Financial Data Analytical Platform for one of top 15 Largest Asset Management

AI-based data analytical platform for wealth advisers and fund distributors that analyzes clients’ stock portfolios, transactions, quantitative market data, and uses NLP to process text data such as market news, research, CRM notes to generate personalized investment insights and recommendations.

About the Client

The client is among the top 20 investment management companies in the world, with assets under management exceeding $1.5 trillion. They manage and distribute a wide range of diversified financial products, including mutual funds, ETFs, ETNs, and managed accounts. These products are used to construct custom portfolios across various asset classes for both institutional and retail investors.

The company employs hundreds of investment advisors who continuously monitor the market, track clients’ portfolios and transactions, and provide tailored recommendations. Their primary goal is to match the right financial products with the needs of institutional investors—such as banks, insurance companies, and pension funds — to help them achieve better returns or hedge against specific market risks.

Project Background

The client experienced growing competition as a result of the digitization sweeping through the financial services industry. Financial advisers, overwhelmed by a constant flow of information, struggled to meet rising customer expectations for personalized service and deeper engagement.

Internal productivity research revealed that advisers were spending approximately 85% of their working time analyzing clients’ portfolios and monitoring market conditions, while only 15% was dedicated to direct client meetings. Despite this intense focus on analysis, they were still unable to track each client’s unique situation, interests, and relevant market events in real time.

To solve this, the client made a strategic decision to build a system capable of automating market data analysis and generating personalized insights, reports, and recommendations for every client. This would allow human advisers to spend less time processing data and more time offering timely, relevant, and tailored advice.

The goal was clear: improve customer satisfaction, boost financial product sales, and reduce the amount of time high-cost personnel spent manually analyzing market information.

After a careful vendor selection process, the client chose Itexus. The decision was based on Itexus’ deep expertise in the stock market and asset management domains, as well as a strong track record in building financial analytics systems, processing complex market data, and implementing advanced technologies like machine learning and natural language processing (NLP).

Project Team

Engagement Model

Time & Materials

Tech stack

Functionality Overview

The system emulates the work of a perfect investment adviser by performing the following tasks:

-

“Reads” and “remembers all available information regarding every client, including their stock portfolios, past transactions, interests, problems, risk profile, previous questions – all available data stored in the CRM.

-

Monitors all market movements, news, and research from multiple data feeds in real time.

-

Generates highly personalized alerts and recommendations for each client.

For example, if a client is heavily invested in the energy sector and the system “reads” research predicting a decline in oil prices, it generates an alert to the adviser with a recommendation to call this specific client and discuss the situation. The adviser can suggest reducing the client’s exposure to energy stocks, share relevant news and data, and provide guidance accordingly. More sophisticated scenarios can also be created based on the available data.

Financial advisers who use the information generated by the system will know which clients to contact first, what information to share, and what trades to propose.

The system comprises the following modules:

-

Data Pipelines – collect information from multiple sources in real time, including quantitative market data, client portfolios, transactions, market news and research from Reuters and Morningstar, CRM notes, etc.

-

Quantitative Analysis Module – analyzes portfolios, market data, and transactions; monitors portfolio parameters and stock prices to generate insights based on changing market conditions, past trades, and portfolio performance.

-

Natural Language Processing (NLP) Module – processes text data and extracts structured information such as entities, sentiments, and facts from news and research papers.

-

Text Summarization Service – generates short summary excerpts from text documents.

-

Entity Extraction Service – extracts entities like “Product Name”, “Ticker”, “Person”, “Economic Sector”, etc.

-

Sentiment Analysis Service – determines the sentiment in which a certain entity or fact was mentioned.

-

Scoring and Recommender Engine – matches market events with client data, calculates relevancy scores, and generates recommendations using an ensemble of algorithms (e.g., collaborative and content-based filtering). All algorithms are continually improved through user feedback and behavioral analysis.

-

Salesforce CRM Widget – displays results within the corporate CRM’s client view. It also collects direct and indirect feedback from users to improve algorithm performance.

-

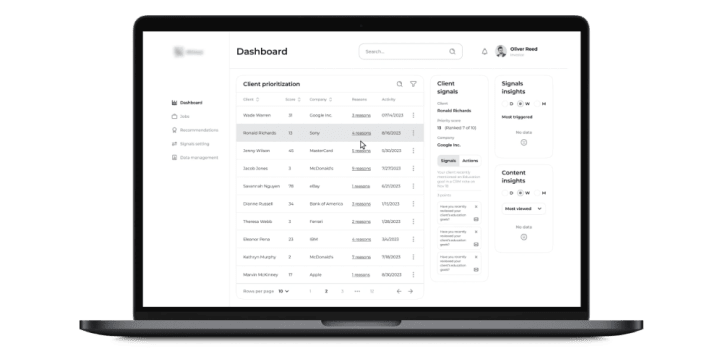

Administrative User Interface – allows for viewing reports, analysis results, and signals. It enables the management of system settings, importing data from different sources, and configuring new signals.

Architecture Overview

The system architecture is based on the Microservices architecture pattern, designed for scalability, flexibility, and performance.

It supports two client interfaces: a web application and a Salesforce widget. Both front-end clients interact with the back-end server through a unified API Gateway. The Salesforce widget provides users with the ability to view personalized system-generated recommendations for each client directly within their existing CRM environment.

The back-end is composed of multiple microservices that communicate through REST APIs. These services rely on asynchronous processes and follow a data pipelines approach to import, clean, analyze, and distribute data efficiently.

The machine learning module integrates both proprietary models and leading open-source libraries, including scikit-learn, spaCy, Hugging Face, Keras, and PyTorch. This module is primarily responsible for processing large volumes of text data and extracting actionable insights.

To handle heavy data loads and computational tasks, the system runs multiple asynchronous jobs using Celery—an open-source distributed task queue framework that takes full advantage of modern multi-core, multi-processor server infrastructure.

The deployment is managed through Azure Kubernetes Service (AKS), which ensures high performance and seamless scalability for applications under varying workloads.

For cloud infrastructure management, the system uses Terraform and follows an infrastructure-as-code approach, allowing for efficient provisioning, versioning, and scaling of all cloud components.

Development Process (or Project Approach)

The project was implemented using an Agile/Scrum-based process. It began with a Product Discovery phase, during which the team:

-

Analyzed the existing business process

-

Documented high-level software requirements

-

Analyzed third-party systems with which the system should integrate, including Salesforce CRM, market data feeds, Morningstar and Refinitiv research feeds, etc.

-

Designed the high-level architecture of the new system

The implementation phase was split into 2-week sprints with intermediate deliveries, demos, and feedback collection sessions at the end of each sprint.

Third-party integrations

Data Providers:

-

CentSai – an eLearning service provider

-

Morningstar – a provider of independent investment research

-

Reuters – an international news agency

-

MT Newswires – news, data, and market analysis provider and aggregator; focused on the extended-hours equity markets

-

The Fly – a digital publisher of real-time financial news

-

IEX – a provider of financial and market data

CRM Platforms:

-

Salesforce – utilized without using the built-in platform interface

-

Wealthbox CRM – utilized without using the built-in platform interface

Search and Analytics Engines:

-

ELK – used to monitor customer behavior on the platform and gather all logs

Results

The first version of the system was developed and deployed in production within eight months, followed by comprehensive user training sessions.

This deployment reduced the time advisers spent preparing for client meetings by approximately 60%. As a result, advisers could focus their efforts on the most promising clients and recommend the most relevant deals, leading to increased sales volumes and higher customer satisfaction.

Overall customer satisfaction, measured through surveys, rose by about 40%, while sales volumes doubled. Additionally, advisers are now able to serve a larger number of clients effectively.

Itexus continues to maintain the system, improve its algorithms, and make adjustments based on the client’s evolving needs.

A digital wallet app ecosystem for Coinstar, a $2.2B global fintech company — including mobile digital wallet apps, ePOS kiosk software, web applications, and a cloud API server enabling cryptocurrency and digital asset trading, bank account linking, crypto-fiat-cash conversions, and online payments.

Need to develop a similar project?