AI-based data analytical platform for wealth advisers and fund distributors that analyzes clients’ stock portfolios, transactions, quantitative market data, and uses NLP to process text data such as market news, research, CRM notes to generate personalized investment insights and recommendations.

The Fintech market is expected to grow to about $882 billion by 2030, recording a CAGR of about 17% between 2024 and 2030. Consequently, the Fintech development outsourcing market is expected to expand at approximately 20% CAGR between 2024 and 2027. The need for innovative FinTech solutions and fintech software providers will grow with the growth of the Fintech market.

“Research has shown that between 2024 and 2028, Fintech companies are expected to experience a threefold revenue growth compared to institutions that are categorized as traditional banks” – McKinsey Research

At the core of Fintech software development and advancement are technologies such as artificial intelligence (AI), Machine learning (ML), Blockchain technology, and Cloud computing.

Currently, the fintech sector has automated complex banking processes such as money lending, insurance, and smart investments. With the growing demand for innovation and fintech software, several providers continue to emerge worldwide. Well, with such a large pool to choose from, it can be challenging to find the best FinTech developers for partnerships.

We have a solution for you. The list of top fintech outsourcing companies below will help you choose the best company, considering the solutions that your fintech firm is looking for. It is an exhaustive description of what each company offers.

Criteria for Selection

When it comes to the selection of fintech software development outsourcing, it is crucial to choose the right company. This is because the success of your fintech company or startup depends on it. Here are the main factors to consider:

- Technical expertise

- Regulatory compliance

- Data protection and security

- Customer experience

- Support and maintenance

- Pricing models

- Innovation

Technical expertise is the cornerstone of fintech development. It is crucial to find partners with a track record for successful software development projects for fintech. Moreover, the provider should demonstrate expertise in emerging technologies like AI, ML, and blockchain technology.

Due to the sensitivity of financial data, the financial industry is highly regulated. The best fintech software providers must know the relevant regulations such as anti-money laundering, payment services directives, KYC, and general data protection regulations. Consequently, they must have the capacity to create solutions that are compliant with these regulations.

Given the mentioned financial data sensitivity, security should be at the core of outsourced software development. Some of the security measures to look out for include; data encryption, access control, and scheduled security audits.

The end-user experience determines the success of a particular solution. When evaluating the software providers, it is advisable to review client testimonials and case studies to ascertain customer satisfaction. Real-world case studies give insight into the company’s ability to build projects that offer good customer experience.

Ensure that your outsourcing IT company of choice offers support post-development. There should be set expectations on issue resolution, response time, and service quality. Some vendors offer a dedicated support team, ensuring issues are solved efficiently and promptly.

Having clarity on pricing models is crucial in budgeting. Fintech software outsourcing companies commonly have three pricing models:

| Pricing Model | Description | Best Suited For | Key Considerations (2026) |

|---|---|---|---|

| Fixed Price | A single, agreed-upon cost for a project with clear scope, deliverables, and timeline. | Projects with well-defined requirements, MVPs, or quick launches. | Predictable budget but usually includes built-in cost buffers; limited flexibility if scope changes. |

| Time & Material (T&M) | Billing based on actual hours worked and resources used; highly flexible and iterative. | Projects where requirements evolve, long-term fintech products, or agile workflows. | Offers transparency and adaptability; risk of overruns unless capped (NTE model). Works best with frequent reporting and sprint-based tracking. |

| Retainer | A monthly or quarterly fixed fee that secures ongoing access to a dedicated team or experts. | Continuous support, long-term fintech partnerships, maintenance, product scaling. | Predictable recurring cost and guaranteed resource availability. Best for products requiring regular updates, compliance checks, and scaling. |

The best fintech software providers meet current needs while anticipating the future needs of the fintech solution required. Therefore, the chosen software provider should demonstrate investment in research and knowledge of industry trends. Proactive participation in innovation drives the development of a competitive edge.

With this criterion in mind, let’s discuss the top 10 fintech software outsourcing companies that are currently offering services globally.

Top 10 FinTech Software Outsourcing Companies

1. Itexus

Itexus is a software outsourcing company offering technology solutions to FinTech industry leaders. Itexus builds customized software solutions and products, helping Fintech companies meet their needs. Some of its clients include BMW Group, AstraZeneca, John Deere, SAP AG, and Cisco Systems.

The company has received several awards and recognition. Deloitte Technology recognized Itexus in the Fast 500 program as one of the companies that has experienced incredible revenue growth within five years. The company was also recognized among the 2010’s Ernst & Young Fast 50. Other awards include the life sciences award given due to the rapid growth Itexus demonstrated while offering new technological solutions.

Itexus offers diverse fintech software solutions in the areas of banking, payments, credit scoring, insurance, investment, wealth management, stock exchange, financial prediction, digital lending, trading, RPA, AI-based virtual assistants, chatbots, and NLP. The services offered include mobile application development, e-commerce platform development, software development, and IT staff augmentation.

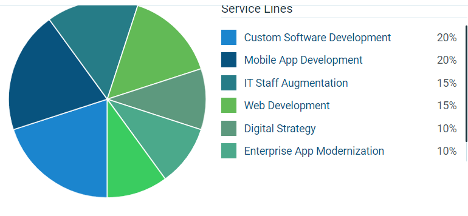

Table showing services for which Itexus develops software solutions.

The company invests in research and development to leverage the advantages offered by emerging technologies such as blockchain, AI, and data analytics. Itexus’s creative product solutions set it apart from its competitors as evidenced by real-world case studies.

Itexus’ Finance App Case Study

Itexus delivered a personal Finance app for a startup in Silicon Valley. The app is aimed at helping users develop healthier financial habits. This app and solution prompts users to set and track saving goals. The objectives can be varied; saving toward debt repayment, vacation, house, or retirement. Additionally, users can automate saving by setting an amount to be transferred to specific accounts monthly, weekly, or daily.

The app has a gamification feature that differentiates it from similar apps in the market. This gamification feature helps with developing better spending decisions. The app categorizes and analyzes the user’s spending while identifying habits that are not healthy.

Furthermore, the app encourages better financial habits by creating challenges. For instance, if a user spends a lot of money on cigarettes, it will be identified as a ‘bad’ habit. Then, the app creates a challenge for the user, like allocating a monthly budget for cigarettes. The user can choose to accept and participate in the challenge or decline. If the user accepts, a penalty fee is set to encourage the user to follow the budget.

The app also incorporates social features that allow users to invite friends and family to take a challenge. The results of the challenge can be shared as well. This feature enables marketing.

2. TCS (Tata Consultancy Services)

TCS is an IT company, offering business solutions and consultation services. The services include technologies such as artificial intelligence, cloud, cognitive business operations, data & analytics, cybersecurity, and IoT digital engineering.

Apart from the banking industry, TCS offers SaaS to other industries such as Capital markets, Education, consumer goods and distribution, healthcare, Insurance, High tech, life sciences, travel and logistics, public services, retail, manufacturing, Energy and resources, and Media & information services.

TCS offers a solution, BaNCs, for the launching of exclusively digital banks, also neobanks, within a few months. The software is designed to cater to every part of business processes expected in the financial services sector. Moreover, it is aimed at ensuring enhanced end-user experience. The BaNCS solution covers banking, insurance, and capital markets.

3. Cognizant

Cognizant is a US company that provides technology solutions globally. Services include applications development, automation, cloud, business processes, data & AI, IoT, Security, enterprise platforms, and consulting.

Similar to TCS, Cognizant partners with companies across different industries. The industries include banking, automotive, capital markets, communications and media, education, Information technology, healthcare, manufacturing, life sciences, insurance, and blue economy.

In the banking industry, the company offers services related to business processes, digital banking, payments, lending, data & AI use in financial services, and commercial & retail banking.

4. EPAM Systems

EPAM Systems, an American software company, specializes in digital product design and digital platform development. The company’s core services include cloud, artificial intelligence, cybersecurity, strategy, data & analytics, cx+, and engineering. EPAM offers services across different industries; financial services, healthcare, life sciences, education, Hi-tech, insurance, Energy, private equity, and media.

The services offered to financial institutions (FI) are aimed at enabling the FIs to keep up with emerging technologies while complying with the dynamic regulatory environment and meeting consumer expectations.

EPAM provides software for digital banking, wealth management apps, regtech & compliance, capital markets & exchanges, payments, and blockchain-related services.

5. Intellectsoft

Intellectsoft, a software development company, specializes in providing mobile and web solutions to businesses and startups. Services provided by the company include App development, software development, Ui/UX design, enterprise software development, DevOps solutions, IT consulting, solution architecture, maintenance & support, and testing.

The industries covered by Intellectsoft include; fintech, healthcare, construction, insurance, real estate, retail, eCommerce, travel, automotive, hospitality, transportation, and logistics. Intellectsoft’s mission is to help companies accelerate the adoption rate for new technologies and to handle complex issues related to digital evolution.

Source: Clutch. co

6. ELEKS

ELEKS is a tech consulting and software development company. The company has been offering services to technology challenges, SMEs, and global enterprises. These services include consultation on product design, data science, cyber security, data strategy, and technical feasibility. Engineering services include app development, PoC development, cloud migration, product-orientation delivery, and enterprise application. Data & AI including generative AI, AI development, conversational AI, machine learning, business intelligence, intelligent automation, and MLOps. Optimization services including support, software audit, and quality assurance.

ELEKS works with several industries from finance to insurance, healthcare, logistics, agriculture, retail, automotive, media & entertainment, energy, and government. The company specializes in emerging technologies such as IoT and blockchain.

7. DataArt

DataArt is an IT consultancy that develops software for all industries. The company offers system modernization, product development, security services, digital transformation, and managed support. Some of DataArt’s clients include Travelport, Univision, Hive, IWG and Meetup.

The industries that DataArt works with include finance, healthcare, life sciences, retail & distribution, media, and travel tech.

DataArt offers services across different areas of the finance industry; capital markets, banks, hedge funds, exchanges, insurance companies, inter-dealer brokers, fintech, market utilities, and rating agencies. The solutions offered are custom, cloud-native, and data-driven, from building, and re-engineering systems and consulting.

8. Virtusa

Virtusa, an American-based IT company, provides technology services and digital engineering across different industries. The industries include finance, communications & media, healthcare, manufacturing, travel, technology and entertainment.

The technology expertise Virtusa offers includes artificial intelligence, digital transformation, robotics, cloud computing, and data analytics.

In finance, Virtusa offers services in corporate banking, retail banking, risk & compliance, cards & payments, and capital markets. Virtusa focuses on enabling financial institutions to have a successful digital transformation; scaling existing business processes and building new solutions.

Some of the solutions by the company include genAI for process automation, customer onboarding platforms, financial products test automation, and automation of data ingestion.

9. SoftServe

SoftServe.Inc. is a tech company offering software development and consultancy services across different industries. The services include solutions in the areas of big data, cloud computing, cyber security, the Internet of things, e-commerce, healthcare, and DevOps.

The services offered by SoftServe include SaaS, software optimization, mobile applications, UX/UI design, security, and analytics.

In 2020, SoftServe was reported to have suffered an attack through ransomware; which may have resulted in access to the client’s source code. This cyber attack forced the company to disconnect their customers, going offline, to prevent the further spread of the ransomware. SoftServe has since partnered with reputable data and cyber security companies to ensure such an occurrence does not happen again.

10. Luxoft

Luxoft is a technology company that focuses on providing SaaS to businesses from all industries including banking, insurance, manufacturing, energy, travel, logistics, media, automotive, healthcare, consumer goods, and E-commerce.

The services offered include data analytics, cloud solutions, engineering, design, innovation strategy, legacy modernization, front-end development, machine learning, intelligent automation, data analytics, and QA automation.

Some of the solutions and products Luxoft offers in the banking sector include core banking digitalization, a SaaS-based lending platform, wealth management tech, CAMS II which facilitates card issuing, banking transformation consultation, boomerang which is a customer engagement solution, cloud banking, and software engineering.

FAQ

- What are FinTech software outsourcing services?

Software development outsourcing refers to the process of hiring third-party technology companies to handle the building of a company’s development projects. Therefore, in this case, the companies outsourcing software services are Fintech. These services range from developing software for the Fintech firm to managing business operations on a specific software or tech solution.

- Why is choosing the right FinTech software outsourcing company important?

The success of a Fintech company is highly affected by the software outsourcing company they choose. Specifically, issues related to how the company provides for security, customer experience, and regulatory compliance. The company needs to offer cyber security and design for regulatory compliance.

Also, customers need to have a great experience while using the platforms. Furthermore, the chosen software company affects employee productivity and the overall performance of the firm.

- What are the key features to look for in a FinTech software outsourcing provider?

Choosing the right software provider for desired web, cloud or mobile applications requires intense evaluation and considerations from pricing models, to technical competencies and data protection measures. The key features to look for include technical expertise, development and design quality, data security, and pricing rates & models.

- How do FinTech software outsourcing companies innovate to stay ahead in the market?

With the global spread of technology, outsourcing companies tap into the global talent pool, finding experts across markets and zones. This trend fosters global partnerships that bolster innovation. The collaboration provides tech innovators with access to a diverse pool of expertise and skills. Diversity is the core of innovation; teams from different backgrounds contribute varied approaches and a spectrum of ideas.

- What are the benefits of outsourcing FinTech software development?

Outsourcing Fintech software development offers a variety of benefits. These benefits include cost efficiency, faster time-to-market, global access to innovators, high scalability and flexibility, expertise, and focus on the Fintech company’s core competencies.

Conclusion

Selecting the best Fintech software developers for outsourcing requires careful evaluation. The desired outcome depends on launching a successful, secure, and compliant Fintech service or product. It is advisable to conduct due diligence before selection to ensure a successful partnership with the software outsourcing company for long-term benefits.

If you’re interested in conducting a more in-depth dive into choosing the right software development company, the above list of top 10 Fintech software outsourcing companies is a good place to start. By following the key features to look for in a FinTech software outsourcing provider, as outlined above, you are poised for a successful partnership in the dynamic Fintech market.