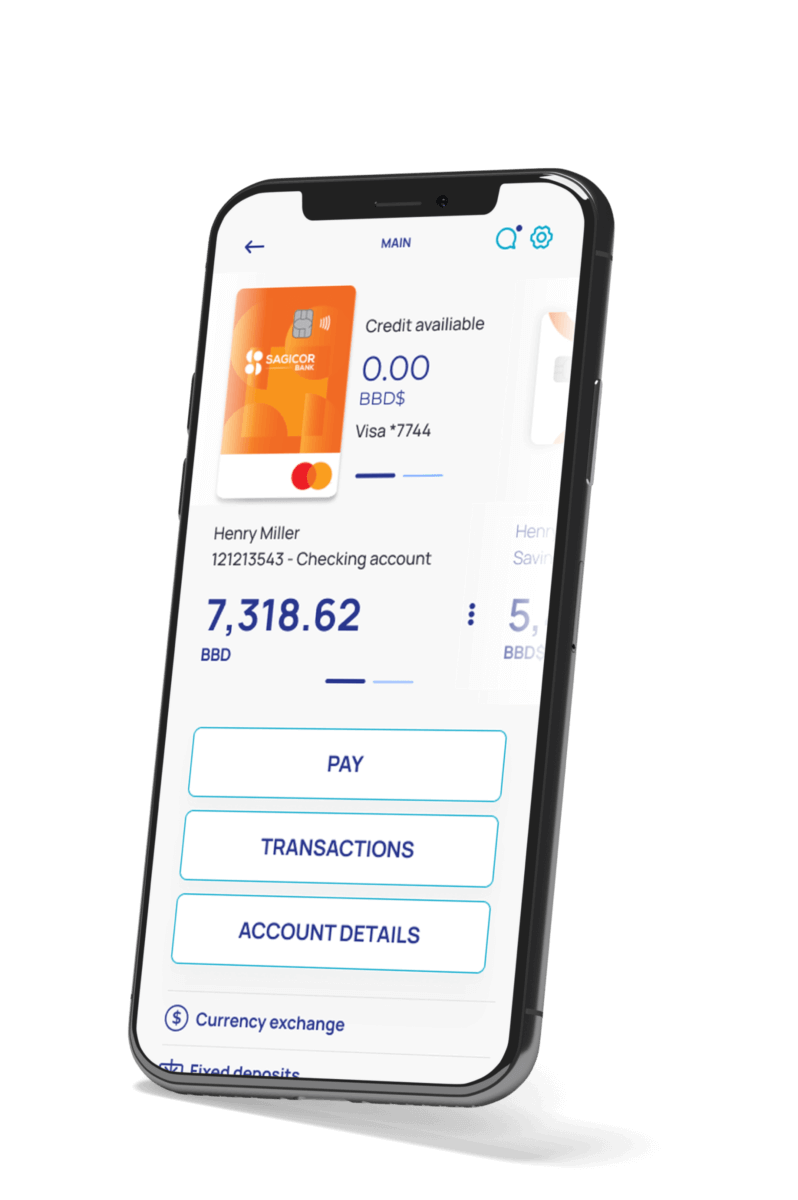

A mobile banking app that allows its users to access all banking services in a secure, convenient and fast way without having to visit bank branches.

In the ever-growing world of fintech, Banking-as-a-Service (BaaS) has become a game-changer. It allows companies to offer banking services without having to build their own banking infrastructure from scratch. With BaaS, businesses can easily integrate services like payments, accounts, lending, and card issuing into their products—all through a simple API.

If you’re building a fintech app, planning to launch a digital bank, or want to add banking features to your platform, BaaS APIs might be exactly what you need. In this article, we’ll explore how BaaS integration works, its use cases, and the costs associated with it, along with a handy table to break down the key BaaS providers.

What is BaaS API?

Banking-as-a-Service (BaaS) is a model that lets businesses offer banking products through APIs without the need to manage the complex back-end systems themselves. Instead of creating banking infrastructure from scratch, businesses can leverage BaaS providers that offer pre-built services, such as payment processing, account management, lending, card issuing, and more.

The BaaS API acts as the connection between your application and the banking system. When you integrate a BaaS API, your app can interact with the banking provider’s services in real-time, providing your users with banking features like creating accounts, transferring funds, or managing payments.

How Does BaaS API Work?

BaaS APIs simplify the integration of banking services into your platform. Here’s how it works:

- Account Creation: Through the BaaS API, users can open digital bank accounts directly on your platform. The API will communicate with the backend banking system to create the accounts.

- Payment Processing: For platforms that need to handle payments—whether eCommerce, peer-to-peer, or in-app purchases—the API will facilitate secure transactions between your platform and the bank.

- Card Issuance: You can issue physical or virtual debit cards to your users by leveraging BaaS APIs, which handle the financial infrastructure behind the scenes.

- Loans and Credit: With BaaS APIs, you can also offer lending services. The API will help you manage loan applications, credit assessments, and repayments.

In short, the BaaS API acts as a bridge between your application and the banking system, allowing you to offer financial services without the hassle of building everything yourself.

Why Use BaaS API?

Here’s why more and more companies are turning to BaaS:

- Faster Time to Market: Integrating BaaS allows you to offer banking services much faster than if you were to build your own system. You don’t need to worry about the complex backend; the BaaS provider takes care of that.

- Cost-Effective: Building banking infrastructure from scratch can be expensive. With BaaS, you pay for the services you use, making it a cost-effective solution for startups and small businesses.

- Scalability: As your business grows, BaaS providers scale their infrastructure for you. You don’t have to worry about performance issues as your user base expands.

- Regulatory Compliance: Staying compliant with financial regulations is challenging. BaaS providers handle compliance, ensuring your platform meets legal standards without the headache.

- Flexibility: You can select only the features you need. Whether it’s payments, lending, or card services, you can mix and match according to your business model.

Cost of BaaS Services

The cost of integrating BaaS services can vary, depending on the provider and the scale of your project. BaaS pricing models are usually flexible and can be based on several factors, such as transaction volume, the number of active users, and the specific services you require. Here’s a general breakdown:

- Account Setup Fees: Some BaaS providers charge a one-time setup fee for integrating their API, which can range from $500 to $5,000.

- Transaction Fees: BaaS providers often charge a fee per transaction. This can range from $0.10 to $0.50 per transaction, depending on the volume.

- Monthly Subscription: Some providers offer subscription models where you pay a fixed monthly fee based on your usage or number of users. These can range from $100 to $5,000 per month.

- Per-User Fees: For services like digital wallets or card issuance, some providers charge a fee per user, often between $1 and $10 per month.

To give you a better idea, here’s a table comparing some popular BaaS providers and their pricing structures:

| BaaS Provider | Key Services | Pricing Model | Example Fee |

|---|---|---|---|

| Synapse | Payment processing, card issuing, account creation | Pay-per-use, subscription, or volume-based | $0.10–$0.50 per transaction |

| Solarisbank | Digital banking services, payments, KYC/AML | Monthly subscription + transaction fees | $100–$2,000 per month |

| Bankable | Payment solutions, virtual accounts, debit cards | Pay-per-use, volume-based pricing | $1 per user per month |

| Railsbank | Credit scoring, lending, compliance, payments | Per API call, per user, or transaction-based | $0.25–$2 per API call |

| Galileo | Payment processing, card issuing, fraud detection | Volume-based pricing, custom pricing | $0.05–$0.10 per transaction |

| Marqeta | Card issuing, payment processing | Volume-based pricing, or per user fees | $0.05–$0.20 per transaction |

(Note: Pricing above is indicative and may vary based on your specific needs and contract terms with the provider.)

Use Cases for BaaS API

BaaS APIs are versatile and can be used across a wide range of fintech applications. Here are a few common scenarios:

- Neobanks: Digital-only banks can use BaaS APIs to offer services like payments, loans, and savings accounts without building the backend themselves.

- Fintech Apps: Apps that provide financial services, such as budgeting, investing, or insurance, can integrate BaaS to manage accounts and transactions.

- eCommerce Platforms: Online stores can use BaaS APIs to offer integrated payment solutions, digital wallets, and even provide financing options for customers.

- Lending Platforms: Companies offering personal or business loans can integrate BaaS APIs to manage loan applications, disbursements, and repayments.

- Digital Wallets & Payment Apps: Payment apps can use BaaS to enable easy fund transfers, card issuance, and instant payments.

- Corporate Payment Solutions: Companies can use BaaS APIs to create custom corporate payment systems, such as employee expense management or corporate credit card services.

Summary

Integrating BaaS APIs into your platform allows you to deliver comprehensive financial services quickly and affordably. Whether you’re launching a neobank, building a lending platform, or adding payment solutions to your app, BaaS provides the infrastructure you need to scale fast, reduce costs, and stay compliant with regulations.

Are you looking to integrate BaaS into your product or create a custom fintech solution? At Itexus, we specialize in building tailored fintech applications and helping businesses leverage BaaS to provide cutting-edge financial services. Contact us today to discuss how we can help turn your ideas into reality!