Document Management Platform for an Insurance Company

A document management platform designed to automate and streamline the management of case files, eliminating manual work in the process.

About the Client

The client is an established insurance company that operates in the United States and aims to provide a variety of insurance products and services that meet the diverse needs of individuals. With a strong presence in the insurance market, this company has earned a reputation for offering reliable and comprehensive insurance coverage to its customers.

Project Background

The client approached us with a request to create a user-friendly platform that would reduce the time and effort required for case file processing. The client already had a clear vision of the solution, so our role was to transform it into detailed software requirements and bring it to life.

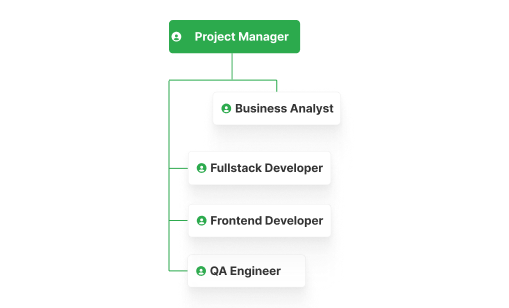

Project Team

Engagement Model

Time & Material

Tech stack

Target Audience

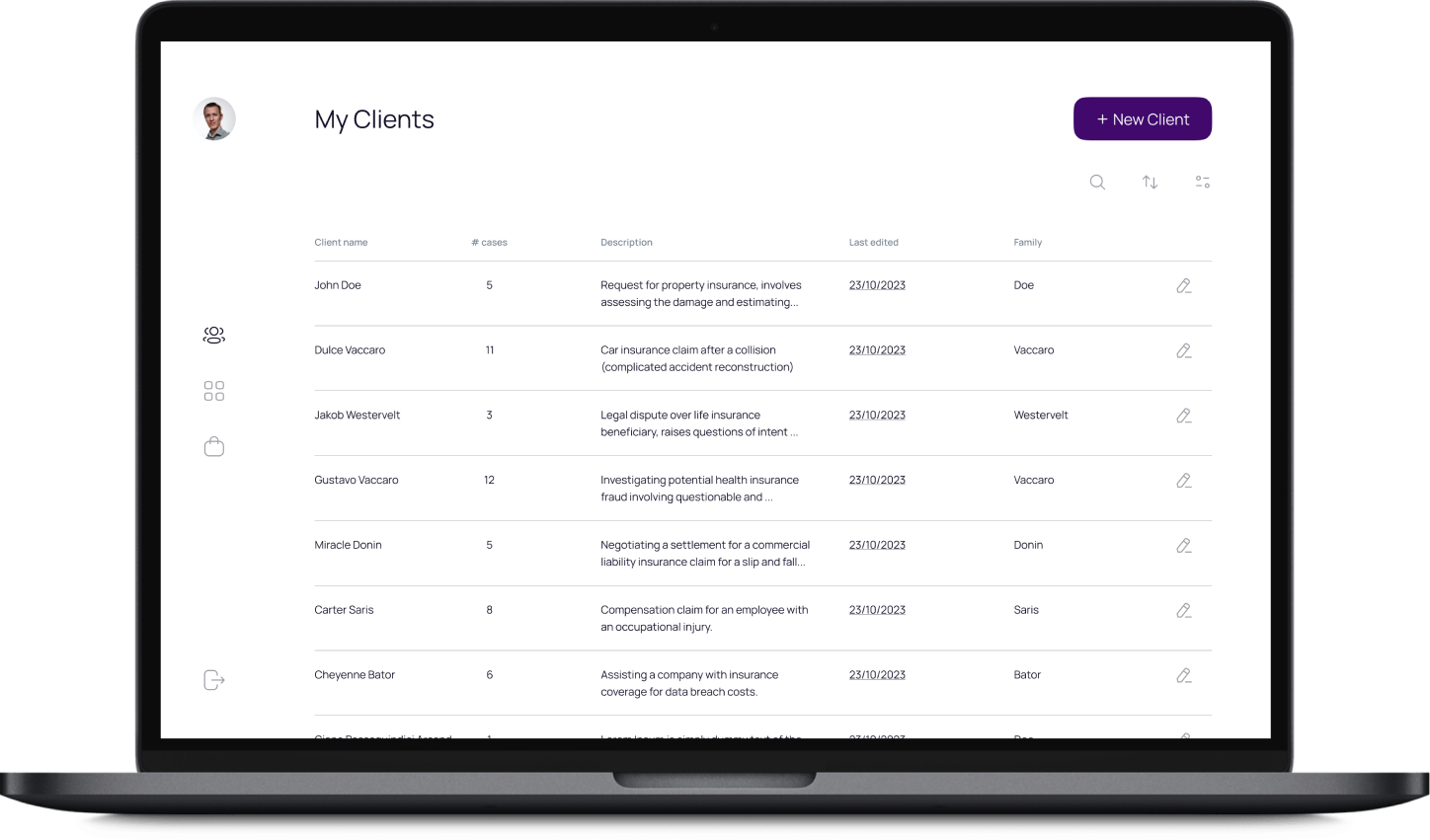

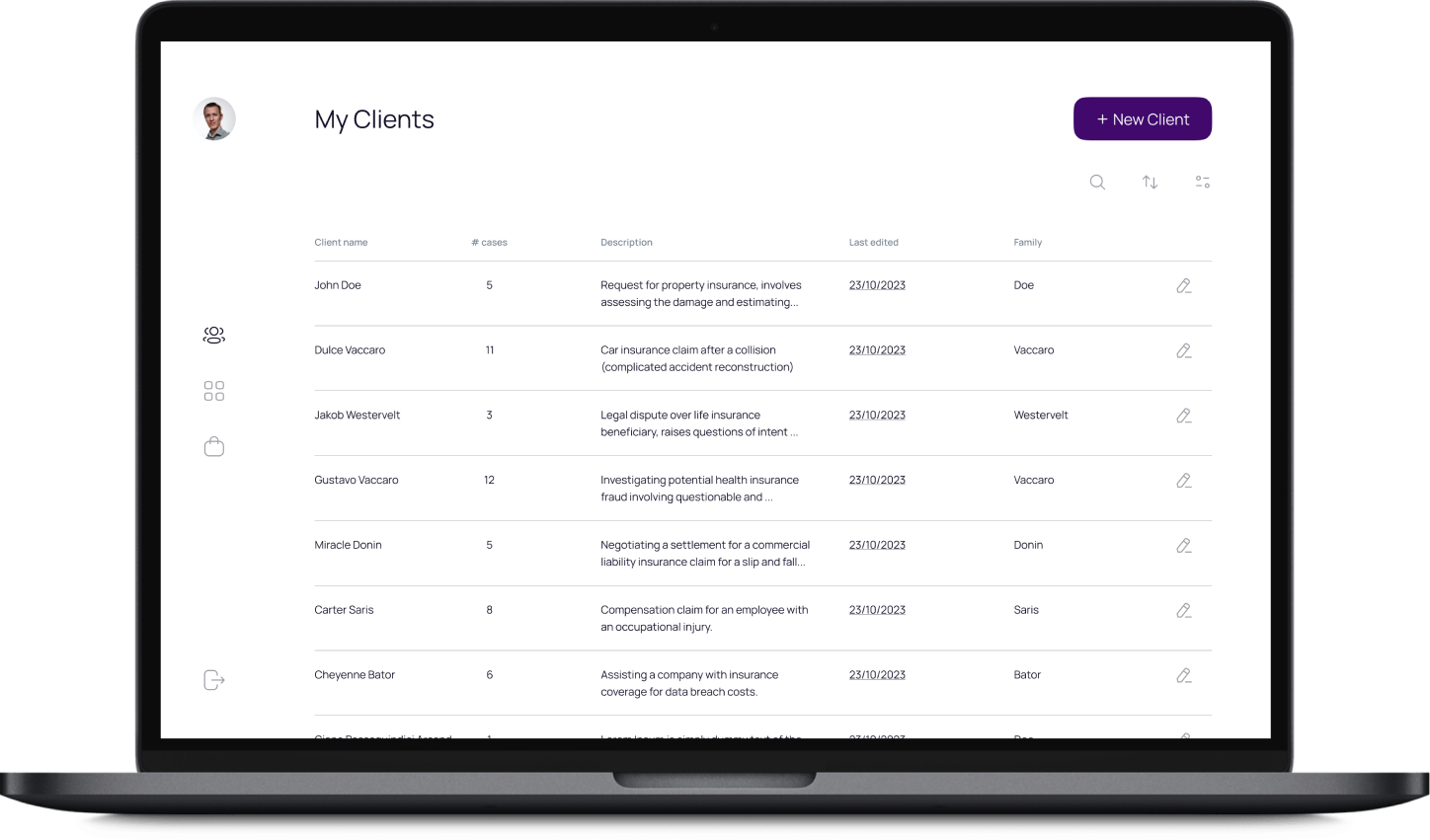

Initially, the platform was intended for use by the employees of the client company. However, the client later decided to sell the platform as a white-label solution to other insurance companies.

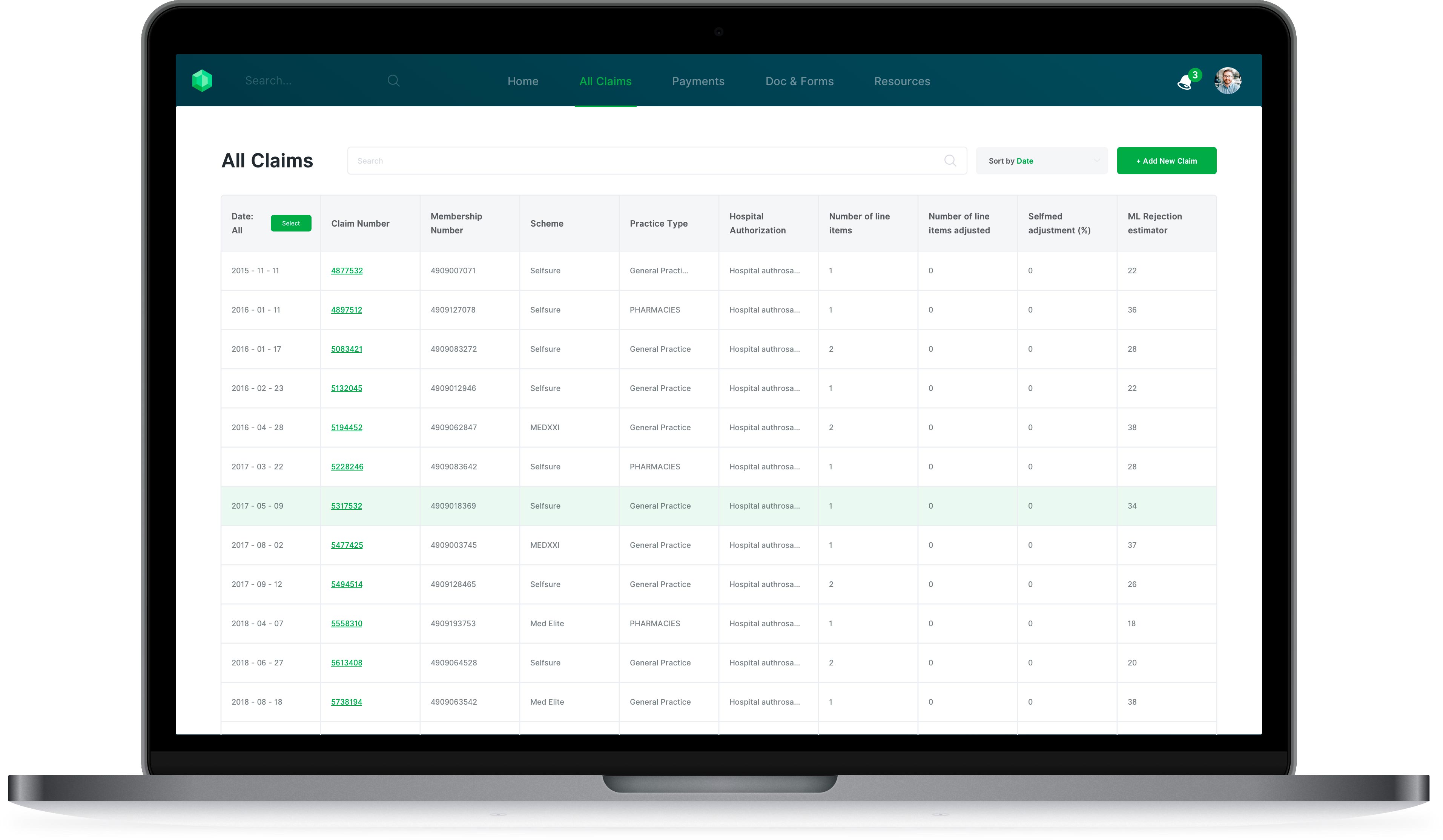

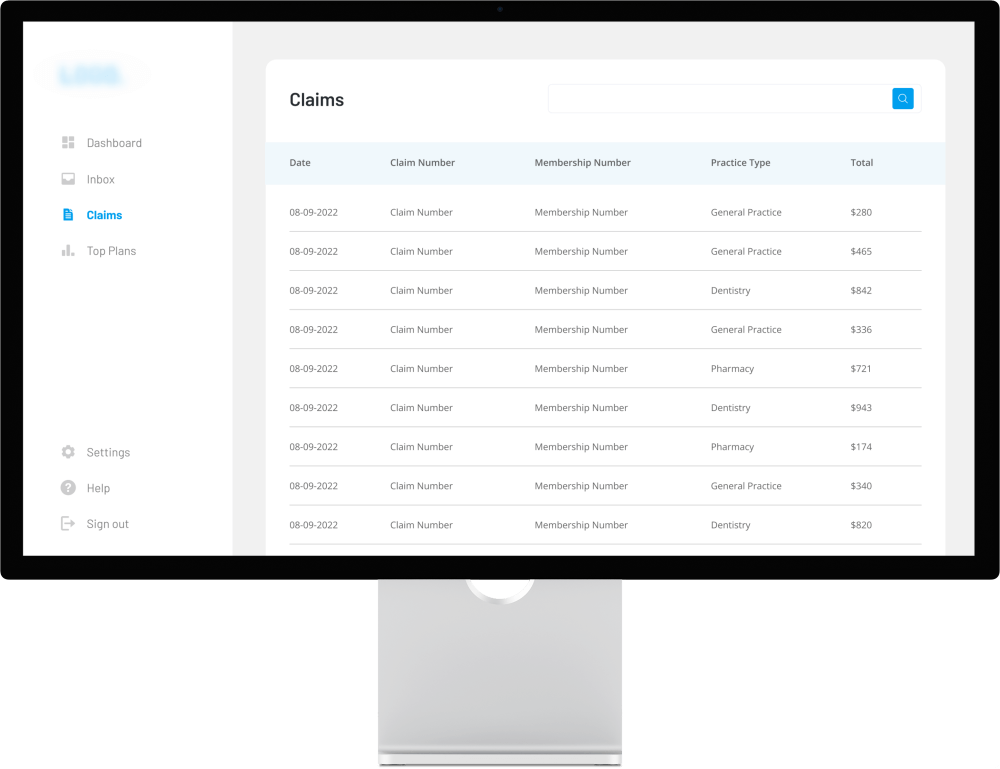

Functionality Overview

In a nutshell, the platform facilitates the management and sending of case-related documents. Here is a description of the platform’s main modules and functionality.

Case file creation

A user creates a case file for each client. The case file includes the following information:

-

basic client information such as name, contact info, etc.

-

documents uploaded by the user, including Word, PDF, Excel files, etc.

-

notes made by the user.

Email management

After uploading documents for a specific client, the user has the option to create an automated email that can be sent to insurance companies. The system is preloaded with the names and email addresses of the insurance companies by the administrator, allowing the user to select the recipients for the email.

-

The email is automatically generated by the system. The user can choose to either edit it or send it as is.

-

The uploaded documents are attached to the email.

The user can send additional emails, along with additional documents, to the insurance companies. They can also view a list of all uploaded documents for each case file and resend previously uploaded documents.

Furthermore, the user can access the activity history, which includes information on recipients, the text of the email, and the attached documents.

Case file book creation

The user can create a PDF book that encompasses the client’s complete case file. This book includes all the attached documents and is automatically formatted with the user’s insurance company logo.

The user has the ability to create a PDF book that encompasses the client’s complete case file. This book includes all the attached documents and is automatically formatted with the user’s insurance company logo.

Development Process

This project was executed using the Scrum methodology, with a focus on ensuring complete transparency of the process for the customer and consistency in delivering results.

We adopted an iterative approach, with each sprint lasting for 3 weeks. After the completion of each sprint, we conducted demonstration and feedback collection sessions. The project team conducted daily meetings to efficiently monitor progress and proactively address any potential challenges.

We maintained regular communication with the client by providing timely reports on time allocation and costs, ensuring that the platform would be delivered within the agreed budget. Our primary means of communication with the client were Slack, Zoom, and emails.

Technical Solution Highlights

The platform is a responsive web application that can be used on mobile devices, both iOS and Android.

Javascript was chosen as the primary frontend programming language due to its cross-platform compatibility. It can be executed in web browsers on a variety of platforms and devices, ensuring that our web application will function properly on different operating systems and devices.

Rapid development and a clean codebase were among our top priorities, so for backend we chose to use Ruby and the Ruby on Rails framework. This combination enables fast development of web applications and offers an elegant and readable syntax.

The platform is integrated with two third-party services: an email provider and a text editor. The email provider is necessary for efficient email management and sending, while the text editor enables the generation and editing of emails.

Results

Within four months, the cross-functional team of specialists at Itexus successfully delivered the platform, meeting all client requirements and staying within the designated timeframe and budget. The application is now fully operational and performs as intended on both web and mobile platforms. The client has reported that the app has greatly reduced the time needed for managing case files and has freed up company resources previously dedicated to these processes. The client is currently considering the option of selling the solution to other insurance companies.

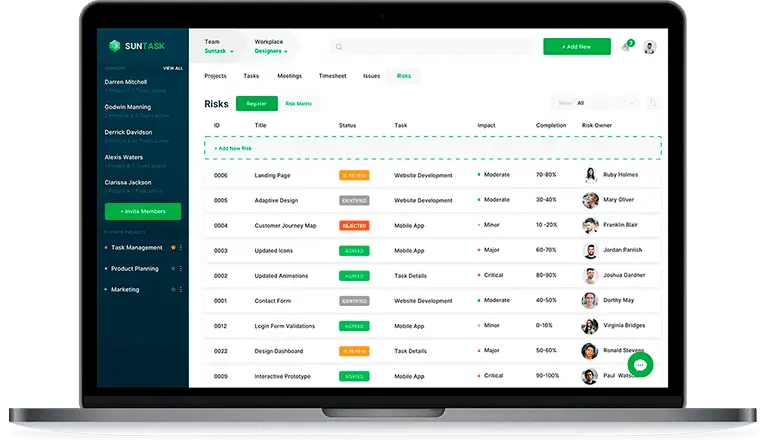

Risk assessment platform for insurance agents that assesses the risk of their prospects and offers high-quality insight that results in the appropriate insurance coverage for each prospect.

Are you planning to build a platform?