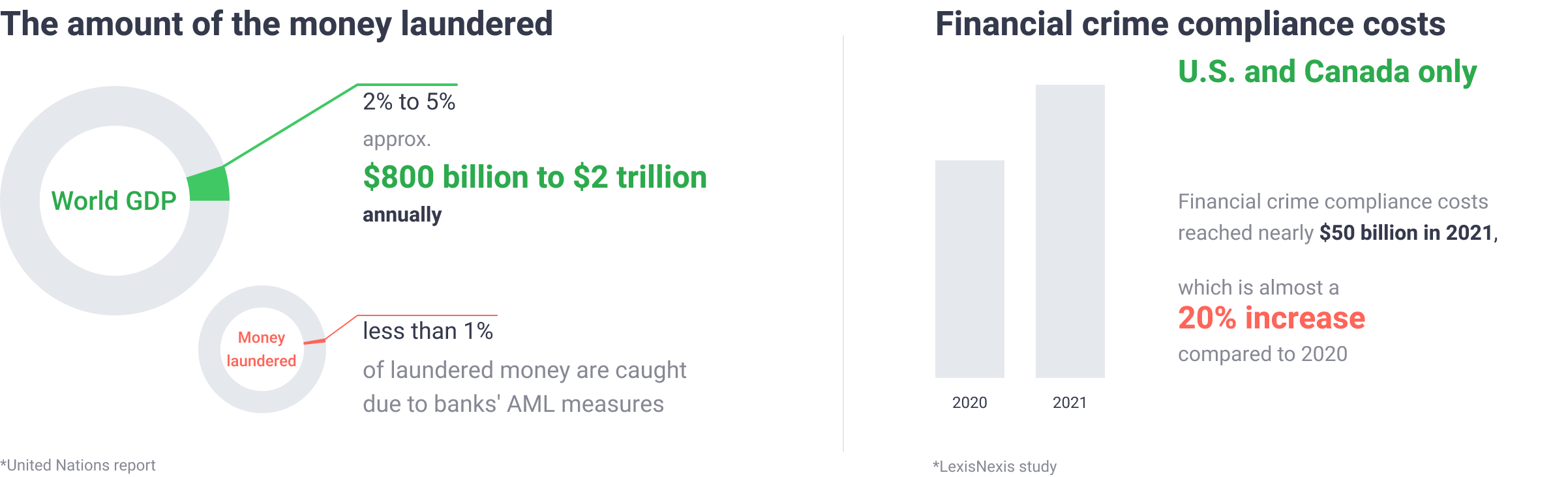

The pandemic has accelerated the global shift toward a digital and cashless society, but it has also created additional opportunities for fraud and financial crime. The latter has always been the major cause of concern for financial institutions, and in this modern complex environment, they are not keeping pace with financial crime threats.

Not only do financial institutions suffer cash losses due to fraud and data leakage, but they are also penalized with heavy fines for non-compliance with regulatory requirements or for the absence or inadequacy of their AML / FCP software.

In its latest report on global financial institution fines for the first six months of 2021, Fenergo found that fines for non-compliance with AML, KYC, data privacy, and MiFID regulations totaled $937.7 million. In contrast, financial institutions were fined $10.6 billion for the same violations in 2020. This is definitely positive momentum, but the fight against financial crime is far from being won.

Combating money laundering and financial crime remains the key challenge for AML in the financial services industry as attackers’ methods become more sophisticated and complex. To reduce the risk of losing money to fraud, avoid non-compliance fines, and protect their reputation, financial institutions should deploy anti-money laundering software solutions and financial crime prevention (AML & FCP) software. Let’s find out where financial institutions should focus their attention to utilize fraud management solutions more effectively, which AML/FCP solutions are available on the market, and what are the key advantages of custom financial crime prevention software.

How to Detect and Prevent Financial Crime and Money Laundering

As fighting financial crime and money laundering is a top priority for any financial institution, they need to seriously consider greater investment in technology as the primary tool to stay ahead of the fraudsters. We have outlined the main directions that banks and non-bank institutions providing financial services should focus on if they are to effectively detect and prevent fraud and ensure security.

Sanctions & PEP Screening

There are two types of checks that make up the screening program:

• Sanctions screening ensures that individuals on the global law enforcement and sanctions list are not allowed to engage in financial transactions.

• PEP screening aims to identify PEPs (politically exposed persons) or other high-risk customers and conduct CDD (customer due diligence).

The screening data comes from OFAC and FATF watch lists, World Check database, EU, UN, Dow Jones Sanction Control and Ownership Research, Accuity, internal blacklists and greylists, etc. All these sources are constantly updated with new names.

AML Transaction Monitoring

It is the process of detecting suspicious behavior indicative of money laundering by monitoring customer transactions and matching reference patterns on a daily and real-time basis. AML transaction monitoring enables organizations to prevent financial crime or spot it very early on and can provide financial institutions with a comprehensive analysis of customer profiles, risk levels, and likely future activity. AML transaction monitoring solutions can generate alerts on suspicious activity and produce reports with information on cash deposits and withdrawals, wire transfers, and ACH (Automated Clearing House) activity.

Risk-Based Scoring KYC

When it comes to AML for banks, standard KYC solutions are not enough to play it safe. Instead, KYC and AML in banking should be assessed from a money laundering risk and compliance perspective. It’s a far more thorough strategy to deploy advanced solutions that are specifically designed to meet all of the banking industry’s needs. Such KYC software typically uses a detailed matrix containing the status, range, and counts to calculate risk based on the customer’s attributes.

When the above measures are applied simultaneously, they prove to be an effective anti-money laundering and financial crime prevention program.

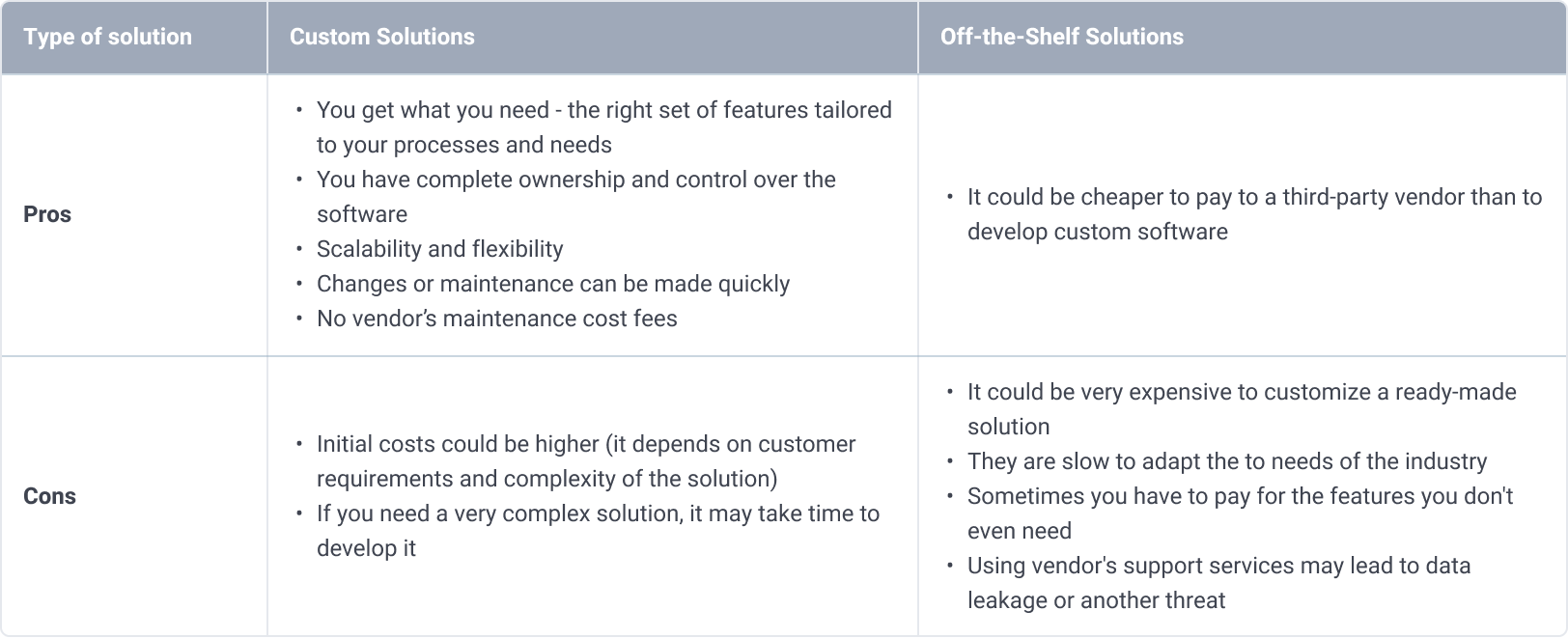

Custom Vs. Off-the-Shelf Solutions

The decision of whether to go with ready-made financial crime prevention software for bank or develop a custom one should be based on the needs of the specific business. If you’re still undecided, check out the list of pros and cons we’ve prepared for each option. You can also contact our specialist for an in-depth consultation that will help you better understand which option is suitable for your specific case and get answers to any questions you may have about AML software vendors and financial crime prevention for banks.

Top AML/FCP Solutions

Let’s take a closer look at the world’s leading financial crime prevention software providers and anti-money laundering software vendors for banks and non-banking organizations offering financial services.

NICE Actimize

The vendor offers a cloud-based analytics solution called NICE Actimize Suspicious Activity Monitoring (SAM). It provides real-time, customer-centric fraud prevention and supports a holistic, enterprise-wide fraud management program helping businesses of all sizes detect, prevent, and investigate money laundering and fraud and avoid compliance violations.

NICE Actimize does not have a free version and does not offer a free trial. Contact the vendor for pricing details.

FICO

FICO’s risk-based AML solution enables companies across multiple industries to protect their businesses from financial crime while meeting regulatory standards, including KYC, sanctions screening, and transaction monitoring. FICO monitors suspicious transactions and non-transactional events, including rules, and basic analytical profiling, and provides advanced analytics with supervised and unsupervised machine learning.

The vendor offers multiple products that can be combined depending on your specific needs, so prices are customizable.

BAE Systems

BAE Systems is an AML RPA (Robotic Process Automation) solution provider and an advanced analytics vendor that offers multiple tools and solutions for anti-money laundering, customer due diligence, WLM (Watch List Management) transaction filtering, compliance, and more. Their AML Transaction Monitoring Tool is an end-to-end solution that manages all aspects of money laundering detection, investigation, and reporting, combining human intelligence with machine learning and advanced analytics to increase efficiency.

Pricing is available upon request. Contact the vendor for details.

At Itexus, we work primarily on fintech projects, leveraging our extensive knowledge in the field. If you want to integrate your solution with ready-made AML software for banks or with an FCP solution, our experts will analyze your requirements and offer you the best solution that perfectly fits your specific case. Contact us to discuss details and find out how we can help you ensure compliance.

Examples of Custom AML/FCP Solutions and Their Functionality

Take a look at some examples of AML/FCP software that our engineers can develop for you. Depending on your needs, we can strengthen any solution with additional features to ensure the greatest possible added value.

A solution for watchlist screening

Such a solution allows screening your customers and all types of transactions (as well as identifying PEP’s) against the watchlists (including sanctions) you choose. We can have the solution check the watchlists from different sources (public, commercial or private), applying geographic and business rules. Such software can also include an extensive knowledge base to identify hidden sanctioned banks and countries.

Suspicious activity prevention solution

This online behavioral profile transaction monitoring solution builds user and customer profiles over time (in accordance with the risk-based approach configured by financial institutions) to detect and stop suspicious transactions with unusual amounts, abnormal frequency, suspicious location, and transactions to unknown counterparties (searching for suspicious behavior at the customer, account, transaction, peer group, and segment levels).

A risk-based scoring KYC solution

This solution assesses risks and categorizes all your customers according to your chosen risk matrix and scoring preferences. The scored and categorized customers can then be subjected to more advanced due diligence when monitoring their transaction profile based on their identified risk profile.

Nice-to-Have Features to Strengthen a Fraud Prevention Solution

Here is the list of advanced features of AML software that would help to increase security levels.

✔️ Support of ad hoc investigation processes of all data stored in the underlying database, including live data, audit trails, and system parameters.

✔️ Support of financial institution’s control over user actions, data rights, and alert evaluation workflows.

✔️ Support for key regional regulatory compliance policies – e.g., PSD2 (Payments Services Directive 2) policy, which determines whether or not a particular transaction initiation requires strong customer authentication (SCA).

✔️ Regulatory reporting functionality – reports generation and submission in a format required by the relevant Financial Intelligent Unit (FIU). For example, depending on the country or jurisdiction, banks may be required to submit a Suspicious Activity Report (SAR) and a Currency Transaction Report (CTR) to FIU.

Points To Consider When Developing a Custom AML/FCP Solution

When it comes to the functionality of custom AML software, the business owner has the final say, but there are some common points that need to be considered regardless of the type of solution you are developing. If you want your solution to add value, not just cost, make sure it is:

• dynamic to respond quickly to industry needs;

• maintainable, when it comes to installations, support, bug fixing, or onboarding new developers;

• high-quality, to keep maintenance costs low;

• flexible to allow for extended functionality or redesign for performance improvements and to support changes to the underlying technology;

• testable, enabling quality control checks at all stages;

• scalable to enable horizontal scalability, linear scalability, and high volumes.

How Itexus Helps Banks and Non-Banks Comply With Regulations and Prevent Money Laundering and Financial Crime

Over the years in the fintech industry, we’ve gained deep insights into the needs and painpoints of businesses and their customers. This solid knowledge helps us identify weaknesses in organizations’ AML and FCP strategies and align improvements with best practices for customer experience. In this way, companies can meet regulatory requirements while providing better service and more personalized experience to customers.

Backed with strong competence in developing fintech solutions for different markets, our specialists will be happy to bring their expertise to the table and help you decide what type of software is best for your business, integrate an off-the-shelf solution, or develop a custom one from scratch. We’ll take into account all the specifics and implement industry best practices to ensure you comply with regulatory requirements and resist financial crime in the most time-, cost-, and resource-efficient way. Contact us to learn more about how you can benefit from our expertise.

Summary

As attackers become more sophisticated in their campaigns and the number and speed of electronic transactions are growing steadily, the fight against financial crime requires more complex and flexible detection methods. The right AML/FCP software provides an industry-leading level of fraud detection and false positives prevention by offering advanced algorithms, intelligent contextual whitelists, and efficient scanning, helping to reduce overhead and cut costs by eliminating the need for manual fraud management without sacrificing your detection rates.

At Itexus, we leverage our advanced knowledge of financial crime prevention and apply international best AML practices to ensure our clients’ software is compliant with AML and CFT regulations. Whether you need help integrating existing AML/FCP software or want to develop a custom solution, we’ve got you covered. Let’s discuss your idea and find out how our experts can help you protect your business against financial crime while meeting regulatory standards.