Automation has reshaped the way businesses across all industries operate. Not long ago, it was viewed as just a tool to eliminate repetitive tasks. Now, automation is an integral part of digital transformation.

With all the benefits automation offers businesses, it’s clear that it will strengthen its position even further. In this article, we’ll guide you through customer service automation in the finance sector and talk about the technologies used to develop smart and efficient insurance and banking automation solutions. Today, people want answers —and they want them fast, accurate, and available 24/7.

Why Automate Customer Service in Banking, Insurance, and Financial Sectors?

Automation in customer service is no longer optional—it’s essential for banking, insurance, and financial services to remain competitive and meet rising customer expectations.

✅ Improved efficiency

Of course, an automation solution is no substitute for human workers. However, it significantly reduces shared effort by taking over simple, repetitive tasks and allowing employees to focus on tasks that require creativity and human touch. Through intelligent automation, banks and insurance companies can reduce the overall resources spent on customer service and provide greater efficiency. To better understand how automation is impacting your CS department performance, take a look at these statistics:

- reduction in processing times by 78%,

- decrease in error rate from 29.7% to 2.0%,

- doubling the number of accounts processed,

- 28% reduction in average handling time (AHT) for compliance checks.

✅ Lower costs and overheads

Automation reduces operational costs by minimizing reliance on large customer service teams. Tasks like handling routine inquiries, processing claims, and onboarding customers can be performed at scale with minimal expense. Automation in customer service and support saves time and money you would have otherwise spent hiring and training agents. Plus, there is typically only a one-time fee to implement automation systems, and companies can upgrade automation tools whenever needed.

Stat Fact: Chatbots save businesses over $8 billion annually in customer service costs, as per Juniper Research.

✅ Real-time data management and processing

One of the biggest challenges for the financial services and insurance industry is collecting, processing, controlling, and analyzing millions of pieces of unstructured and fluctuating data. Customer service automation software not only allows companies to process large amounts of data but also minimizes human error. Real-time data processing is widely used in risk management, intelligent cash management, trade monitoring, and many other cases.

✅ Better customer experience

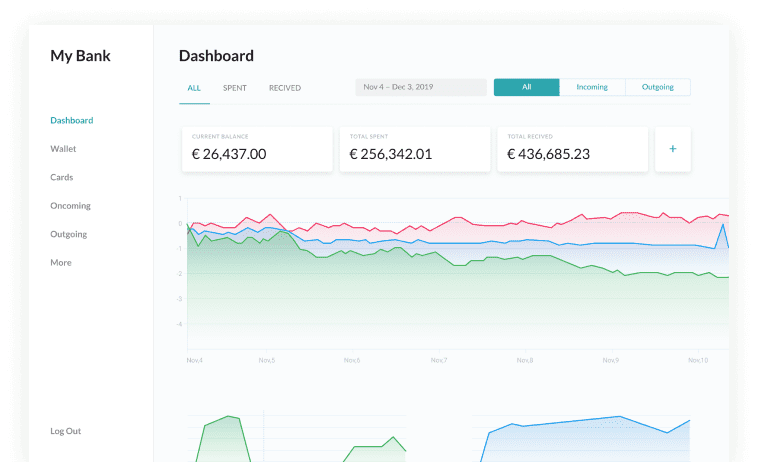

Customers’ diverse priorities, needs, and preferences are forcing banks, financial service providers, and insurance companies to redefine their approach to customer service. AI tools can now track and analyze customer data (demographics, behavior, location, etc.) and determine the identity of the customer. This allows companies to provide the best service to their customers, exponentially improving the overall customer experience. Moreover, service automation enables customers to get the information at a time of their choice. Any form of self-help is available 24×7.

Incorporating both automation and artificial intelligence is crucial for optimizing operational efficiency, but it’s equally essential to maintain 24/7 phone contact in order to guarantee customer satisfaction and loyalty. While automation and artificial intelligence excel in various aspects, such as data analysis and process streamlining, they have yet to fully replicate the personalized, human touch that fosters emotional connections. To ensure customer loyalty, offering one-to-one contact provides warmth and creates a unique, personal bond that technology alone cannot replicate.

Let’s explore the onboarding process in terms of service automation. Customers can now fill out all the necessary forms, verify their IDs, and sign documents through an application without having to speak to a bank or insurance agent in person.

Technologies Used for Automation of Customer Service

If you are wondering how to improve customer service in the banking, insurance, and financial services sectors, read on to learn about modern technologies that allow creating smart, efficient, and powerful automation solutions:

• Artificial Intelligence

AI is widely used for automation in banking, as well as for insurance automation. AI-driven conversational bots (chatbots) already know customers better than humans and automate most customer service interactions. Fully automated customer service with chatbots is not yet possible, but it could dramatically reduce the number of employees handling most routine operations. Chatbots can provide a compelling personalized experience by predicting customer intent and helping users engage with products and brands.

• Machine Learning

Machine Learning is used to understand customers, drive personalization, and create convenient and memorable customer experiences. Information from sensors, images, videos, and other digital sources is used to streamline workflows and facilitate automated decision-making.

• Robotic Process Automation

RPA is considered one of the latest achievements in customer service. It is an application that processes transactions, manipulates data or triggers responses, depending on the scope of the request. RPA technology is especially beneficial for regulated industries with high volume and transactional business processes.

• Intelligent Automation

Intelligent Automation (IA) is a combination of AI and RPA. It is used to mimic customer behavior by using applications to find data and transform it into automated business processes and workflows. In customer service, IA can be used to capture valuable data to automatically support and manage customer interactions. It is a supplemental tool that provides customers and agents alike with the information and assistance they need.

• Blockchain

Technology improves access for disadvantaged customers, makes businesses more accountable, and increases security in all types of interactions between businesses and customers. In addition, a blockchain-based loyalty rewards program reduces system management costs with smart contracts that report tracked, secure, and transparent transactions to legacy systems. It reduces costs associated with errors and fraud.

• Fraud Detection and Prevention

Automation enhances security by monitoring transactions and activities in real-time. AI-powered systems detect unusual patterns and flag potential fraud faster than manual reviews.

- In Banking: Real-time fraud alerts for suspicious transactions.

- In Insurance: Tools identify exaggerated or false claims through predictive modeling.

Guide: How to Automate Customer Service

To help you better understand the automation concept and how to apply it in practice, we’ve broken down the customer service automation journey into six steps: from strategy definition to full-fledged automated workflow.

1. Determine the end-state vision and develop a strategy

Successful financial services companies develop an enterprise-wide vision for the future, reimagining how they will be organized and how work will get done – both with the automation capabilities that exist today and the new automation capabilities that will be implemented. It’s important to focus on automating the processes that are critical to the company’s long-term competitiveness. Start with a quick diagnostic to assess the total value at stake, define the company’s goals, and develop a high-level implementation roadmap to achieve those goals.

2. Assemble a team to manage the automation processes

The next step is to establish a well-run center of excellence (COE). It manages the enterprise-wide transformation approach and plays a number of important roles, such as managing supplier relationships, building capabilities, and more. The capabilities of the center should not only be technical, but also strategic, as COE is required to re-imagine groups and organizations, redefine the way people work with technology across the company, and translate new ways of working into measurable efficiencies.

3. Find a tech partner

A close partnership with IT is especially important. A technical partner designs the entire lifecycle of the system, supports development, manages deployment with IT priorities in mind, and provides ongoing maintenance. In a nutshell, you decide which customer problems require a customer service automation solution, and your tech partner identifies which solution is best.

4. Create detailed roadmaps with your tech partner

Some of the changes will happen relatively quickly. However, it often takes several years for banks, insurance companies, and financial firms to implement the transformation across all areas of their business. To be successful in the long term, you need a clear plan for each business unit and function, as well as for the entire company.

5. Define deadlines considering risks

Deadlines help work together toward achieving a shared goal and keep complex, multi-phase customer service automation projects on track. When defining deadlines, be sure to consider various risks to avoid setting expectations too high.

6. Reap the benefits of customer service automation software and the resulting improvement in customer experience!

Summary

Customer service is important to your business because it retains customers, increases sales and profits, and provides you with lucrative long-term relationships. When it comes to automation in customer service, there are a number of specifics to consider to maintain and multiply all achievements of your CS unit.

At Itexus, we’ve helped more than 220 companies in a variety of industries get the most out of their customer service automation efforts and take customers from contact to loyalty. Contact our team if you need a trusted tech partner to automate customer service and improve the overall customer experience.