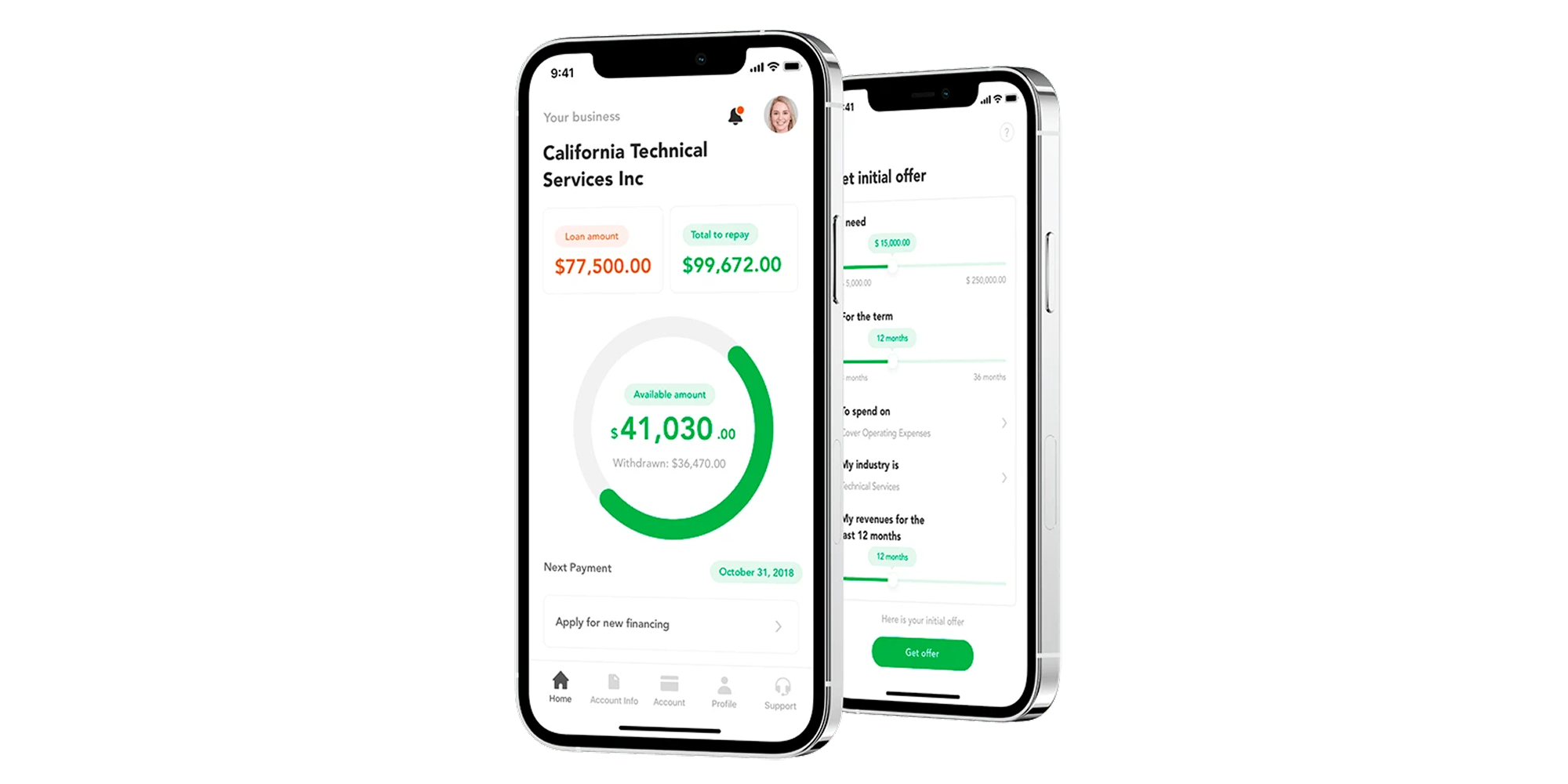

App for Getting Instant Loans / Online Lending Platform for Small Businesses

Digital lending platform (and a matching mobile app client) with an automated loan-lending process.

About the Client

Digital lending platform and corresponding mobile app client that fully automates the loan process (e.g., origination, online loan application, KYC, credit scoring, underwriting, payments, reporting, and bad deal management).

Features a custom, AI-based analytics and scoring engine; virtual credit cards; and integration with major credit reporting agencies and a bank account’s aggregation platform.

Project Background

The client is a FinTech startup with decades of experience in the financial services industry. Recognizing a gap in the current business-loan lending sphere for small and midsize businesses, they decided to launch a fully digital, online loan platform (and a corresponding mobile app) that would fully automate traditional loan business and provide the following benefits:

- Allowing end clients to apply for, receive, and make payments for a loan without having to leave their home

- Lower operational costs for capital providers and lower interest rates for end clients by minimizing human involvement and fully automating the loan process

- Disbursement of more loans with a lower default rate, using an AI-based, self-learning, credit-scoring module

- Moving operations from brick-and-mortar branches to the online platform

The client was looking for a technical partner with profound expertise in the FinTech industry, specifically in digital-lending technologies, artificial intelligence, and mobile app development. Itexus was selected for our expertise in these areas, as well as for our flexible, startup-oriented approach.

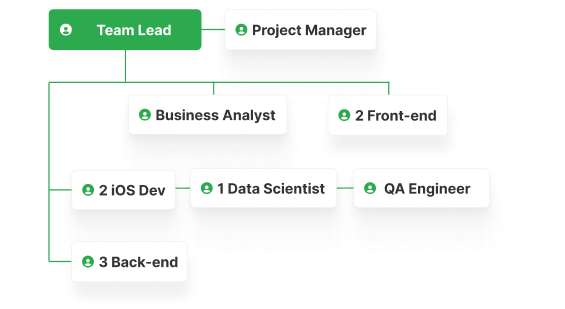

Project Team

Engagement Model

Time & Materials

Tech stack

Functionality Overview

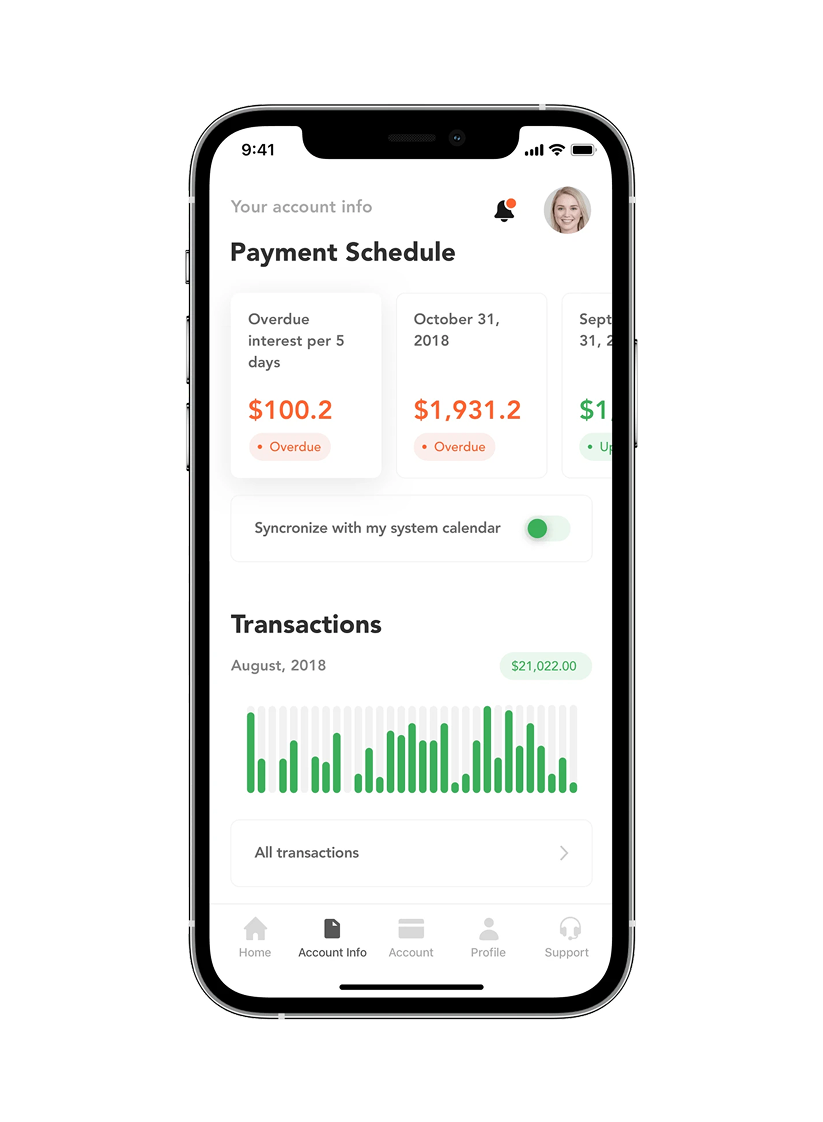

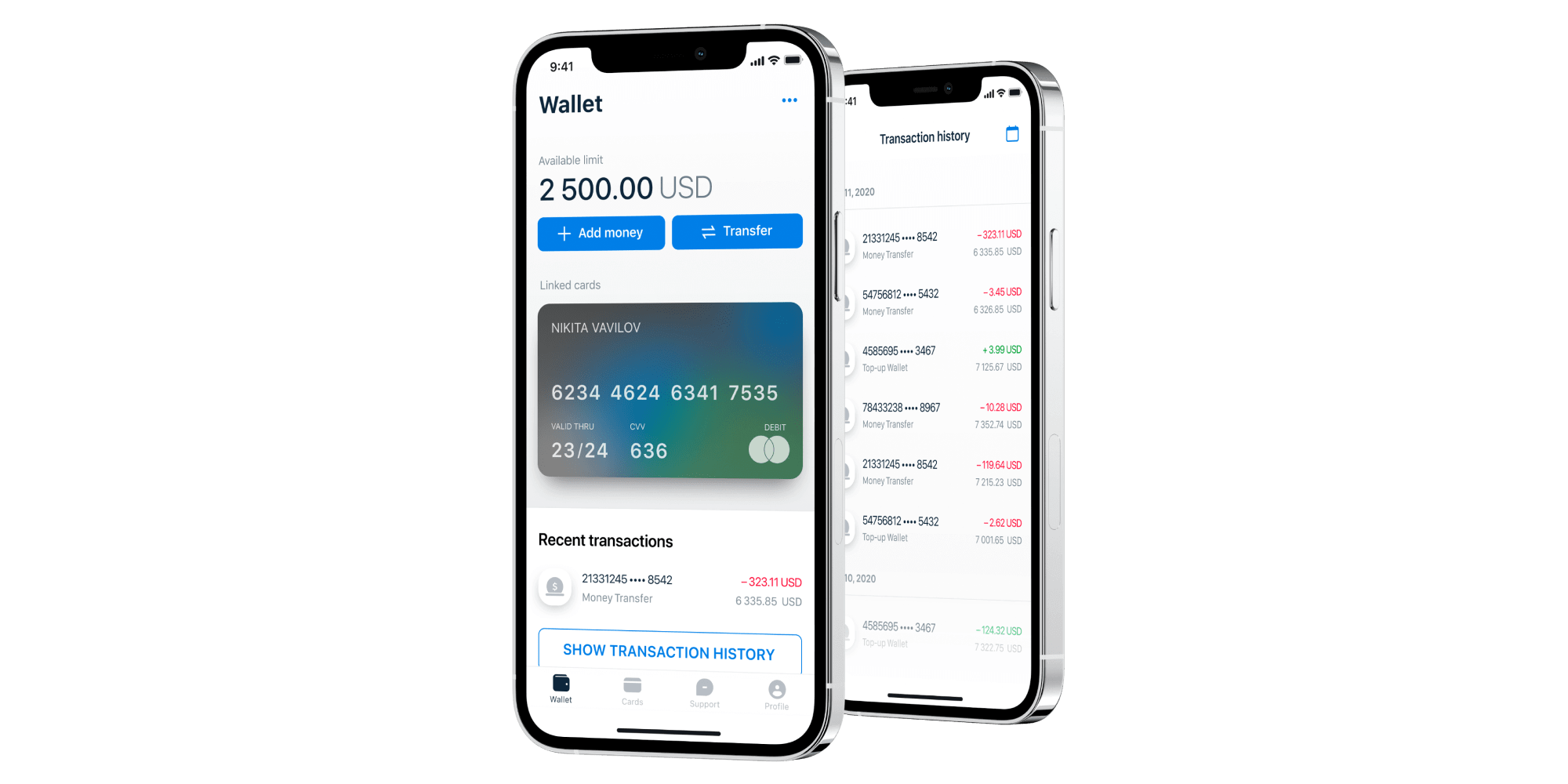

- A mobile app for end clients with user registration, KYC, loan application, agreement signing via DocuSign, virtual credit card issuance, payments, statistics, and reminders functionality.

- Administration Module featuring overall stats about app performance, user management, scoring settings, and reporting.

- Back office with advanced reporting and loan portfolio-monitoring functionality.

- Advanced credit-scoring model that uses credit history, transaction data, and an ensemble of statistical and machine-learning algorithms to determine credit risk, interest rate, and other parameters.

- Automated Know Your Customer (KYC), Anti Money Laundering (AML) processes through the integration of leading industry KYC/AML providers, such as Experian.

- Automated ‘Bad Deal Management’ module, which automatically sells nonperforming loans to a collection agency.

Client Subsystem

- A mobile app for end clients with user registration, KYC, loan application, agreement signing via DocuSign, virtual credit card issuance, payments, statistics, and reminders functionality.

- Advanced credit-scoring model that uses credit history, transaction data, and an ensemble of statistical and machine-learning algorithms to determine credit risk, interest rate, and other parameters.

- Automated Know Your Customer (KYC), Anti Money Laundering (AML) processes through the integration of leading industry KYC/AML providers, such as Experian.

- Automated ‘Bad Deal Management’ module, which automatically sells nonperforming loans to a collection agency.

Admin Subsystem

- Administration Module featuring overall stats about app performance, user management, scoring settings, and reporting.

- Back office with advanced reporting and loan portfolio-monitoring functionality.

Architecture Overview

Discovery

The project started with a discovery phase, during which an Itexus Business Analyst and our Software Architect performed an in-depth market and requirements analysis, and created the initial project documentation:

- Software Requirements Specification

Document describing all functional requirements, with use cases, diagrams, user screen mockups, user journey, etc.

- Software Architecture Document

Document describing suggested technology and architecture of the system, addressing third party integrations, security, performance, reliability, and other non-functional requirements.

- Project Plan and Work Estimate

Detailed project plan with all work broken down into 8-16 hour tasks, including priorities, dependencies, and team structure.

UX/UI Design

At the start of the project, our team of UX/UI specialists designed an intuitive, user-friendly UI of the mobile app (in accordance with Apple’s Human Interface Guidelines). The UI mockups were combined into a clickable prototype and used in a video for marketing purposes, long before the system was ready.

Development Process (or Project Approach)

- Agile/Scrum development process, conducted using two-week sprints with demonstrations of new product versions and feedback-collecting sessions at the end of each sprint

- Continuous integration and deployment process

- Combination of different tests (unit, automated service, UI-level, and manual)

Third-party integrations

- Plaid is a service that allows users to easily, securely, and reliably connect their financial data to apps and services. With its help, we can access and receive relevant and necessary data (e.g., account balance, list of transactions and their categories, and loans.) from a linked financial institution.

- PayPal is an online payment platform that offers low-cost services to individuals and businesses. We use it to enable our clients to conduct online payments.

- DocuSign is a service that enables certified online delivery, acknowledgment, electronic signature, and storage of eDocuments over the Internet. With this service, users can sign loan agreements and other documents online.

- Mbanq is a fully digital and compliant BaaS platform with a unified database and quick time-to-market, that supports a wide range of financial services. It is used to open different types of accounts, process payments, issue virtual and physical credit/debit cards, etc.

- Experian offers a wide range of services for the verification of individuals and companies, including the full suite of KYC and KYB procedures, AML compliance, scoring modules, etc. It is used for collecting user data and receiving clients’ scores in order to make better lending decisions.

- Acuant is a technology provider of identity verification, document authentication, and fraud prevention. With its help, we verify user identity and automate KYC decisions for user onboarding.

- Jumio‘s identity verification, eKYC, and AML solutions fight fraud and other financial crimes, ensure compliance, and help onboard eligible customers into apps faster. We use it to monitor our customers’ transactions to prevent fraud and ensure compliance with AML regulations.

Results & Future Plans

The final product has been delivered within budget and on schedule, ready to launch in the App Store. The client is currently negotiating deals with major national and local community banks in the United States to launch the financial platform as a means to deploy capital through the platform. The Itexus team is currently working on the second version of the product, turning it into a white-label solution.

Discuss your digital lending platform development needs with us.

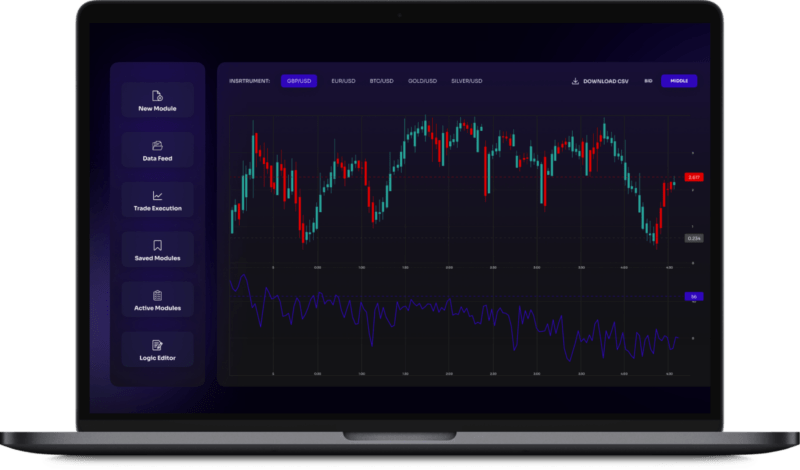

An automated, real-time trading system that allows administrators to configure trading strategies based on various technical indicators, and investors to invest their money in a selected strategy.

A mobile banking app for migrants, designed to facilitate monetary transactions like sending financial help abroad, getting paychecks early, receiving microloans, etc.

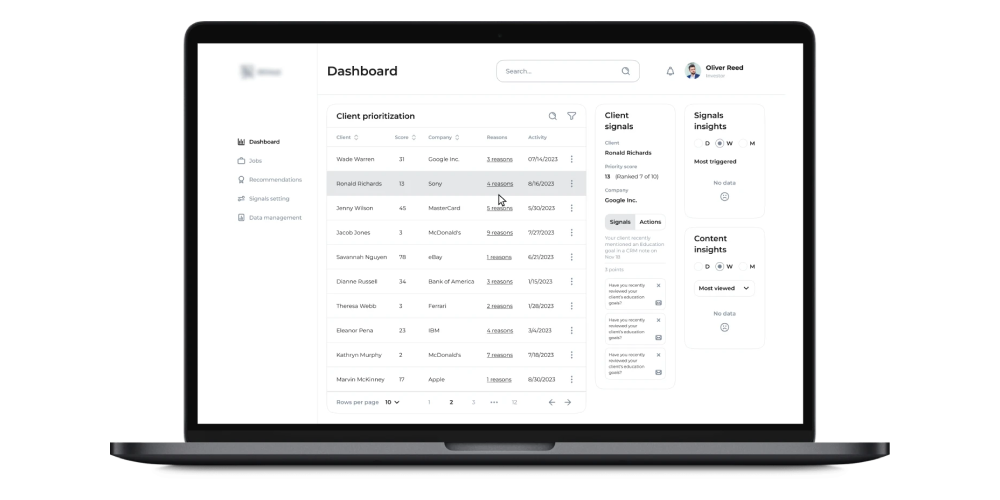

AI-based data analytical platform for wealth advisers and fund distributors that analyzes clients’ stock portfolios, transactions, quantitative market data, and uses NLP to process text data such as market news, research, CRM notes to generate personalized investment insights and recommendations.