Mobile banking isn’t a luxury anymore. It’s a necessity. It’s something that banks must have these days.

Don’t you agree?

So, what’s going on? American banks are lagging behind in mobile banking. Fintechs like Revolut and N26 are thriving. How is it possible that US banks, which have led the world in innovative technologies since launching credit cards in the 1950s, are now falling behind?

Unfortunately, that’s the case—we’re trailing behind developing countries like Kenya.

Doubt it?

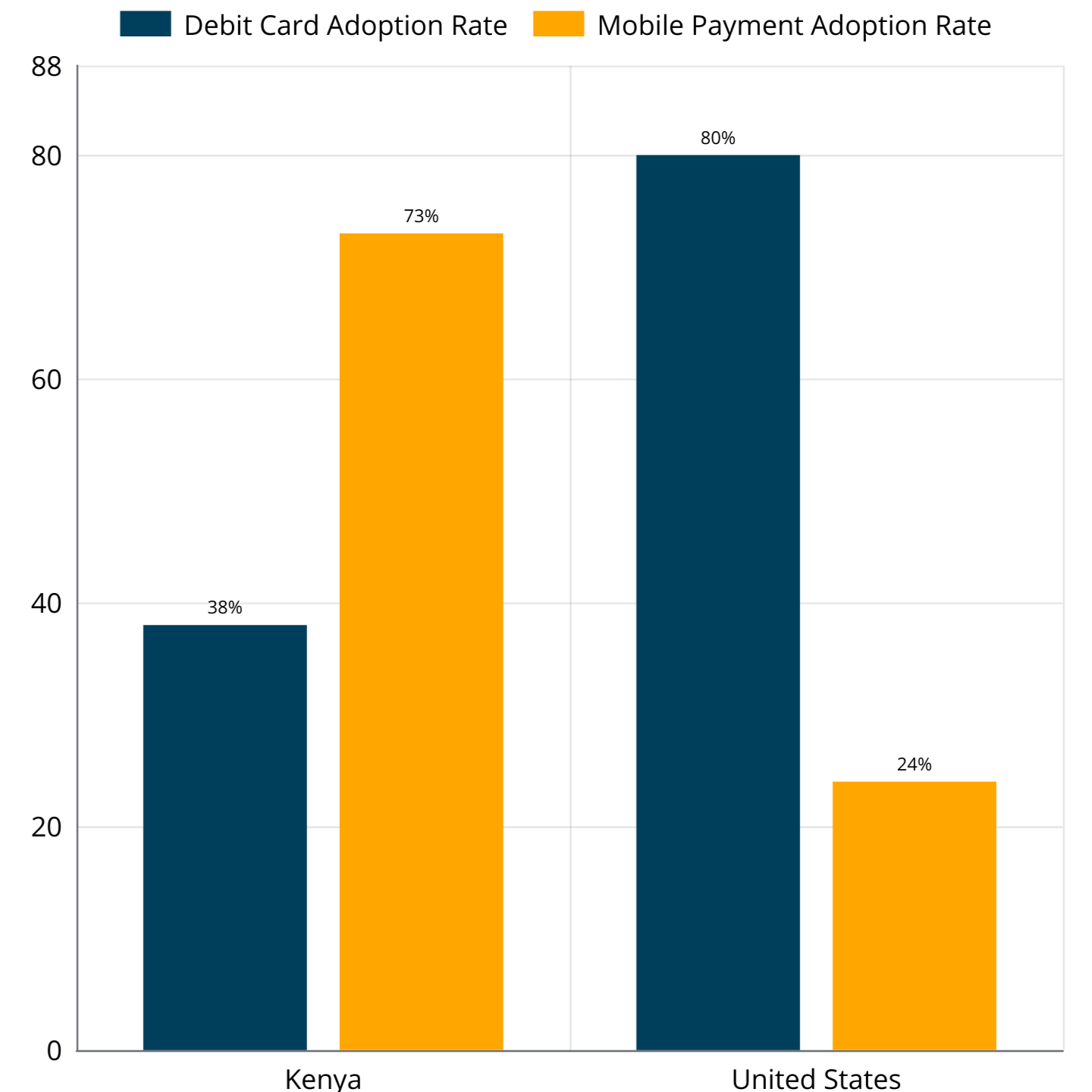

Look at the report from the Federal Reserve Bank of Richmond: Kenya’s mobile payment adoption rate is about 75%, while in the U.S., it’s less than 25%.

Seventy-five percent versus twenty-five percent—what a difference!

What are the reasons for this disparity?

Many sources point to key issues such as the existing payment infrastructure and regulatory environment. Secondary factors could include the high costs associated with developing their own mobile banking solutions for many banks. Additionally, there is often a lack of resources and expertise needed to create modern solutions.

Ready to dig in?

Having been in Fintech software development for 11 years we’re at Itexus are familiar with the problems and know how to work them out. In this article, we explore many aspects that can either increase or decrease the cost. On top of that, we will share some tips and tricks on how to reduce development costs by 10 to 20%.

How Much It Cost To Create Mobile Banking App

The average cost of mobile banking app development typically ranges from $30,000 to $500,000. However, many factors affect the cost of development. The most significant are the app’s functionality and the complexity of the processes involved in development.

The more functionality, the higher cost.

| Basic account and payment | Basic | Medium | Advanced |

| Virtual credit cards | + | + | + |

| Deposits | + | + | + |

| Online loans | + | + | + |

| ACH payments | + | + | |

| International wire transfers | + | + | |

| Brokarage accounts and trading | + | + | |

| KYC | + | + | |

| Apple/Google Play | + | ||

| Expediture analytics | + | ||

| Loyalty programms | + | ||

| COST | USD 30,000 | USD 60,000 | USD 120,000 |

Contact us for a free consultation and a one-day estimate for your project

Custom vs. Ready-Made Banking Apps: Finding the Right Fit

Banks face a crucial decision when it comes to mobile app development. They can either build an application from scratch or opt for a ready-made white-label banking app. Developing from scratch offers several advantages. A custom app is tailored to meet specific client requirements perfectly. It reflects the bank’s unique branding and provides a seamless user experience.

On the other hand, ready-made white-label solutions present a quicker, more cost-effective alternative. These apps can be customized to some extent, but they are inherently a compromise. Think of it like choosing between a tailored suit and one bought off the rack. While the off-the-rack suit is convenient, it may not fit perfectly. Ultimately, the choice depends on the bank’s goals, timeline, and budget. Each option has its pros and cons; banks must carefully weigh their priorities before deciding which path to take.

Simple apps have basic functionality with minimal features that allow users to do the following:

- Access accounts and cards.

- Check their balances.

- Transfer funds.

- Make banking inquiries.

- KYC

- Two factor authentication.

- Facial recognition.

Medium apps have advanced significantly in terms of UI/UX design and functionality. In addition to the simpler apps mentioned above, they include the following features:

- Make payments to merchants and for services delivered.

- Open and withdraw from deposits.

- View transaction history.

- Manage savings.

- Order debit, credit, and virtual cards.

- Receive notifications for financial transactions.

- Apply for loans.

- Conduct wire and ACH transfers.

- Calculate interest rates.

Advanced apps often use AI and offer the following features:

- Spending Analysis: Provides insights into spending patterns and categorizes expenses.

- Budgeting Tools: Helps users set up budgets and track progress toward financial goals.

- Fraud Alerts: Notifies customers of potentially fraudulent activity on their accounts.

- Support for Financial Questions: Answers general inquiries about banking products and services using AI.

- Voice and Chat Interaction: Allows users to interact through text or voice commands in the mobile app.

- Cryptocurrency.

- Personalized Insights: Offers tips and recommendations based on users’ financial behavior and goals.

- Investment Management: Facilitates management of investment portfolios.

In the USA, several leading banks in the industry offer banking apps with comprehensive features, including Bank of America, Citibank, Chase, and Capital One

Prior to developing a mobile banking app, it’s essential to review several key factors that significantly influence the overall cost. These include complexity, functionality, team performance, and quality. Each of these elements plays a crucial role in determining how much you’ll spend and what you can expect from the final product.

Don’t miss out! Check out the advanced apps other banks are using too!

White-Label Mobile Banking App

Mobile Banking App for Migrants

Loan Lending App

Mobile Bank Transfer App

Project Team Commonly Involved in Banking App Development

Typically, the following roles are involved in such projects: Project Manager (PM), Business Analyst (BA), UI/UX Designer, Program Architect, Developers, Frontend Developers, Quality Assurance (QA) Engineers, Security Experts, and DevOps Engineers.

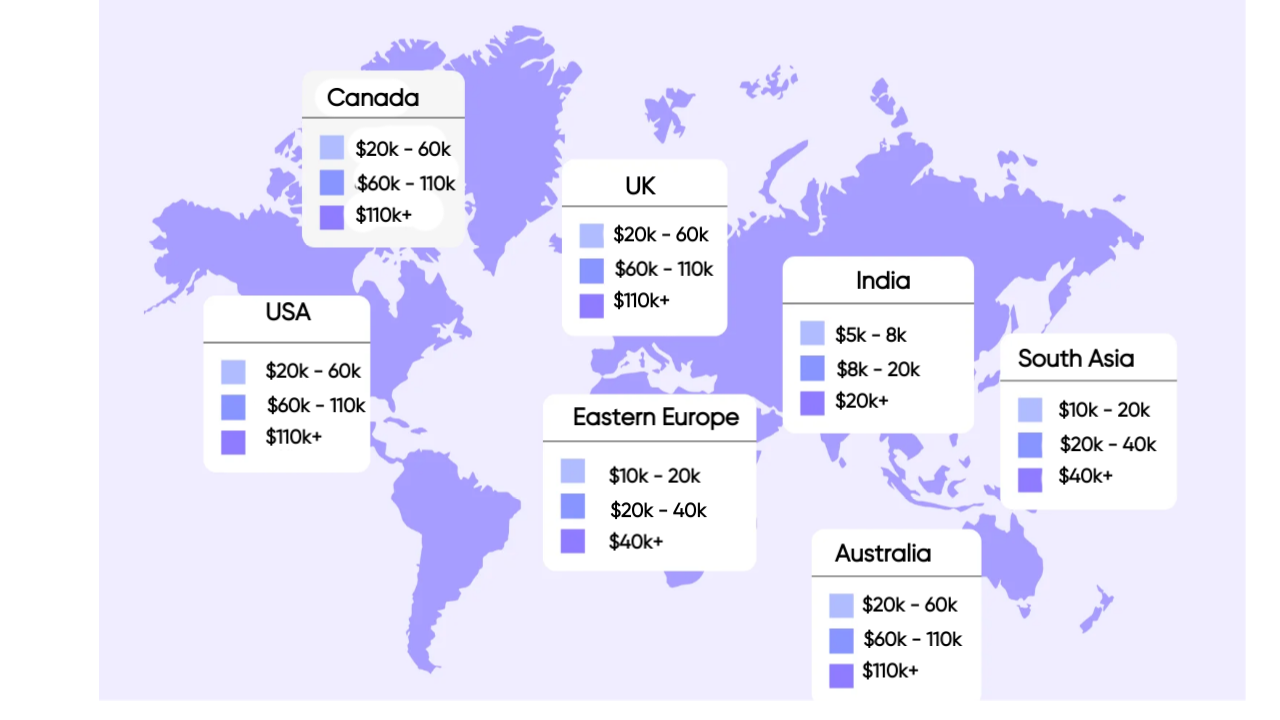

Review of Global Hourly Rates

Prior to developing a mobile banking app, it’s essential to review several key factors that significantly influence the overall cost. These include complexity, functionality, team performance, and quality. Each of these elements plays a crucial role in determining how much you’ll spend and what you can expect from the final product.

To navigate through them and avoid potential pitfalls, it makes sense to hire a team of professionals.

Just a heads-up—the price also depends on the region and local rates. We’ve shared our rates above, but costs vary globally. Some regions are more affordable, while others can be pricier. It all impacts your budget!

To give you an idea, here are some rates:

- In the USA and UK, it’s between $70 and $150 per hour.

- In Eastern Europe, average rates fluctuate from $40 to $80 per hour.

- Over in Asia, rates range from $20 to $40 per hour.

As you can see, it varies widely!

Now, here’s a crucial piece of advice: while it might be tempting to go with a cheaper development team, that decision can lead to significant pitfalls. A low-budget option may result in a project that doesn’t take off, or worse, delivers a low-quality application filled with defects and security vulnerabilities.

Imagine dealing with complex and expensive code maintenance due to bad architecture that can’t support high loads—yikes! In the end, you could wind up spending hundreds of thousands of dollars and months or even years on development, only to realize you’ll have to scrap everything and start over.

That’s a costly setback nobody wants! So, when embarking on your mobile banking app journey, remember to hire a professional team and keep a close eye on the process and quality at every stage. After all, investing in expertise will save you time, money, and headaches down the road!

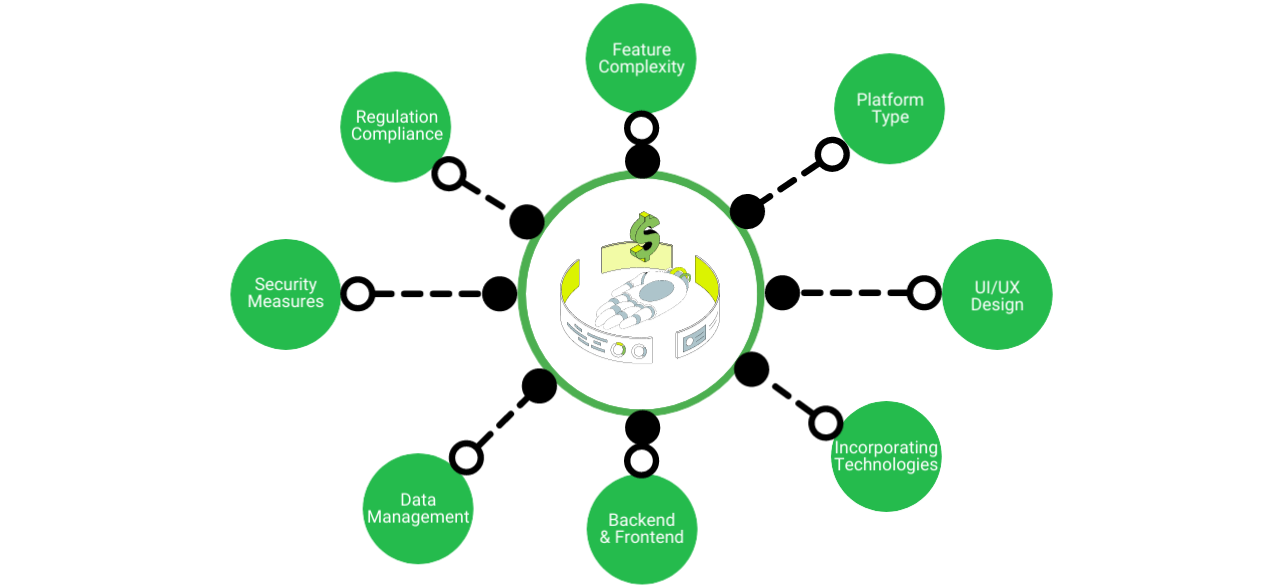

Key Factors Affecting Mobile Banking Application Costs

Needless to say, the more functionality you employ to an app the more technical resource and labor it requires.

Let’s look at each factor in detail.

Feature Complexity: The breadth and depth of features and services, such as core banking functions versus advanced investment tools, directly influence the development effort and associated costs. To put it simply, a savings account feature will be less costly than an integrated wealth management tool.

Functionality: Adding features like fund transfers and chatbots increases costs. More features need more coding and testing.

UI/UX Design: Creating an attractive, easy-to-use interface needs skilled designers, raising costs. A good user experience keeps customers.

Data Management: Securely managing customer data is costly. This includes server costs and maintenance. It’s vital for compliance and trust.

Banking Regulation Compliance: Meeting regulations like GDPR and AML requires extra work. This includes testing and documentation, raising costs.

Security Measures: Strong security, like encryption and multi-factor authentication, increases development time and costs. It’s crucial for preventing breaches and keeping customer trust.

Performance and Scalability – the application may need to be able to handle millions of simultaneous users and transactions, this requires proper scalable architecture design which seriously affects the cost compared to a single user app with identical functionality.

Hidden Costs in Banking App Development

Now that we reviewed the factors it makes sense to delve into something very important that can affect your project. It’s about hidden costs.

Service Subscription

Depending on its functionality, an app may require additional subscriptions for third-party services, such as:

- Email delivery

- SMS delivery

- Push notifications

- Chatbot services

- Hosting

- Servers

- Data and image storage

Marketing

Needless to say, marketing is crucial. Without the promotion of a product, there are no sales. This cost can be limitless.

How to reduce mobile banking app Development Cost

Indeed, those invisible aspects can be unpleasant. However, there are hints that can help reduce costs, and we have collected insights from our experience that everyone can employ while developing an app.

MVP Development

MVP — minimum viable product — it’s initial version of your app. An MVP can help you gather valuable user feedback before your entire budget goes to a product that doesn’t meet customer expectations. Instead of spending a lot of money and find that some features are out of interest for users, MVP allows to determine it on the early stage that lead to reducton of cost.

Validate capabilities

MVP helps to test the core features of the app and its scalability without a large investment of capital.

Risks and challenges of building a banking application

Given the specialized nature of the banking industry, it is extremely sensitive to financial data and regulatory requirements. This leads to numerous risks and challenges when building a banking application:

1. Security and Compliance Risks:

– Protecting sensitive customer data from breaches and fraudulent activities is critical. Additionally, ensuring compliance with regulations such as GDPR and PCI DSS can complicate development.

2. User Trust and Experience:

– Gaining user trust is paramount, as security incidents can erode confidence. Moreover, the application must be intuitive and user-friendly to prevent high abandonment rates.

3. Integration and Data Management:

– Integrating with legacy systems and third-party services can pose challenges, while maintaining data accuracy, consistency, and privacy remains crucial for user satisfaction.

4. Performance and Scalability:

– The app must handle high traffic, especially during peak times, and be scalable to accommodate growing user bases without sacrificing performance.

5. Cost and Development Delays:

– Initial development costs can exceed estimates, and unforeseen complexities may lead to delays, necessitating careful budget management and efficient project planning.

Final Thoughts

Oh, I know what you’re thinking: What’s the real cost of developing a mobile banking app? Understanding this is crucial, with typical costs ranging from $30,000 to $500,000. These figures depend on various factors, including app complexity, functionality, and design.

Ready to embark on your project? First, pinpoint the functionality you need. Then, reach out to several professional companies for assessments and technical proposals. Be sure to take your time comparing your options. If you’re considering an in-house approach, hiring a third-party auditor or a trusted service station can help keep everything on track. These steps will set you up for success from the get-go!

At Itexus, we specialize in fintech application development, offering tailored solutions to meet your unique requirements. Our team excels at integrating modern technology with comprehensive feature sets that align perfectly with your business goals.

We have a proven track record with successful projects, like the White-Label Mobile Banking App that improved a leading bank’s customer retention by 20%, along with innovative apps for migrants, loan lending, and mobile bank transfers. These examples highlight our commitment to delivering impactful solutions that drive results.

So, are you ready to elevate your mobile banking capabilities? Don’t hesitate to connect with the Itexus team for more information on our banking software development solutions. Let’s collaborate to create an app that transforms your business and enhances your customers’ banking experience!