Digital Insurance Marketplace with Recommender Engine

Online marketplace that connects insurance brokers, insurance companies and the end customers.

The definitive feature of this marketplace is the automation of information exchange and key business processes, such as customer acquisition, underwriting, and claims management.

The solution features a recommender engine that assesses client information and suggests the best-fitting insurance plan.

Engagement model

Time & Material model for the MVP stage, Agile/Scrum for other stages

Effort and Duration

Ongoing, 6 months to create and launch the MVP

Solution

SaaS Marketplace

Project Team

1 Team Lead, 5 Developers, 1 Business Analyst, 2 QA Engineers, 1 Project Manager

Tech stack / Platforms

Client’s Request

The client is a consulting company based in Switzerland with more than 20 years of experience in the insurance industry. They decided to launch a new digital SaaS insurance marketplace that would fully automate business processes for insurance companies and brokers, and provide a fully digital experience for their end clients, allowing them to select and purchase an insurance policy online from multiple insurance companies and receive automatic recommendations on the best-fitting insurance plans for them.

The client selected Itexus because of our specialization and experience in the FinTech and Insurance domains, and our experience with building recommender systems in the financial domain.

Functionality Overview

The primary aim of the platform is to transfer all business processes related to insurance activities online, as well as to attract a larger client base by offering a more convenient way of getting services and a wide variety of offers via marketplace. All data is gathered, saved, and updated with one tool, enabling all parties involved in the process (brokers, insurers and clients) to interact with each other in one place, with greater speed and efficiency.

- The platform covers many types of insurance products including statutory health insurance, accident insurance, personal liability, roadside assistance and many more.

- The platform automatically analyzes clients’ situations and recommends the best-fitting insurance product by using collaborative and content-based filtering in tandem with expert-defined rules.

- It enables clients to stay up-to-date with new products and with all changes in existing products.

- It allows for online consultations via a built-in chat with appointment scheduling and calendar synchronization.

- The Administration module allows the admin to set up all entities (e.g., types of insurances, consulting and insurance companies, consultants) and generate and view reports.

Development Process

The project started with a Discovery phase and a deep analysis of the Swiss insurance market and the client’s business goals. The Discovery phase resulted in the creation of detailed project documentation, including the software requirements specification, UI mockups, and a software architecture document. This document laid out suggestions for the technology stack, architecture, and third-party components that were recommended to meet the project’s performance, security, and scalability requirements.

Following the Discovery phase, the development process was organized based on Agile and Scrum frameworks, with two-week sprints followed by demonstrations of the developed features and a feedback collection session.

In addition to Agile flexibility, the Itexus project manager kept close track of the project’s budget and scope, reported costs on a weekly basis, and alerted the client if any necessary changes needed to be made to the original scope and requirements, such as corrections to the budget or simplifications of the project scope.

Technical Solution Highlights

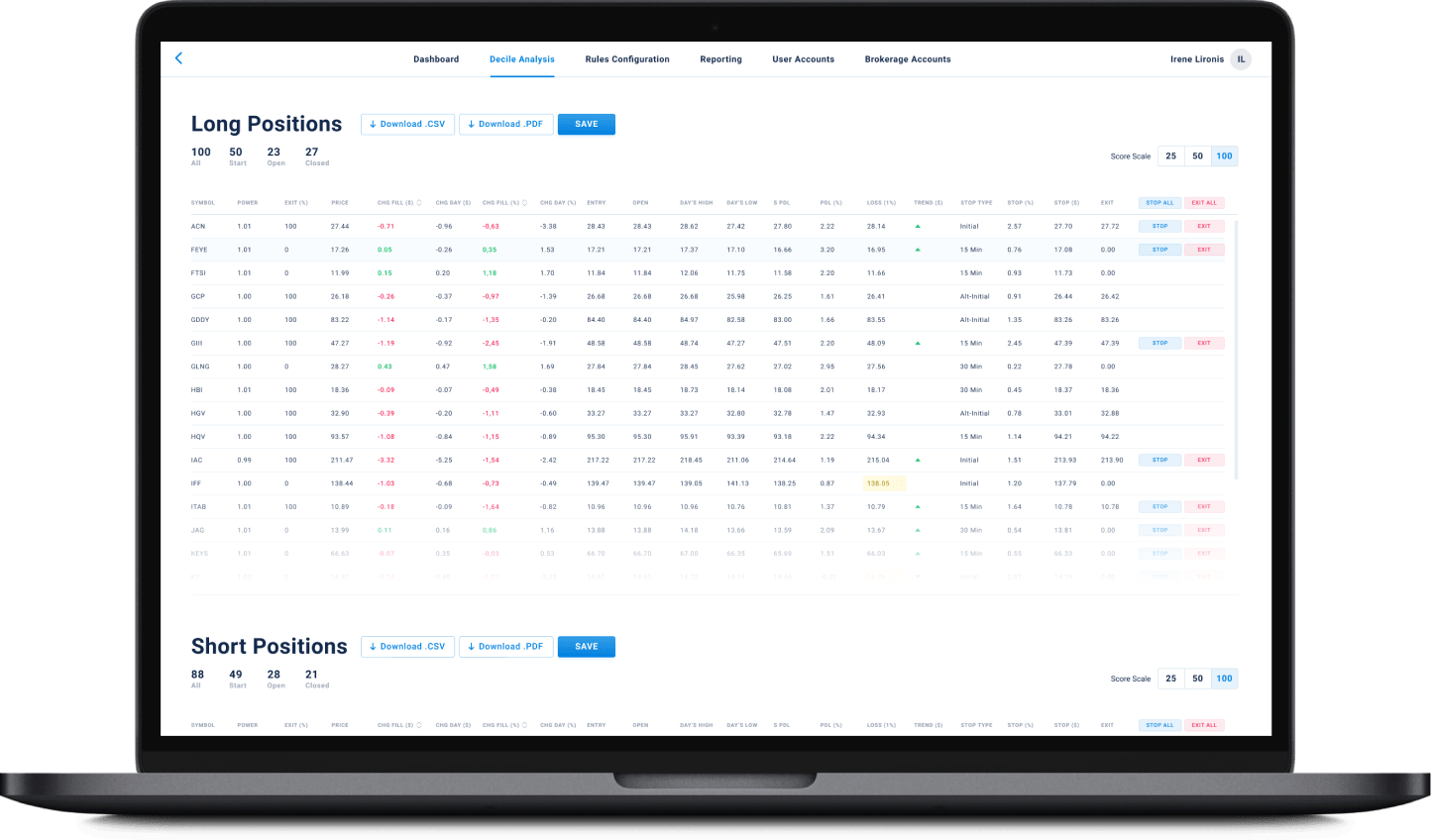

The system consists of a backend server and database hosted in the Azure cloud and three semi-independent web applications for Clients, Brokers, and Administrators, following the micro frontend software architecture pattern.

The web applications communicate with the server via REST API. The same API can be used by mobile application clients in the future.

The backend server also exposes public APIs for external systems to integrate.

Microsoft Azure Blob storage is used to store large volumes of scanned documents.

Tech Stack

Microsoft .NET, C#, Microsoft Azure, and SQL Server were selected as to create a mature, well-supported, enterprise-grade technology stack.

Angular 8 was chosen to implement a rich real-time web interface of the system.

Micro Frontends

As the application provides pretty different functionality for each User role, the Itexus team decided to split the front-end part into different applications with the appropriate features set based on the Micro Frontends Architecture Pattern which allows better maintainability, security, and scalability of the system.

Security

Since the application has to store sensitive user data, security was a key priority in the system’s design. In addition to the security measures needed to comply with basic regulations like GDPR and the usage of best encryption practices provided by Azure Cloud (e.g., Transparent Data Encryption, Azure SQL Auditing, Dynamic Data Masking, Azure ‘Always Encrypt’), Itexus developed its own mechanism for user data encryption to prevent any fraud.

Results & Future Plans

Itexus delivered an MVP for a digital insurance marketplace that would allow the client to avoid the inefficient process of gathering information via paper forms, manage claims effectively, automate the process of customer assessments, and generate the most suitable insurance offers for their customers.

This MVP version of the system has been already released in the Swiss market and is currently in beta-testing mode. The client is currently launching its marketing activities and planning future versions of the product, which will include a task management system and workflow automation for consultants, payments processing, claims management, personalized news feeds for customers, and more.

Related Projects

All ProjectsMobile E-Wallet Application

Contact Form

Drop us a line and we’ll get back to you shortly.

For Quick Inquiries

Offices

8, The Green, STE road, Dover, DE 19901

Żurawia 6/12/lok 766, 00-503 Warszawa, Poland