Stock Trading Bot

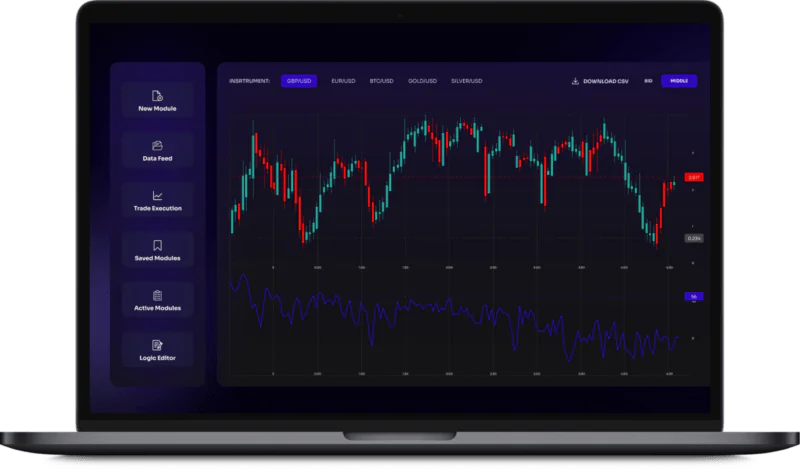

A cloud-based trading bot that automatically trades stocks per intraday scalping strategy following pre-configured buy and sell rules.

About the client

Our client is an investment company that specializes in active stock trading.

Client's request

The client requested the implementation of a trading bot to automate one of their proprietary stock trading strategies. The strategy is based on the scalping style, which focuses on profiting off of small price changes and making fast profits from reselling.

Engagement model

Time & Materials

Effort and duration

3 months

Solution

Stock Trading Bot

Project team

1 Tech Lead, 1 Developer, 1 Project Manager, 1 Business Analyst, 1 QA Engineer

Tech stack / Platforms

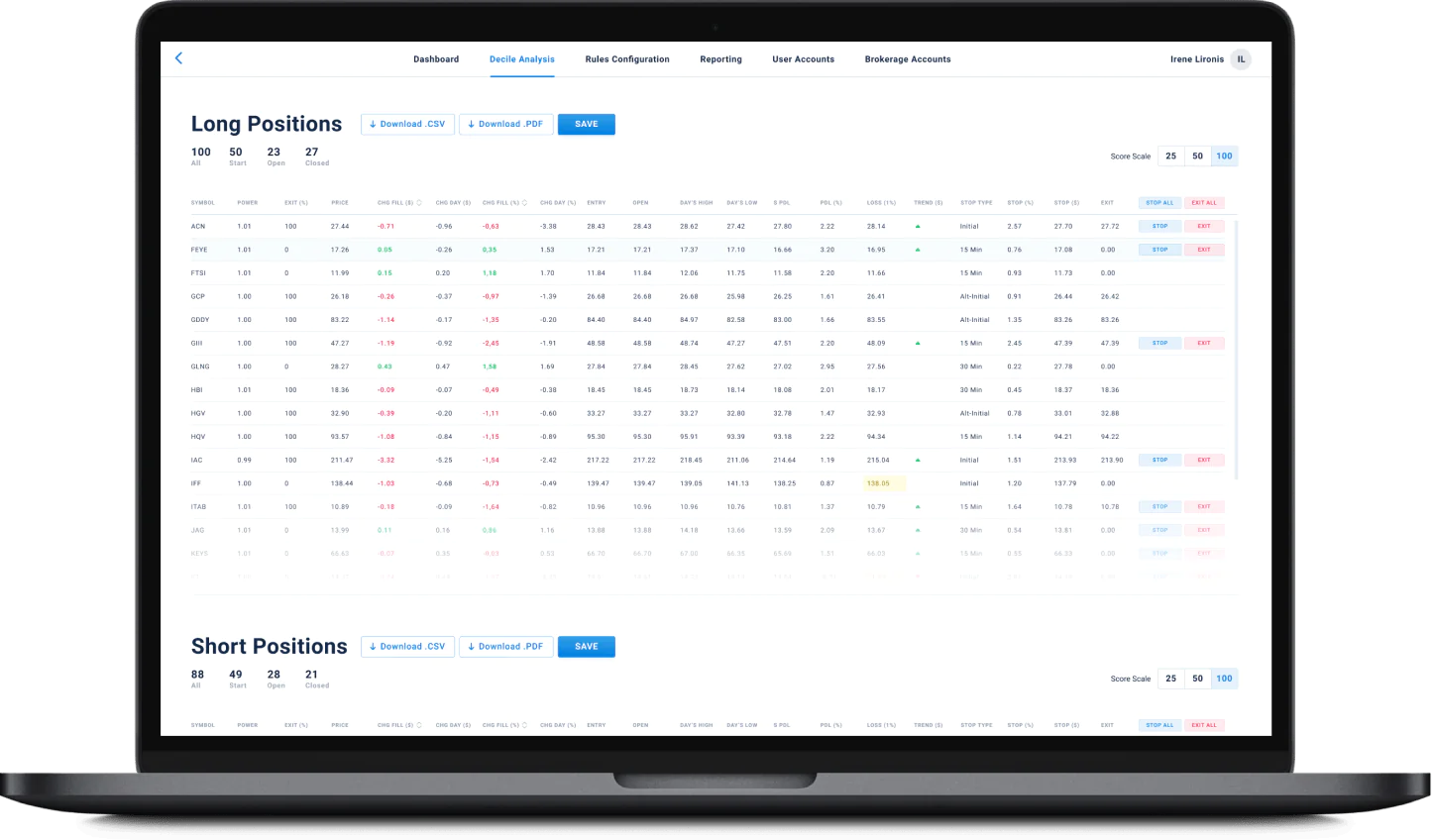

Solution overview

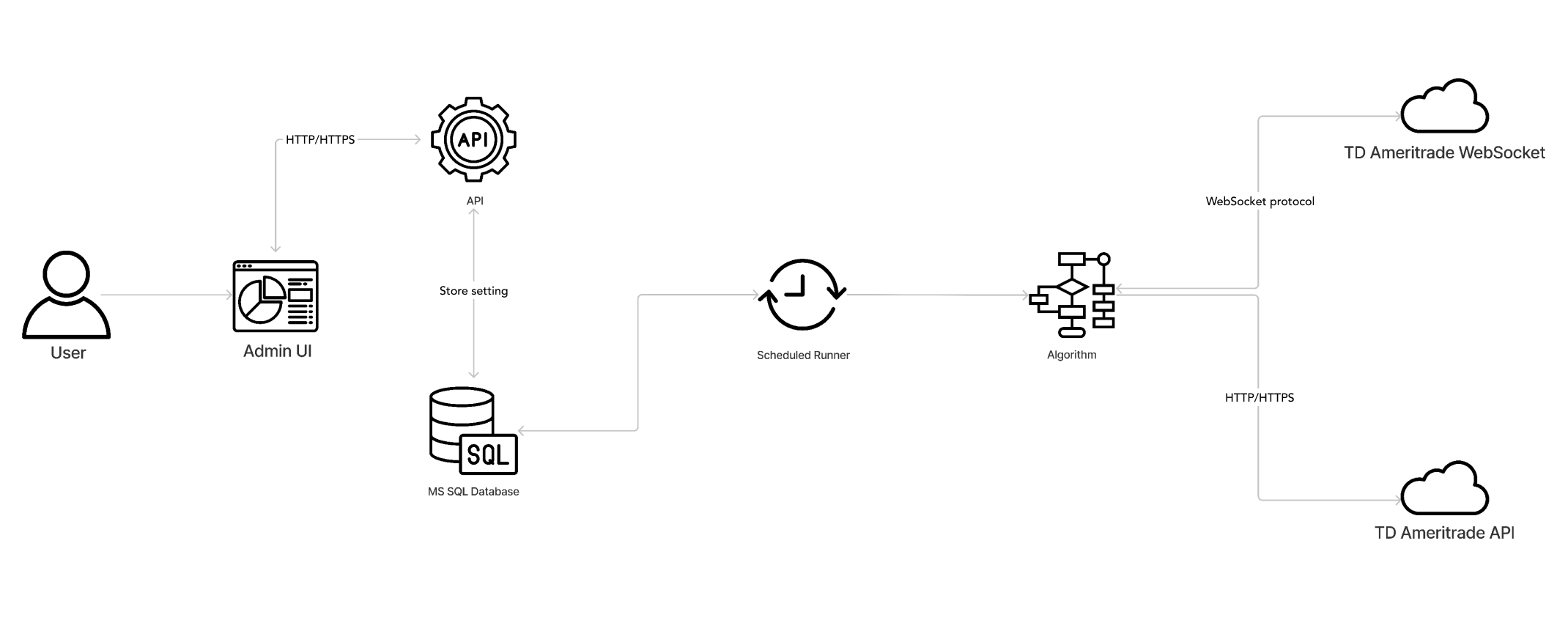

The bot is a cloud-based application connected to a brokerage account via an API. It automates stock trading by executing trades, based on preset requirements such as a stock’s price, time of day, past trades that week, and technical indicators such as RSI (Relative Strength Index). The bot tracks stocks throughout the day, looking for indicators that signal when it should buy. Once the preset buy parameters are met, the bot executes the trade. Likewise, once all the sell parameters are met, the bot executes the sell order.

Functional modules

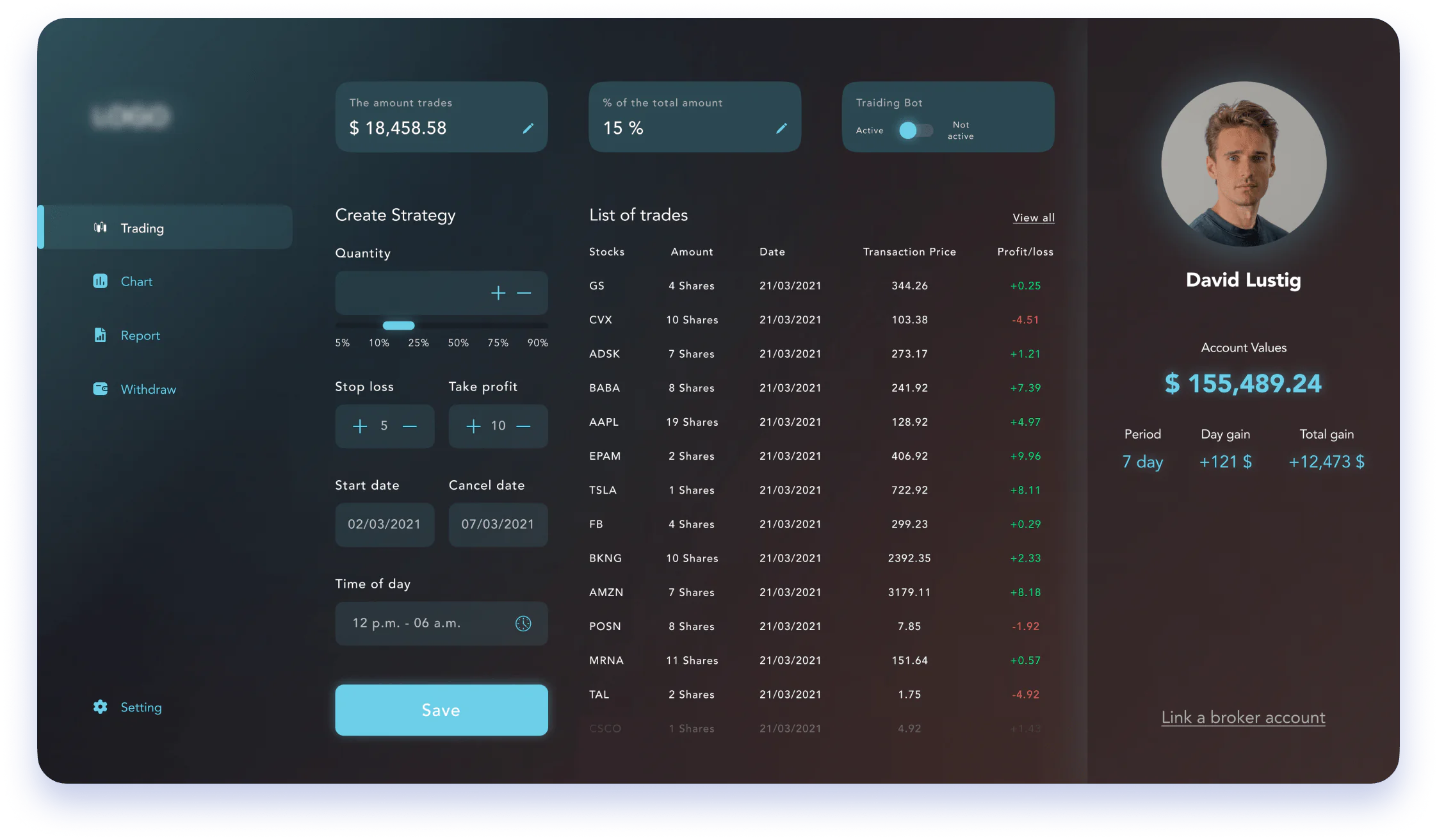

The trading bot consists of two components:

- The trading algorithm, which is responsible for buying and selling stocks based on the preset rules;

- The admin part, which allows the user to manage risk by controlling the bot: starting and stopping it, changing the amount the bot trades, and adjusting the parameters of the trading strategy, such as indicators’ parameters, risk management, and leverage.

The administration part of the system allows users to:

- link a broker account to the profile

- start bot

- stop bot

- set the percentage of account amount the bot can trade

- adjust the parameters of the trading strategy in the admin panel

- create joint trading accounts to trade on the principle of mutual funds

Third-party integrations

Project approach

On this project, we applied modern agile development practices, with frequent deliveries, full transparency, and close collaboration with the client on a daily basis – Itexus’ standard approach to project delivery. Every two weeks, the team delivered and demonstrated results and provided reports on costs, to ensure that the client only paid for what they got. This approach afforded us the flexibility to adjust the scope of the project and functionality as new ideas inevitably emerged following the project start.

Technical solution highlights

Initially, the client wanted the bot to trade within the Thinkorswim desktop app. But this approach presented a critical challenge – a trading bot created as part of a desktop trading app only trades when the app is running. It also requires a stable internet connection for the bot to work. In response, we suggested a more advanced solution: a cloud-based bot with a simple web admin panel. A cloud-based bot connected to a broker via an API will work 24/7, provided that a stable Internet connection is guaranteed and the bot is hosted in a well-managed, secure data center. We used the .NET Core framework as the main technology for this project because it is a mature, stable, and secure open-source enterprise technology. It has a large community and is widely used for enterprise fintech solutions. Furthermore, it provides the means to quickly deploy robust, secure, and high-performance applications by reusing many existing components and mechanisms for authentication, authorization, data protection, and attack prevention.

Project challenges

When it comes to a scalping strategy, order execution speed is critical. For our client, it was extremely important that the bot could instantly place orders. At the same time, intraday trading is all about building up small profits through many trades throughout the day, rather than making a large profit in one fell swoop. This means that the profit from a trade can sometimes be less than the broker’s commission for the order execution. Given this environment, it was crucial to choose a broker that would allow our bot to place orders immediately and charge low commissions for order execution that would allow intraday trading to remain profitable. After thorough market research, we decided to go with the TD Ameritrade platform, one of the leading market brokers. The platform provides good connectivity (APIs), allows trading with all required instruments, and offers commission-free trading plans.

Results

It took only 10 weeks to implement and launch the trading bot, which allowed our client to automate the strategy and increase trading profits. Thanks to our extensive experience in developing fintech software, particularly trading solutions, we were also able to provide the client with improvements to their trading strategy that further helped maximize profits and manage risk. Need to automate your strategy or want to develop a trading bot? Our experts would be happy to help. Contact us to discuss your project details and get started.

Related Projects

All ProjectsFinancial Data Analytical Platform for one of top 15 Largest Asset Management

Financial Data Analytical Platform for one of top 15 Largest Asset Management

- Fintech

- Enterprise

- ML/AI

- Project Audit and Rescue

AI-based data analytical platform for wealth advisers and fund distributors that analyzes clients’ stock portfolios, transactions, quantitative market data, and uses NLP to process text data such as market news, research, CRM notes to generate personalized investment insights and recommendations.

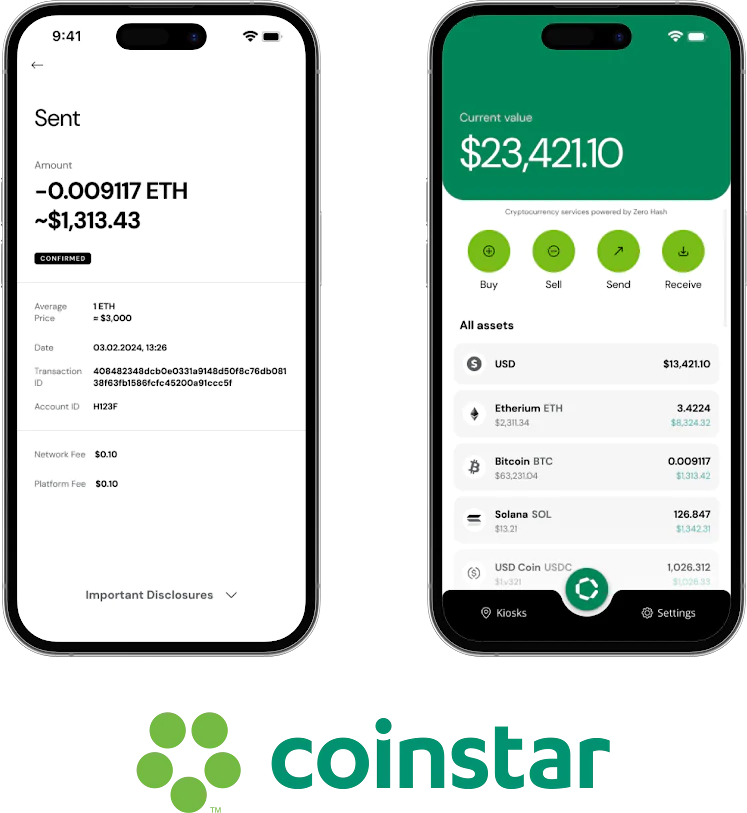

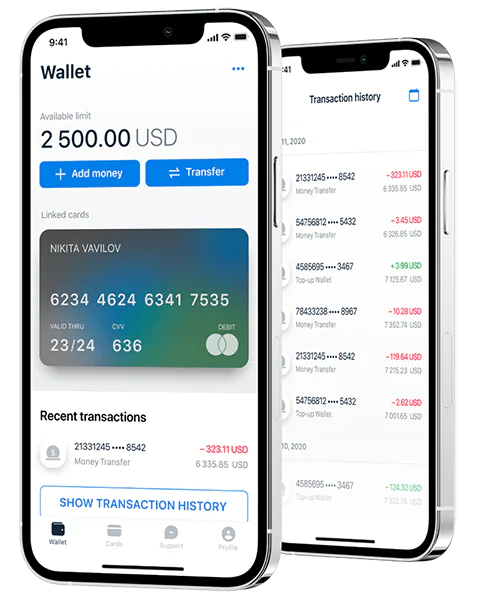

Mobile E-Wallet Application

App for Getting Instant Loans / Online Lending Platform for Small Businesses

App for Getting Instant Loans / Online Lending Platform for Small Businesses

- Fintech

- ML/AI

- Credit Scoring

Digital lending platform with a mobile app client fully automating the loan process from origination, online loan application, KYC, credit scoring, underwriting, payments, reporting, and bad deal management. Featuring a custom AI analytics & scoring engine, virtual credit cards, and integration with major credit reporting agencies and a bank accounts aggregation platform.

Contact Form

Drop us a line and we’ll get back to you shortly.

For Quick Inquiries

Offices

8, The Green, STE road, Dover, DE 19901

Żurawia 6/12/lok 766, 00-503 Warszawa, Poland