White-Label Mobile Banking App

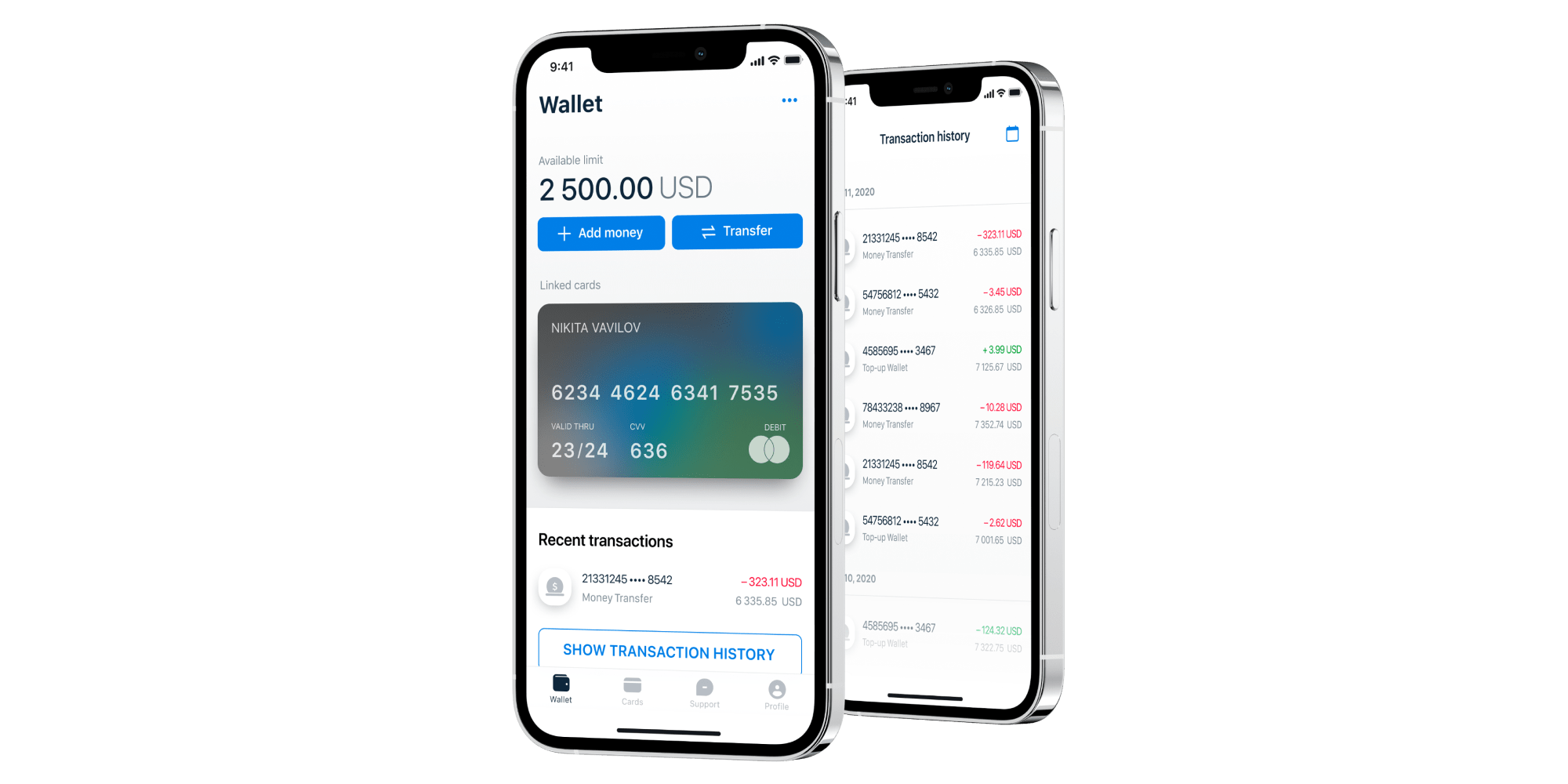

A white-label mobile banking application for a Silicon Valley-based digital banking services provider.

About the Client

Our client is a Silicon Valley-based provider of digital banking services. The company offers its customers a SaaS-based digital banking platform that enables them to set up and run a digital bank of any size while meeting international and local regulatory requirements such as GDPR, PSD2, and ISO.

Project Background

We developed a mobile banking app for a US-based fintech startup and needed to integrate it with our current client’s digital banking platform. To clarify some details about the platform integration, we got in touch with the client’s development team – that’s how our story began. A little later, the client decided to develop their own white-label mobile banking app and approached us to implement the project. They chose Itexus for development because they had already seen our engineers in action and were impressed by their expertise and strong communication, collaboration, and problem-solving skills.

The white-label application we developed is targeted at credit unions, fintechs, digital banks, and other financial companies in the U.S. market that want to leverage our client’s banking-as-a-service platform and offer mobile banking apps under their brands.

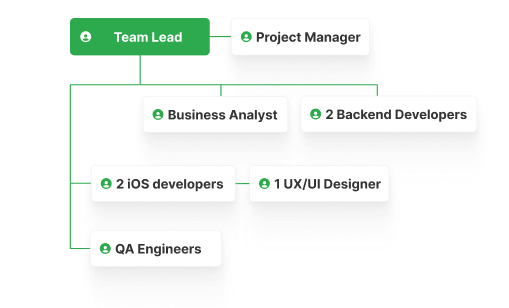

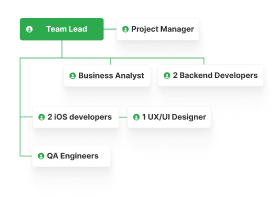

Project Team

Engagement Model

Time & Material

Tech stack

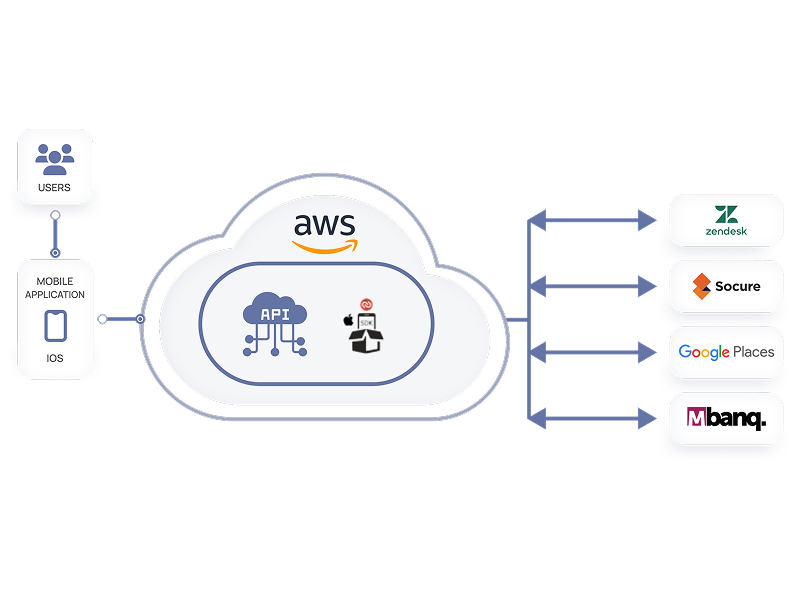

Architecture Overview

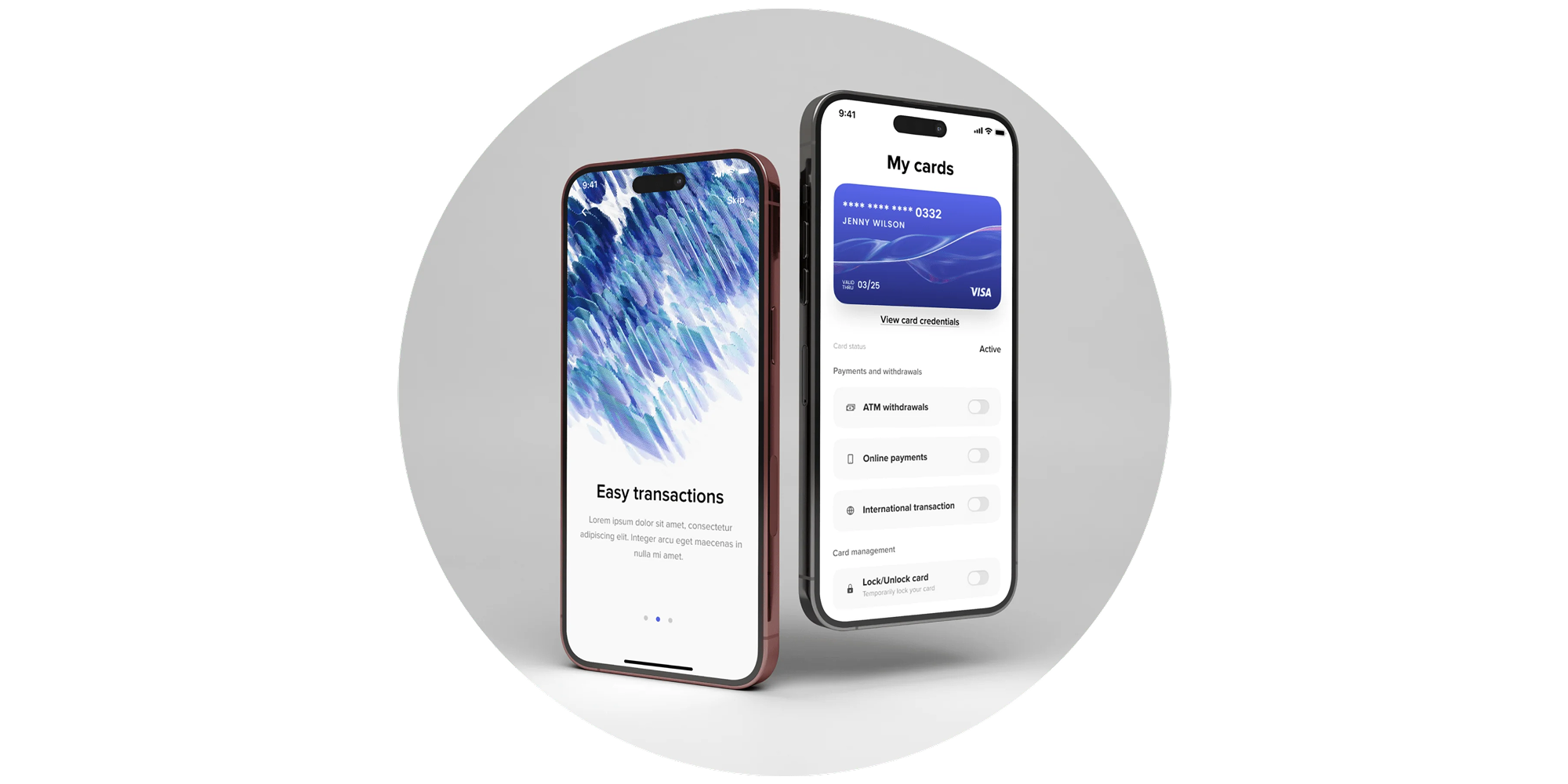

The solution is a customizable and scalable white-label mobile banking application developed for the iOS and Android platform. It enables the full range of financial services that banks and non-banking financial organizations want to offer to their customers.

Solution main features

- Sign up & sign in, MFA (Touch ID, Face ID)

- Onboarding

- KYC, upload & verification of documents

- Profile creation, personal information management

- Card issuance (both virtual and physical) & management (block, limit, etc.)

- Account balance view & management, account statement access & download

- Access transactions history and details

- ACH money transfers

- Transfers between cards within the app

- Transfers to cards issued by other banks (non-partners)

- Recharging the account of cards issued by other banks (non-partners)

- OTP for verification of transactions

- Customer support (ticketing system + chat with support staff)

Development Process (or Project Approach)

First, we created a comprehensive software requirements specification document, describing all the details carefully to ensure the app would be developed to meet our client’s goals and deliver maximum value. Then the design phase began. Our UX /UI specialist thought out the navigation and created mockups and a prototype. After the client gave their approval, we created the final design. Note that the white-label concept requires that multiple companies can rebrand a single solution. Therefore, UI should appeal to a wide audience and be easily rebranded. Once the design was ready, the developers programmed the app, and after thorough testing, it was ready to be sold to companies using our client’s platform. The project was implemented following the agile development process with frequent deliveries, full transparency, and close collaboration with our client. Every two weeks we delivered and demonstrated results and reported on costs.

Third-party integrations

- Socure is an identity verification platform that acts as a KYC provider and verifies users’ identities based on the data provided.

- Zendesk is a customer support and interaction service that allows users to access the support team and get help with money transfers, payments, cash flows, and any other issues. Google Places is a service that provides information about users’ places.

- Mbanq is a global provider of cloud banking technology that offers multiple services to financial organizations such as traditional banks, fintechs, and others. It’s integrated with the app to enable the following: • Notifications (WEBHOOK, email) • SMS notifications • Transaction history • Internal and external (ACH, WIRE) money transfers • Physical card orders • Recharge by external card Thus, the app exchanges information with the provider, keeps the received data up to date, and allows customers to manage accounts, create more than one monetary account, and manage cards and beneficiary data.

Project Challenges

Deciding on the tech stack for app development wasn’t easy – based on our experience, we offered optimal technologies to ensure time- and cost-efficient development and high performance of the solution. However, the app was to be supported by the client’s in-house development team, but they weren’t familiar with the technologies we offered that were optimal for the project implementation. Finally, we agreed on a compromise and selected the right technology stack that would make it easy for the client’s in-house team to support and maintain the app without compromising its performance.

Results & Future Plans

In four months, we designed, developed, and delivered the white-label mobile banking application with basic functionality. Now it is being tested by the first customers, and we are collecting feedback and making improvements based on the reviews of real users. Want to develop a white-label application? Contact us to find out how we can help.

Discuss your White-Label mobile banking app development needs with us

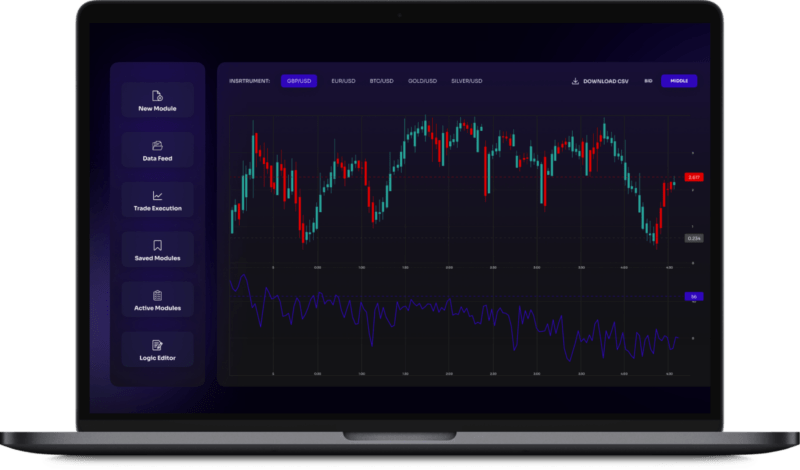

An automated, real-time trading system that allows administrators to configure trading strategies based on various technical indicators, and investors to invest their money in a selected strategy.

A mobile banking app for migrants, designed to facilitate monetary transactions like sending financial help abroad, getting paychecks early, receiving microloans, etc.

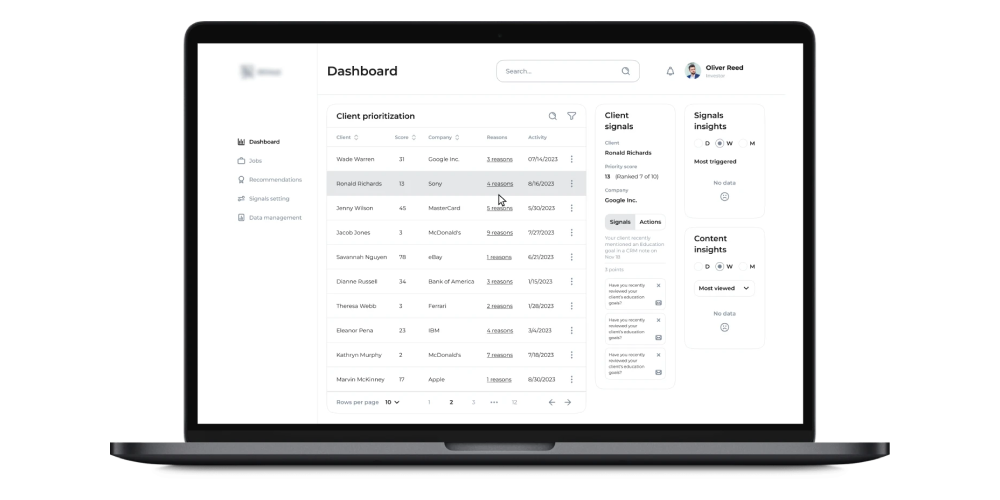

AI-based data analytical platform for wealth advisers and fund distributors that analyzes clients’ stock portfolios, transactions, quantitative market data, and uses NLP to process text data such as market news, research, CRM notes to generate personalized investment insights and recommendations.