Itexus delivered the app according to the requirements. The team met all development milestones and deliverables. They were efficient, friendly, and cooperative. Itexus team was very timely with updates, a regular meeting cadence, and ad-hoc questions and answers via Slack. The team was very responsive and still is.

Banking Robotic Process Automation Services

At Itexus, we specialize in banking process automation services designed to streamline operations, reduce costs, and enhance customer satisfaction. Leverage our deep expertise in modern fintech solutions to drive efficiency and scale your financial institution with precision.

Automated Processes in Banking Industry

Account Opening and KYC (Know Your Customer)

Automated KYC eliminates endless back and forths between the customer and the bank and makes the account opening process quicker and more accurate. The technology automatically verifies customer identity, documents, checks the client against CFT, PEP, OFAC and other databases of heightened risk individuals and entities to dramatically reduce screening, identification, and verification time.

Accounts Payable Management

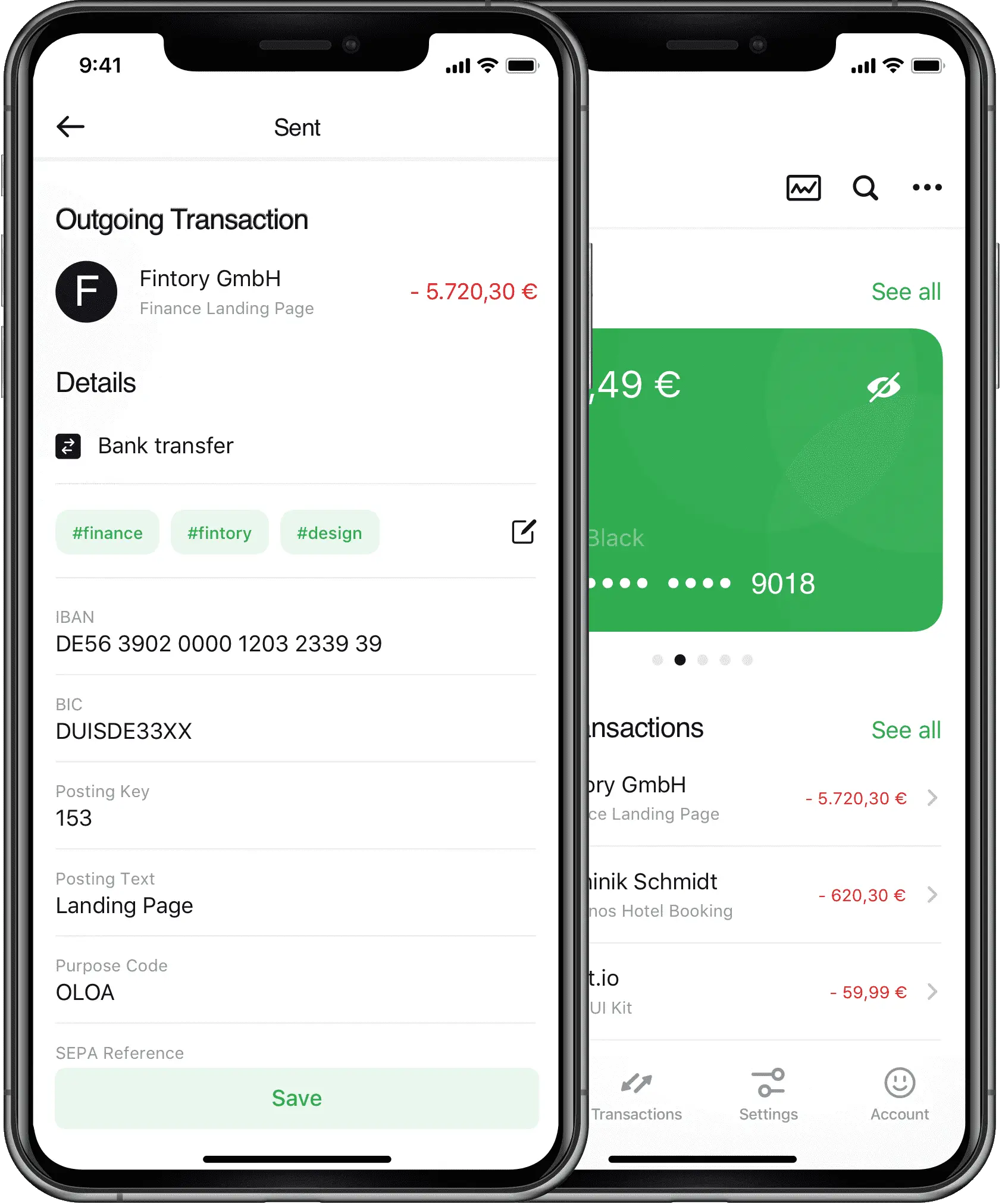

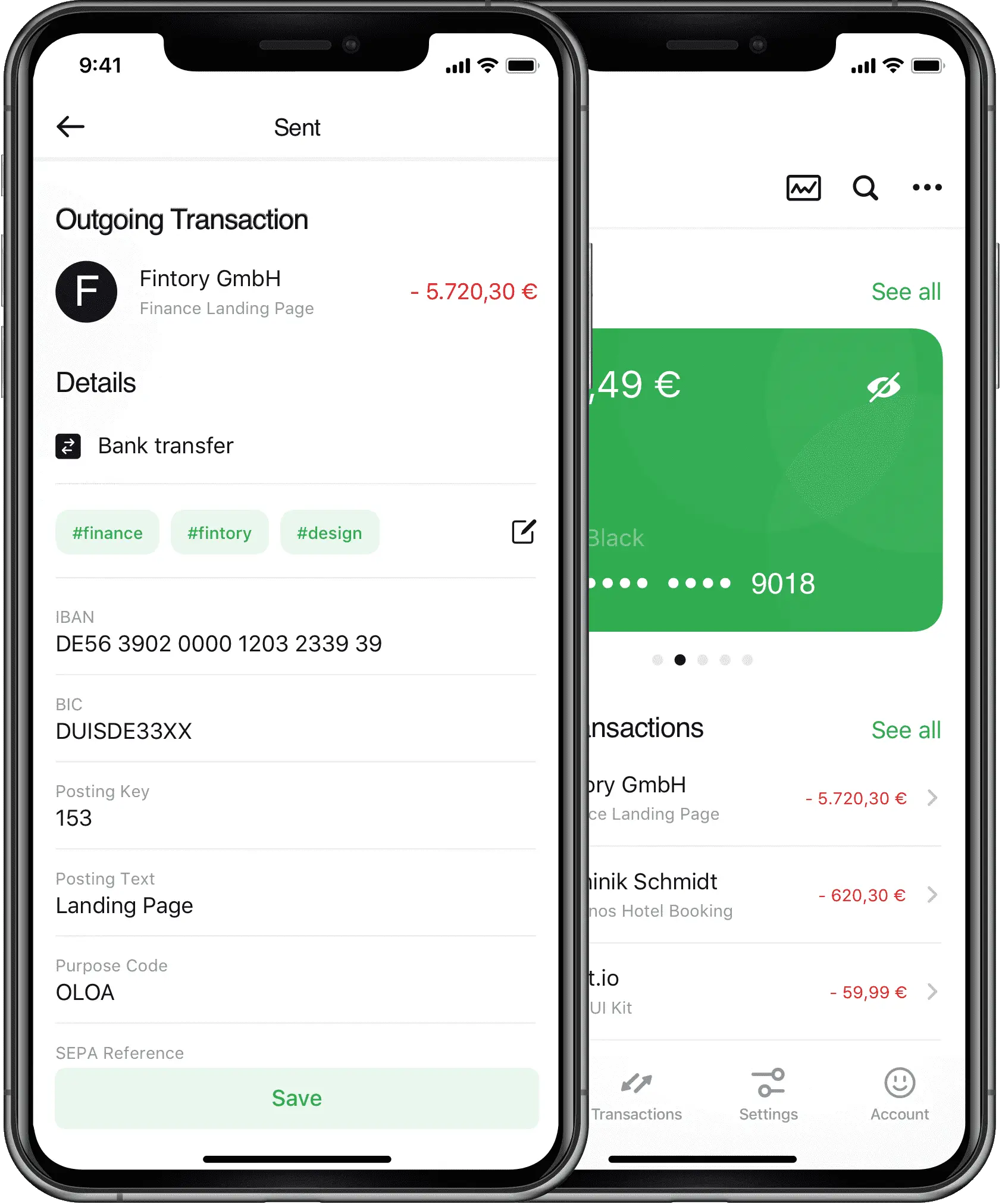

We equip Robotic Process Automation (RPA) software with the Optical Character Recognition (OCR) technology to streamline the monotonous processes of extracting vendor information, validating it, and processing the payment. OCR reads the vendor information from the digital or physical copy and transmits it to the RPA system, which, in its turn, validates the information and processes the payment.

LIBOR Transitions

The London Interbank Offered Rate (LIBOR is turning the industry upside down and making bank executives invest millions of dollars in reviewing contracts and looking for solutions for remediation. Itexus implements NLP based solutions which recognize legal entities in the corpus of LIBOR-related contracts and remediate them in seconds across thousands of documents.

Customer Service Operations

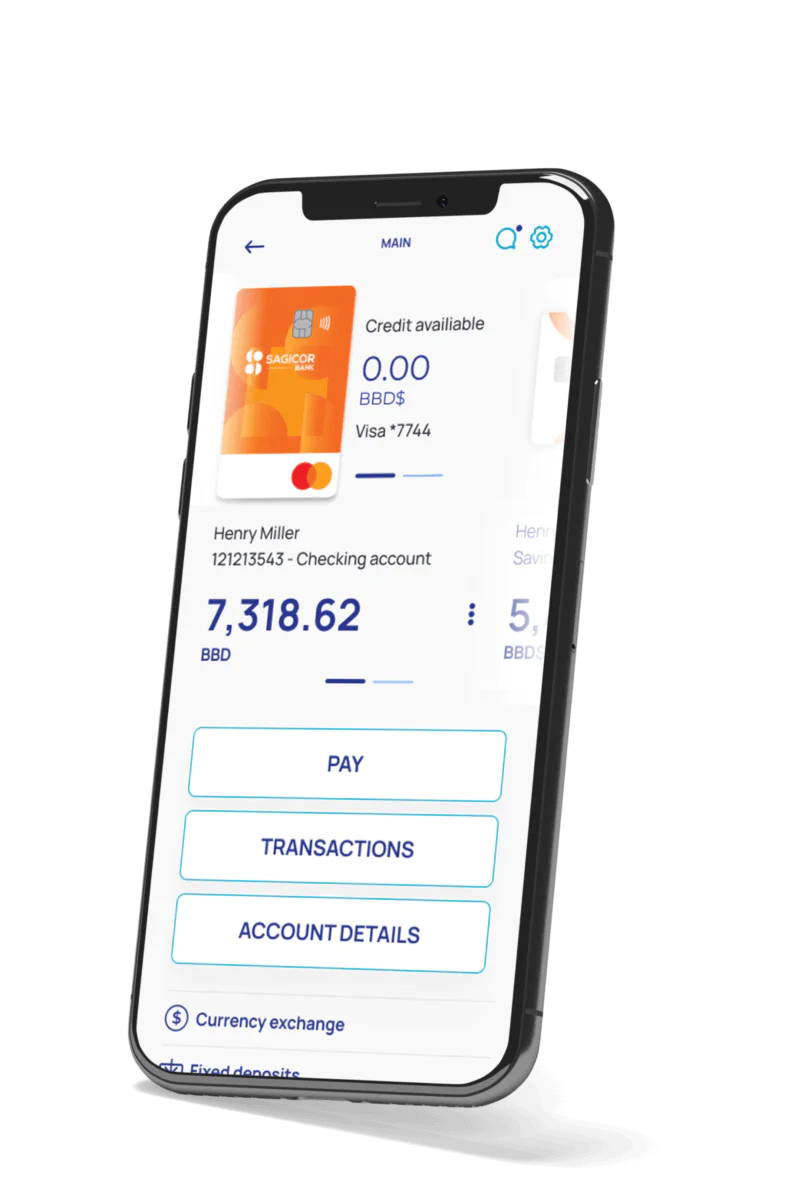

To provide superior user experience to customers and reduce the cost of the support operation the management of the bank can implement omni-channel customer support automation of banking systems that are able to automatically answer calls, emails and chat requests, perform client verification, handle basic support requests and route advanced cases to appropriate human personnel, saving all interactions in the log and capturing client’s feedback.

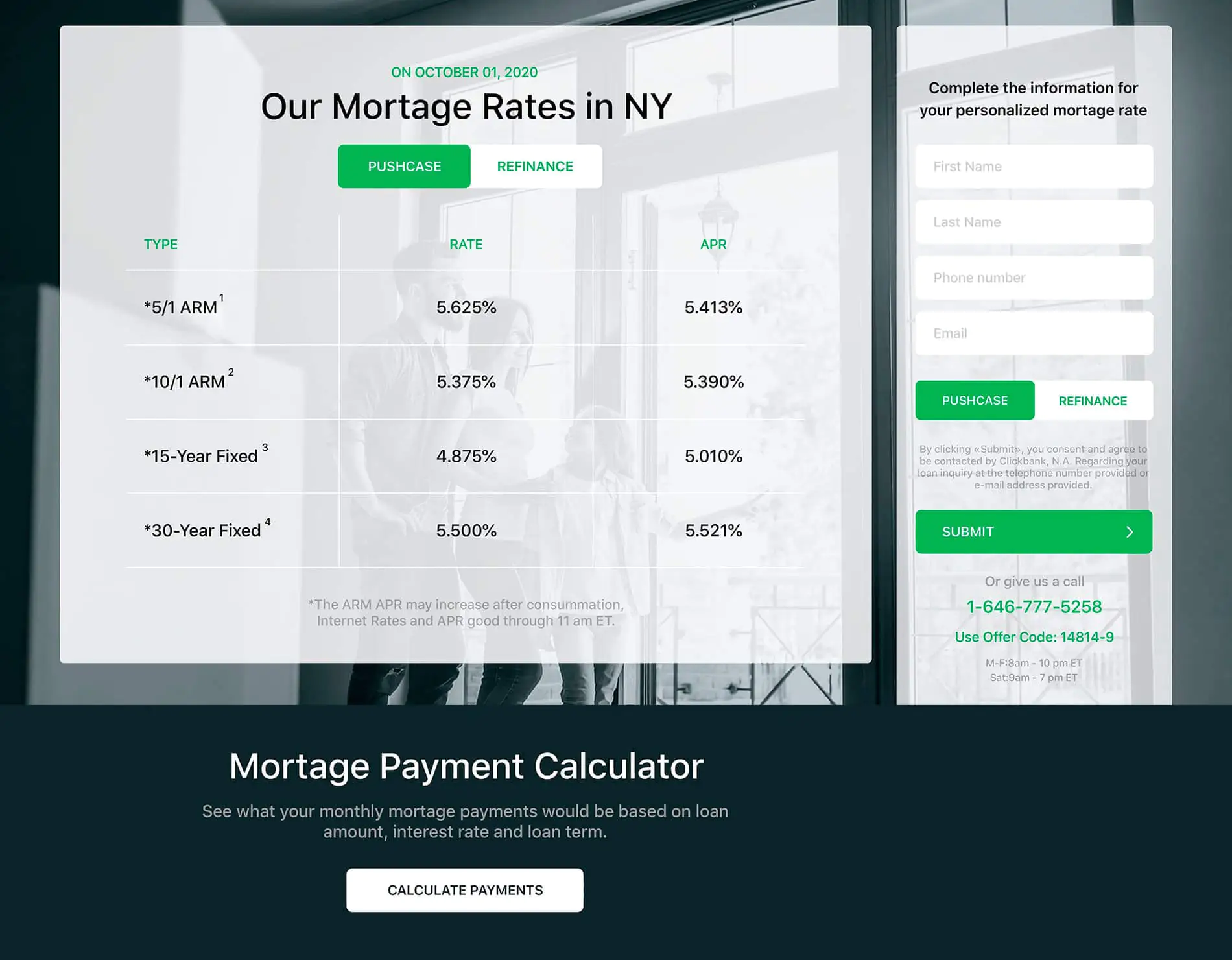

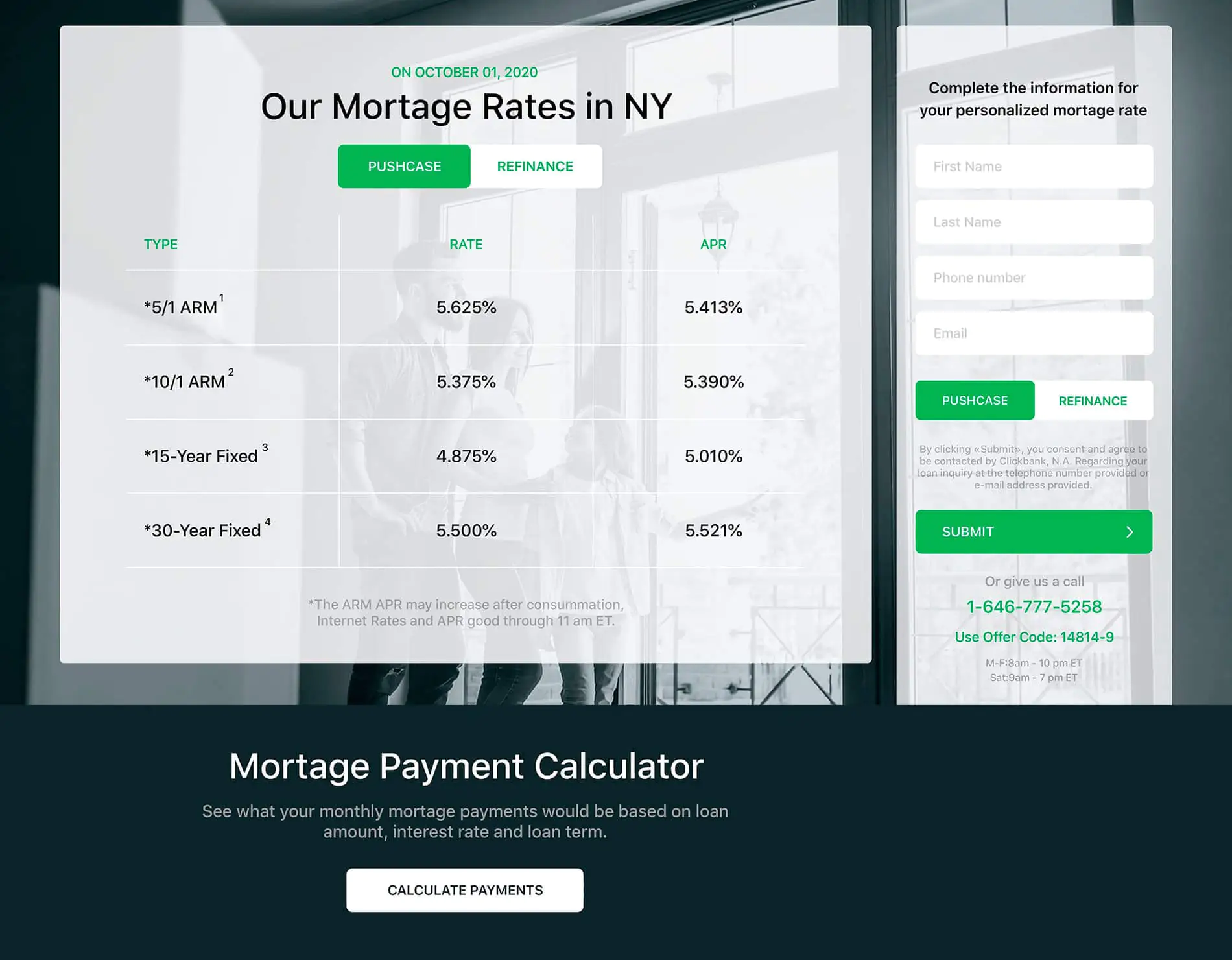

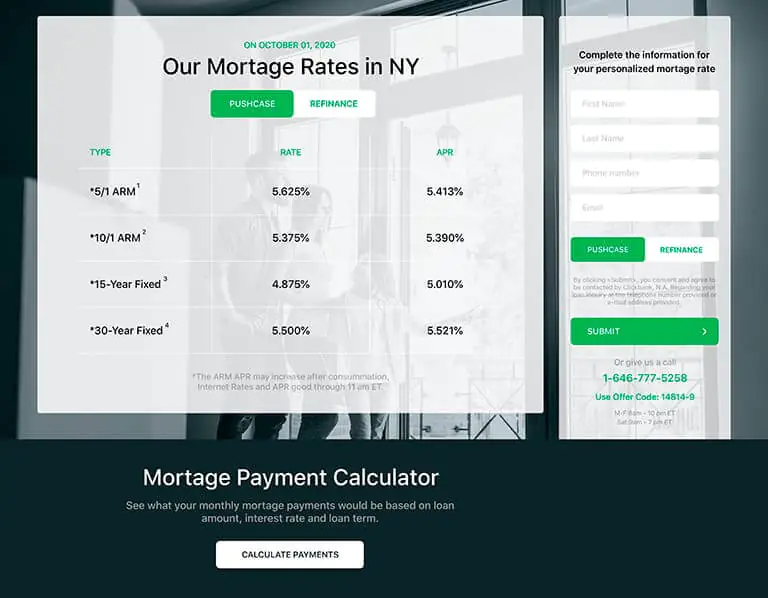

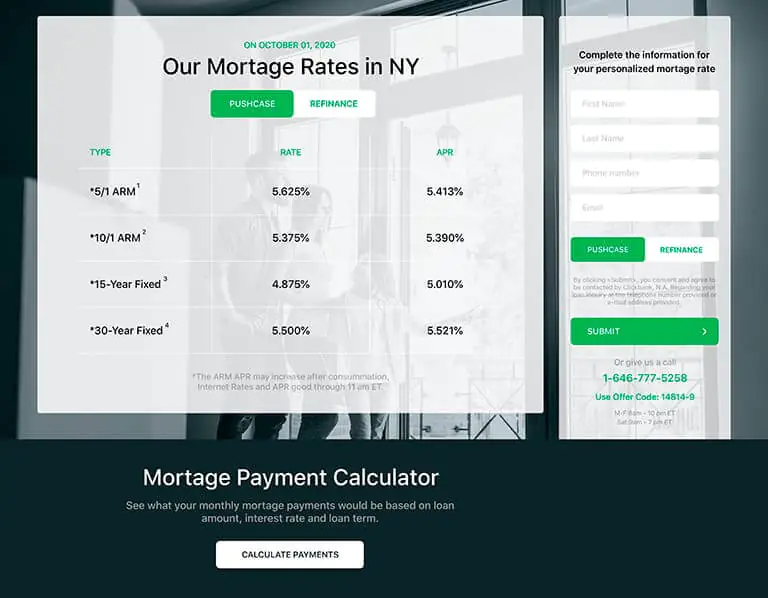

Digital Mortgage Lending

As the mortgage industry stays highly regulated and still relies on manual document exchange, many banks are losing their share of the market to Fintech startups. Automation in mortgage lending allows banks to accelerate these processes, including mortgage fraud checking, better loan workflow navigation, and reconciliation process management. With clearly defined rules, banking robotic process automation software processes information verification and analyzes applicant’s identity, background, employment history, credit score, credit history, and financial status in next to no time.

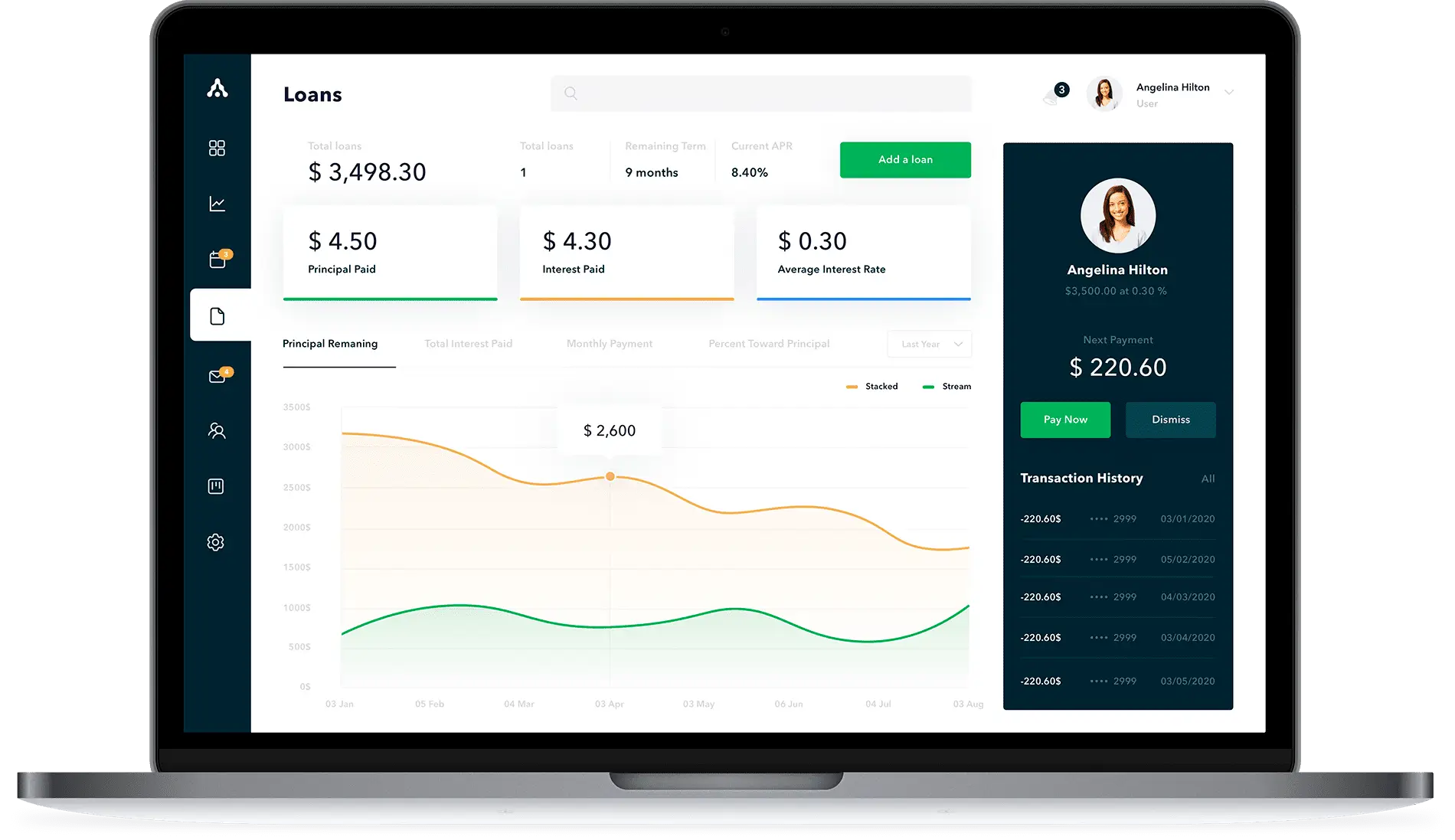

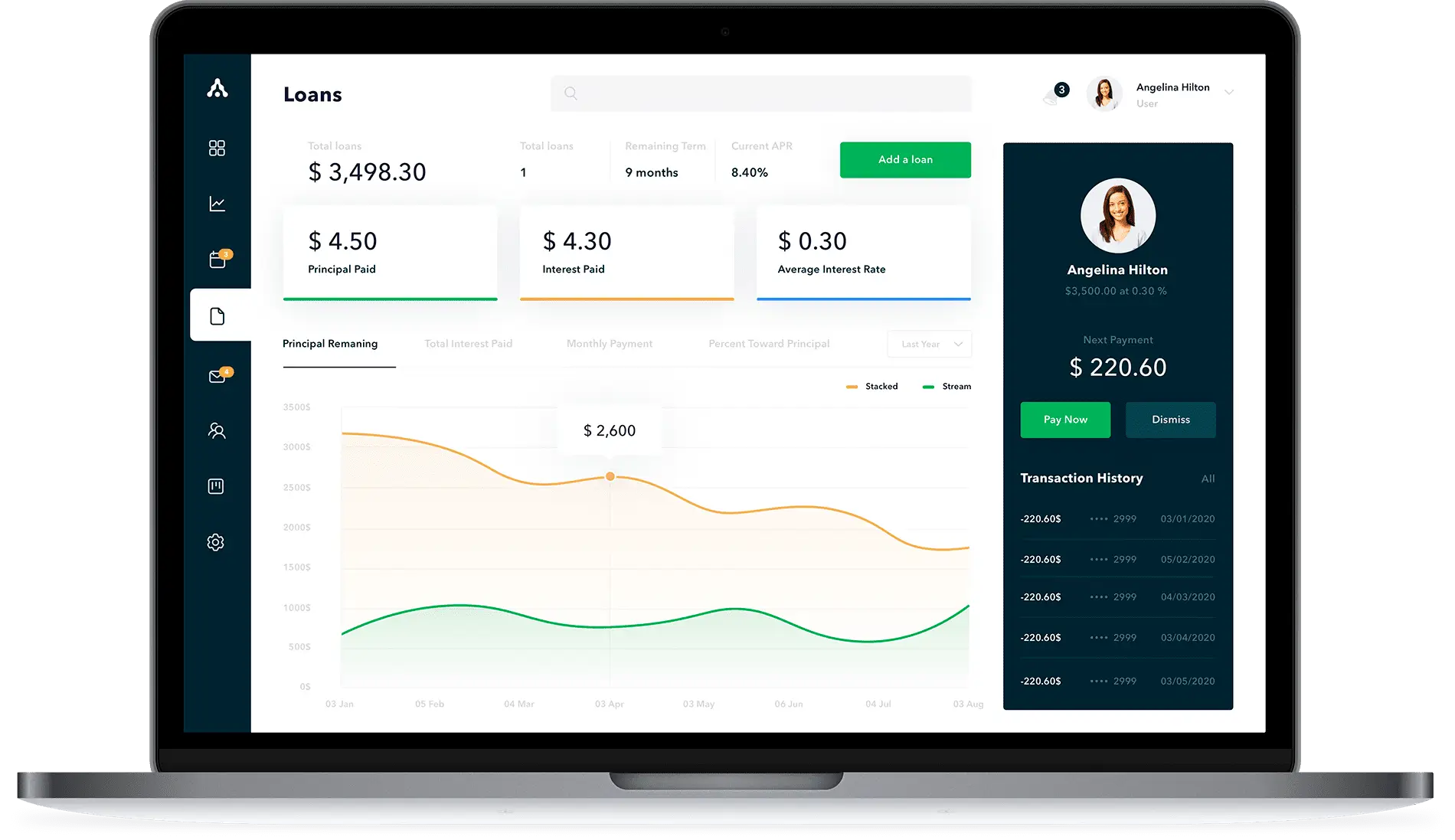

Loans Processing

Financial institutions need solutions that will enhance loan applications, help in the management of loan payments for the banks, and eliminate the risk of defaults in the payments of loans. Itexus develops custom banking robotic process automation bots that will process loans, provide an accurate lending report for each loan application, and handle the back-office loan verification, processing, and management.

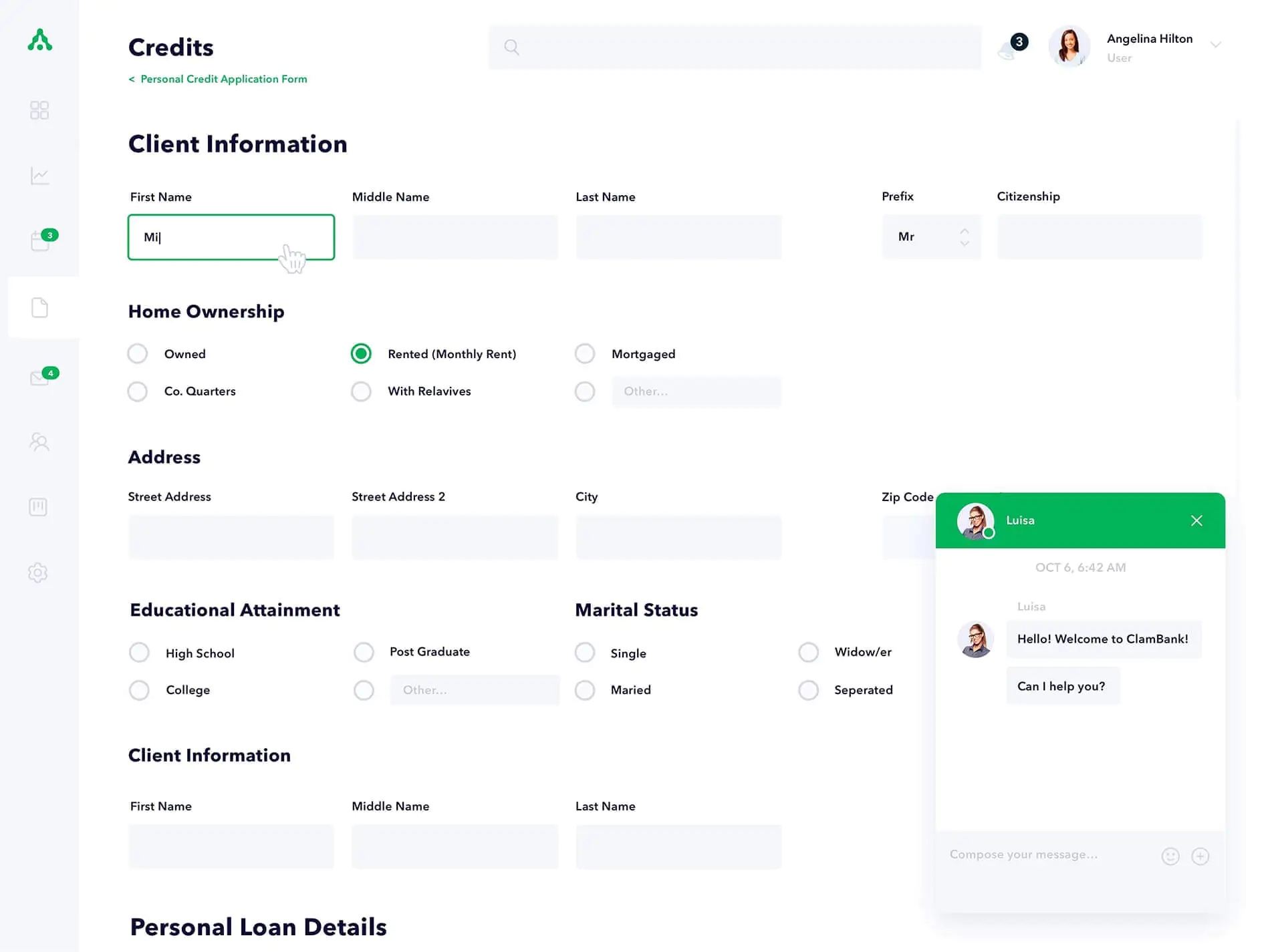

Credit Application Processing

Itexus builds custom software tools that pull data from various sources, including credit bureaus and other public institutions, provide online credit applications forms, input ratios and period-to-period comparisons into the credit scoring model, and generate approvals/denials in line with the predefined parameters. Once the application is approved, our solutions can go the extra mile and generate new customer documents like approval letters, contracts, leases, and security agreements.

General Banking Ledger Management

Banks handle and process enormous amounts of data – interest incomes, account receivables, account payables, expenses, assets, liabilities, and so on – every business day, storing it in the general ledger and withdrawing it from there to prepare reports and financial statements. Updating and managing the general ledger is a non-trivial task, and Itexus knows how to handle it. We deliver advanced software that automates these processes, accurately updates the general ledger, and communicates with distributed systems regarding the required financial data.

Anti-money Laundering (AML)

AML processes are challenged by heightened regulatory scrutiny and the increasing cost pressures. To address these challenges, our specialists design advanced algorithms that evaluate massive data sets for targeted accounts, process thousands of checks, discover suspicious patterns, and generate alerts. The automated AML compliance process results in reduced regulatory risks and an improved quality of investigations.

Suspicious Transactions Reporting

We create automation of banking systems which investigate and uncover suspicious activity, complete a Suspicious Activity Report (SAR) correctly, and submit it to the appropriate authorities like FinCEN. According to your needs we create the custom software that automatically completes the necessary data fields, ensures one click e-filing, transforms dispersed SAR workflows into a regulated business process with a proper status control, and provides custom dashboards and charts for better reporting history analysis.

Trade Operations

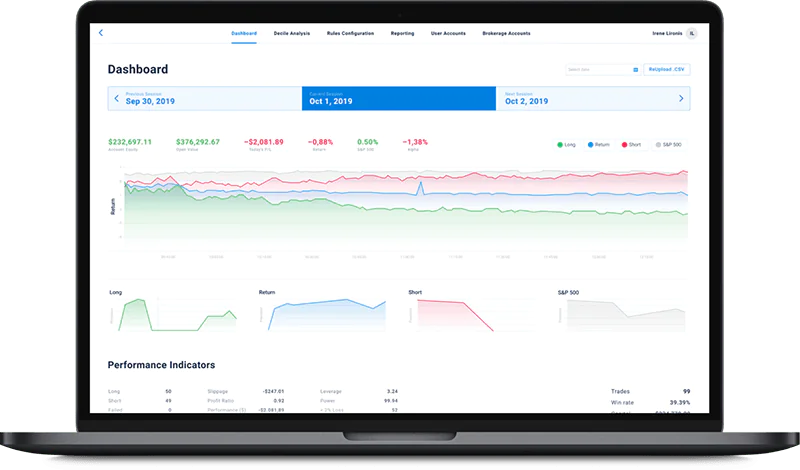

Itexus works with central securities depositories (CSDs), investment banks, custodians and other trade players developing systems for trade validation, confirmation, settlement, reporting, and accounting operations. We automate and centralize standard trade finance processes, ensure adherence to SLAs and regulatory requirements by implementing checklists and other forms of internal controls, and replace manual case reviews with an automated rules engine.

Why Use Custom Software for Banking Automation?

No license costs

Along with regular subscription fees, off-the-shelf solutions often come with upfront license costs which vary significantly and may run into huge sums. A tailor-made solution is paid for once and for all, and a client becomes the owner of its source code which he/she can later modify, upgrade, and share in accordance with their own preferences and needs.

Fully customized & scalable solution

We deliver banking robotic process automation solutions in line with your needs and equip them with new technologies to give you an edge over your competitors. You don’t adjust your business processes to off-the-shelf software – but get a product fitting your goals.

Extra security

We know that bulletproof security across the entire financial application ecosystem is the principal requirement. Our engineers apply the zero trust and “never trust/always verify” approach and test every aspect related to data privacy and customer trust multiple times before handing the project over to the client.

Long-term partnership

With dedicated engineers and managers assigned to your project and fully investing into it, you get personalized high-quality service. As your project is evolving, our experts will take into account new ideas and needs, add features, and provide post-launch support and maintenance services.

Benefits of Process Automation in Banking & Financial Services

Cost savings

Expedited operational efficiency

Higher accuracy and reduced manual errors

Increased customer satisfaction

Stronger team management and reporting

Strengthened regulatory compliance

Trends Disrupting Banking Process Automation

Robotic Process Automation (RPA)

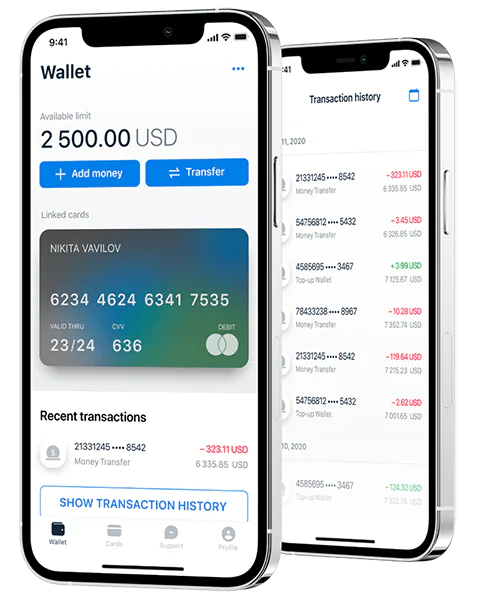

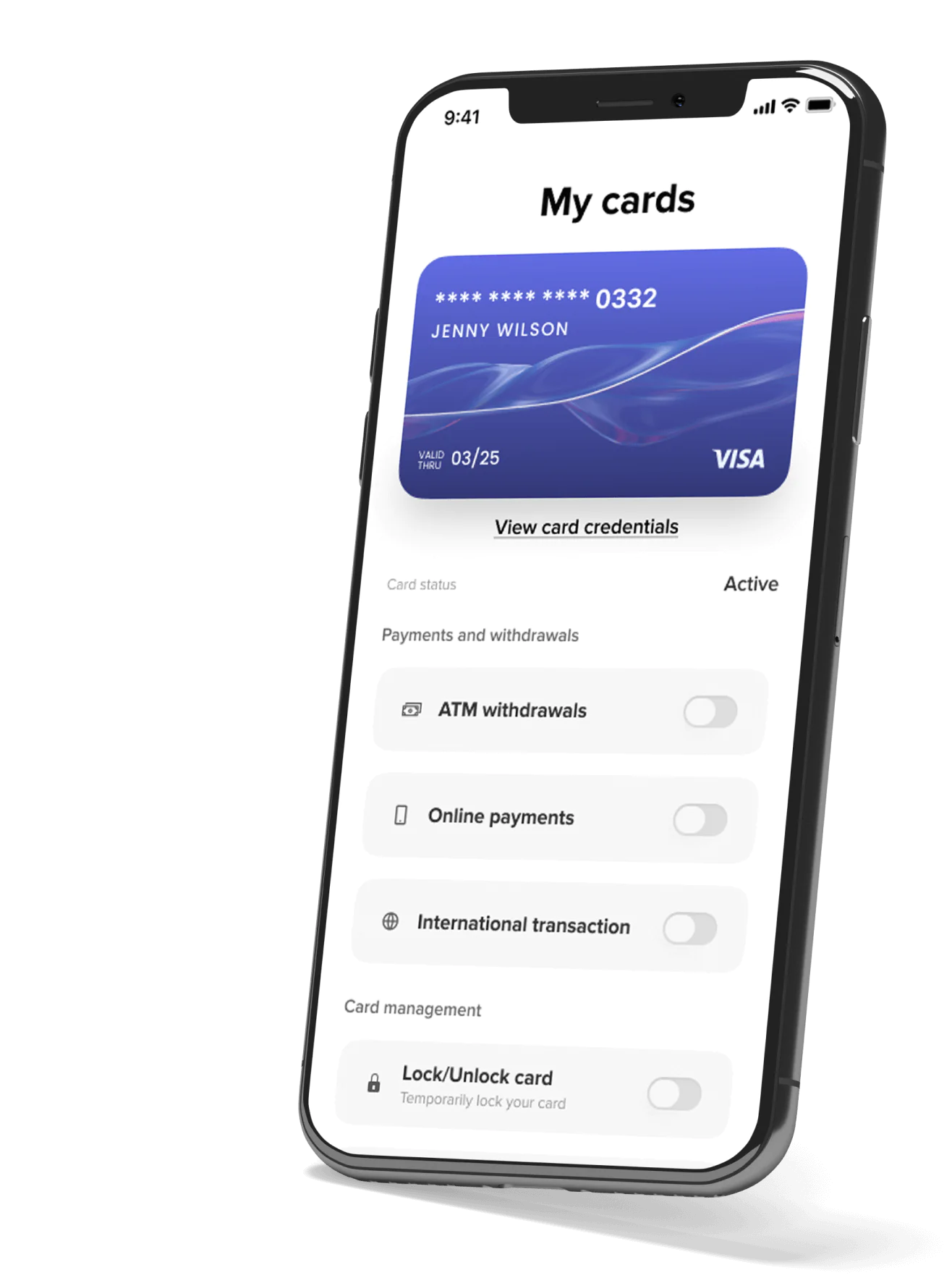

We help our clients use robotic process automation in banking for their front office, back office and support functions. RPA in the banking industry is efficient for operations with a well-defined set of rules and repetitive tasks to train the automation, such as invoice processing operations, expediting card issuance, and executing transactions.

Artificial Intelligence and Machine Learning

Itexus uses predictive AI software and incorporates special algorithms to monitor backlogs, detect frauds, and drive data-driven day-to-day decisions. Neural networks, deep learning, and big data services are only some of the technologies used by our team to scale our clients’ automation initiatives and refocus their workforce on business transformation across the whole banking value chain. The predictive models further apply to real-time evaluation of extensive volumes of data sets and pattern recognition in various processes, including loan approvals, stock forecasts, and fraud prevention.

Blockchain

We use distributed ledger technology (DLT), cryptographic hash functions, and public and private keys to code smart contracts, enable encrypted updates to client’s details spread across banks and institutions, provide a historical record of all documents shared and all compliance activities undertaken, and process KYC checks on the blockchain.

Intelligent Automation

For more complex scenarios where a system needs to learn and adjust over time., Itexus deploys cognitive Intelligent Process Automation (IPA) solutions. Equipped with prescriptive and predictive analytics tools, text analytics, computer vision, and NLP, they process unstructured data, handle exceptions, and cope with judgement-based tasks, like regulation compliance, suspicious pattern monitoring, and fraud prevention.

NLP

We integrate Natural Language Processing software, including text classification and clusterization, entity extraction, sentiment analysis, into our analytics programs, chatbots, AI-based digital assistants, and compliance monitoring systems, to help the system understand unstructured data, unlock actionable insights from it, and support users throughout their journey.

FAQ on Banking Process Automation Services

How process automation can help my bank provide superior customer experience?

Can you describe the process? How will the workflow and our interaction be organized if I choose Itexus for my project?

Your project manager will provide you with regular updates on the project’s progress.