Mobile Banking App for Migrants

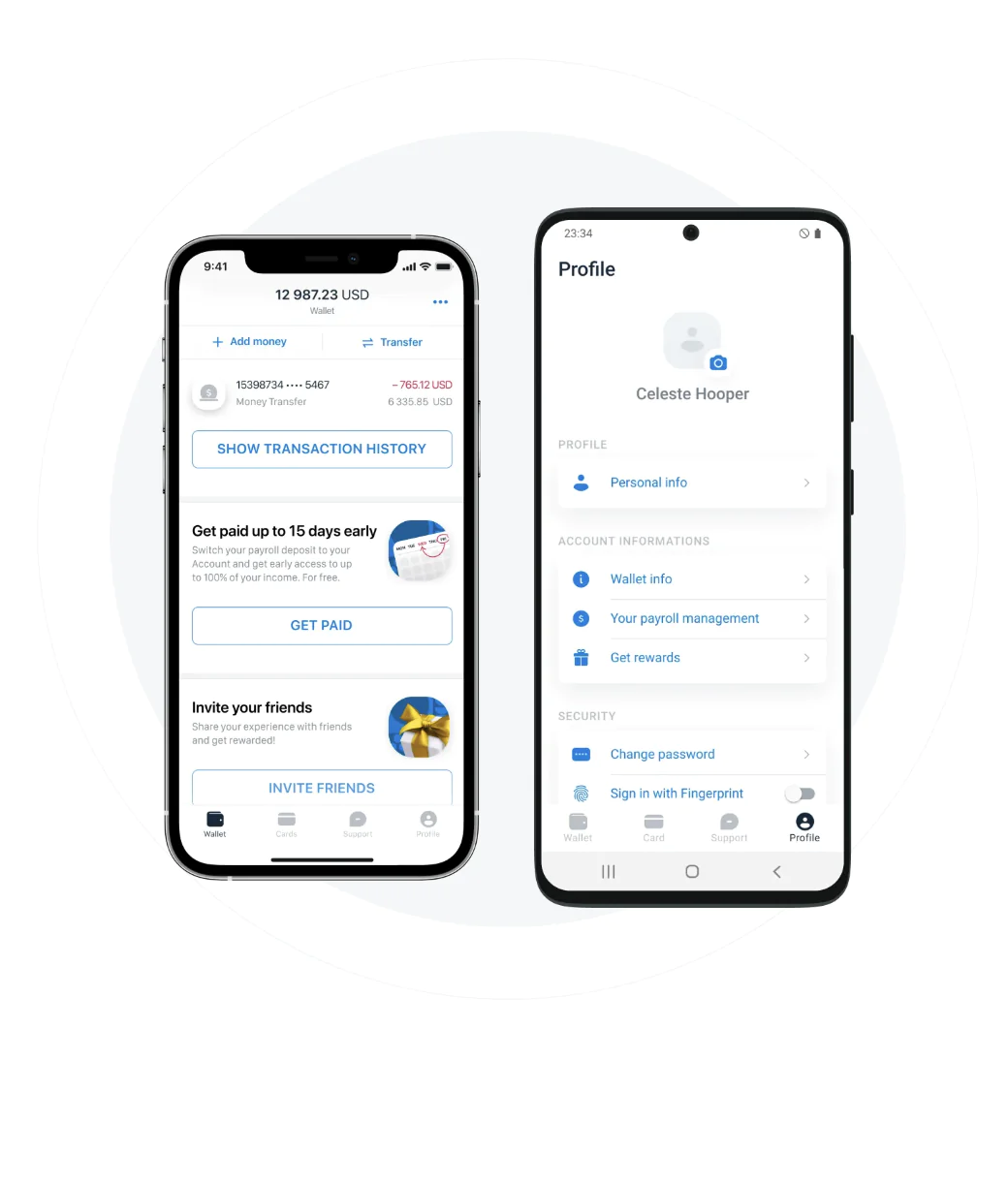

A mobile banking app for migrants, designed to facilitate monetary transactions like sending financial help abroad, getting paychecks early, receiving microloans, etc.

About the Client

The client is an American entrepreneur whose business interests and expertise lie primarily in the fintech industry.

The client contacted us with an idea for crafting a neobank solution that would serve migrants, who make up a large but unbanked segment of the population. It was crucial for our client that the contractor not only had a solid background in fintech development but also a good grasp of working in such a highly regulated business environment as banking. Our in-depth knowledge of legal and regulatory issues impacting fintech companies and our technical expertise gained over years of work left no doubt that Itexus was perfect for a fintech project, so we set to work.

Project Background

The app’s target audience is people who have recently immigrated to the United States, have a job, and regularly send money to their families. Each year, more than 1 million people come to America to earn a living and financially support their families who remain in their home country. As customers of U.S. banks, these people have special needs and problems. Yet they are not potential bank customers due to the missing or low credit scores. Until recently, there was no specific banking product that could address and meet the immigrants’ needs. The app we’ve developed is intended to support this sizeable but vulnerable section of society.

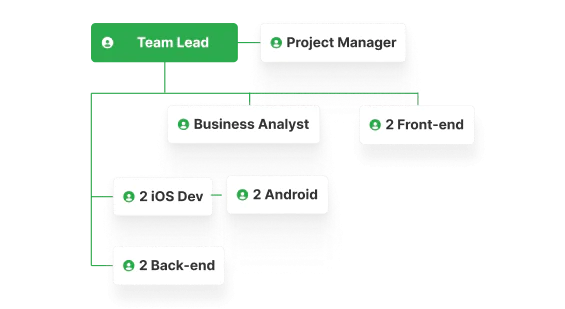

Project Team

Engagement Model

Time & Materials

Tech stack

Functionality Overview

Together with our client, we hosted a few ideation sessions to create a user persona and reflect on the user journey, with an additional session dedicated to design thinking. These sessions allowed us to better understand users’ needs, motives, and pain points, and to come up with ideas for app features that would address them.

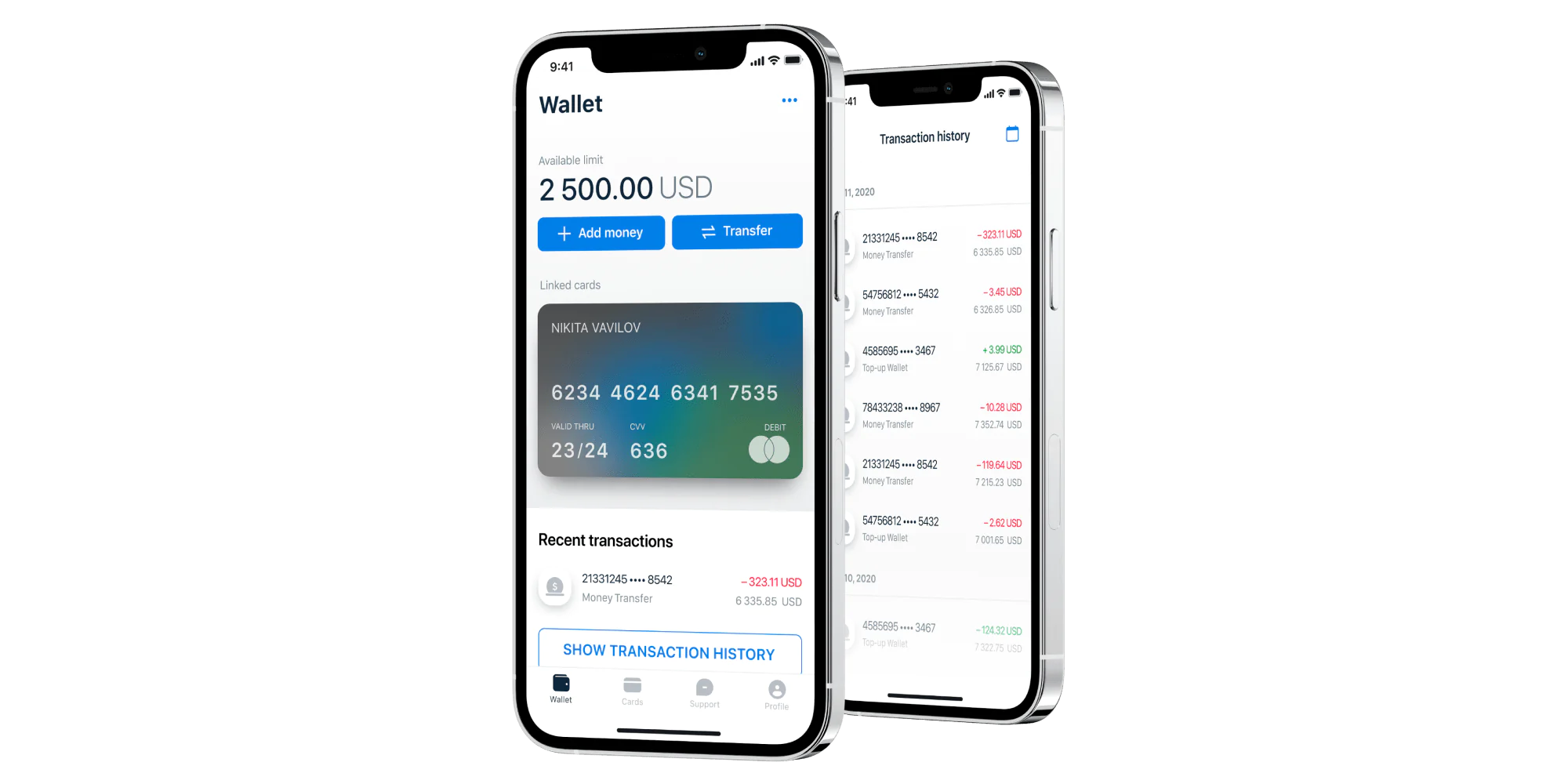

• Money transfer

There are two types of transactions available in the app: money transfers to other user accounts and ACH transactions for non-users. We have enabled the app for P2P payments and allowed transfers from other banks’ accounts, so users can top up their app accounts with cards from other banks. Users can also deposit funds into their accounts by visiting a bank branch in person.

• Family mode

As previously stated, migrants can use the app to send money to their families abroad. With the ‘Family Mode’ feature, users can immediately distribute money to different family members without any fees, as long as they also have accounts in the app.

• Early paycheck

Users can receive wages a few days before payday, by asking their employers to process payroll via the app’s banking partner.

• Microloans

Users can receive microloans from the banking partner — without red tape and unnecessary delays. The app assesses the user’s creditworthiness based on transaction amounts and grants a loan equal to a certain percentage of the sum of the transfer.

• Apple Wallet & Google Pay Integration

Immediately after successful registration in the application, the user can add their virtual card created in the app to Apple Pay or Google Pay. This allows the user to pay for their purchases with their card even before they receive it.

Client Subsystem

After downloading the app, users must sign up and pass the KYC procedure via the Alloy system, providing their social security number, and personal data (e.g., first name, last name, date of birth, phone number, and address). After their identity has been verified via the third-party service Vouched, the user receives a confirmation SMS and sets a password for their account. At this point, a personal virtual card is created and made available for immediate use; a physical card is created by a banking partner and delivered to the user’s address within a few business days.

Admin Subsystem

Administrators can review identity validation results, track the delivery status of physical cards, and manage user-related issues. The subsystem also includes dashboards for system analytics, fraud monitoring, and compliance oversight, ensuring secure and efficient operations.

Architecture Overview

The app contains multiple integrations with third-party services that create dependencies. Any technical issue on a service provider’s side has the potential to cause a problem beyond our control that may adversely affect the app’s performance. As a result, we have considered different scenarios and developed a fallback plan should such cases occur. In addition to implementing system event logging and a built-in online chat that enables users to notify the support team about any issues that arise, our team is also setting up monitoring for the uptime of external services. Such surveillance is configured with early warnings (via email and SMS) for an unresponsive service. Last but not least, Itexus has created a dedicated environment for the pivotal Mbanq service and stable API, so that updated versions are deployed in sync with the newer mobile app versions.

Development Process (or Project Approach)

We used the Scrum framework for work on this project. Each iteration lasts three weeks: the first two were spent on implementing the iteration backlog requirements, and the third is used for testing and bug fixing. At the end of each three-week sprint, we held a demo session to demonstrate the functionality increment to the client, who then install it on iPhones and Android devices for user acceptability testing. Any resulting notes and update requests were given back to us, and we worked to implement them during the subsequent sprint.

Third-party integrations

- Mbanq is a Banking-as-a-Service solution. It is used to open current and savings accounts, process payments, issue virtual and physical or virtual credit/debit cards, etc.

- Alloy allows automating KYC decisions during onboarding. So, all user data is checked and as a result, a decision is made: whether a user is eligible to be registered in the app or not.

- TransUnion checks transactions for AML purposes.

- AI-driven service Vouched was selected for user’s ID verification to detect fraud and meet compliance requirements.

- With the help of Plaid, we can access and receive the necessary data (e.g. account balance, list of transactions and their categories, loans, etc.) from a linked financial institution.

- Argyle allows users to receive their salary directly on app account. Users can either distribute their salaries by percentage (e.g. 60-40 split ) or in dollar amounts (e.g. $2,000 to one account and the rest to another).

- With the help of Mitek, users can capture a check and the amount will be deposited to their account.

- Uniteller is used for international payments from one bank account to another.

- Twilio provides one-time passwords for users’ phone numbers verification.

- SendGrid is used for sending emails.

Project Challenges

When it comes to neobank solutions, it is crucial to ensure the security of users’ data. The app has passed a security audit and a penetration test confirming that the solution doesn’t pose risks to customers and their data. We equipped the app with the best products and services the Azure Cloud platform has to offer:

- Azure SQL Database

- Azure Security Center

- Transport Layer Security 1.2

- Azure Key Vault

For fintechs, meeting multiple regulatory standards is a must for operating within a regulatory framework. The app we delivered to our client is fully compliant with AML (Anti-Money Laundering), CFT (Combating the Financing of Terrorism), PCI DSS (Payment Card Industry Data Security Standards), and a number of other regulations and guidelines.

Since most of the online banking services available in the app are tied to the cloud-based banking platform Mbanq, the solution depends entirely on this third-party provider. The challenge is that Mbanq updates its APIs frequently, so we need to constantly track the changes to ensure continuous and flawless performance and availability of the app.

Results & Future Plans

It took us 13 months to deliver the solution to the client. The apps have been PCI DSS certified and released to the app stores. iOS and Android apps are expected to serve over 30 million migrant users who need a solution designed specifically to fulfill their goals, with the expectation that these users will eventually become the banking partner’s clients over time. Our near-term plans include integrating the check cashing feature, which allows users to deposit checks into their savings accounts online. As for Itexus, we will continue to maintain and provide support for the app, allowing our client to move forward in leaps and bounds. Got an idea? Share it with us, and we’ll see how we can help you change the world.

Discuss your mobile banking app development needs with us.

A mobile banking app that allows its users to access all banking services in a secure, convenient and fast way without having to visit bank branches.