Itexus delivered the app according to the requirements. The team met all development milestones and deliverables. They were efficient, friendly, and cooperative. Itexus team was very timely with updates, a regular meeting cadence, and ad-hoc questions and answers via Slack. The team was very responsive and still is.

Insurance Software Development Company

As an insurance and financial software development company, we help businesses modernize legacy systems, automate operations, and improve customer experience.

Insurance Software Development Services We Offer

Insurance software development is changing the way the insurance industry works. As customer needs grow and technology moves forward companies are turning to smart software solutions to cut costs, gain new clients, and keep existing ones. Today, insurance businesses rely on skilled insurance software developers to stay competitive and grow faster. Our experience in financial software development also allows us to deliver end-to-end digital solutions across insurance and broader financial domains.

on digitization & insurance automation

Insurance software development from scratch

Legacy systems modernization & data migration

and enhancement of the existing insurance platform

with third-party software

Go-mobile consulting & app development

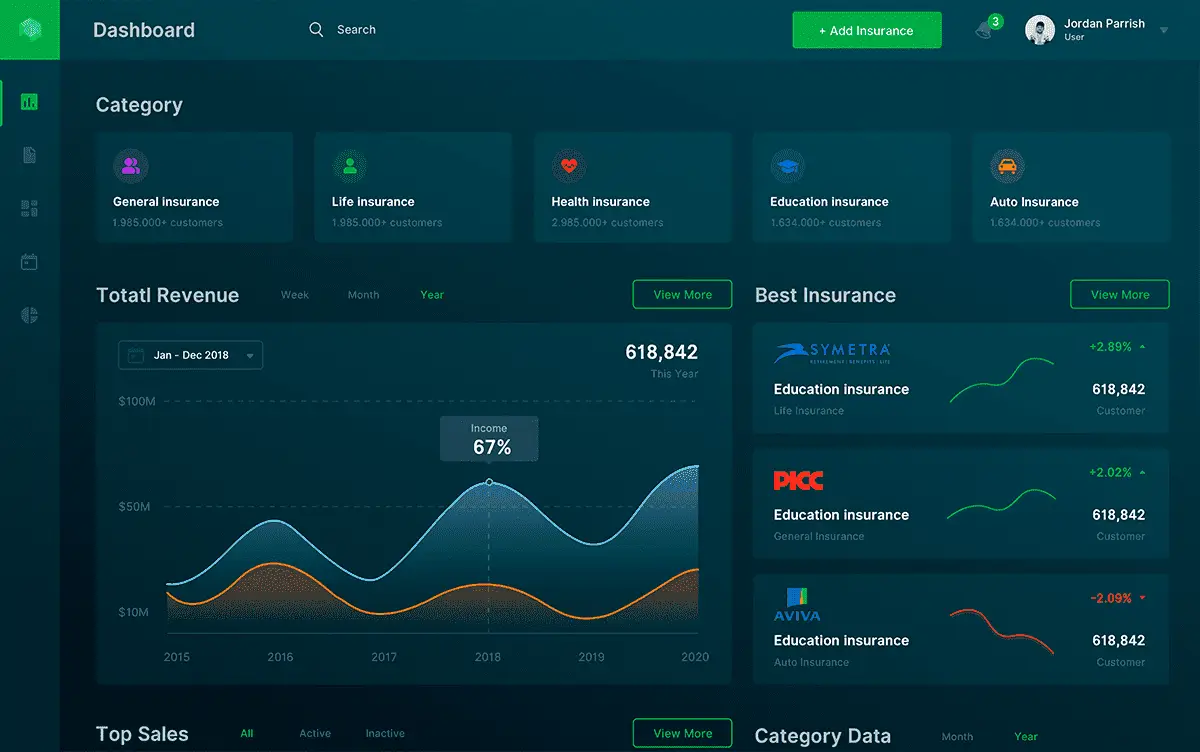

Insurance Software Development Solutions

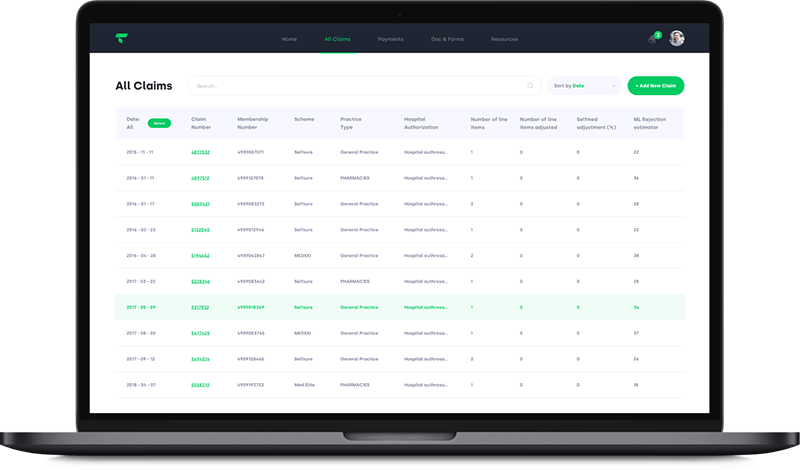

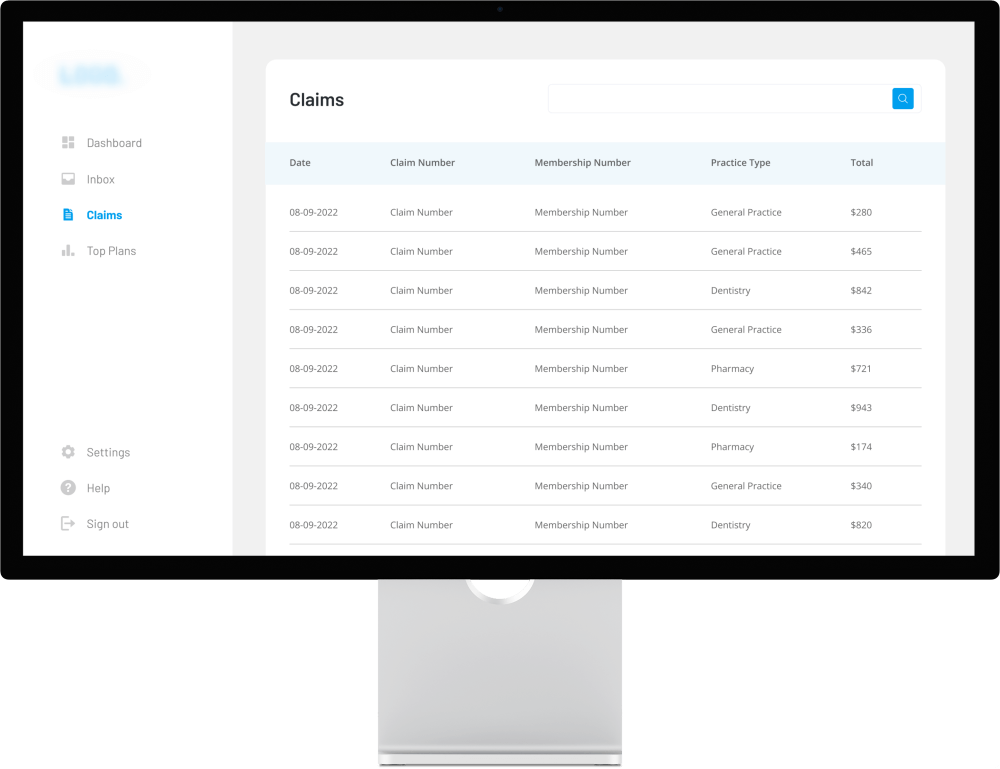

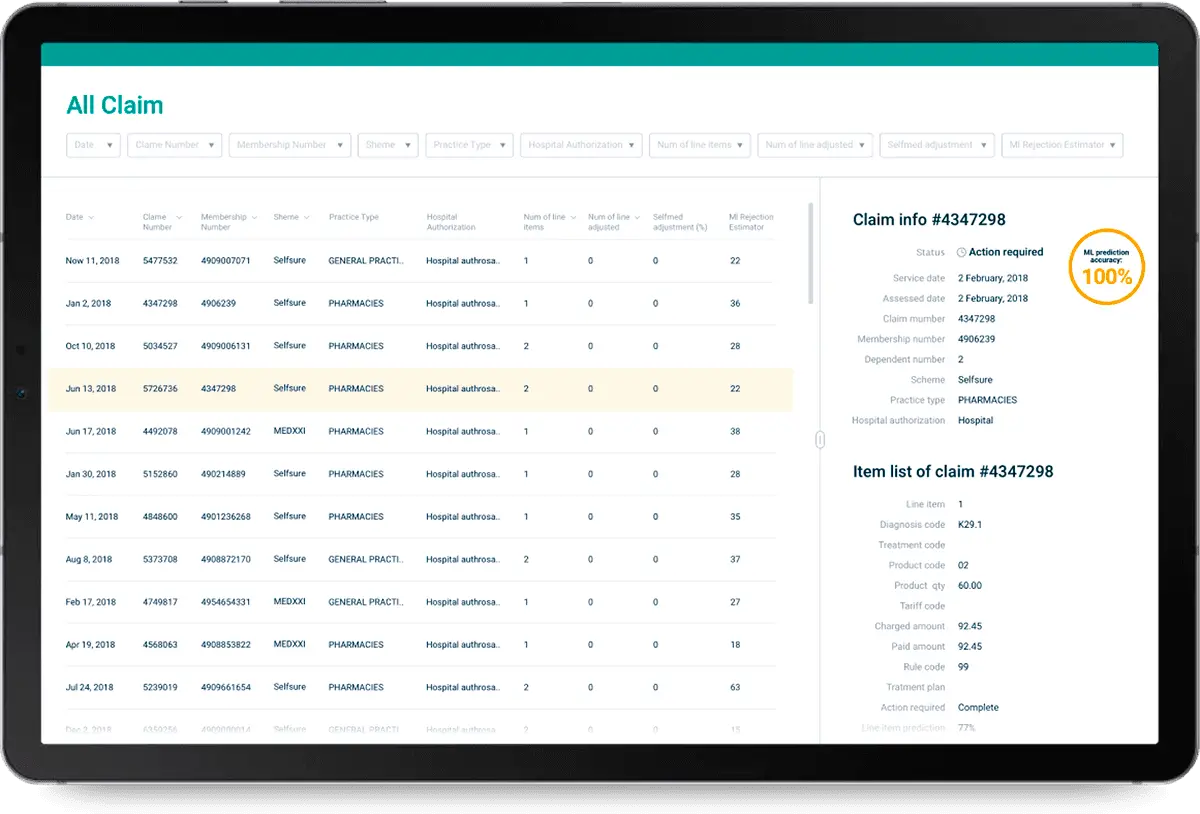

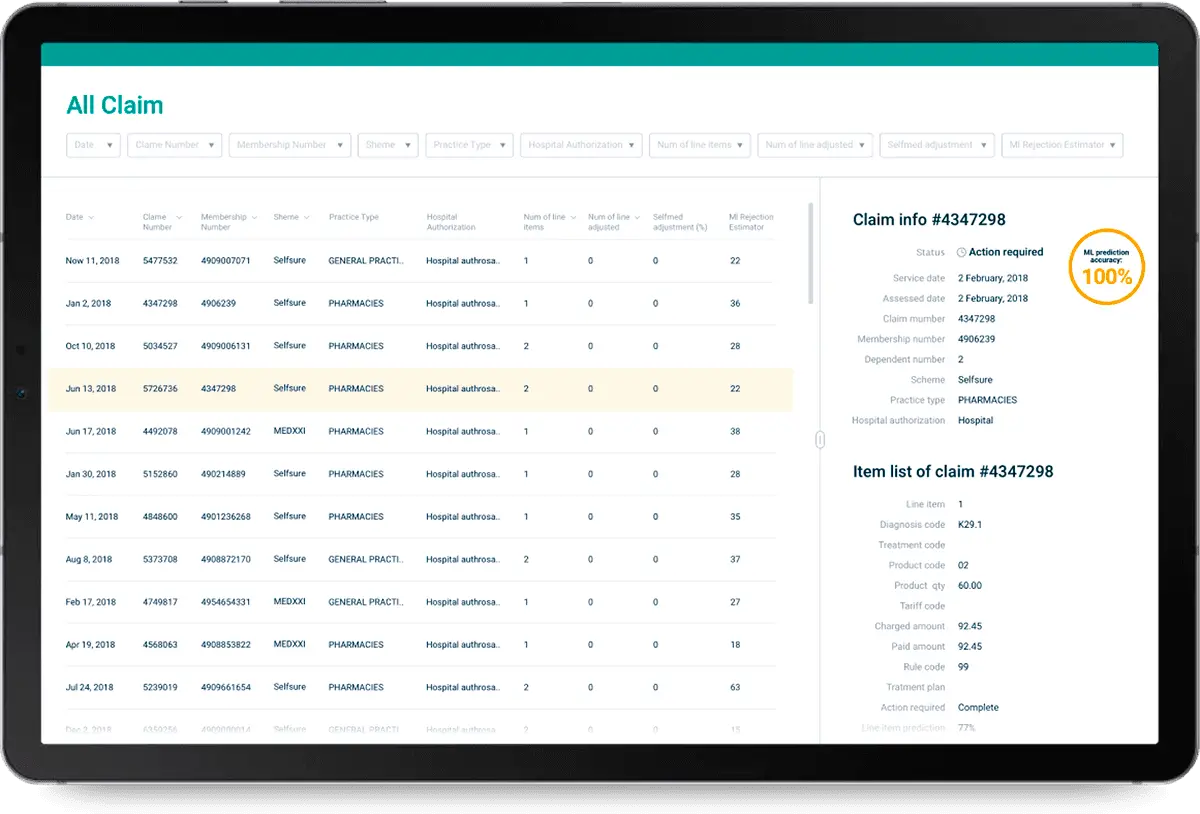

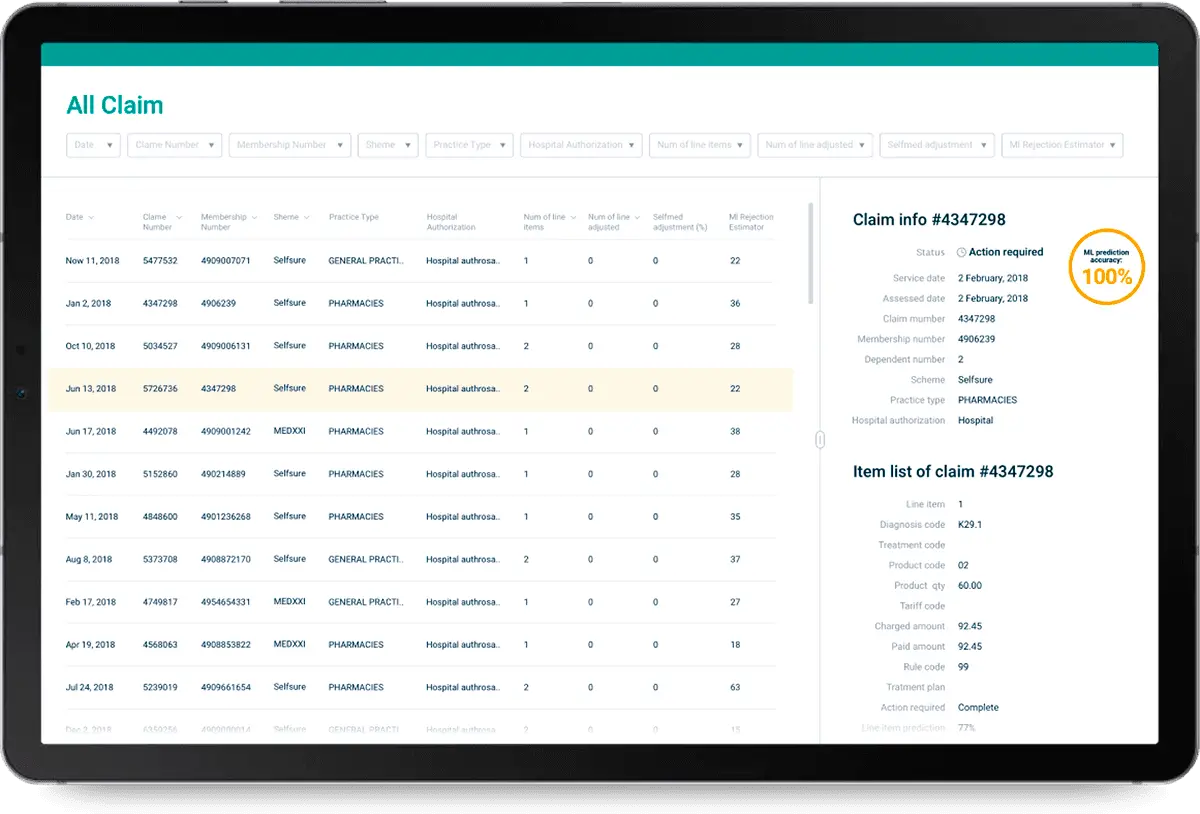

Claims Management Software

Build a custom claims management system that meets your business needs and ACORD insurance standards: manage the entire claims lifecycle, including data collection and database building, authentication, carrier submission, etc. As an insurance application development company we can implement any integrations and industry specific features.

- Reduce fraudulent claims

- Improve claims processing efficiency

- Cut claims management cost

- Better customer experience

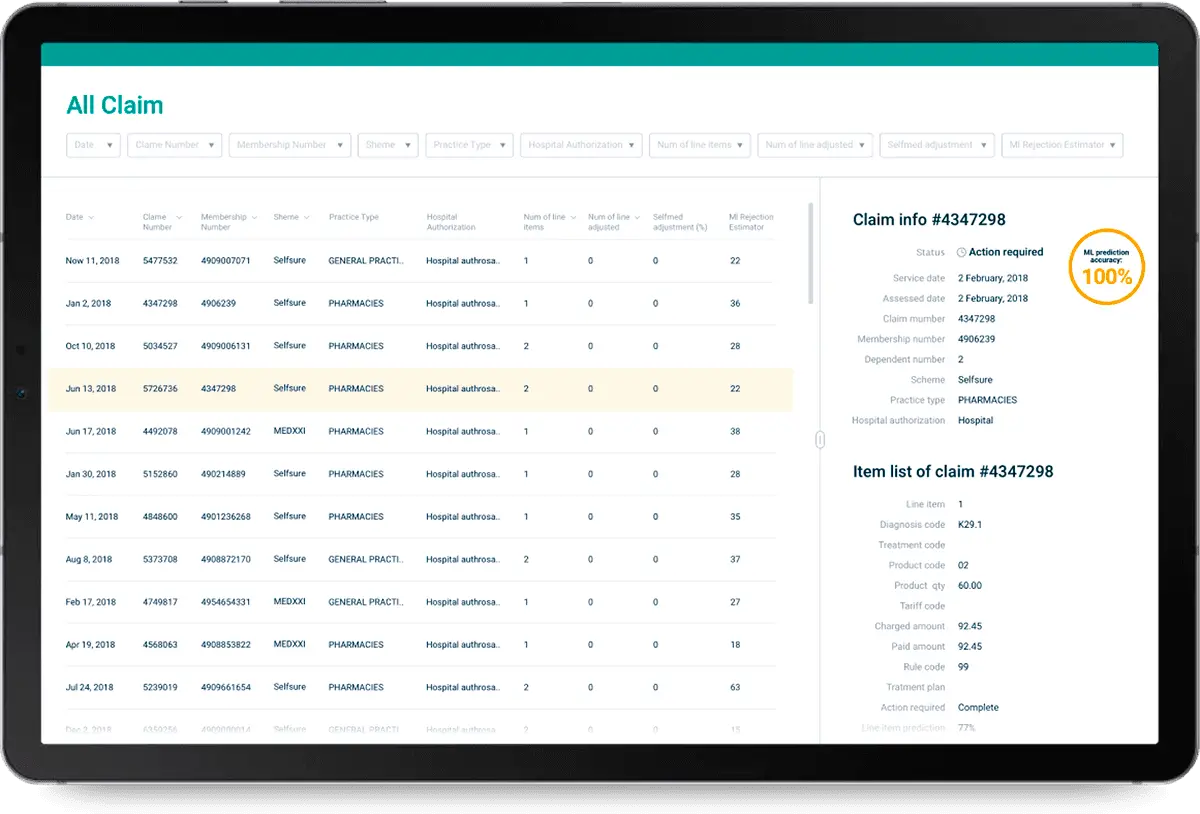

Policy Management System

Develop a policy management system with multitasking flows. The system will ensure all the coverages are timely renewed. All necessary features as accurate quoting, creating policies, binding, etc. will be added according to the client’s needs. Automated process of managing insurance contracts increases efficiency and decreases the cost of processing.

- Simplify policy administration

- Enhance efficiency with automating policy management

- Empower your system with better compliance

- Improve cost-effectiveness

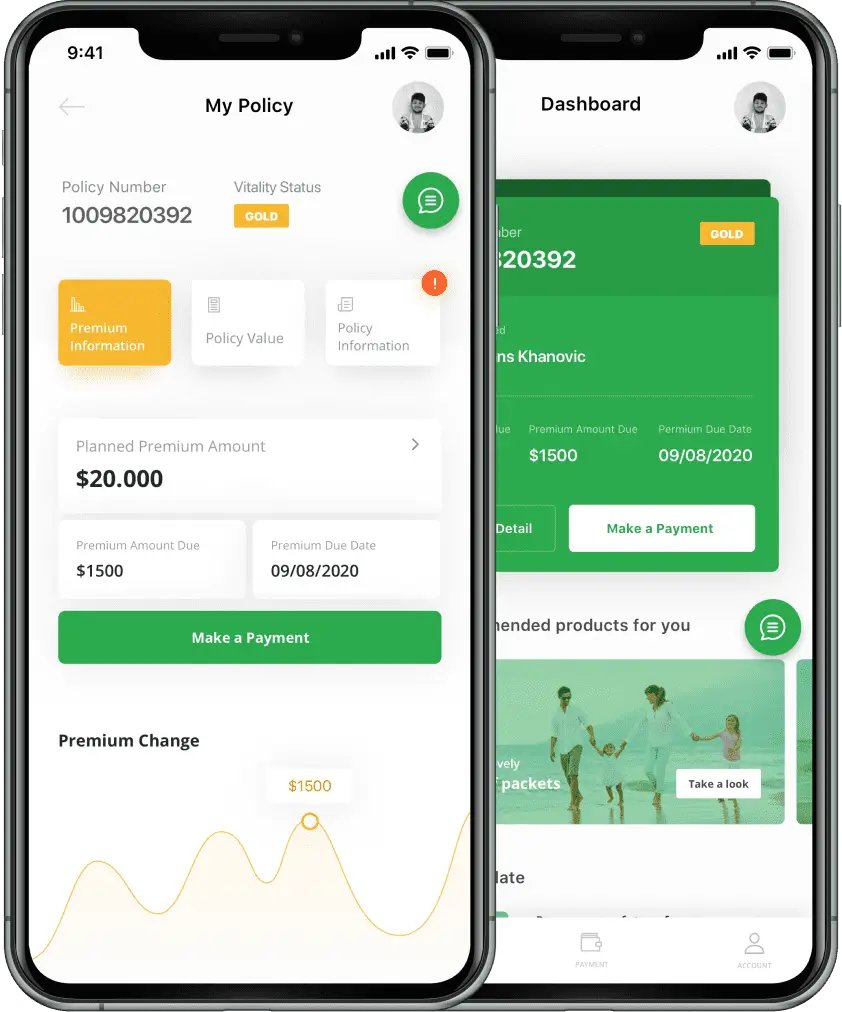

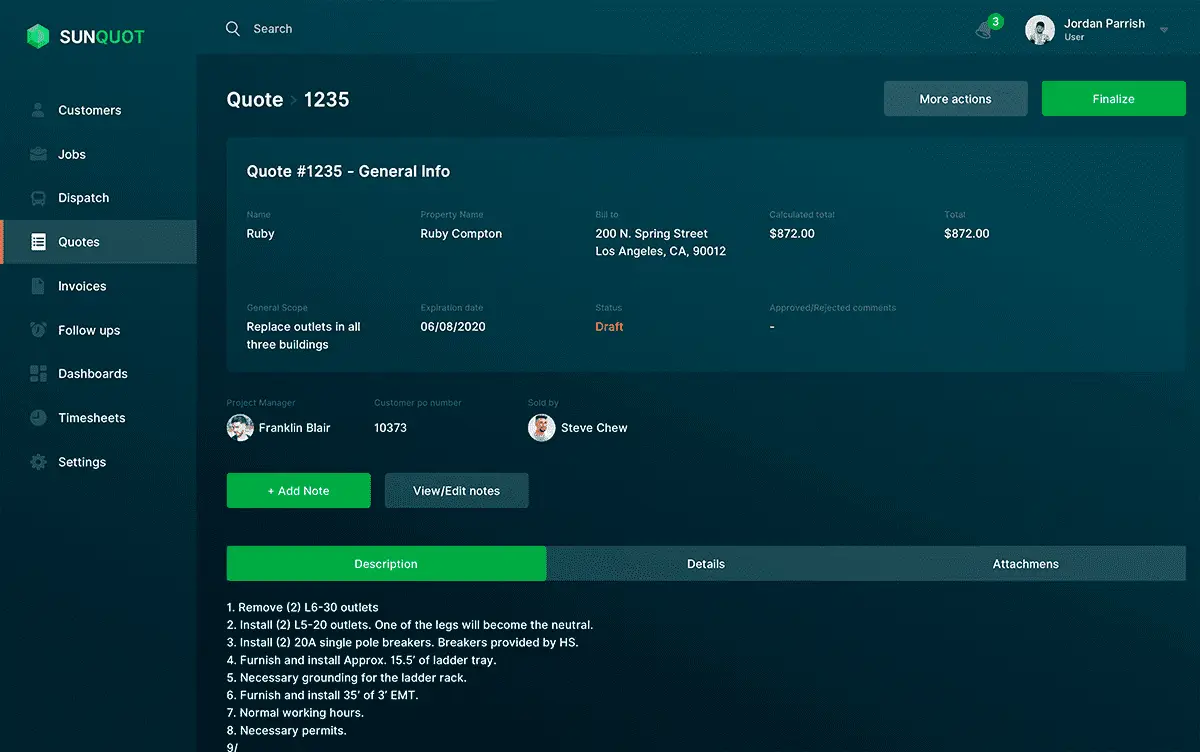

Underwriting or Quoting Software

Create a custom software with numerous underwriting algorithms for high-quality risk assessment based on your requirements. The custom-made quoting software is easily integrated with ISO or others according to the insurers’ needs and specific policy types to make the underwriting process as simple as possible.

- Better tracking and improve workflow

- Use underwriting resources effectively

- Enhance visibility and service

- Increase consistent decisions

- Reduce paper work

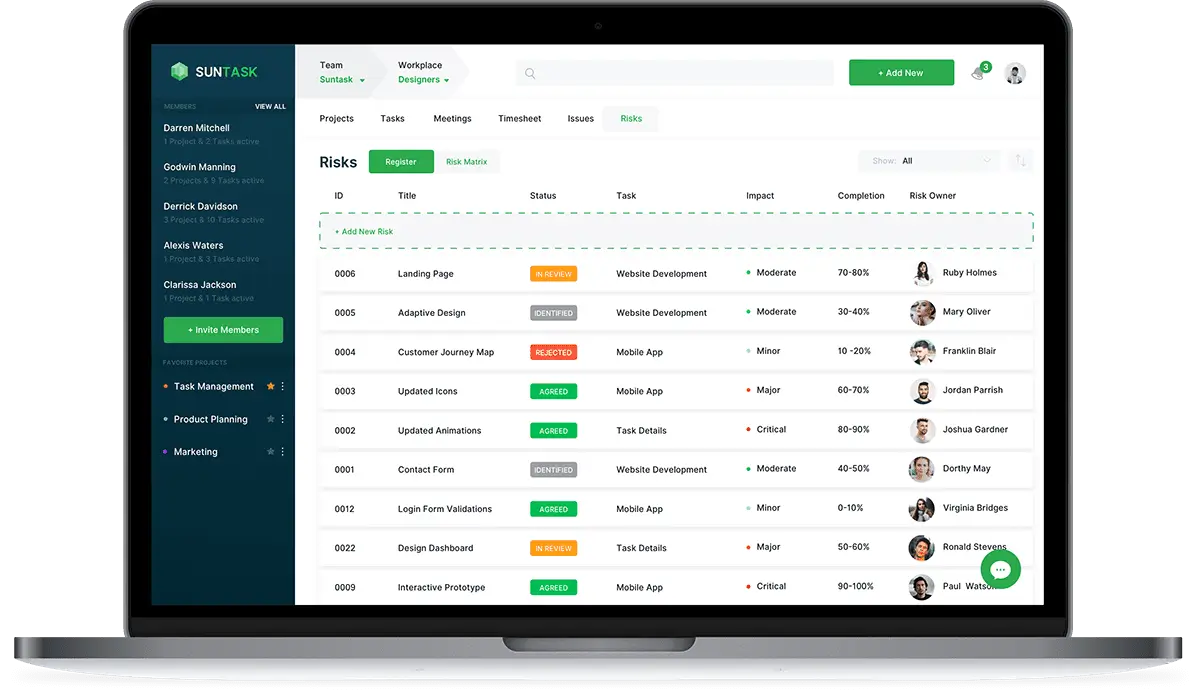

Risk Management Software (RMS)

Get tailored to the specific business needs ERM software that tracks key risk indicators for insurance agencies. We can build a risk management software with an automated real-time monitoring and data analysis with automated alerting for rapid decision-making. Any features could be added based on the business operations – build-in custom risk libraries, multiple criteria templates, mitigation protocols, etc.

- Identify and classify risks

- Take actions to minimize risks

- Get automated risk reports

- Save time and money

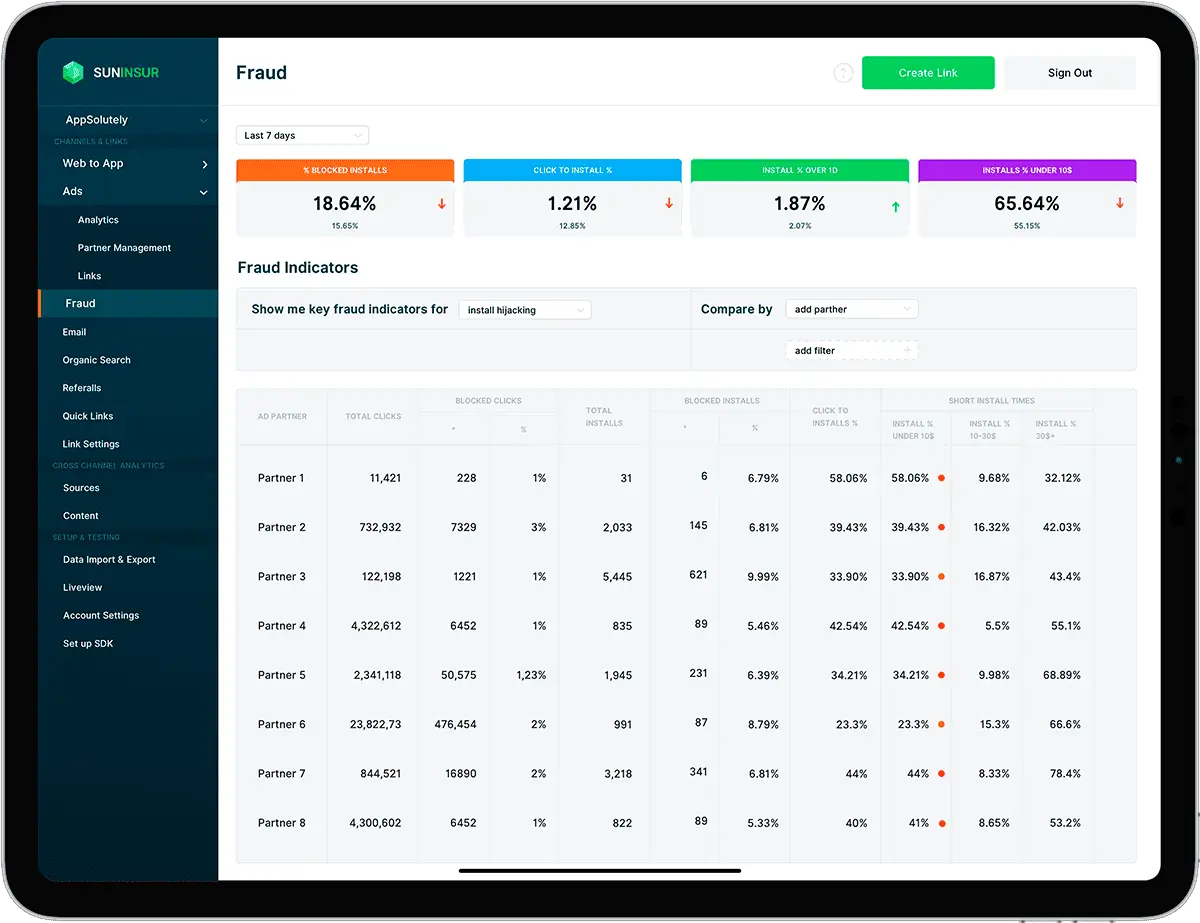

Fraud Analysis Software

Detecting and preventing fraud is a real challenge and very often a problem for insurers. Build your own fraud analysis software for detecting, preventing and managing claims fraud. With the latest technologies applied we’ll improve insurance fraud detection and investigation. Don’t pay for fraudulent claims.

- Monitor every transaction and claim

- Get alerts for the claims that need further investigation

- Stop complex fraud schemes with AI & ML

- Screen and score vendors to ensure compliance

- Reduce the losses and exposure

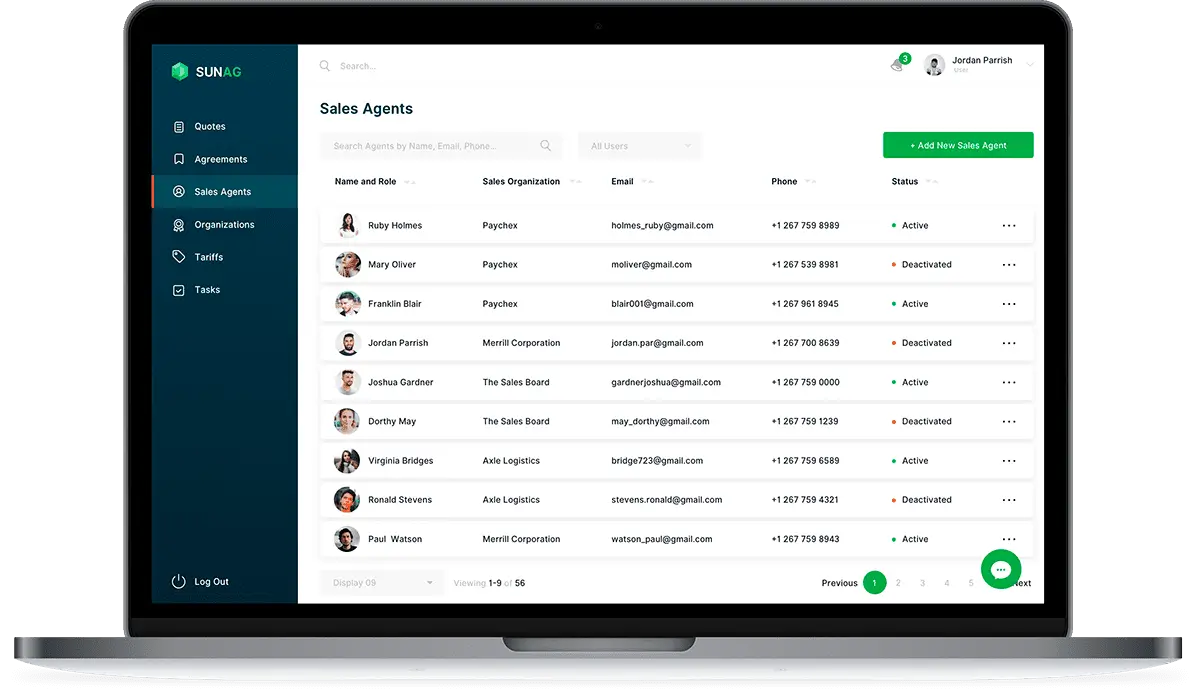

Omnichannel CRM for Agents & Brokers

An omnichannel CRM helps insurance businesses organize prospects, track opportunities, and automate activities, so agents and brokers can focus on improving customer experience. Itexus team can develop a custom CRM from scratch or customize the one you use. Any features could be implemented:

- Optimized workflow

- Smart alerts & chat

- Events tracking

- AI assistant

- Claim auto-tracking

- Task delegation

- Process automation

One-stop Support App for Policyholders

Let your support team get any critical information and deliver high-quality service quickly and easily. With our insurance mobile app development services you’ll increase customer engagement and loyalty by allowing policyholders to reach you through a mobile customer support app retaining the interaction across different channels.

- Video chat

- Text chatbot

- Context driven communication tools

- Alert analytics

- Emergency tools

- Push notifications

- News feed

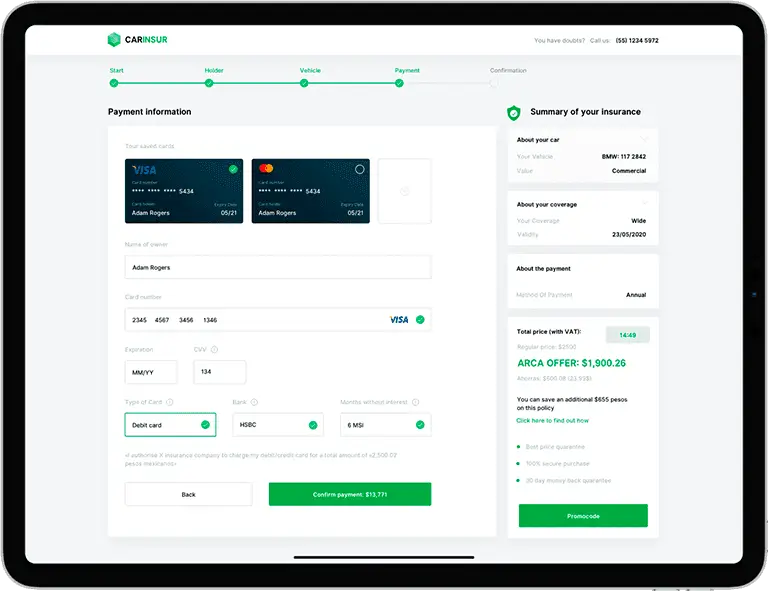

Billing & Payments Solutions for Insurance

Simplify payment processing with billing & payment services integrated into the Insurance ecosystem. Win the customers’ loyalty, reduce reliance on paper and checks, save money along the way. Our insurance software company will build the billing and payment solutions from scratch based on your company’s specifics or our team will integrate and customize an off-the-shelf solution.

- Prepare customized and branded bills

- Present printed and digital bills to policyholders

- Give policyholders the choice to pay in different ways

- Reduce regulatory compliance and security risk

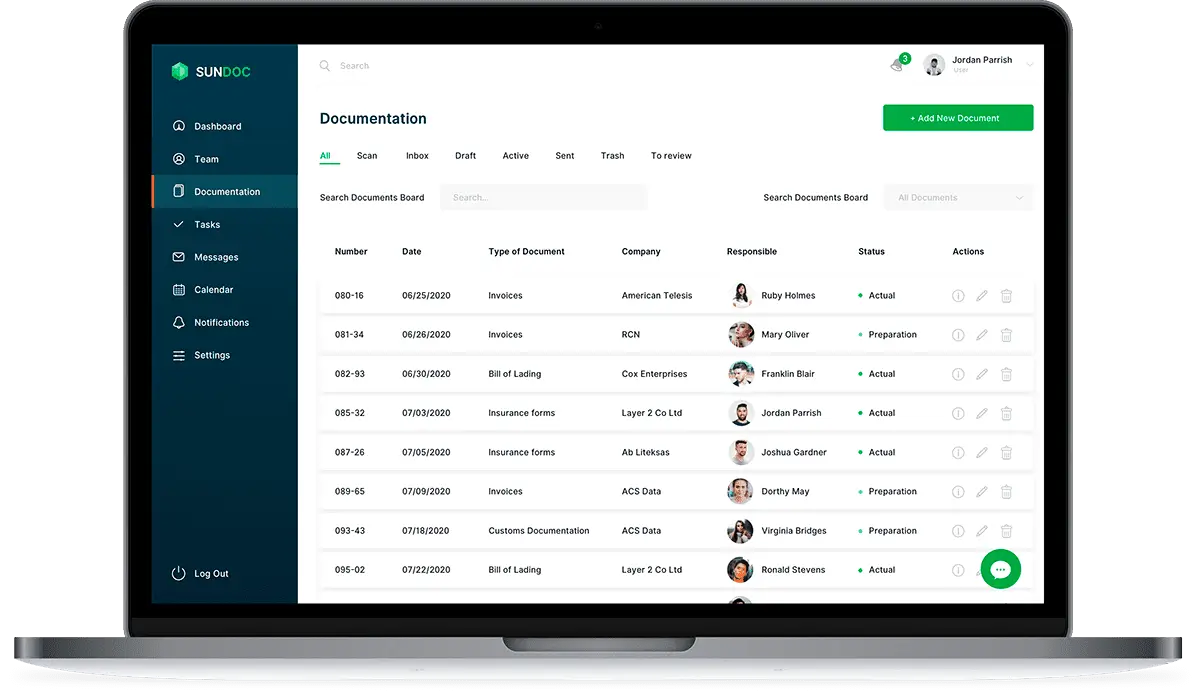

Document Management Software (DMS)

Unify document management with Itexus software development team. We can customize document capture software and policy forms and connect it to cloud-based DMS (Document Management Systems). With custom logic in multiple search capabilities it will be easy to manage the databases of policyholders, contracts, policies, licenses, etc.

- Streamline insurance paperwork processes

- Improve insurance regulatory compliance

- Enhance documentation security

- Enable remote working

- Distribute workforce enablement

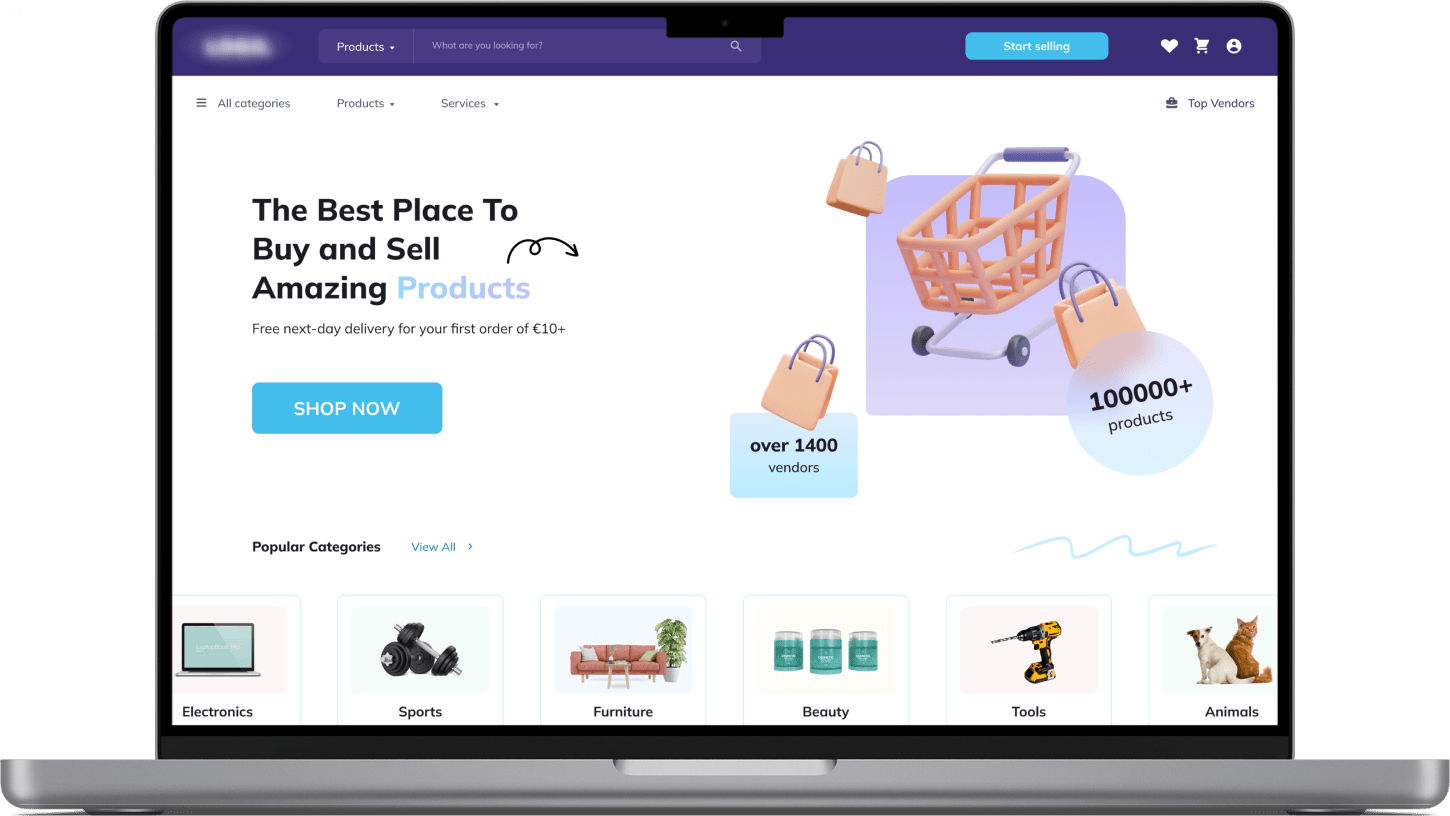

Insurance Marketplaces & Aggregators

Build a digital Insurance marketplace that connects insurance brokers, insurance companies and the end customers. One of the well-known types is Health insurance marketplace where people without health insurance can purchase one that complies with the Affordable Care Act (ACA, US). Itexus develops custom Insurance marketplaces for global and local markets.

- Advanced filtering options

- Comparison of the chosen insurers

- Built-in online payments

- AI-based recommendation engine

- Online consultations

P2P Insurance Solutions

Develop P2P Insurance platforms where a group of individuals pool their resources together to insure against a risk. P2P insurance model is a transparent, high-tech and low-cost alternative to traditional insurance. Cover your customers’ needs with our insurance software development company.

- Speed up the quoting process

- Make the covering process transparent

- Ease the claims management

- Take advantage of all-digitized processes

New Technologies Driving Insurance Innovation

AI-Powered Claims

We use machine learning models to speed up claims validation, detect anomalies, and predict risks — all based on real-time data and behavioral patterns.

Process Automation with RPA

Robotic Process Automation replaces repetitive manual tasks — from policy updates to document checks — freeing up your team for higher-value work.

Connected Insurance with IoT

We integrate data from connected devices — like car sensors, smart homes, and wearables — to offer usage-based pricing and proactive risk management.

Smart Contracts on Blockchain

We build blockchain-based solutions to automate claims and policy processing using smart contracts that trigger actions when conditions are met.

Why Insurance Leaders Choose Itexus

With over 10 years of experience in insurance software development, we’ve delivered tailored solutions for insurance carriers, banks, digital wallets, and investment platforms. We speak your language and understand the logic behind your business processes.

Our custom insurance software solutions are built using a library of ready-to-integrate modules — for claims, CRM, billing, and underwriting. This accelerates delivery while reducing cost across insurance software product development cycles.

We help insurance providers modernize legacy infrastructure by migrating to scalable architectures. It’s a common need among clients switching from generic vendors to insurance software development companies with real domain focus.

GDPR, HIPAA, ISO, OWASP, and NDA-compliant practices. We build systems with embedded data protection, user access control, and regulatory alignment from day one.

Our insurance software development services are focused on long-term efficiency. We reduce manual effort, automate core workflows, and deliver maintainable, scalable systems that grow with your business.

Need an Experts in Insurance & Finance Software?

Need a reliable technology partner with expertise in insurance? Drop us a line to discuss your business goals and we’ll contact you back with solution ideas.

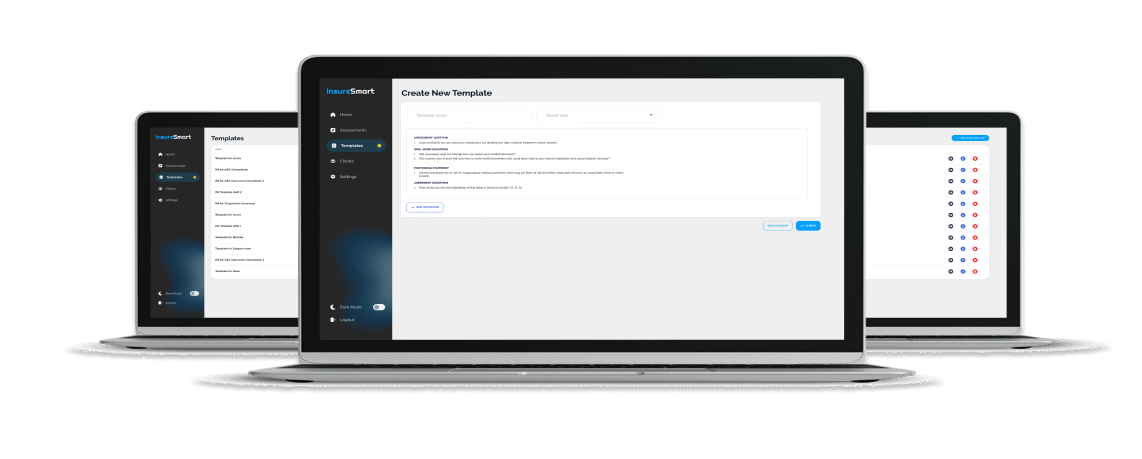

Insurance Software Development Process

Research

Architecture and Design

Project Setup

Agile Development

Testing and QA

Launch and Handover

Ongoing Support

Not sure where to start?

We’ll guide youBetter your Business with Itexus

Go Digital

- Attract more customers

- Get new sources of data and analytic tools

- Streamline the sales process

- Engage with policyholders more often

- Modernize insurer operations

Automate operations

- Accelerate underwriting process

- Speed up customer service

- Cut operational costs

- Benefit from robo advisory capabilities

- Manage data easily

Go Mobile

- Allow customers to start/pause/stop coverage on their mobile apps

- Provide pay-as-you-go insurance

- Enhance customer experience

- Unleash the power of connectivity & wearables

- Multiply upselling and cross-selling deals

Move to Cloud

- Easily operate and access great amount of data

- Stay secure

- Scale your business

- Reduce operating and capital investment costs

- Increase agility

FAQ on Insurance Software Development

How much does it cost to develop insurance software?

Can you guarantee data security in my insurance software?

What is your insurance software development process?

We define the project scope and create a high-level delivery schedule. Then our UI/UX specialists design an intuitive and visually appealing user interface. After that, Itexus’ skillful developers deliver your insurance application using an iterative approach (with 2-4 week iterations) and integrate your app with required third-party services. Your project manager will keep you regularly updated on the progress.

Before any major release of your app, our QA engineers perform all the necessary tests. Afterwards, the project team releases the application and submits it to the app stores, if required.

Do you provide post-development support?

Can you integrate a third-party service with my solution?

Do you sign NDA?

I have a rough idea of insurance software. What should I start with?

We’ve already started with another development team, but we would like to change the team. Can you catch our project?

Clients’ Testimonials & Awards

Need a reliable team to bring your insurance software solution to life?