Trading has always attracted people seeking additional income. Long ago, trading was a strenuous, semi-manual job, but today, with the help of the latest technologies and solutions, it’s quite an enjoyable activity that can earn you money. Every year, more and more trading companies are considering building their own trading platform and are looking for a team of developers to make their idea a reality. No wonder, as automated and algorithmic trading systems are the most intelligent solutions that make trading so much easier.

The process of successful trading requires a powerful solution that allows traders to analyze data, reduce risks and react to rapidly changing market conjuncture promptly. Developing such a stock trading platform from scratch can be pretty hard, so leave it to the professionals – here’s a list of top trading software development companies.

1. Itexus

Itexus is an exemplary FinTech software development company renowned for its sophisticated trading platforms and digital wealth management solutions. Their core competencies include developing automated trading systems, data-driven stock market analytics and passive asset allocation strategies. Itexus’s solutions emphasize security, reliability and a seamless user experience, making them a trusted partner for financial institutions.

Recently, Itexus developed a centralized platform for trading over-the-counter securities, connecting security issuers with investors and automating the trading process. This innovative platform has enhanced transparency and efficiency in the OTC market, showcasing Itexus’s ability to deliver cutting-edge financial solutions.

2. InfosysTrade

InfosysTrade is a leading provider of high-performance trading and financial software, offering intelligent trading systems and exchange platforms. Their team of experienced developers creates robust solutions that integrate high-speed performance and strong security measures, ensuring stability and cost-effectiveness for clients.

InfosysTrade specializes in algorithmic trading, real-time market data integration, and financial analytics tools. Company has a track record of developing scalable and secure trading systems for various financial institutions. Their solutions have been widely praised for their reliability and innovation, helping clients optimize their trading strategies and achieve their financial goals.

3. Techasoft

Techasoft is a premier choice for businesses seeking custom trading software development. With a deep understanding of the financial industry, company creates bespoke solutions tailored to specific business needs, ensuring optimal performance and user satisfaction.

Techasoft’s expertise includes developing multi-asset trading platforms, payment gateways, and financial management software. One of Techasoft’s notable innovations is a biometric authentication system for mobile banking applications, enhancing security and user experience. This system has been widely adopted by financial institutions, highlighting Techasoft’s commitment to providing cutting-edge solutions.

4. Empirica

Empirica, with a decade of experience, excels in creating trading software for capital and crypto markets. Their expertise includes execution engines, trading algorithms, and connectivity to various exchanges, providing comprehensive solutions for traders.

Empirica’s solutions include investor frontends and portfolio management tools, catering to both traditional and cryptocurrency trading. Company has developed an AI-driven trading platform that optimizes trading strategies and enhances decision-making for investment firms. This platform has been widely adopted, demonstrating Empirica’s ability to provide sophisticated financial solutions.

5. Softvelopers

Softvelopers specializes in developing sophisticated trading platforms that meet the challenges of the trading industry. Their team’s expertise includes creating crowdfunding platforms, multi-market trading systems and single-dealer solutions.

Company focuses on delivering enterprise-wide trading platforms that ensure high performance, security and compliance with industry standards. Standout innovation from Softvelopers is their enterprise-wide trading platform, which integrates real-time market data and advanced analytics. This platform has significantly enhanced trading efficiency and decision-making for financial institutions.

6. Magnise

Magnise is a leader in cryptocurrency exchange software development, providing innovative solutions for traders and brokers. Utilizing the latest technologies, Magnise builds advanced trading platforms that offer real-time market data, algorithmic trading capabilities, and secure transactions.

Magnise’s platforms are designed to enhance trading efficiency and user experience, making them a preferred choice for cryptocurrency trading enterprises. One of companies key innovations is a blockchain-based loyalty program that increases customer engagement and transparency. This solution has been widely adopted by financial institutions, highlighting Magnise’s ability to innovate and lead in the FinTech space.

7. Mobilunity

Mobilunity is a prime candidate for FinTech expertise, particularly known for its remote development teams. With a commitment to technological innovation and client satisfaction, Mobilunity addresses the specific needs of the financial industry with tailored solutions.

Mobilunity specializes in creating mobile banking applications and financial analytics tools. Their unique financial analytics platform provides real-time insights and predictive analytics, enabling clients to make informed decisions and stay ahead of market trends. This innovation has made Mobilunity a trusted partner for banks and payment processors.

8. Scopic Software

Scopic Software leverages cutting-edge technologies to develop web and mobile trading platforms. They focus on delivering flexible and secure solutions for financial brokers, traders and entrepreneurs. Scopic’s team ensures that client visions are realized through customized trading platforms that offer fast, secure and reliable trading operations, enhancing overall trading efficiency.

Company focus is on creating financial management tools and trading systems. A standout innovation from Scopic Software is their decentralized finance platform, which facilitates peer-to-peer lending. This platform has revolutionized the way financial transactions are conducted, providing greater transparency and security for users.

9. Rademade

Rademade specializes in custom trading software development for algorithmic trading. Their team employs the latest technologies and tools to create solutions that adhere strictly to client requirements. Rademade’s platforms are designed to be innovative, budget-friendly and punctual, providing traders with efficient and reliable tools for algorithmic trading.

Company focuses on creating mobile banking applications, payment processing systems, and financial analytics tools. Their development of an AI-driven financial analytics platform has significantly enhanced decision-making and operational efficiency for banks and financial institutions. This innovation highlights Rademade’s ability to deliver sophisticated tools that drive success.

10. Technoloader

Technoloader is an outstanding choice for comprehensive FinTech solutions, particularly known for its algorithmic trading systems. Established with a mission of addressing the specific needs of the financial industry, Technoloader leverages cutting-edge technologies to deliver robust IT solutions.

Technoloader focuses on creating trading platforms and financial analytics tools. Their development of an AI-driven trading platform has significantly enhanced decision-making and execution speed for hedge funds, brokerages, and investment firms. This innovation highlights Technoloader’s ability to deliver sophisticated tools that optimize trading strategies and drive success.

Itexus Expertise in Trading Software Development

Over the years of developing fintech solutions for businesses across the world, Itexus has mastered the art of exceeding client expectations. Take a look at some trading solutions Itexus has recently implemented.

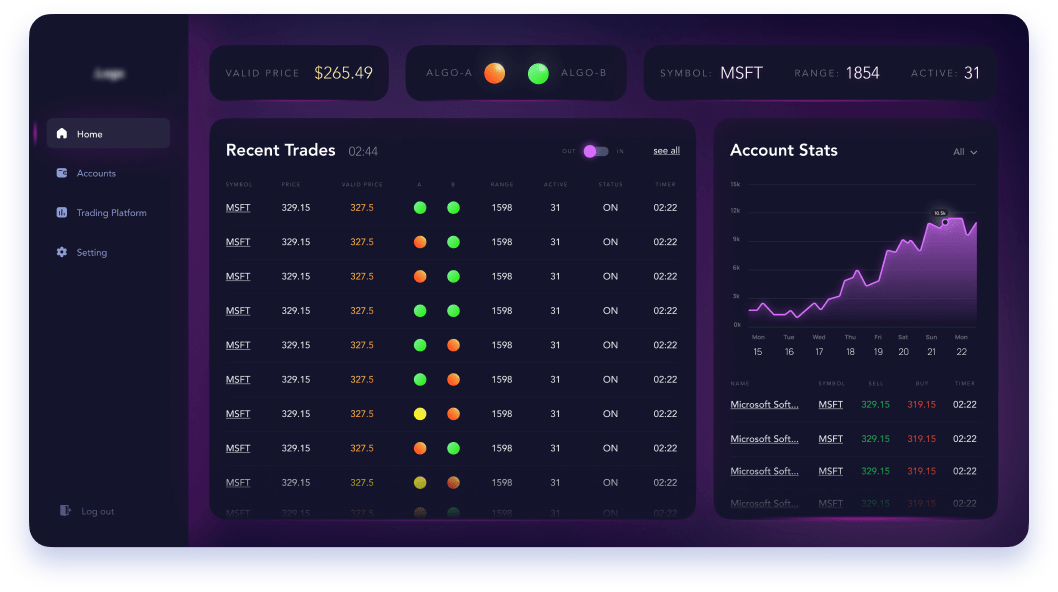

Stock Trading Signals Platform

An investment company specializing in active day trading on the stock market turned to Itexus to develop a configurable platform that could automate technical analysis tasks and calculations according to the company’s strategies for different asset classes. For this client, the Itexus team developed an intelligent investment assistant that performs technical analysis on a range of stocks, automatically tracks multiple indicators on the stock exchanges, and generates buy/sell and risk signals for a human trader. The solution enabled the client’s in-house trading team to identify investment opportunities faster, make decisions with fewer mistakes, and thus increase the company’s trading profits.

To learn more about the project, please read the original case study.

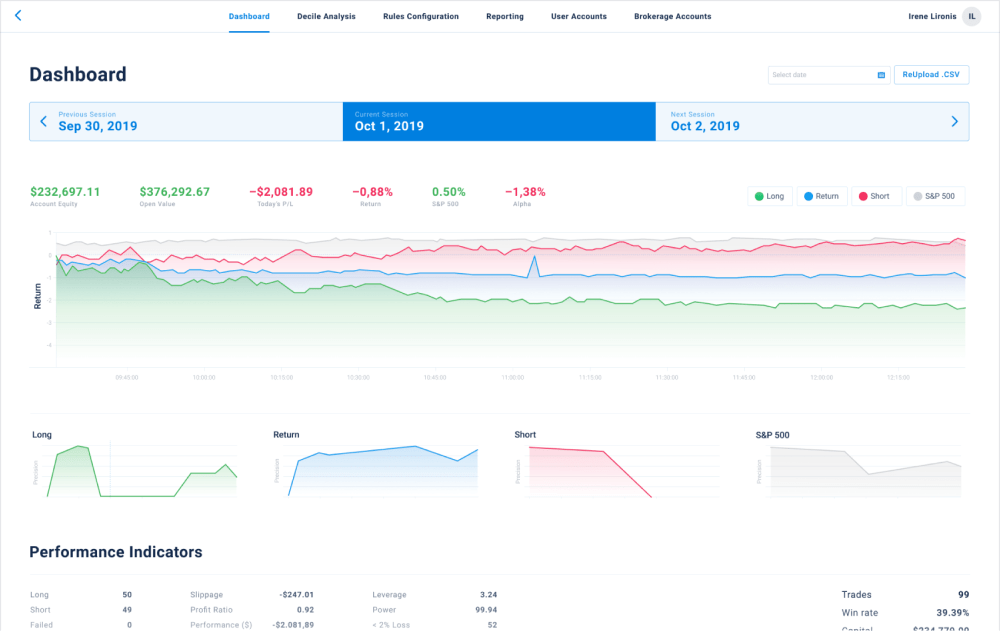

Algorithmic Intraday Stock Trading System

One more trading solution was delivered to a wealth management company with 20 years of experience and its proprietary active stock trading strategy. The client wanted to create a SaaS system that would automate the trading strategy and operations goal and help to increase the customer base, augment profits from trading, and decrease the cost of operations. In a nutshell, the solution allows investors to connect their brokerage accounts and configure a robot to trade stocks from their accounts automatically for a commission and subscription fee.

To learn more about the project, please read the original case study.

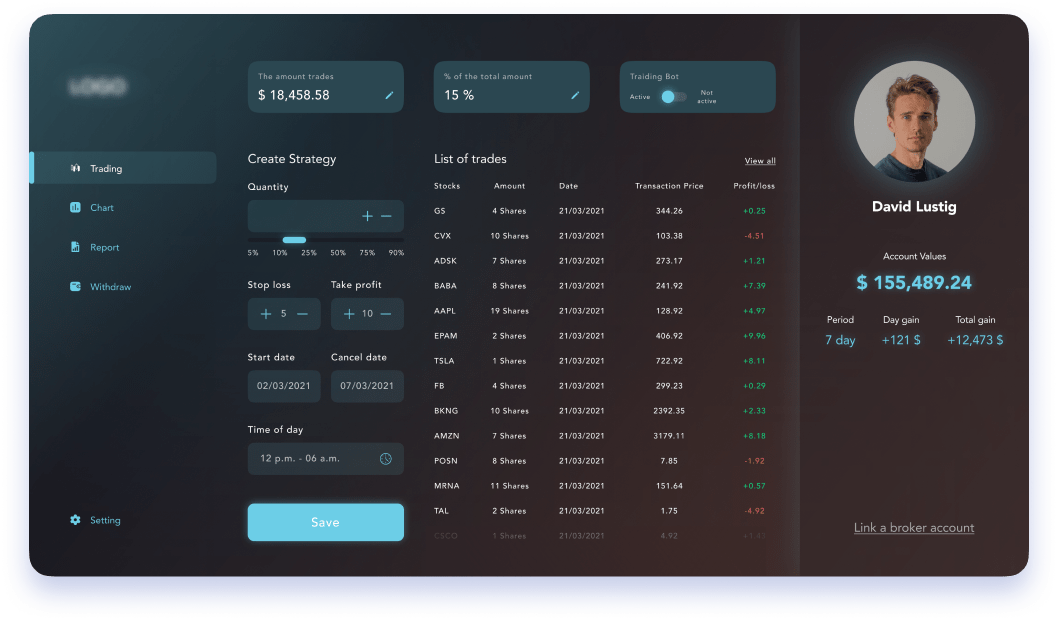

Stock Trading Bot

An investment company specializing in active stock trading approached Itexus to implement a trading bot that would automate one of the company’s proprietary stock trading strategies. The strategy is based on the scalping style, which specializes in profiting off of small price changes and making a fast profit off reselling. The bot delivered by Itexus is a cloud-based application connected to a brokerage account via an API. It automates stock trading by executing trades based on preset requirements such as a stock’s price, time of day, past trades that week, and technical indicators. The bot tracks stocks throughout the day, looking for a few indications as to when it should buy.

To learn more about the project, please read the original case study.

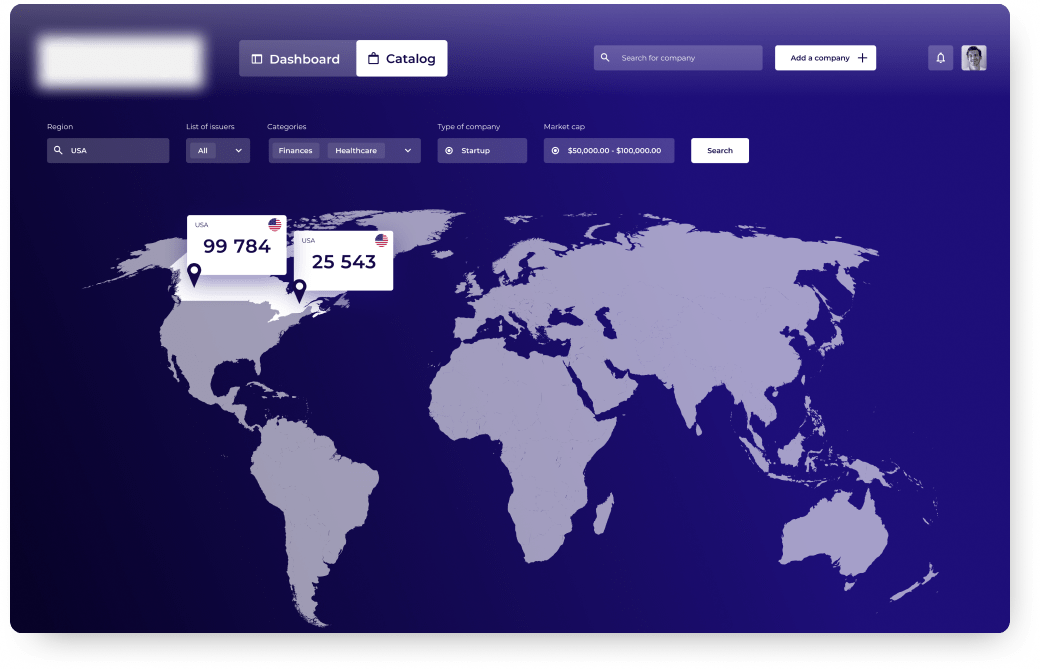

Centralized Platform for Trading Over-the-Counter Securities

Another client with long-standing experience in stock trading and professional investment portfolio management wanted to automate the process of OTC securities trading. He approached Itexus with the idea of building a centralized platform that would connect the security issuer or holder with the investor and automate the process of buying and selling over-the-counter securities. For this client, Itexus delivered a centralized platform for trading over-the-counter securities that brings holders and investors together, allowing them to bypass intermediaries and trade assets easily and quickly. To match buy and sell orders for OTC securities within the platform, Itexus engineers equipped the platform with a matching engine that identifies the best buy order with the highest price and matches it with the best sell order with the lowest price.

To learn more about the project, please read the original case study.

How to Choose a Vendor for Custom Trading Software Development?

Let’s point out what to keep in mind while choosing a contractor for trading solution development.

✔️ Domain Expertise

While shortlisting companies and choosing the winner, pay close attention to the relevant expertise because it’s illogical to anticipate that the company specializing in, say, telemedicine would build a stellar trading solution.

Figure out whether the company has had similar projects, clarify if they can scale the team if needed, and check how their previous projects perform. Consider all the details carefully and don’t go for the vendor if he’s lacking one important ingredient of productive collaboration.

✔️ Support & Maintenance

Developing the system itself is only half the battle. The other half is constant support and maintenance of the existing system. Learn whether and on what conditions the vendor provides further maintenance beforehand and only if the terms are acceptable, sign the contract.

✔️ Rates

There’s a direct dependency between the quality of the result and the cost of the provider’s work. Attempting to make savings in trading platform development may lead to budget overrun and performance issues, so try to find a middle ground instead of sacrificing quality for a lower budget.

✔️ Impeccable reputation

Traders & brokers worldwide need to be sure the money and data they entrust to a trading system are highly secured. The reputation of your trading solution must be spotless, and it’s clearly dependent on the reputation of the chosen vendor.

Get Your Project Estimate

Estimating your trading software project is key when shortlisting a candidate for development as it defines the time and budget required for developing, testing, and launching the trading platform. Getting an estimate is quite easy – drop us a line, sign the NDA, and after the goals and requirements discussion, we will provide a precise project estimate.