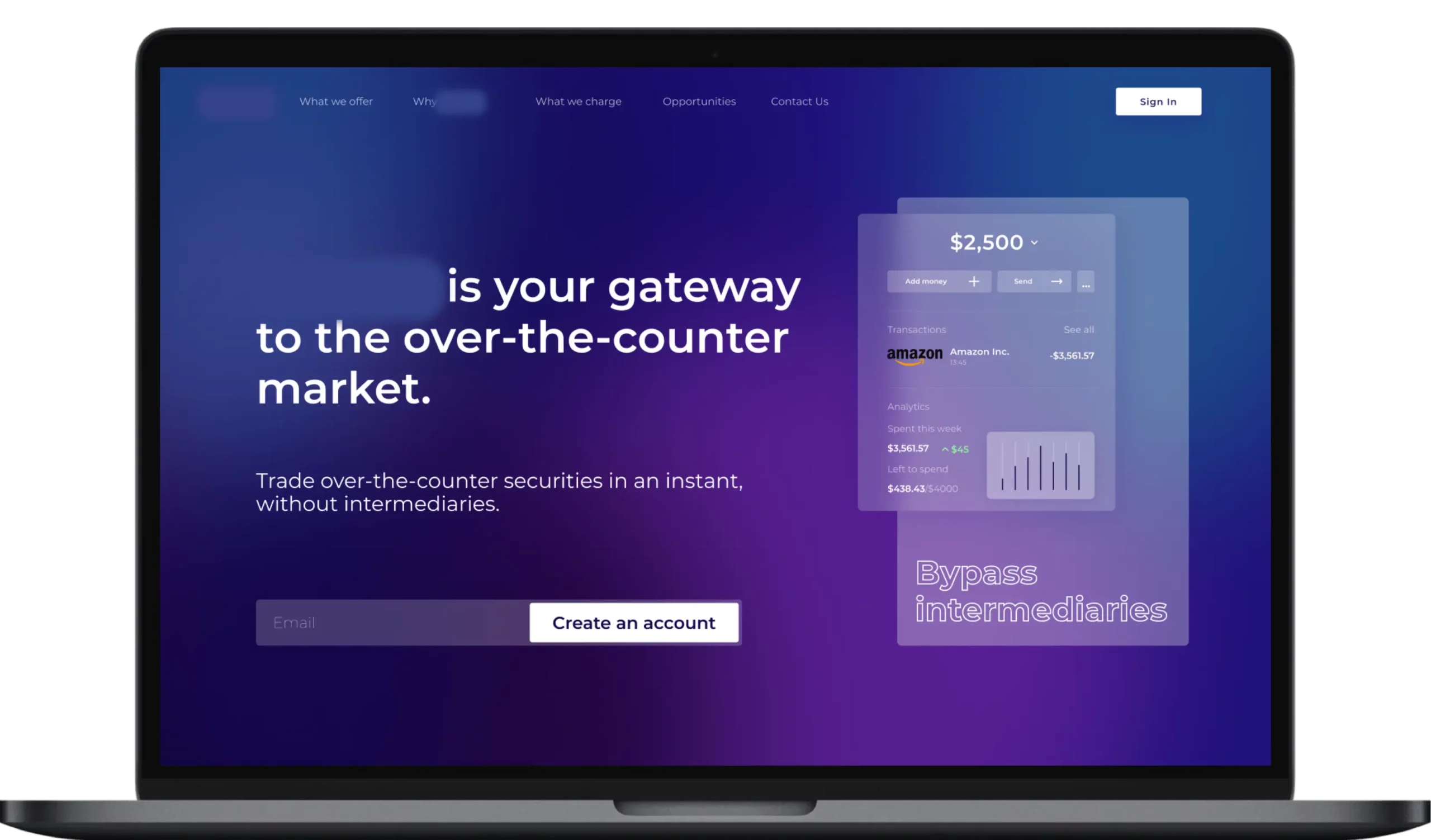

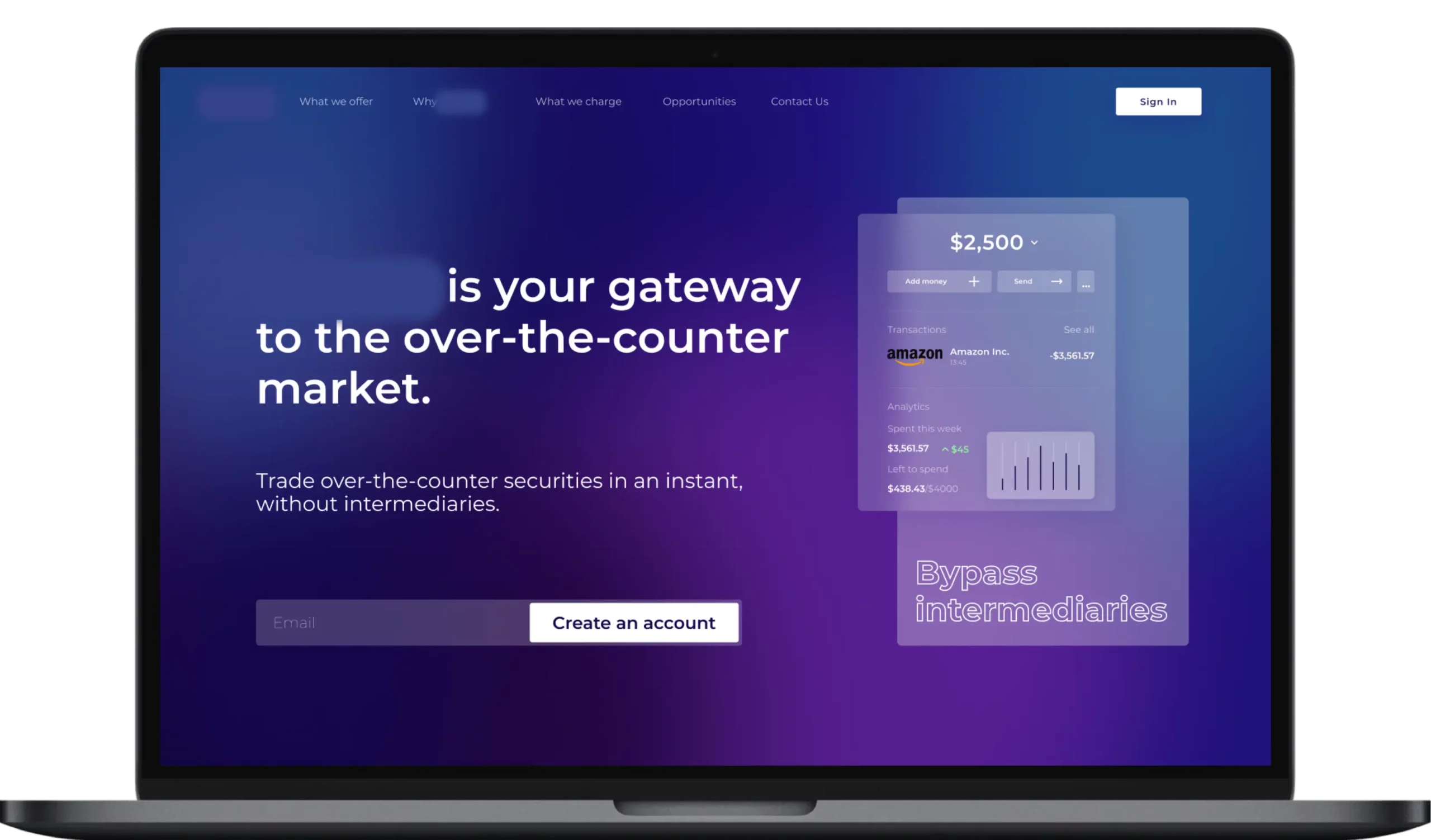

Centralized Platform for Trading Over-the-Counter Securities

A centralized platform for trading over-the-counter securities that brings holders and investors together, allowing them to bypass intermediaries and trade assets - quickly and easily.

About the client

The client is an investment company specializing in the over-the-counter (OTC) market and off-exchange trading.

Engagement model

Time & Materials

Solution

Web app for trading over-the-counter securities

Project Team

1 PM, 1 BA, 2 Frontend Developers, 3 Backend Developers, 1 Software Architect, 2 QA engineers

Effort and Duration

18 months

Project background

When it comes to the over-the-counter market, searching for information and concluding deals requires a significant investment of time. It is difficult for an investor to know that OTC securities are available for order because the information is usually only accessible on the website of the depository where they are stored. Investing in OTC securities is further complicated by the presence of multiple intermediaries between the investor and the issuer, and by the fact that the investor’s personal presence is often required to close the deal. At the same time, the OTC market often offers investment opportunities that aren’t available in the highly competitive market of publicly listed companies. Our client wanted to automate the process of OTC securities trading. He approached us with the idea of building a centralized platform that would connect the security issuer or holder with the investor, and automate the buying and selling of OTC securities as well as the search and exchange of information. The client chose Itexus because of our extensive experience in developing complex fintech systems, and for our ability to speak the language of experienced financiers.

Tech stack / Platforms

Target audience

The solution is targeted at two main segments – issuing companies looking to raise additional capital for business development, and security holders looking to sell their assets. It is also expected to attract inexperienced investors, who will appreciate both the transparency and the intuitive and simple navigation throughout the whole OTC trading journey, from registration to money withdrawal.

Solution overview

The primary purpose of the solution is to simplify and automate the process of buying and selling over-the-counter securities. The product is a web application designed to perform two primary functions:

- Trading OTC securities

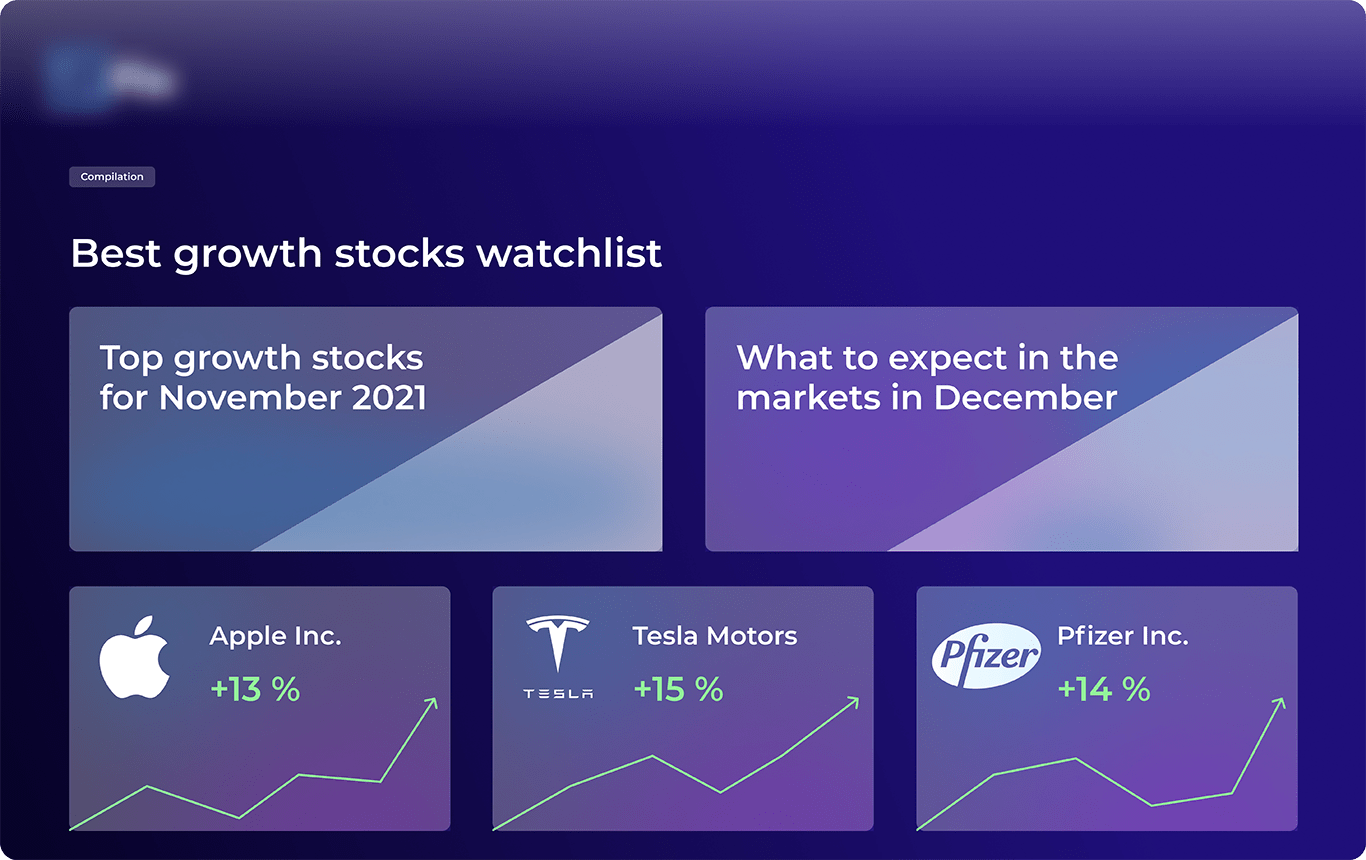

- Collecting and disclosing reliable information about the security issuers

How it works:

- The issuer or holder declares that they want to sell their securities and adds them to the platform. Securities issuers can reduce the commissions charged for trades by providing information about the company.

- Investors review the offers of holders and issuers, and can then make a purchase decision.

- Investors buy securities and manage their portfolios. Investors can also indirectly influence the demand for the securities of specific issuers by leaving reviews.

- Money and securities are accumulated on the platform’s bank and depository accounts.

- The internal billing system distributes funds to users’ accounts according to their shares.

Functional modules and solution main features

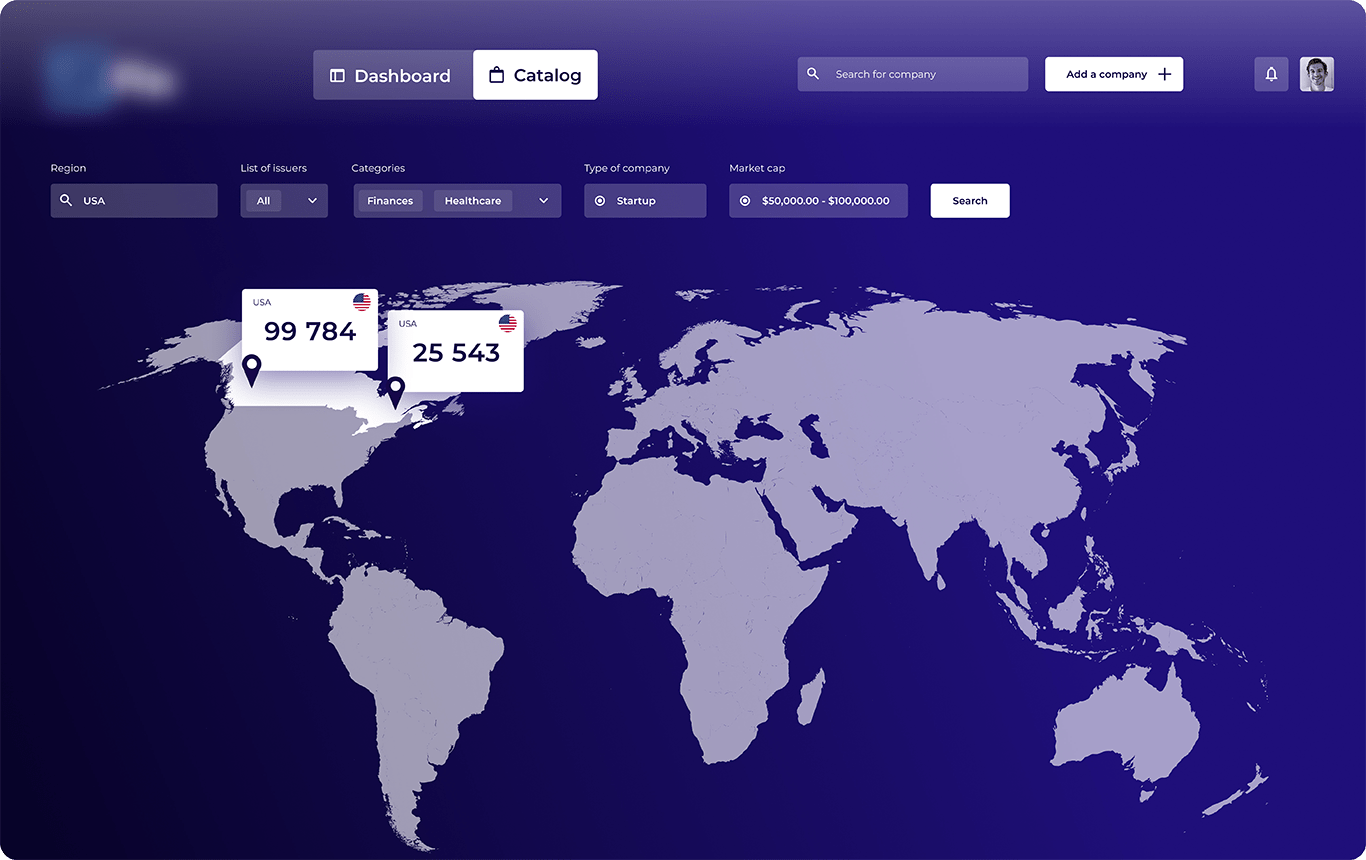

The platform consists of client and admin modules. Admins can moderate users, issuers, and assets information, manage content, and analyze business performance. As for the client module, different options are available. Depending on the user’s goals, they can buy or offer securities.

Investor role functionality:

- View offers from securities holders

- Filter securities by industry, revenue, profitability, and other criteria

- Pass KYC procedure to access trading

- Add more money to their account

- See the purchased securities in the personal account

- Leave reviews on different issuers

- Monitor portfolio performance

- Withdraw securities/money from the platform

For the client, it was important that we not only created a solution for trading OTC securities, but also one that encouraged communication within the investment community. Through the platform, investors can get acquainted and follow each other’s public actions. Similar social networks for investors have already been implemented by major banks.

Security Holder role functionality:

- Place securities on the platform

- Set prices on securities and put them out for sale

- See the money received on the internal account

- Monitor portfolio performance

- Remove securities from circulation

- Withdraw securities/money from the platform

If the security holder is also the issuer, they can attach supporting documents that disclose information about the issuing company, or provide details about the company that may be of interest to potential investors.

Third-party integrations

Project approach

We started with a discovery phase and came up with the solution architecture, crafted a software requirements specification document, prioritized features, and made a product roadmap and a risk mitigation plan. Then we moved on to the development process, which was organized according to the Agile model. Taking into account the prioritized features, we divided the building process into several iterations. Each iteration was followed by the demonstration of the developed features to the client and a feedback collection session.

Technical solution highlights

Matching engine

On-premise servers

Results & future plans

The first version of the system was completed and launched in beta testing mode within 18 months. The Itexus team developed the trading platform in full compliance with the client’s expectations, delivered a robust and intelligent solution that connects investors and securities holders, and facilitates OTC trading by enabling the bypassing of intermediaries. Currently, we are preparing to launch the platform in our client’s local market. As we collect data on consumer responses, we will introduce enhancements and focus on exploring new markets. Interested in crafting a similar solution? Just need some expert advice on the topic? We’re happy to assist you in any way we can! Contact us today.

Related Projects

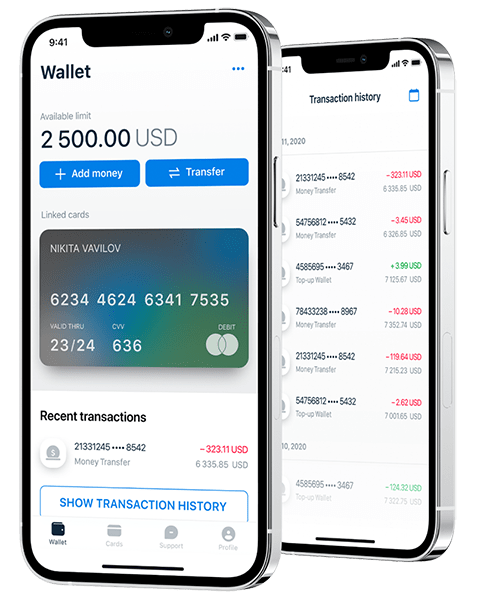

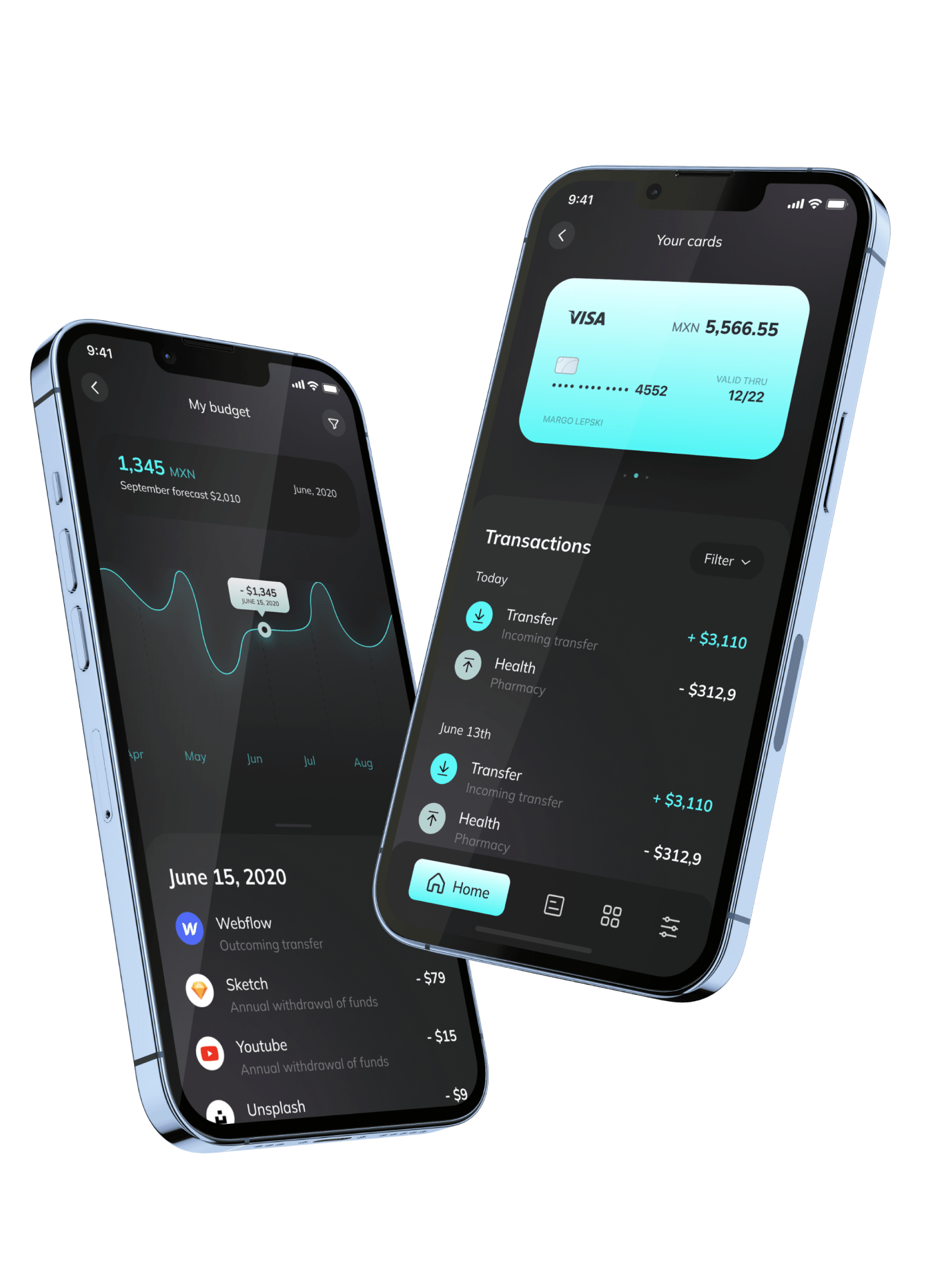

All ProjectsMobile E-Wallet Application

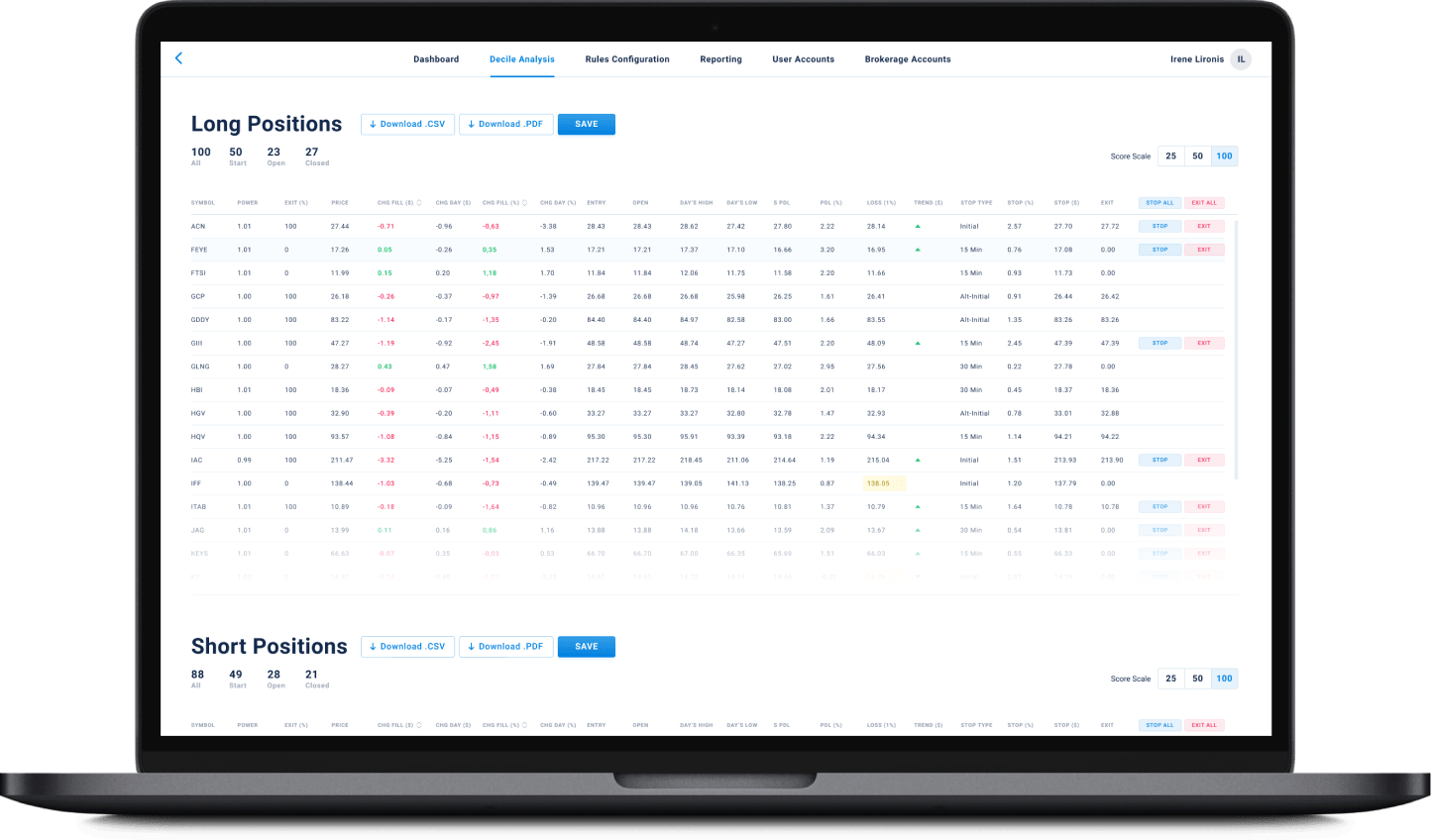

Financial Data Analytical Platform for one of top 15 Largest Asset Management

Financial Data Analytical Platform for one of top 15 Largest Asset Management

- Fintech

- Enterprise

- ML/AI

- Project Audit and Rescue

AI-based data analytical platform for wealth advisers and fund distributors that analyzes clients’ stock portfolios, transactions, quantitative market data, and uses NLP to process text data such as market news, research, CRM notes to generate personalized investment insights and recommendations.

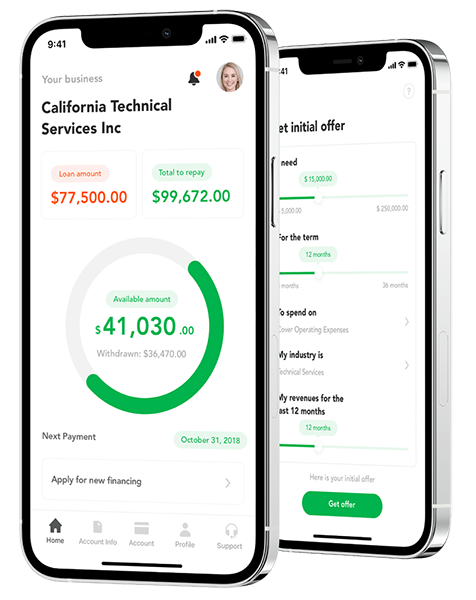

App for Getting Instant Loans / Online Lending Platform for Small Businesses

App for Getting Instant Loans / Online Lending Platform for Small Businesses

- Fintech

- ML/AI

- Credit Scoring

Digital lending platform with a mobile app client fully automating the loan process from origination, online loan application, KYC, credit scoring, underwriting, payments, reporting, and bad deal management. Featuring a custom AI analytics & scoring engine, virtual credit cards, and integration with major credit reporting agencies and a bank accounts aggregation platform.

Contact Form

Drop us a line and we’ll get back to you shortly.

For Quick Inquiries

Offices

8, The Green, STE road, Dover, DE 19901

Żurawia 6/12/lok 766, 00-503 Warszawa, Poland