A mobile banking app that allows its users to access all banking services in a secure, convenient and fast way without having to visit bank branches.

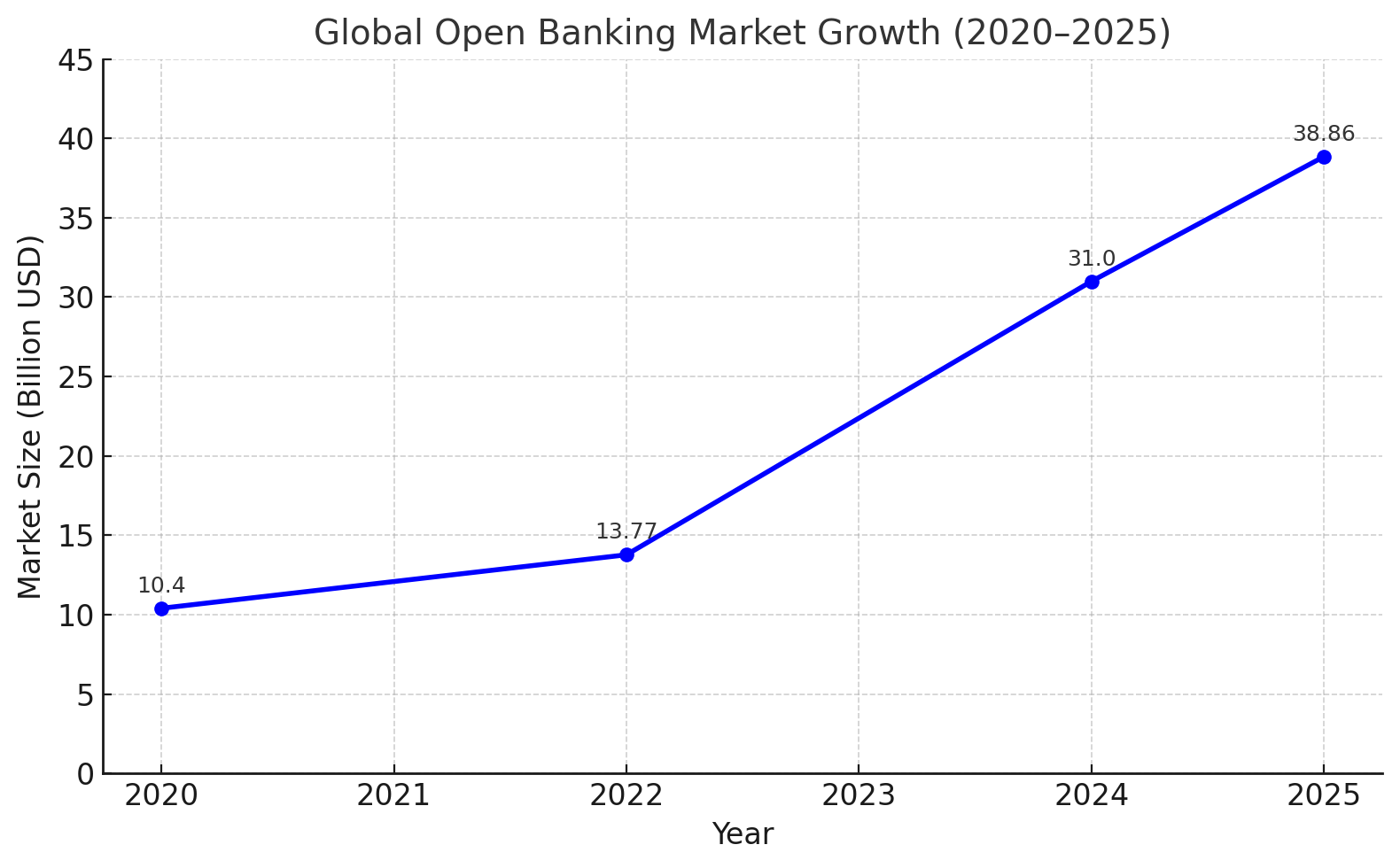

Why Open Banking Still Matters in 2026:

Open banking isn’t “new” anymore. It’s the plumbing behind budgeting apps, account verification, pay-by-bank checkout, and credit decisions. If you’re building in 2026, the real question isn’t whether to use open banking. It’s which open banking api provider gives you the right mix of coverage, data quality, and payment capability—without creating a long-term integration headache.

This refreshed guide breaks down what changed recently, how to evaluate open banking platform providers, and how to pick open banking api solutions that match your product plan.

What’s different in 2026 (and why buyers should care)

Open banking is turning into open finance. More data types are coming into scope, which means broader connectors, more consent flows, and more governance work.

The US is moving toward formal consumer data access rules. The CFPB’s Section 1033 work (and recognition of industry standards like FDX) is shaping expectations for data access, portability, and liability.

What an “open banking API provider” really provides

Most providers fall into one (or more) of these buckets: data access (AIS), payments initiation (PIS), verification and risk signals, and the platform layer around it all (dashboards, webhooks, consent tooling, reporting, and support workflows). Some vendors focus on connectivity. Others behave like full open banking platform providers with a lot of product surface area, which can be helpful—or expensive—depending on what you’re shipping first.

Trends Defining Open Banking APIs in 2026

- Hyper-Personalization is Key

AI and data analytics embedded in APIs help providers tailor financial experiences down to the micro-level. Budgeting apps can now predict your monthly spending before you overspend. - Global APIs for Borderless Banking

Open banking fintech APIs now cater to a globalized workforce, offering multicurrency accounts, cross-border payments, and compliance with region-specific regulations. Companies like Salt Edge have expanded fintech API integrations to 8,000+ banks worldwide, enabling businesses to connect to bank data via secure financial services API. - Embedded Finance: Invisible Yet Everywhere

It’s 2026, and embedded finance isn’t just a feature—it’s expected. From retail platforms to healthcare apps, APIs allow businesses to offer “Buy Now, Pay Later” or instant loans within their ecosystems, creating smooth financial interactions everywhere. Increasingly, companies also integrate a white label trading platform to expand financial services without reinventing the wheel. - Real-Time Everything

Real-time balance checks, payments, and credit approvals are no longer perks—they’re non-negotiables. Customers demand immediate solutions, and APIs like those from Plaid and Yapily deliver. - Financial Inclusion at Scale

Open banking has bridged gaps for the underbanked by introducing models based on alternative data (e.g., bill payments, phone usage). In parallel,

fintech software development company helps insurers design inclusive platforms that analyze non-traditional data and extend coverage to underserved populations.

So here the top 10 open banking API providers driving this technological revolution? We’ve picked up some of our favorites.

Criteria for Selection

While choosing top open banking API providers, we need to keep several factors in mind to ensure the chosen APIs are of the highest standards in terms of functionality, security, and user experience. The detailed breakdown of some key factors is as follows:

- Security: The financial sector is very sensitive. Providers should be able to demonstrate robust measures in the protection of sensitive data and compliance to industry standards, which advocate for OAuth in authentication and encryption in data transmission. Because these APIs bridge various corporate and private infrastructures, they often work alongside comprehensive network access control solutions to ensure only authorized entities can interact with the financial gateway. This is critical for any bank account API handling account data, balances, and transaction history in secure financial applications.

- Scalability: This is the capacity to manage increased loads without performance degradation. The top APIs providers, which scale seamlessly with an increasing number of users and transactions.

- Compliance: The providers must be compliant with the regulatory requirements, such as PSD2 in Europe or the Consumer Data Right in Australia. Providers will ensure their API compliance with relevant laws and regulations in regions of operation.

- Ease of Integration: The API should be easy to integrate into existing systems. Good documentation, developer support, and a painless setup process sign a provider focused on ease of integration. Many top mobile app development companies emphasize seamless API integration to deliver scalable fintech products.

- Customer Reviews: Feedback from actual customers may give insight into the reliability and performance of the API in live scenarios.

- Technological Innovation: Innovation-focused providers provide top-of-the-line APIs loaded with AI-driven insights, predictive analytics, and personalized financial services.

Using the above-mentioned criteria will help in evaluating and selecting the finest open banking API providers who can offer safe, scalable, and innovative solutions in finance. It’s also good to opt for providers with a proven track record and positive endorsements from industry experts and clients.

Top 10 Open Banking API Providers

Open Banking disrupts financial services with new, unparalleled data sharing and collaboration. Here come the top 10 Open Banking API providers who will lead the charge in 2026 and enable seamless integration with innovative solutions in the Fintech landscape. Together, these banking api providers make it possible to launch new products faster while maintaining strict security and compliance standards.

Itexus

Itexus has grown to become one of the major providers of open banking API solutions. Itexus is well known for its role in shifting the look of traditional banking with the development of an ecosystem where financial service providers would collaborate, innovate, and compete. They are easing customers into commanding better control over their personal financial information through access that is secured by customer authorization. Itexus’s approach to open banking API solutions demonstrates a huge understanding of the fintech industry and a commitment to innovative customer-centric services. What sets them apart in the market is their ability to provide customized, seamlessly integrated solutions with very strong security and compliance features.

Key Offerings:

- Advanced API Technology: Itexus develops state-of-the-art technological interfaces and protocols for the secure sharing of data between different systems, delivering secure bank api integration for open banking connectivity, payments, and account data access.

- Global Standards Compliance: They ensure that solutions developed by them adapt to international regulations. This means they have really high standards of compliance.

- Strong Security Features: Integrating encryption and consent mechanisms into its solution offering, Itexus is highly sensitive about the protection of customers’ data and the associated rights to privacy.

- Successful Implementations: Itexus has a record of successful implementations, thus proving the ability to deliver reliable and effective open banking solutions.

Unique Selling Points:

- Customizable Solutions: Itexus offers solutions tailored to meet clients’ needs, bringing flexibility and personalization.

- Seamless Integration: Their open banking APIs are designed to be integrated easily with financial systems that exist, ensuring a smooth transition and operation.

- Excellent Customer Support: Itexus is known for its close relationships with clients, commitment to good support in the process of development and further implementation.

Plaid

The open banking API at Plaid is core technology in the FinTech ecosystem and drives innovation of new financial services and applications. It lets consumers safely, seamlessly, and securely share their financial data with thousands of apps, improving the way they interact with money. It provides a consumer-first approach to infrastructure that will drive financial possibilities and a myriad of user experiences.

· Key offerings and strengths

The key offerings and strengths of Plaid include broad coverage of financial data, solid security features, and a very friendly and well-documented developer platform. Plaid allows for real-time balance checks, transaction categorization, and secure account authentication. This ensures the security of data and empowers a great user and developer experience.

· Notable partnerships and integrations

On the list of notable partnerships and integrations, Plaid features as a market leader, operating in more than 50 companies across North America and Europe. Its ecosystem is full of payment and tech providers and BaaS platforms, working together to simplify account-based payments and bring seamless financial interactions. Notable partners include Dwolla, Galileo, Silicon Valley Bank, and Square, all of whom integrate Plaid’s technology for improved payment experiences.

TrueLayer

TrueLayer’s API platform is a robust, Omni functional gateway into open banking and empowers businesses. It provides a suite of APIs that secure direct connections between financial institutions and third-party applications. With TrueLayer, developers can build new types of financial services that users engage with seamlessly for payments, data aggregation, and identity verification. The platform ensures trust and safety in financial transactions because it is guided by regulatory compliance and user consent.

· Key offerings and strengths

The main offerings of TrueLayer include high-performance APIs that provide real-time financial data and initiate payments. By focusing on the European markets, it respects the tough open banking regulation of this region. TrueLayer has invested a lot in good developer tools, including detailed documentation and fast track guides that make it very easy to onboard and have a smooth development process.

· Notable client success stories

Among the notable stories of client success is the case of JamDoughnut, which integrated TrueLayer for a high-converting ‘Pay by bank’ option, and Anna Money, where transactions increased by 10% while invoice payment speed increased tenfold. Another example was Freetrade, which applied TrueLayer’s open banking payments to enhance the size of the average deposit by 18%, thus underpinning the capability of the platform to improve financial operations and user experiences.

Yapily

Yapily‘s open banking API provides a robust infrastructure that any application can use for easy connectivity to users’ banks, either for payment processing or gathering financial data. It adheres to the principles of REST, uses standard HTTP response codes, and is secured with HTTP Basic Authentication. Through the open banking ecosystem, Yapily provides access to enriched financial data and a variety of payment services, from single, scheduled, and periodic direct account-to-account payments, all integrated across over 1900 institutions.

· Strengths and Key Offerings

Yapily is one-of-a-kind in terms of deep market penetration across Europe, covering an extensive network across consumer and business payments in 19 countries. It provides a fast and efficient platform for speedy, confident credit assessments and innovations that make repayments seamless. Customers are empowered through transparent pricing models and a core focus on continuous innovation at Yapily to drive personalized financial experiences on a trusted open banking platform.

· Noteworthy Use Cases and Customer Feedback

Customers have used Yapily’s API to increase the value proposition of financial services, citing its powerful ability to provide real-time financial data and drive better financial wellbeing. Yapily’s infrastructure has been instrumental in powering inclusive financial services and optimizing credit risk models. Customer feedback is very strong, with a high content usefulness score—this would suggest satisfaction with the performance of the platform and how it has positively affected businesses and consumers.

Tink

With its open banking API, Tink facilitates seamless access to financial data from over 6,000 banks across Europe. By providing a single, PSD2-compliant API for smart, personalized financial services and engaging customer experiences, Tink’s technology empowers ambition through a cloud-based platform that gives breadth and quality of data—both PSD2 and non-PSD2—through reliable connections to a vast network of financial institutions.

· Key offerings and strengths

The key offerings and strengths of Tink lie in its comprehensive European coverage, solid data enrichment features, and strong commitment to compliance. Their open banking API uses ready-made authentication flows, thus allowing operations under Tink’s PSD2 license. This solution provides a complete overview of financial information: loans, credit cards, investments, savings, and so on—ensuring an overall complete financial picture to the customer.

· Notable client implementations

Notable implementations of Tink open banking solutions are at SEB and ABN Amro, thereby showcasing the competencies that Tink has. On the other hand, SEB uses Tink’s technology to offer first-class digital banking and customer experience, while ABN Amro’s Grip app holds one of their most successful partnerships, unbeatable in time-to-market. These implementations show evidence of how Tink can provide broad connectivity and enrich financial services across Europe.

Salt Edge

The entire solution offered by Salt Edge’s API platform, the Open Banking Gateway, was designed in favor of the needs of the financial institution when accessing any customer bank account across Europe and beyond. Both Account Information and Payment Initiation services are provided through one API. It assumes an integration of Account Information API, Payment Initiation API, and a Data Enrichment platform in order to provide a solid framework for the aggregation of customer account data and payment initiation in a secure environment.

· Key offerings and strengths

An international reach with access to over 5,000 banks worldwide places Salt Edge among the international leaders. The platform is 100% compliant with the PSD2 regulatory framework, which ensures complete safety to customers in making confident strides in open banking. Real-time data aggregation empowers businesses with the capability to invent new services that rely on up-to-date financial data, providing a competitive edge on the market.

· Customer success stories

These continuous success stories among Salt Edge clients, such as MoneyWiz, Agicap, and Globitex, show once more the major impetus and power of the platform in action. Its clients use solutions from Salt Edge for improving their financial management, enabling cash flow forecasting, and securing the payment environment. As the proof to these success stories, the company is capable of empowering businesses with an efficient and compliant way of accessing financial data, which would drive the growth and innovation of the open banking sector.

Nordigen

Nordigen is one-of-a-kind in the open banking space. It runs on a freemium model and provides a free open banking API based on the PSD2 Directive in Europe. This helps businesses access account information for free and gives a kick to financial transparency and inclusion. Its API makes it possible to have single connections to over 2,300 banks around Europe, and hence it is critical to any fintech company or developer.

· Key offerings and strengths

Nordigen’s key offerings are free access to open banking data, a strong focus on data analytics, and ease of integration. Its API provides a unified format for information from various banks, ensuring reliable and PSD2-compliant data. This put Nordigen among the truly important partners for businesses in the domains of finance, lending, and personal finance, especially across Europe.

· Market reception and developer feedback

Nordigen’s solution seems to be well accepted on the market, as evidenced by the company’s growth. The acquisition allowed Nordigen to enhance its capabilities further with GoCardless, open banking-as-a-service, and rich new payment features like Instant Bank Pay and Verified Mandates. This strategic move is set to redefine the potentials of open banking, with Nordigen’s free data access model leading to broader experimentation and new use cases.

Finicity

Finicity, a Mastercard Company, is one of the leaders in the open banking movement. It provides an easy and secure way for consumers and businesses to share their financial data. Through this platform, the potential for unlocking a new world of possibilities is opened up, where a consumer-permissioned, shared future in financial services is paved by innovative sharing. Finicity’s commitment to seamless connections covers the vast majority of financial accounts in the United States, underlining broad and complete access that creates an environment where further development of financial management and innovation is possible.

· Key offerings and strengths

Finicity’s major offerings include robust management of consumer data, large API capabilities, and a focus on financial inclusion. It allows for the execution of a much more inclusive vision in finance by returning control over financial data to the consumer and therefore substantially expanding services from loan applications to personalized advice. Their battle-tested APIs have built leadership in direct data access connectivity to drive high-quality data and better financial outcomes.

· Notable partnerships and industry recognition

Finicity’s position as a leader in the open banking space is evidenced by its list of notable partnerships and industry recognition. Larger financial institutions and fintechs, like Rocket Mortgage and Experian, show how Finicity is one of the leading companies pushing toward the forefront in innovation in the advancement of financial services. Its acquisition by Mastercard and integration into Jack Henry’s Banno Digital Platform further demonstrate the trust and value Finicity’s technology places in driving better digital financial management.

MX

MX‘s open banking API platform is designed to make financial institutions, FinTechs, and third-party providers share and integrate easily. It puts in the limelight secure, consumer-permissioned sharing of data using well-defined APIs that permit a full view of financial data from multiple sources. MX’s platform brings open finance into focus, moving way beyond banking for a much more diversified portfolio of financial services. It offers reliable, fast, and secure access to financial information, enables the innovation of personalized experiences, and increases the pace of innovation for organizations.

· Key offerings and strengths

It core offerings are advanced data aggregation and personalized financial insights, underpinning the platform’s strengths in enhancing user experience. Advanced data aggregation enables an all-encompassing view of customers’ financial situations and, therefore, better decision making. Personalized insights from that data help users make better financial decisions according to their own individual situations. MX focuses on user experience with intuitive interfaces and actionable financial guidance designed to dumb down complex financial information for end-users.

· Case studies and client feedback

Case studies and client feedback demonstrate the transformative impact MX is having in financial services. Clients praise MX for being able to connect financial accounts and bring to the surface meaningful insights that power better money management and customer engagement. Those financial institutions using the solutions from MX note that with this new and enhanced digital strategy, their customer focus makes way for better, more personalized money experiences. These testimonials underscore MX’s role in driving further innovation toward stronger financial outcomes for consumers.

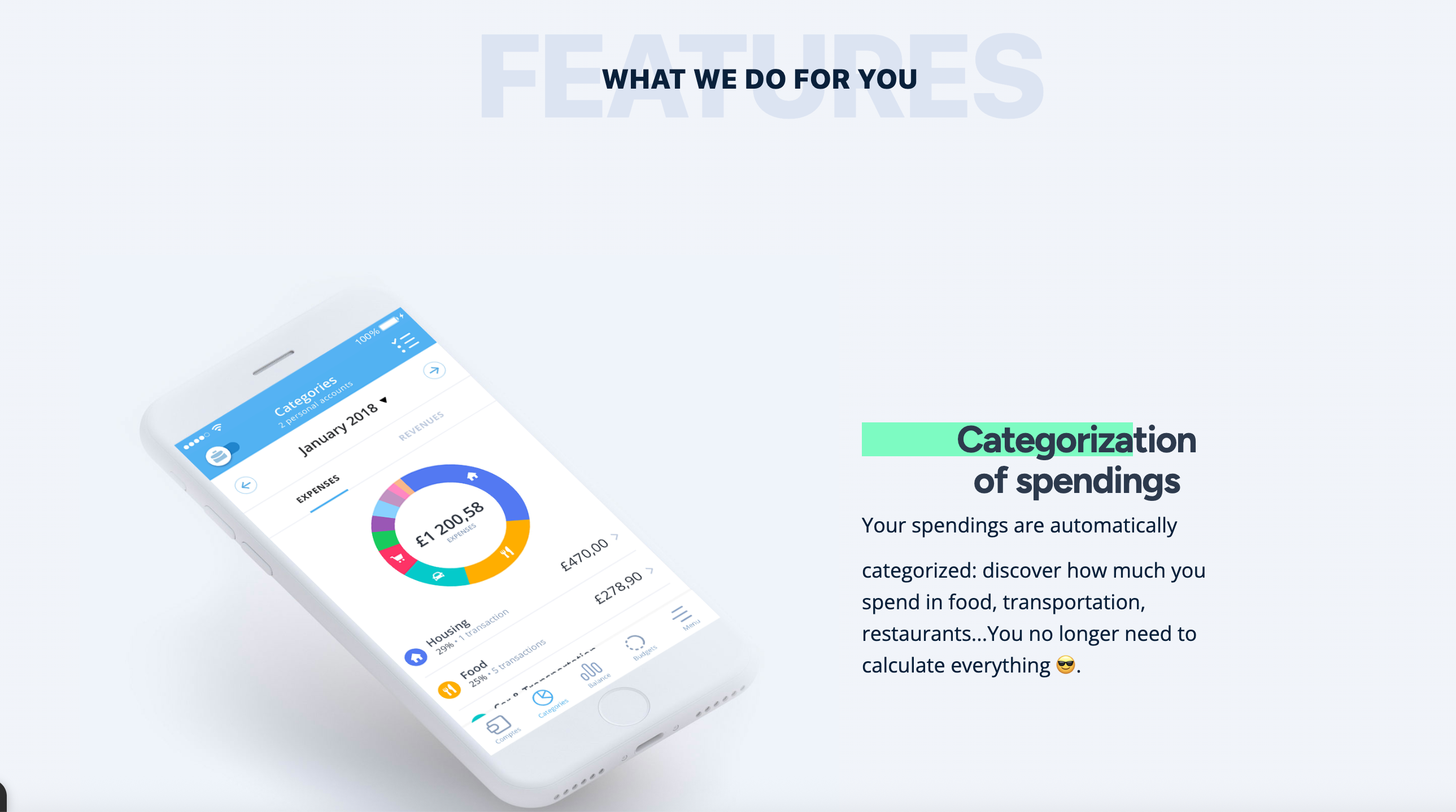

Bankin

Bankin‘ leads the open banking revolution with a suite of API services that empower third-party developers to build new innovative applications in finance. Bankin’ offers access to financial data, providing for much more personalization and transparency toward banking. Their APIs allow services from account aggregation to seamless payment processing, always keeping respect for data security and compliance with regulatory requirements. Their customer-centric approach has improved satisfaction and loyalty, thus putting Bankin’ at the forefront of the open banking ecosystem.

· Key Offerings and Strengths

Bankin’ stands out with its ease of use across the platform, letting developers integrate banking into their apps. Its leading geographical positioning in Europe helps the company serve clients varying in their diversity. Security is one of the bases that holds up their offer, with strong features guaranteeing the protection of sensitive financial data, thereby gaining trust from users and partners.

· Customer Testimonials and Market Impact

Customers and experts in the field alike rave about Bankin’ as one of the most disruptive businesses within the banking sector. A lot of testimonials refer to its user-friendliness and the innovativeness that Bankin’s APIs bring to financial services. This company is hence a very relevant contribution to the market, setting up competition by encouraging traditional banks to improve their web and mobile offers.

The shortlist process that prevents bad choices:

Start from a product flow, not a vendor list. Pick one flow—onboarding, account linking, transaction sync, or pay-by-bank—and define what “good” looks like in numbers (conversion, time-to-link, data freshness, support tickets per 1,000 users).

Then run a bank-level coverage test. List the top banks your users actually use and ask each vendor to confirm support and connection method. After that, test consent UX with real people across a few banks and watch where users get stuck.

Finally, break down operational load and pricing. You want to know what alerts you get, what logs exist, who owns first-line troubleshooting, and how costs scale with retries, re-links, and refreshes. Negotiate exit paths early so you’re not trapped if your coverage needs change.

Pro Tip: Picking Your Open Banking API Provider

When choosing an open banking API, ask yourself:

- Does it prioritize security and compliance with up-to-date regulations like GDPR and PSD3?

- How easily can it integrate with your system? Look for providers offering pre-built SDKs and comprehensive documentation, as well as clear patterns for open banking api integration so your team doesn’t have to start from scratch.

- What do user reviews say? Sometimes, the best insights come from real-world experiences.

Checklist for Choosing an Open Banking API Provider

- Regulatory Compliance

- Adherence to PSD2, GDPR, and relevant certifications like ISO 27001.

- Security

- Strong encryption, multi-factor authentication, regular vulnerability tests.

- API Features

- Support for AIS, PIS, transaction history, and real-time data access.

- Integration

- Clear documentation, SDKs, and sandbox environments.

- Scalability

- High uptime (e.g., 99.9%), low latency, and support for large transactions.

- Data Standards

- Compatibility with ISO 20022 and leading banking platforms.

- Costs

- Transparent pricing models and no hidden fees.

- Flexibility

- Customizable endpoints and white-label options.

- Support

- 24/7 assistance, dedicated managers, and active developer communities.

- Reputation

- Positive reviews, client testimonials, and trusted partnerships.

- Ecosystem

- Integrations with major banks and other fintech solutions.

- Future-Ready

- Regular updates and commitment to compliance with changing regulations.

2026 is About Customer First

Gone are the days of static financial services. Open banking providers are shaping a future where customers have total control over their financial lives. Whether you’re a startup or a financial giant, aligning with the right API provider could be your key to staying ahead. Many banks and fintechs also invest in digital wallet app development to complement open banking APIs and ensure seamless payments.

Ready to explore open banking APIs that fit your needs? Start with Itexus or Plaid for scalability or Nordigen if you’re budget-conscious. The right choice among today’s leading banking api providers can redefine your user experience, especially when paired with well-planned open banking api integration and long-term product strategy.

Conclusion

In 2026, open banking is core infrastructure for fintech products that touch money movement, identity, or account data. Choose an open banking api provider whose consent UX and operational model match your team’s reality, and compare open banking platform providers only when you truly need the extra layers.

If you want the next iteration, I can rewrite your meta title/description, propose internal links across the Itexus fintech cluster, and craft a short FAQ block designed to capture long-tail queries without adding fluff.

FAQs

What could be the best Banking API?

One would say the best banking API is the one that delivers reliability, good documentation, good support, and features that help business customers solve particular pain points. Itexus is one of the leaders in this space, with extraordinary commitment to innovation, security, and customer satisfaction. Itexus’s Open Banking API offers better customer experience and efficiency, innovation, and data democratization that shifts power dynamics in favor of customers.

Does open banking use API?

Yes, open banking is based on APIs. They have a very key role in open banking, allowing banks and third-party providers to share data securely and efficiently. They would serve as a type of digital translators that would allow software applications to communicate with one another, secure sharing of information, and provide a seamless user experience.

How much does it cost for an open banking API?

The various open banking API pricing models also include volume discounts, transaction costs, or variable payment terms to help in the building and scaling of a product. Some providers offer a “try before you buy” model or scalable pricing that adjusts according to the growth stage of the company.

Is open banking API safe?

Open banking APIs have robust security mechanisms that counter all possible threats, thus ensuring safety and compliance with regulations, much like PSD2. This would include, but not be limited to, SCA, encryption, secure authentication mechanisms for the protection of sensitive financial data, and financial-grade API security standards that guarantee safe access to personal data.

Conclusion

Choosing the right open banking API provider is a game-changer for any financial institution or developer eager to stay ahead in the fintech revolution. Beyond simply accessing new financial services, a top provider brings innovation, regulatory compliance, robust security, and a seamless user experience.

In this fast-evolving market, Itexus stands out as a leader. Renowned for its cutting-edge and secure solutions, Itexus delivers comprehensive open banking services that open new doors for businesses and enhance customer value. For many organizations, partnering with experienced banking api providers and leveraging proven open banking api solutions is the most efficient path to market. Ready to elevate your offerings and thrive in the open banking landscape? Connect with Itexus today and discover how their transformative solutions can drive your success.