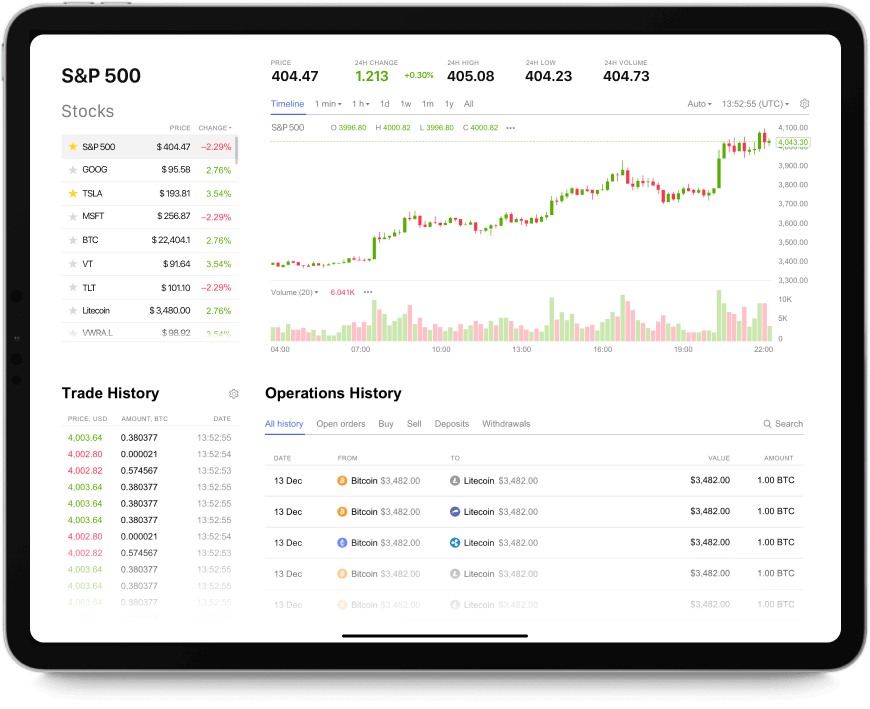

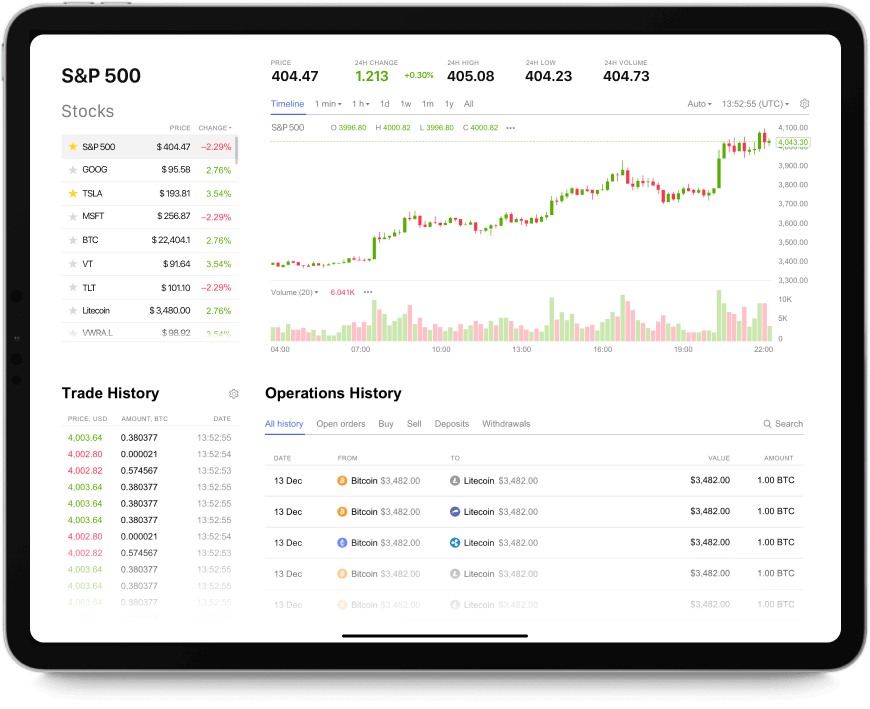

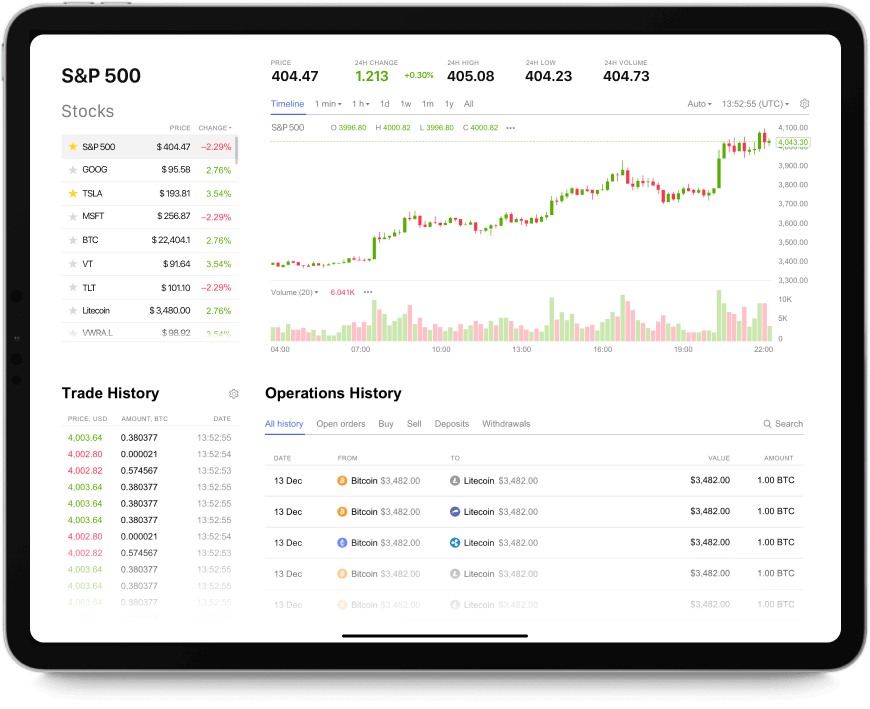

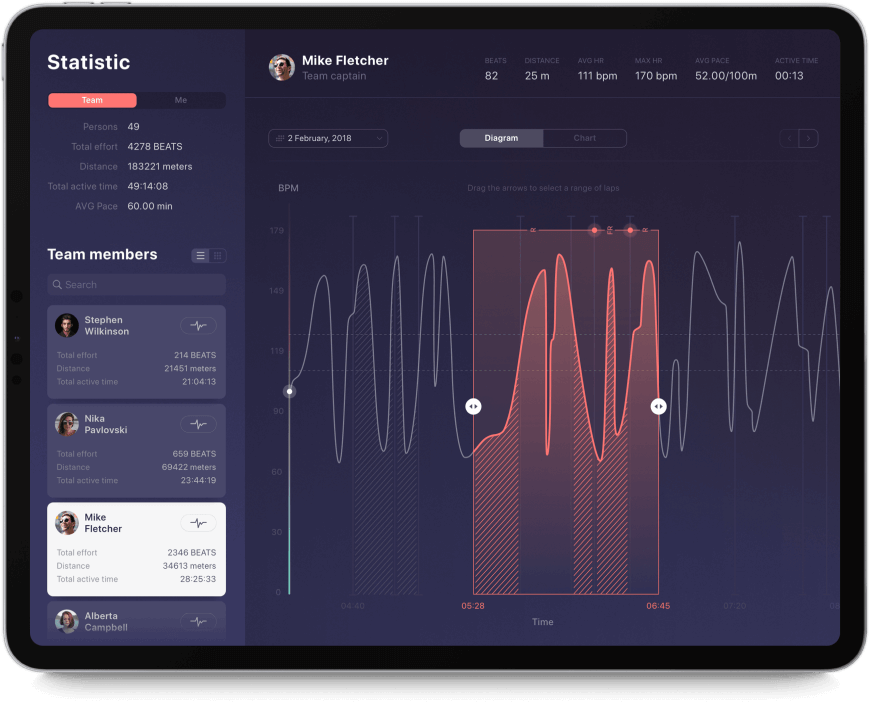

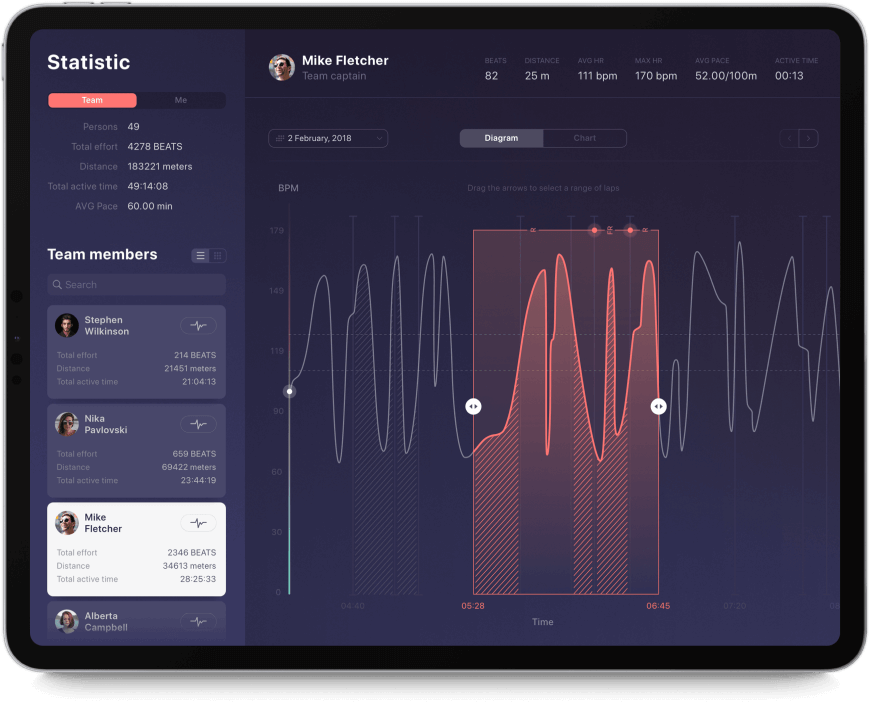

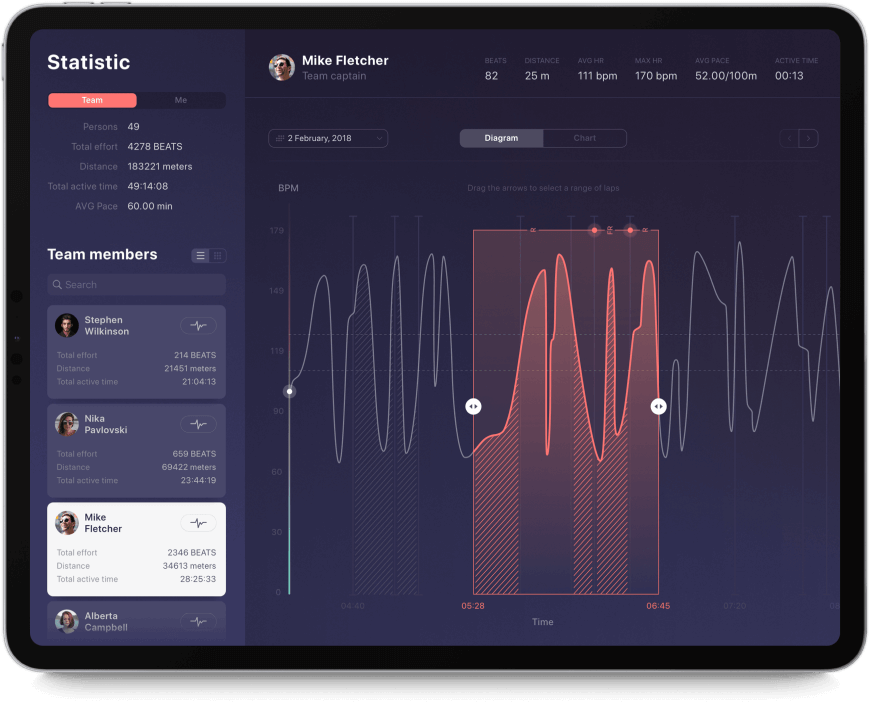

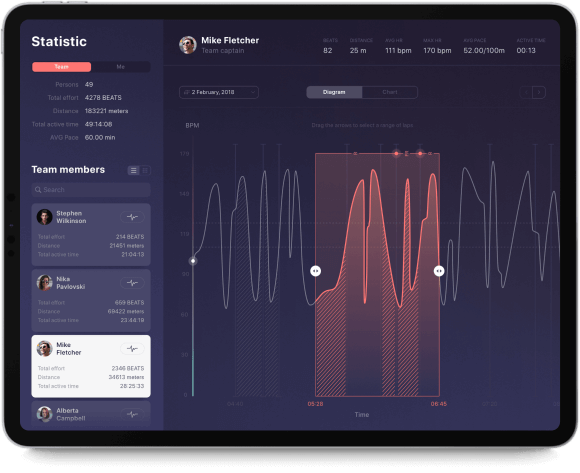

Charts Analysis and Navigation

Comprehensive and understandable charts (bar, line, and point-and-figure charts; market profiles and candlesticks) based on selected indicators with the use of technical analysis tools, help your users to make data-driven investment decisions.

Backtesting

Allows users to test and optimize strategies using historical market data before risking money on a real trade.

Analytics With Infographics

Enable users to quickly capture information, analyze trading profitability (e.g., profits and losses, return rate, various profitability indicators, cash flow statement), and adjust investment decisions.

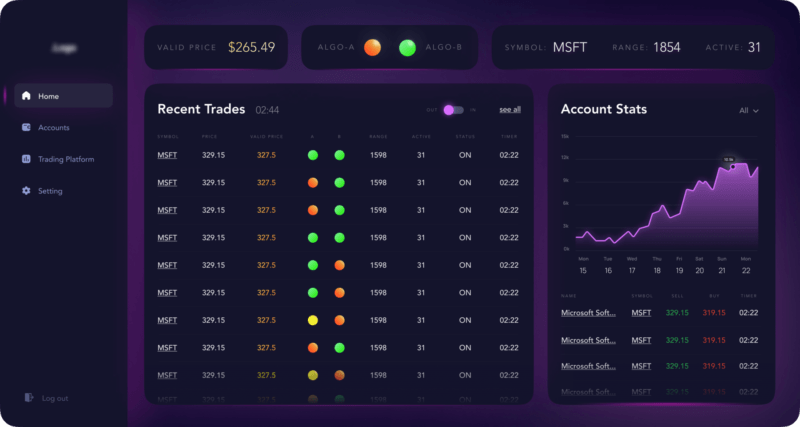

Quote Monitoring

This feature is indispensable for day traders and high-frequency traders, as it provides up-to-the-second prices for the assets they trade.

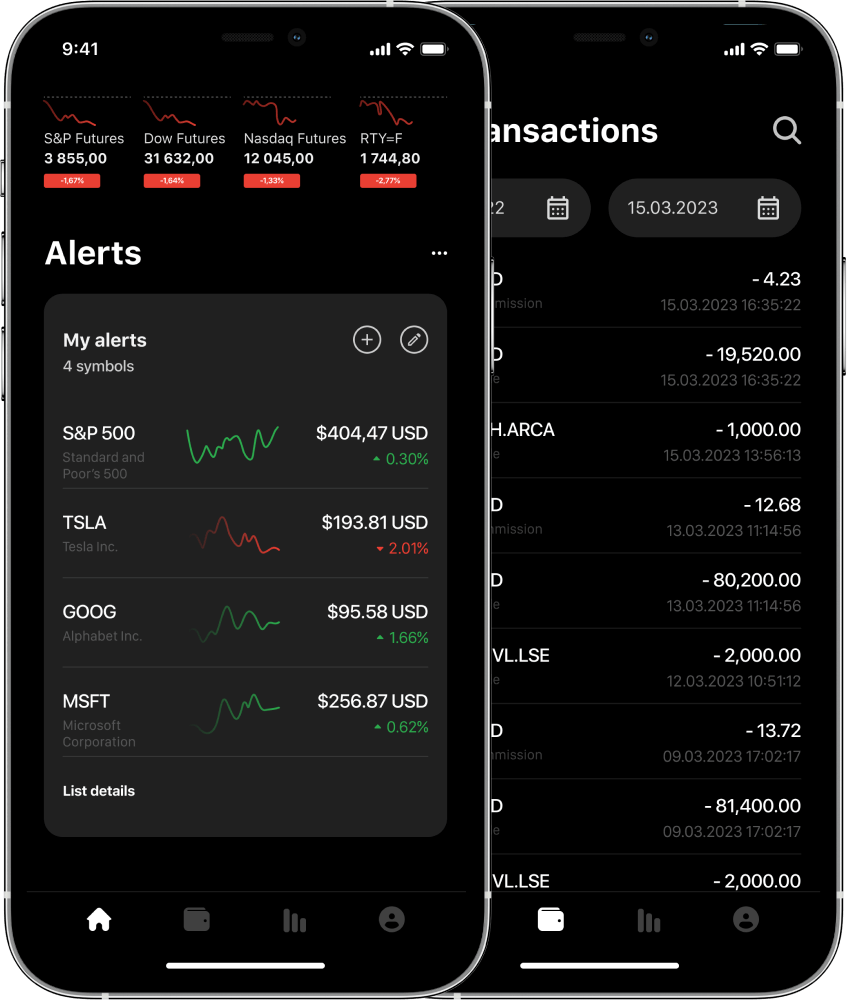

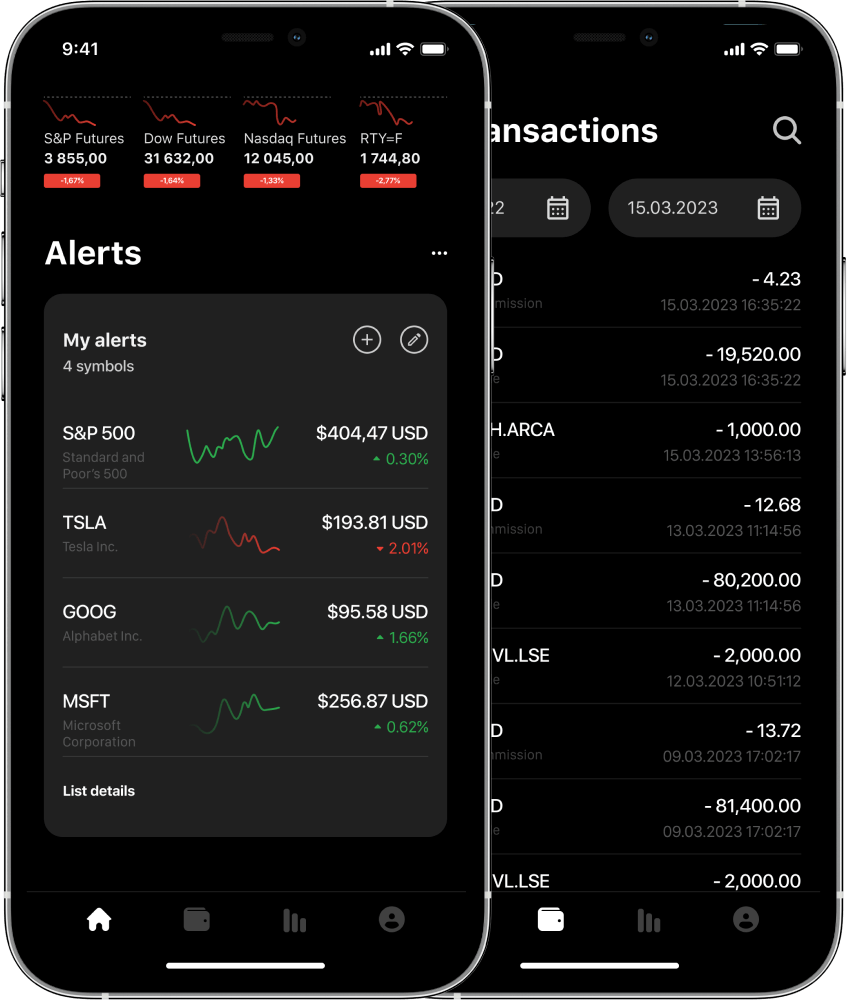

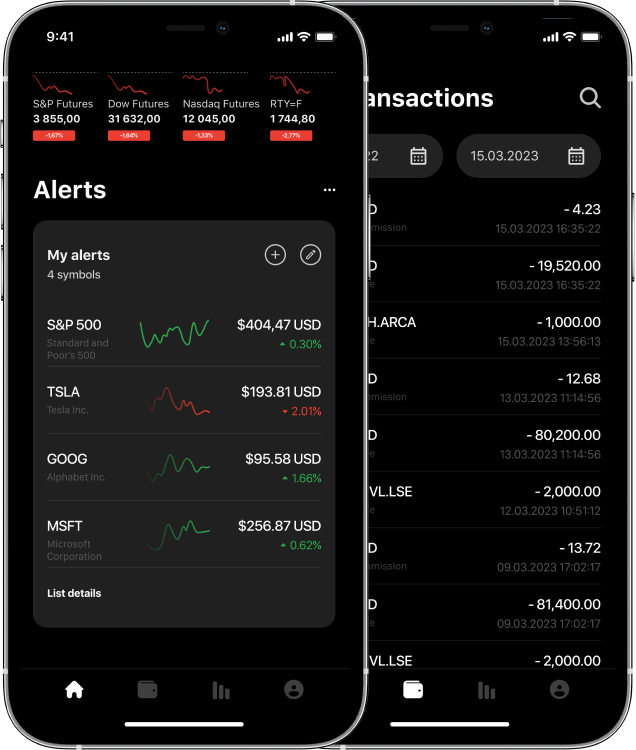

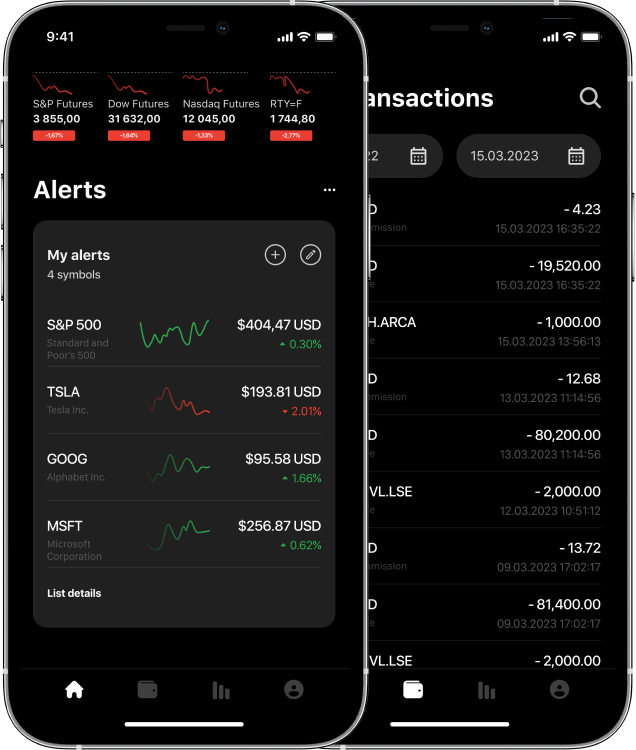

Real-Time Alerts on Changes

The fine-tuned asset alert allows users to be notified within seconds when a specific target price for one of their assets or exchange-traded funds rises or falls.

Market News

We can integrate your solution with news websites or brokerage firms to keep your users constantly updated with the latest financial news.

Trade Log

Detailed information about users’ trading histories (e.g., rules set for orders, instruments, order types, number of contracts, price, and time) makes it possible to identify mistakes and adjust strategies.

Order Management

To make the most of your trading solution, users should be able to manage order types (market, stop, limit, etc.); define quantity, leverage, time in force, and price; and execute stop-loss and take-profit strategies.

Money Deposit and Withdrawal

Linking users’ bank accounts and cards to their accounts to quickly deposit and withdraw money. We can also set up the linking of digital wallets to enable crypto transfers.

Strategy Builder

We can implement both a visual builder and a code editor so that your users can create their own strategies with different indicators and algorithms.

Paper Trading

Simulated trades under real market conditions allow users to test their strategies and practice buying and selling without risking real money.

FAQ on Trading Software Development

How much does it cost to develop a trading platform?

How long does it take to build a trading platform?

Can you create a trading platform and integrate it with a third-party service?

Do you offer support services?

Do you sign an NDA agreement?

What does trading software do?

Have you built a trading platform before?

What is the most used trading software?

I have an idea for a trading platform. Where should I start?

How to hire trading platform developers?

Clients’ Testimonials & Awards

Contact Form