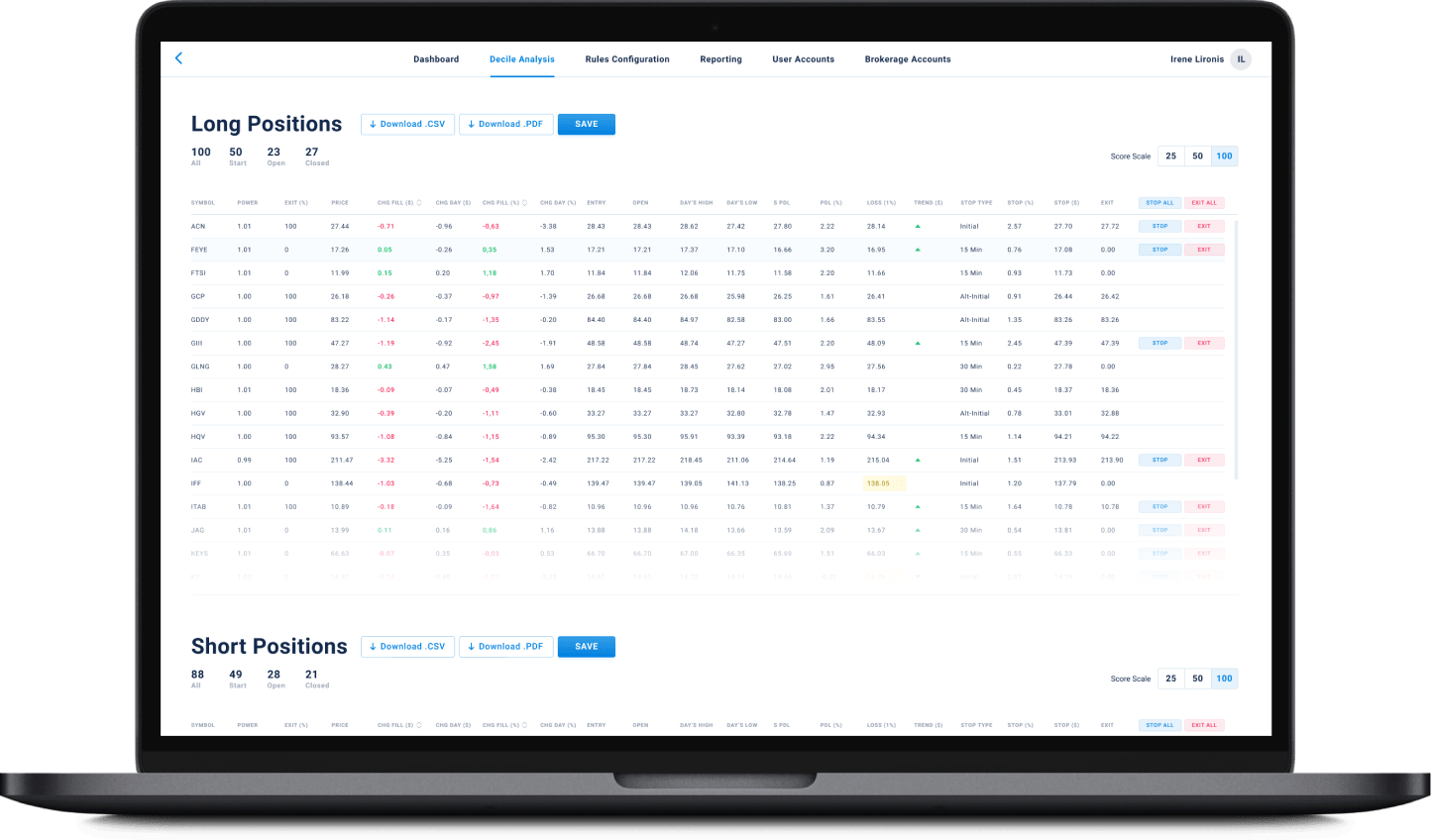

Claims Management System for Evaluating Hospital Bills

A web app solution that helps medical insurance auditors make judgments on the claims of medical aid providers.

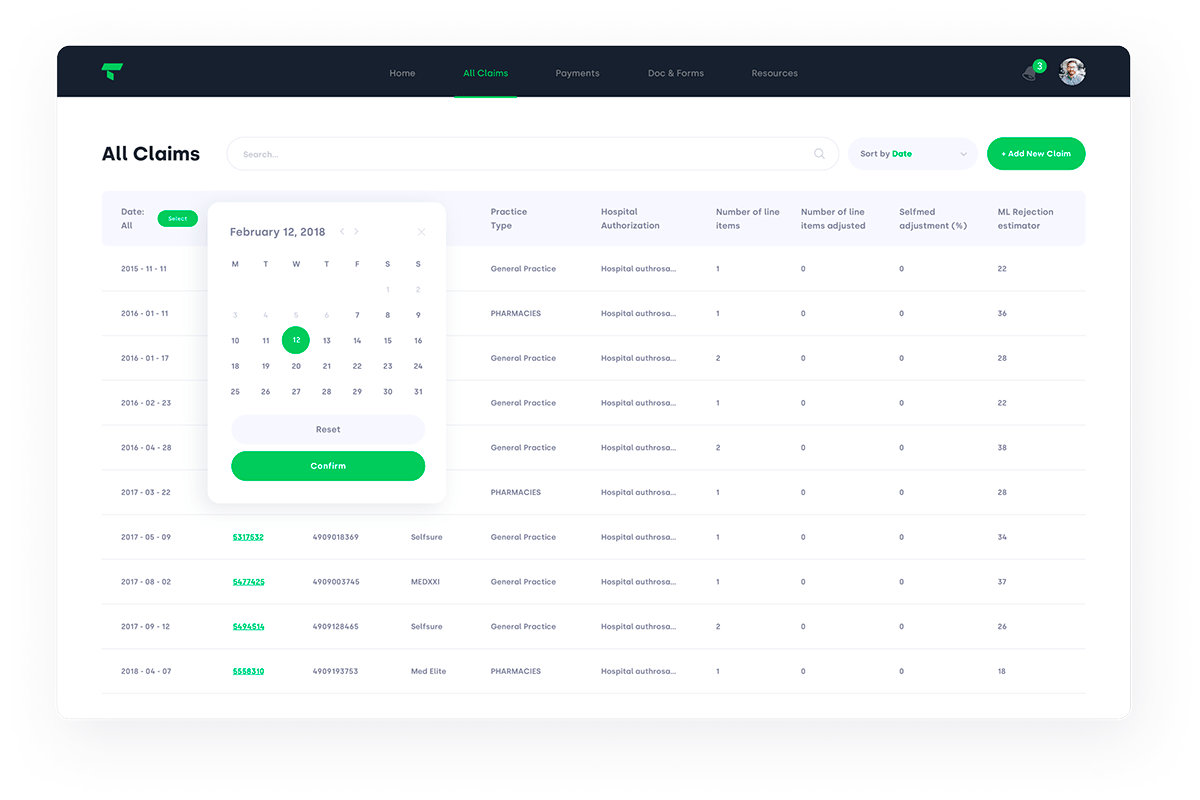

The Healthcare Claims Management System is a web app that helps medical insurance auditors make judgments on the claims issued by medical aid providers.

With the help of machine learning algorithms, it reduces the costs of the claims-auditing process, minimizing both fraudulent risks and human mistakes.

Engagement model

Time & Materials

Project Team

1 Project Manager, 1 Tech Lead, 1 Web App Developer, 2 Business Analysts, 1 QA, 1 Data Science Engineer for ML Engine Prediction Models

Tech stack / Platforms

How It All Started

A medical insurance company needed a solution that would help their auditors make correct judgments on the claims issued by the medical aid providers. The main objective behind the creation of the system was to reduce the costs associated with the claims-auditing process performed by auditors. With the help of Machine Learning algorithms, the system was designed to reduce the risks of human error. After sufficient training, the algorithm is expected to optimize the day-to-day activities of the company’s insurance auditor. To calculate the required metrics, the system relies on AI technologies and past data instead of making decisions based on variable computational rules.

Features

- Users are able to search for specific claims within a database;

- Users can compare the claim valuations made by the auditor with the ones made by our ML algorithm;

- Users may leave comments on the results of particular claim valuation;

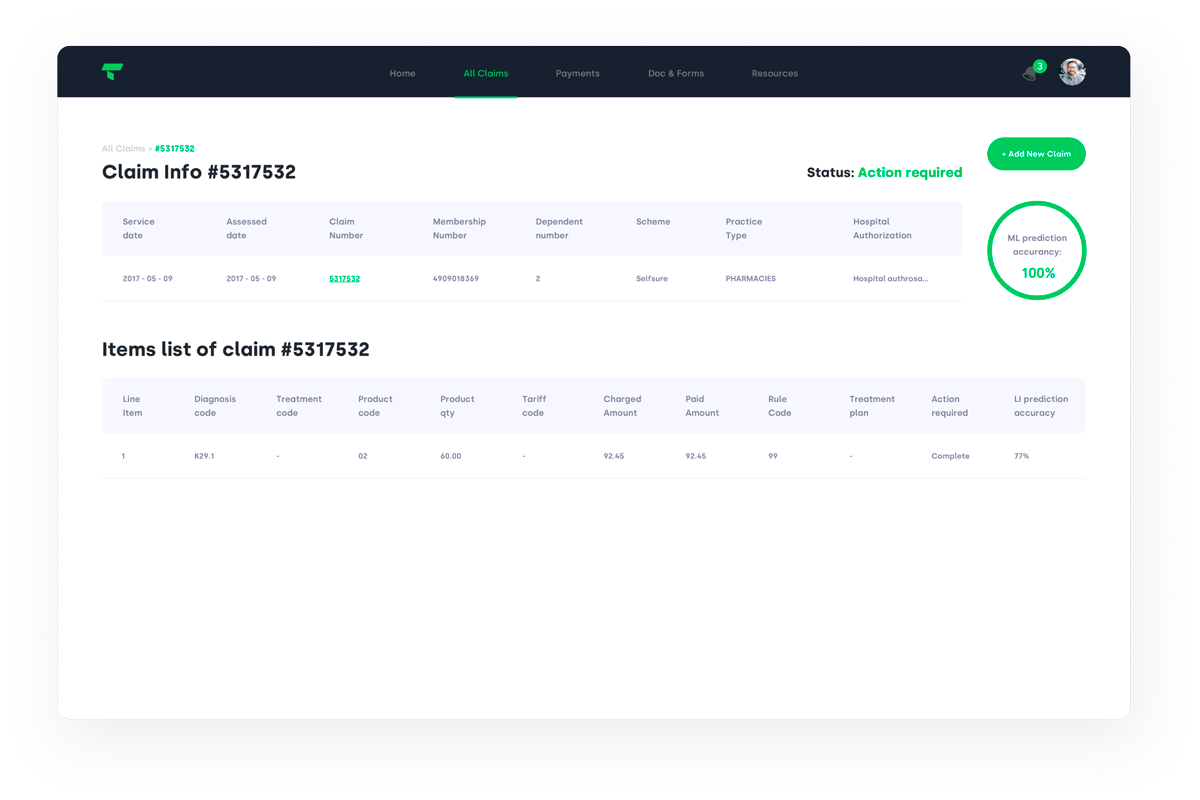

- The system is able to display a claim’s fair paid amount, classify a claim as being fair/unfair, display the error code and its classification, and decide whether further action is required by the auditor for a particular claim;

- By using the system data with the accompanying documentation for an ML engine, an auditor can have a better sense of the parameters influencing the system’s judgments of the particular claim. In the case of any errors or a lack of parameters, an auditor can leave a comment about the errors for an ML Engineer. The latter option allows for the system’s prediction accuracy to improve over time

Development Work

As a provider of insurance software development services, Itexus created the actual system from scratch.

The work was organized using the Agile development model and the Scrum framework. We split development into bi-weekly sprints with new features and product demos delivered at the end of each stage. Communications with the client were conducted via Slack and Skype, and Git was used as a code repository.

The whole development process can be subdivided into 4 main stages:

- The 1st stage involved training the ML algorithm to analyze the results of an auditor’s decisions, based on data from over 6 million claim items collected over the past 5 years.

- At the 2nd stage of the development process, the system was sufficiently trained to provide auditors with some useful information they’ll need to make correct judgments about a particular claim.

- At the 3rd stage, we enabled our system to automatically make correct decisions about the claims received by the medical insurance company.

- The 4th stage was highlighted by the system being able to optimize the day-to-day activities of the company’s medical insurance auditors.

System Architecture

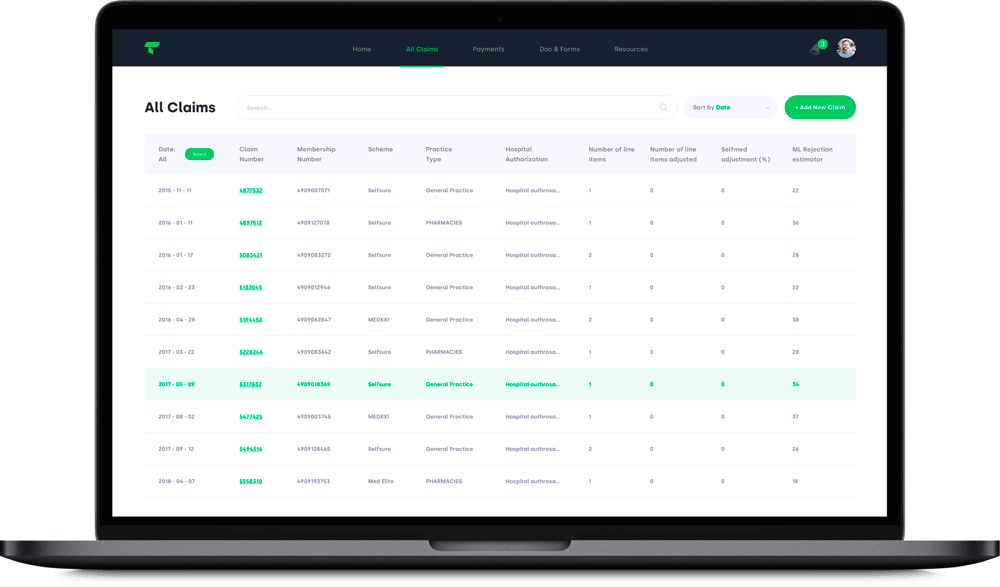

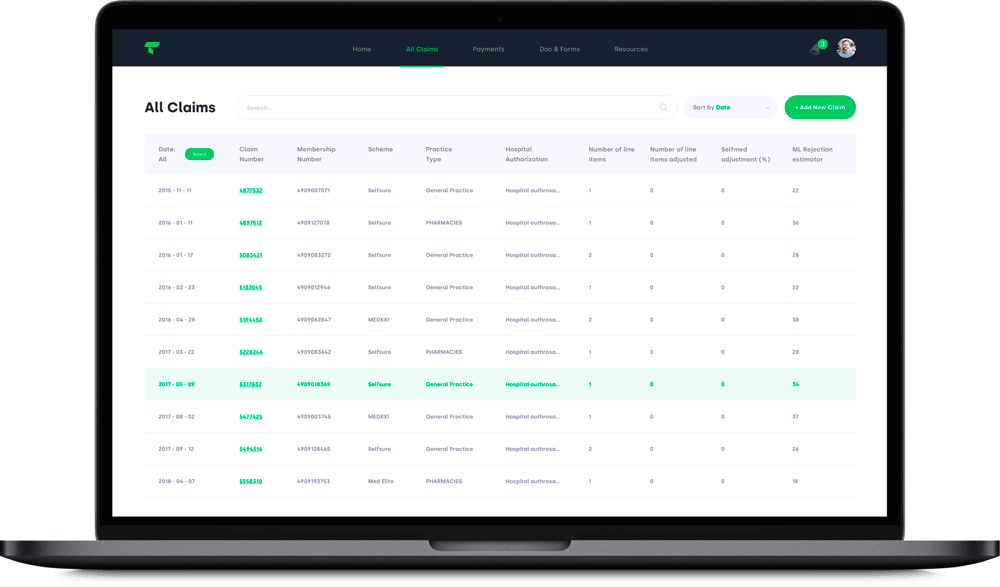

The system consists of the following UI elements:

- All claims table

- Claim details UI

Comments UI. This is useful for Machine Learning engineers when there is a deviation between the auditor’s claim judgment and the one made by our system.

System Component Activities

- Big Data in Healthcare: load, combine, and structure the available members’ data;

- ETL: clean unnecessary data from the database;

- Process data using Supervised Learning, Neural Networks, Deep Learning, and other algorithms.

Related Projects

All ProjectsContact Form

Drop us a line and we’ll get back to you shortly.

For Quick Inquiries

Offices

8, The Green, STE road, Dover, DE 19901

Żurawia 6/12/lok 766, 00-503 Warszawa, Poland