Risk Assessment Platform for Insurance Agents

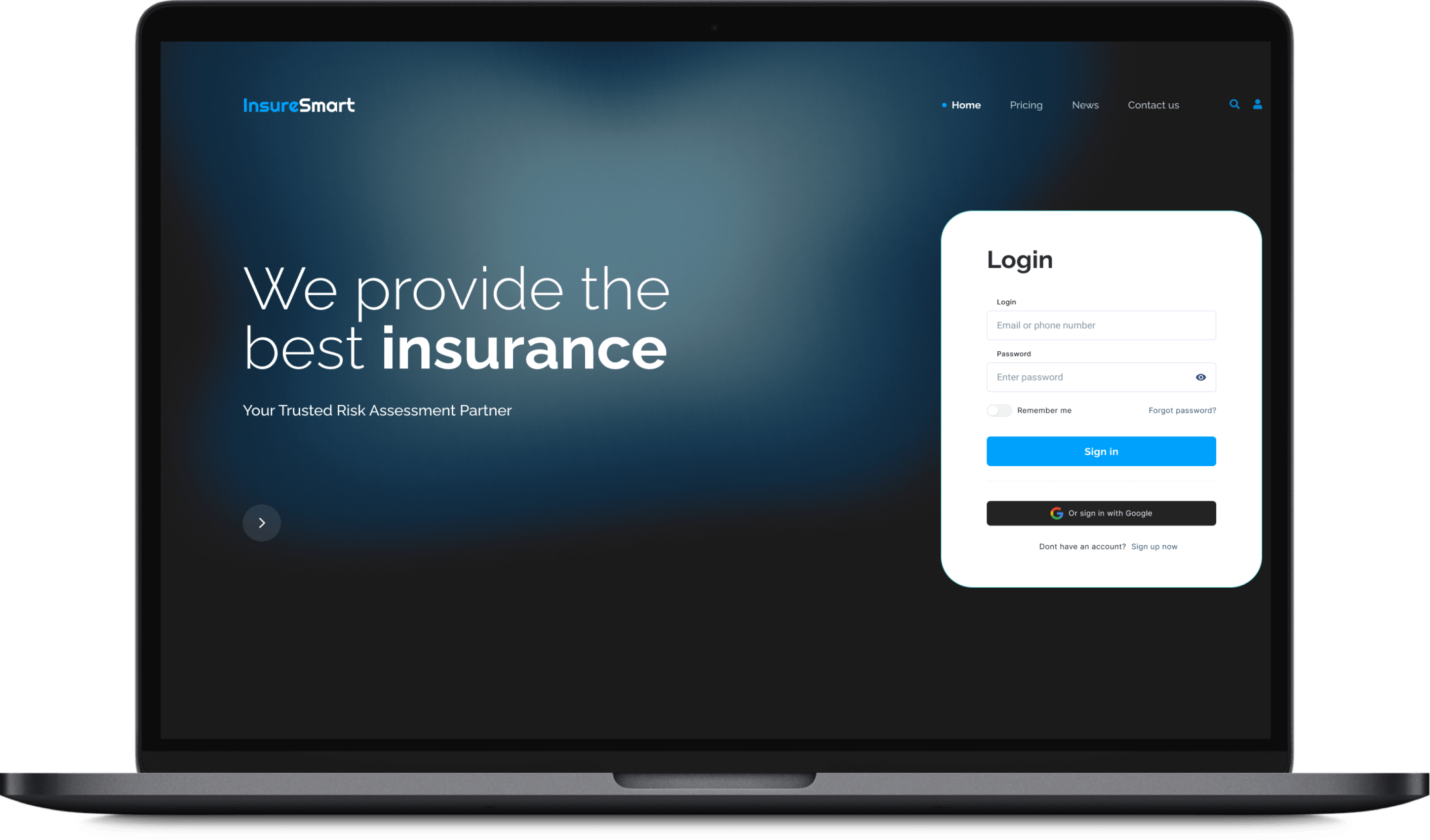

Risk assessment platform for insurance agents that assesses the risk of their prospects and offers high-quality insight that results in the appropriate insurance coverage for each prospect.

About the Client

Our client is a US-based insurance agency that boasts a rich history of serving the diverse insurance needs of individuals and businesses across the nation.

Project Background

In the highly commoditized insurance market, Insurance Producers (salespeople) struggle to distinguish their offerings from those of other producers. To address this challenge, our client aimed to develop an innovative Insurance Producer Risk Assessment Platform. The platform was expected to provide a unique and differentiated experience for potential customers, helping producers distinguish themselves in the market, and enhance the perceived value of their services. This, in turn, would lead to a well-informed and compelling choice for customers to purchase insurance through the producer. The solution is designed to meet the needs of insurance agents and assist them in addressing the challenges they encounter.

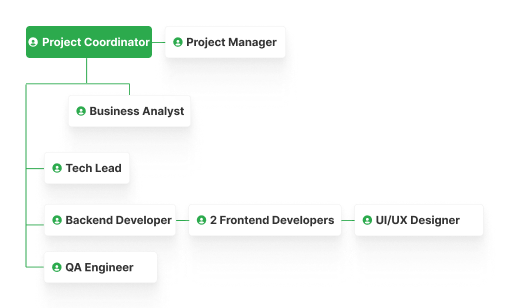

Project Team

Engagement Model

Time & Materials

Tech stack

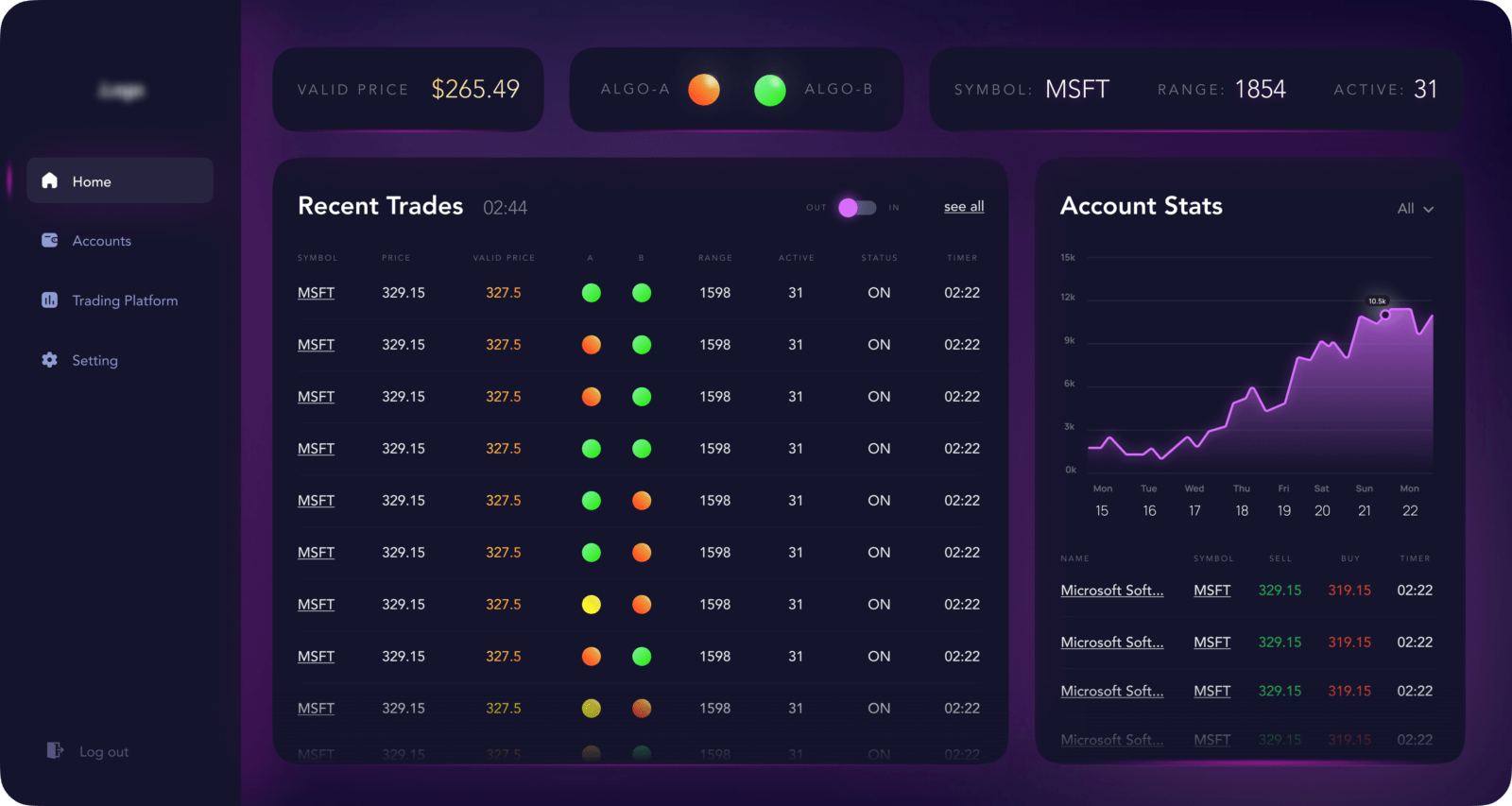

Architecture Overview

The risk assessment platform is an interactive online interface where producers can manage, customize, and distribute risk assessment questionnaires. During a sales conversation, producers engage with insureds by posing questions from the questionnaire and recording their responses. After the conversation, producers can customize and generate an agency-branded summary of the risk assessment for the insured.

Below we describe the platform’s modules and their functionality.

Risk assessment library

-

Build risk assessment (from template / from blank)

-

Edit risk assessment (add, delete, rename)

Risk assessment delivery

-

Send links to risk assessment (prospect self-directed)

-

Button click to risk assessment experience (produced assisted)

-

Collect and store risk assessment responses (titled and accessible after completion)

Risk assessment summary

-

Locate previously completed risk assessment

-

Edit responses / add commentary

-

Save new version

Risk assessment output

-

Print out risk assessment summary (+ title page & table of contents)

-

White-labeled for producer’s agency (logo & color)

Development Process (or Project Approach)

We adopted the Scrum framework and organized the project into two-week sprints. This approach promoted flexibility, efficient management of evolving project requirements, iterative development, continuous improvement, and client collaboration.

To maintain complete visibility into project progress, we provided detailed weekly reports. These included a granular breakdown of time spent, ensuring optimal resource utilization and keeping the project on track. We also included visual representations, such as velocity charts and burndown charts, in our weekly reports. These charts offer a comprehensive overview of the team’s performance, illustrating the amount of work completed compared to the planned targets for each sprint.

We also organized weekly status calls to keep all stakeholders updated, promptly address questions or concerns, and maintain alignment with project objectives. These calls helped promote transparency and technical knowledge throughout the project’s lifecycle.

Technical Solution Highlights

For front-end development, we’ve used React.js, supplemented with TypeScript and Redux, to build a responsive and interactive user interface. Bootstrap has been incorporated for efficient styling, while SASS aids in creating a flexible and maintainable design system. This potent combination offers a superior user experience and upholds code quality.

On the back end, we’ve opted for the .NET 5 framework, employing C# in .NET Core to build a highly performant and scalable application. We’re hosting on Azure Cloud, monitoring with Azure Application Insights, storing data in Azure Blob Storage, and managing our database with Microsoft SQL Server. This ensures a robust, secure, and efficient infrastructure. Seamless deployment and continuous integration are facilitated by Azure DevOps, while rigorous testing and quality control are ensured by xUnit.

Mailgun, an email delivery service, is integrated to enable email functionality and provide communication and notification capabilities.

Results

Within three months, our team successfully delivered a risk assessment platform on schedule and within budget. Our client is confident that this platform will provide insurance agents with a competitive advantage in their market.

Have an idea and need a reliable tech partner to bring it to life? At Itexus, we assist clients from various countries and industries in transforming their boldest ideas into innovative and robust software solutions. Contact us to find out how you can benefit from our experience.

A digital wallet app ecosystem for Coinstar, a $2.2B global fintech company — including mobile digital wallet apps, ePOS kiosk software, web applications, and a cloud API server enabling cryptocurrency and digital asset trading, bank account linking, crypto-fiat-cash conversions, and online payments.

Need to develop a similar risk assessment platform?