An automated, real-time trading system that allows administrators to configure trading strategies based on various technical indicators, and investors to invest their money in a selected strategy.

According to various estimates, the share of automated trading (also called algorithmic trading) ranges from 60% to 75% of the stock market, depending on the region. In developing markets, the numbers are lower – about 40%, which is still quite substantial.

This immense popularity of automated trading systems (ATS) is a clear indication of their effectiveness in managing risk and increasing profitability in any market environment. But what does it take to develop a robust, accurate, and no-fault ATS? Read on to learn how to build a trading platform and to get answers to other questions you may have about trading system development.

What Is an Automated Trading System?

Before we get into the development of automated trading systems, let’s define the term. ATS is also referred to as algorithmic trading, algo, mechanical or automated trading. All these terms stand for a trading platform that uses computer algorithms to monitor the stock markets for certain conditions. Traders set certain rules for buy and sell orders that are executed automatically via ATS.

Such systems emerged as a result of the growing popularity of trading and the increasing number of private investors. These conditions stipulated the emergence of trading tools that facilitate the placement of buy and sell orders on the stock exchanges, and the use of these tools will continue to expand.

Advantages of Automated Trading Systems

With the improvement of technical capabilities and the emergence of new software solutions, automated trading is becoming more and more precise in managing risks and increasing trading profitability. Below you’ll find the main advantages of algo trading.

✅ Strong discipline

For traders, one of the biggest challenges is to strictly stick to the developed trading plan. Even a potentially profitable strategy will fail if traders bend their own rules. Automated trading systems allow users to achieve consistency by trading according to a plan. Neither the fear of taking a loss nor the desire to make more profit from trading would lead to a breach of discipline.

✅ Reduced risk of manual errors

Automated trading software reduces the risk of manual errors and mitigates the human factor. Where a human runs the risk of error due to stress, distraction, rush, or fatigue, the computer acts unmistakably. This is a huge advantage in an activity where a single misclick can literally cost you a fortune.

✅ Diversified trading

ATS allows users to trade on multiple accounts, either replicating the strategy on different stocks or applying different strategies simultaneously. It scans different markets looking for specific conditions, generates orders, monitors trades and enables users to trade around the clock thus allowing them to diversify their portfolio in the most efficient way. This way, you can spread the risk across different instruments and still hedge against losing positions.

✅ Backtesting

Backtesting helps traders determine the most profitable strategy by testing the rules against historical data before risking their money on a trade. This is due to the very principle of automated trading. Building an automated trading system means telling the computer exactly what to do and making all rules absolute. Traders test these precise rules based on historical data, thus validating or rejecting the idea. This allows users to adjust a strategy and helps avoid losses before they start real trading.

✅ Instant orders placement

When it comes to getting in or out of a trade, even milliseconds can affect the deal. Therefore, when designing the system, it’s crucial to achieve the lowest possible latency. This is particularly relevant for volatile markets when prices can change too quickly. High-frequency trading systems generate orders immediately when the trading criteria are met, maximizing the chances of getting the best possible deal.

✅ Reduced emotional component

Sober and informed decisions are what help traders succeed, even though it’s sometimes quite hard to think clearly and remain unbiased and calm. An automated trading system offsets the role of the human factor, as it doesn’t feel the excitement and always follows the set rules, which reduces the risk of compulsive and ill-considered trades. The system is automated, which means that a trader has fewer chances to lose the entire capital.

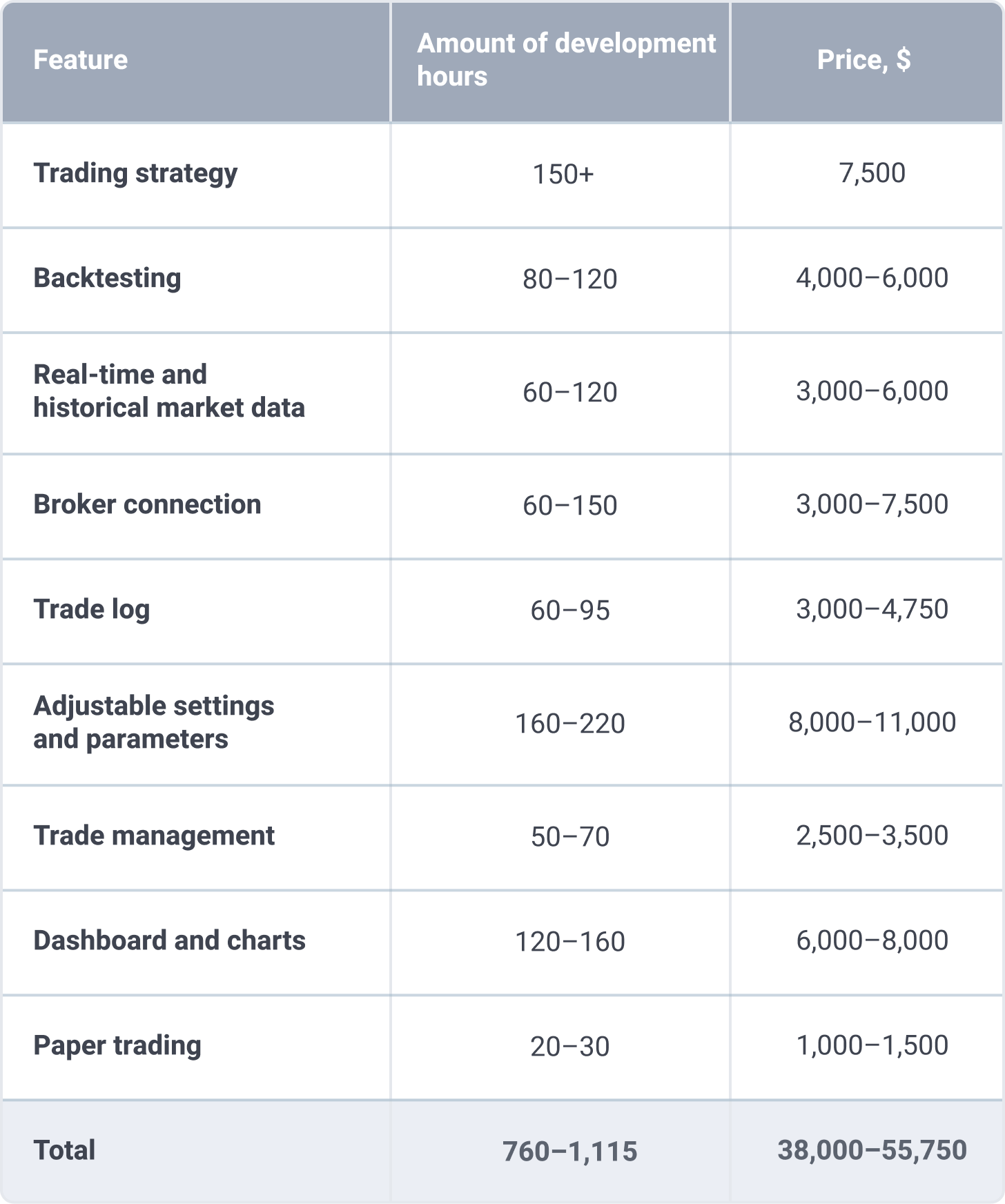

Cost of Automated Trading System Development

Let’s clarify how much it costs to create a trading platform and what features need to be implemented. The final cost may vary depending on the contractor’s rate, so for simplicity, we measure the cost in person-hours. Note that these are only rough estimates. However, we can accurately estimate development costs if you contact us and describe your needs and requirements.

• Trading strategy

Building an automated trading system starts with implementing trading strategies. There is no one-size-fits-all approach, so users need to find their preferred strategies that can then be traded automatically. To do this, they have to be able to choose between different technical indicators and use them as a set of rules for trading. Setting up these indicators and implementing trading strategies is a meticulous process that takes more than 150 person-hours.

• Backtesting

Backtesting enables users to test and optimize a strategy using historical data before risking money on a real trade. This is an important feature that has become a standard of any efficient ATS. Implementing the backtesting functionality can take between 80 and 120 working hours.

• Real-time and historical market data

However, implementing the backtest function is only half the battle. The other half is providing real-time and historical market data for live sessions and charting. There may be single or multiple data providers, for example, as backup data sources or for other reasons. Implementing the feature that would enable the collection and supply of comprehensive market data requires between 60 and 120 person-hours.

• Integration with brokers

To place and execute orders, users need to connect their broker accounts to ATS. This is possible by integrating brokers into the automated trading system. Depending on the number of brokerage platforms to be integrated, this can take between 60 and 150 person-hours.

• Trade log

Trade log enables users to get a holistic overview of their trading history helping them to highlight successes, identify mistakes, and fine-tune their preferred strategies. The trade log usually contains details such as the rules set for orders, instruments, order types, number of contracts, price, time, etc. The estimated time required to implement the trade log functionality is 60 – 95 person hours.

• Adjustable settings and parameters

Flexibility is imperative for a truly superior ATS. To meet all the demands of the rapidly changing market, the system must be adjustable and customizable. Users may want to adjust parameters for protective orders, maximum order size, maximum intraday position, price tolerance, etc., and they should be able to adjust their strategies whenever they need to. Making settings and parameters customizable takes between 160 and 220 hours.

• Trade management

Even though the term ATS implies automation, it does not exclude manual control, because sometimes users need to fine-tune some parameters. With the trade management functionality, users can manage the trade the moment it is executed. They can send the limit order, set the stop loss/take profit value, cancel orders, close positions and adjust many other parameters to improve the results. The implementation of a trade management function requires about 50-70 hours.

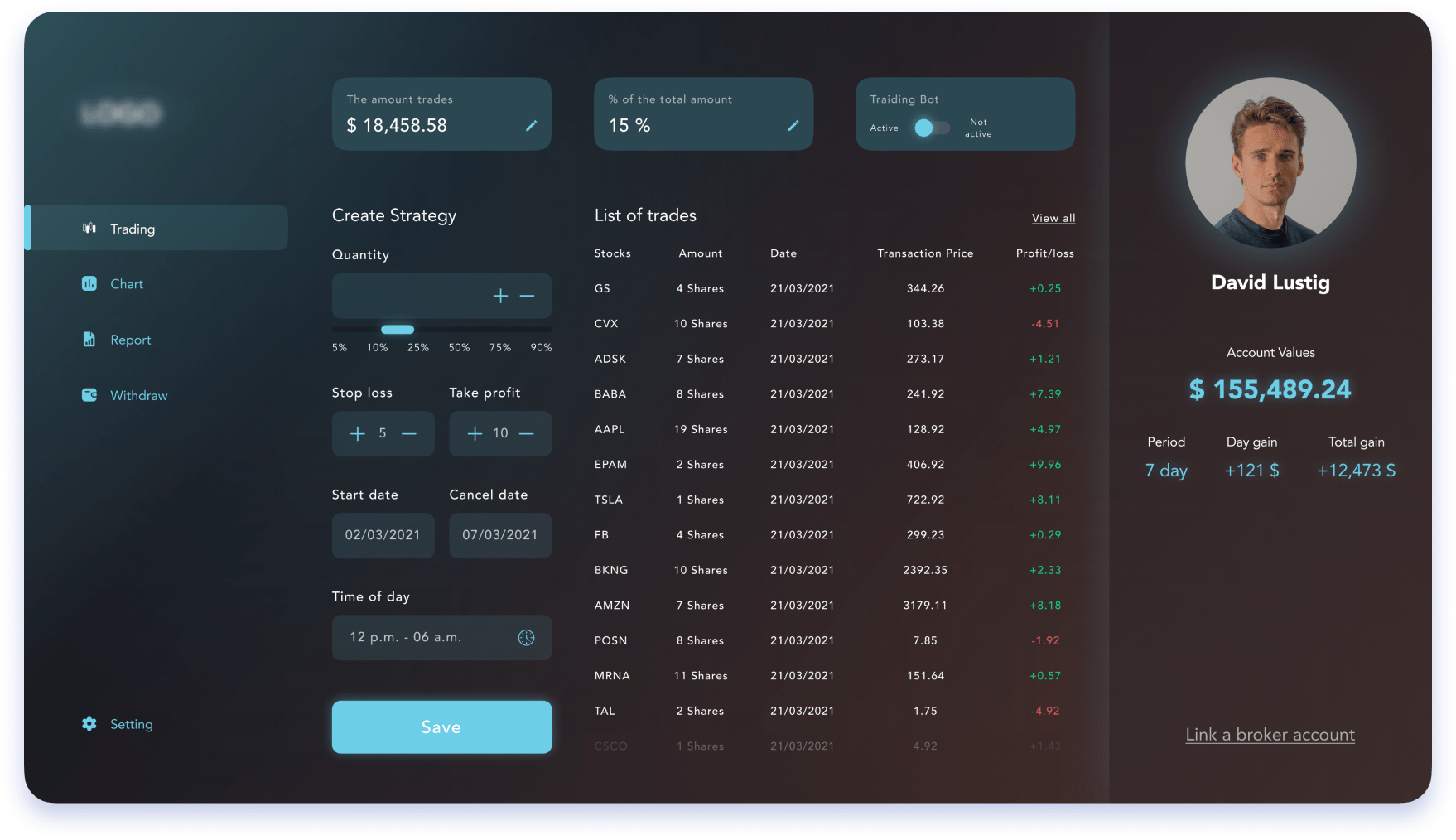

• Dashboard and charts

Sustained access to user data is essential for data-driven decisions. Dashboards and charts help users have at their fingertips details such as total account balance, day trading results, commissions, various indicators, price movements, and anything else they need to improve their results. The implementation of dashboards and charts is estimated at 120 – 160 working hours.

• Paper trading

The paper trading feature simulates a market environment reproducing some features of a real stock market on a computer. It allows participants to practice without financial risk before placing real orders. Implementing paper trading functionality is not very labor intensive, but the benefits are great. In our experience, it can be done in 20 to 30 hours.

Note that these are rough estimates. The costs shown in the right column are based on the average hourly rate of developers, which is $50 per hour for fintech projects of this complexity.

Where to Start to Build an Automated Trading System?

Let’s find out what you should consider when choosing a contractor for ATS development.

✅ Hands-on experience

When choosing a trading software development company, ask for the relevant experience, because it is irrational to expect that a company specializing in, say, telemedicine would develop a stellar ATS.

Figure out if the vendor has similar projects in its portfolio. What has happened to those projects? Is there an experienced BA in the company who has worked on industry-specific projects? Is he/she able to clearly communicate your requirements to the development team?

Consider the details carefully and do not compromise if the vendor lacks a key ingredient for a productive collaboration.

✅ Post-development support and maintenance

Automated trading system development itself is half a win. The other half is ongoing support and maintenance of the existing system. Before signing a contract, find out if the vendor offers further maintenance and on what terms.

✅ Rates

It is clear that overpaying for world-famous names is not a guarantee of quality. However, there is a direct correlation between the quality of the result and the cost of the contractor’s work. Trying to have ATS developed cheaply will definitely lead to problems. So try to find a middle ground instead of sacrificing quality in favor of cost savings.

✅ Impeccable reputation

Traders want to be sure that the money and data they entrust to an ATS are perfectly safe. The reputation of your ATS must be impeccable, and it clearly depends on the reputation of the contractor you have chosen to build a trading system.

Itexus Expertise in Automated Trading Systems Development

Itexus is a proven fintech development partner for financial management companies that choose us for our comprehensive approach and experience in building automated trading systems including high-frequency trading systems. We are proud to share some of these projects with you.

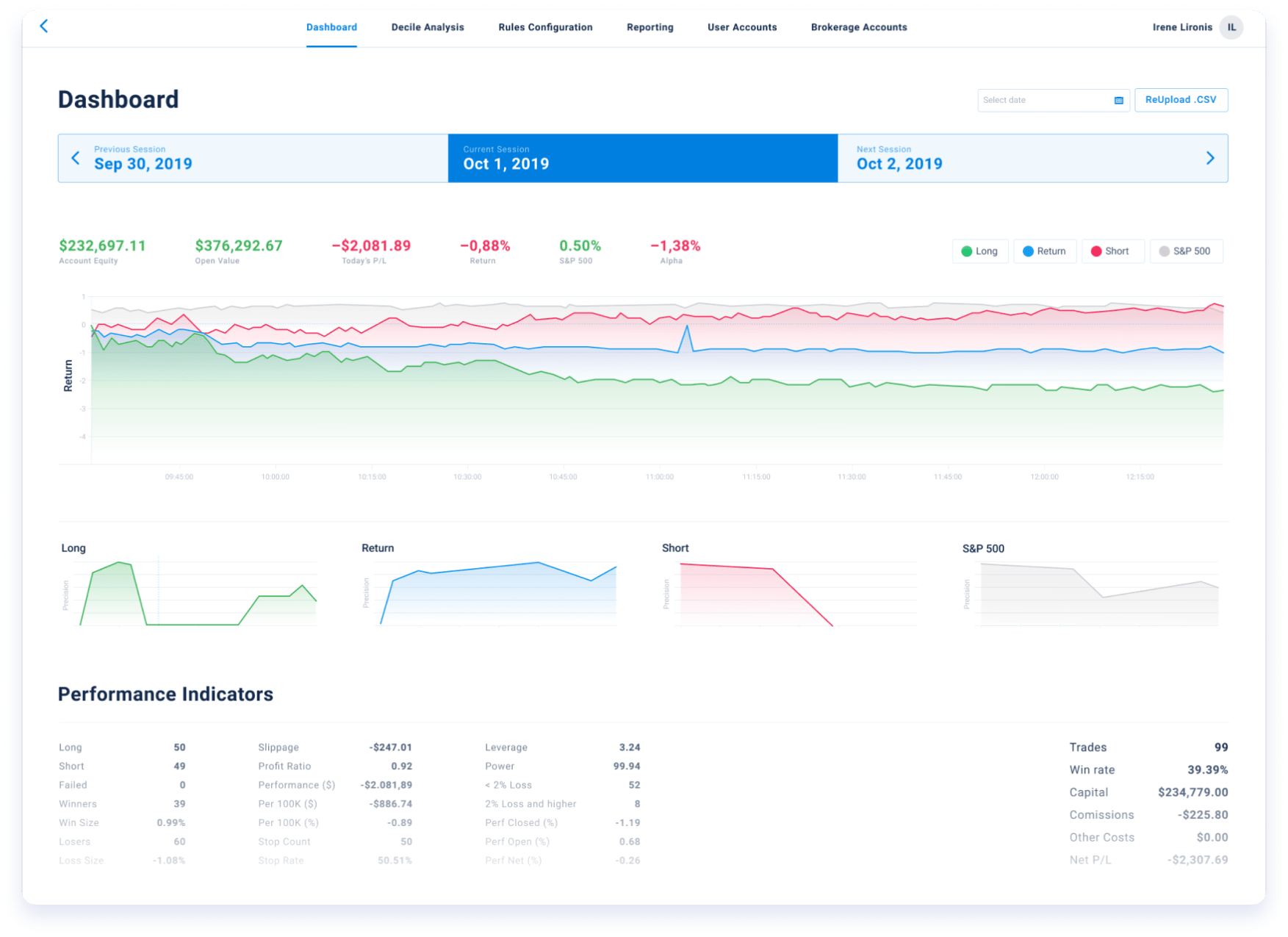

Algorithmic Intraday Stock Trading System

For a wealth management company with 20 years of experience, we developed a stock trading bot. The client wanted to digitize their business to grow their customer base, increase trading profits, and reduce operational costs by developing a SaaS system that would automate trading strategy and operations. The algorithmic intraday stock trading system we developed allows clients to register and connect their brokerage accounts, configure trading strategy parameters, run automated trading from their brokerage accounts, monitor trades in real-time, and view profit/loss reports. In return, they pay a commission fee and a percentage of the profit generated. For more details on this project, see the original case study.

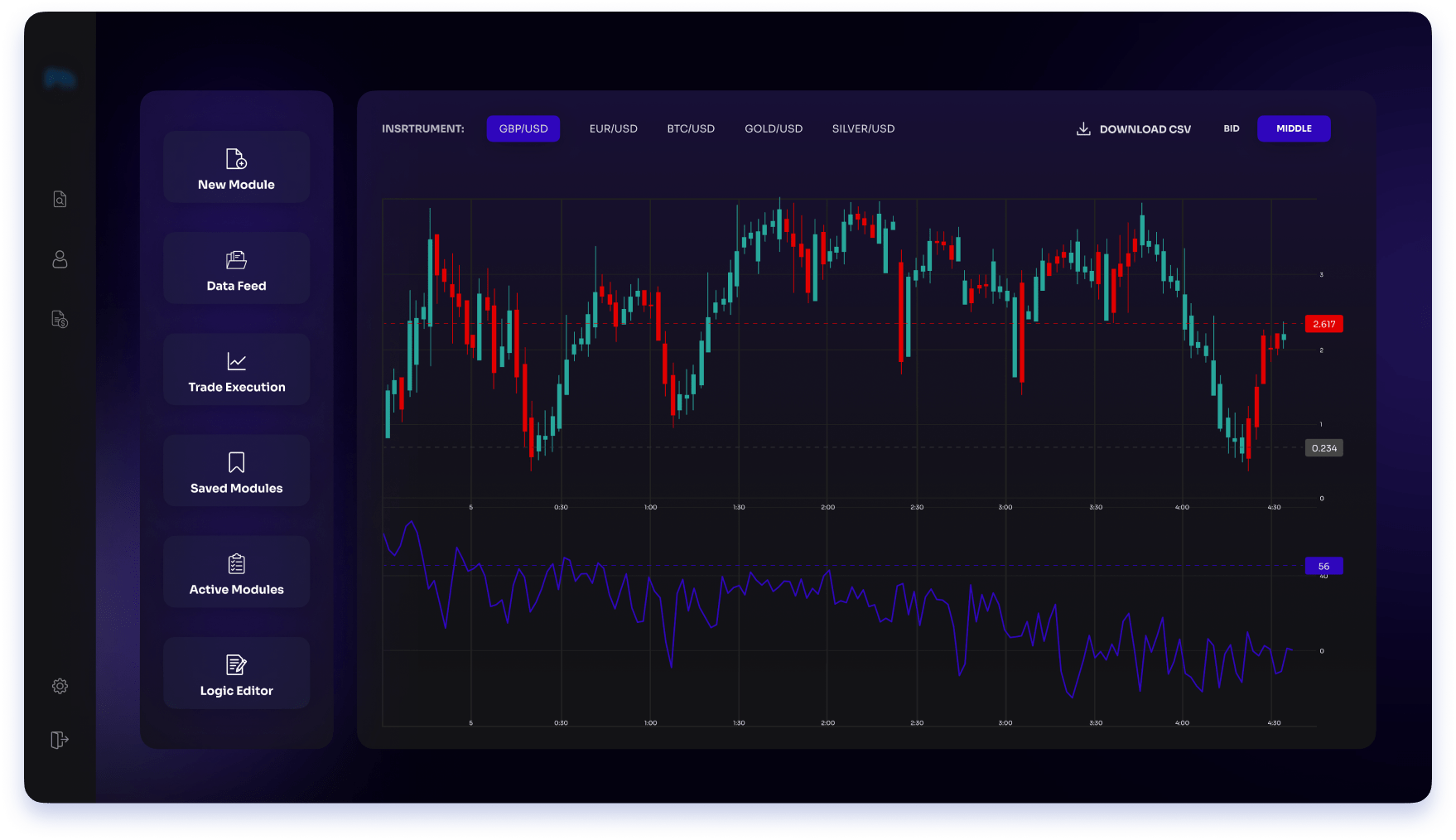

Automated Stock Trading Platform

Another ATS development project was implemented by the Itexus team for an investment management company that provides services to both individual and institutional investors. The algorithmic trading system development is based on a complex, multi-level analysis of prices and the behavior of their derived characteristics. The system allows the administrator to set up trading strategies with different market instruments and test them with data from different financial markets and time frames. For more details on this project, see the case study.

Stock Trading Bot

An investment company specializing in active stock trading commissioned us to develop a stock trading bot. For this client, we developed a cloud-based app that connects to a user’s brokerage account via an API. The bot automates stock trading by executing trades based on preset rules. The bot tracks stocks throughout the day, looking for clues about when to buy, and executes the trade once the preset buy parameters are met. Conversely, the bot executes a sell order once all sell parameters are met. For more details on this project, see the case study.

Summary

Developing a robust, trouble-free, and efficient ATS is a laborious process, the success of which consists of many components: the customer’s requirements and resources, the vendor’s experience, and clear communication between the two. The quality of the ATS is critical, as poorly functioning software can lead to large losses. Therefore, automated trading system development requires solid hands-on experience on the vendor’s side. Drop us a line if you have a drafted concept of an ATS and want to build a trading system – we look forward to transforming it into a competitive and robust solution.