Isn’t it amazing how much the banking world has changed lately?

With digital customer onboarding taking center stage, can wave goodbye to those boring days, we have. No longer will you have to complete piles of paperwork You would not need to go back and forth to the bank multiple times to open an account.

Banking from where?

But with online platforms and tech advances, you can now do everything from your couch or that cute coffee shop down the block. It’s not just about making things easier. Your onboarding process is key to a lasting customer relationship. A good beginning of an banking relationship leads to trust and loyalty. And it’s a win-win for all parties involved!

So, in this article, we’ll take a walk through digital customer onboarding. We’ll explore how it’s evolved from traditional methods into the modern age. You’ll discover the key steps in the onboarding process. We’ll discuss why security and personalization matter. Plus, we’ll look at how cutting-edge technologies—like biometric verification and AI chatbots—are shaking things up. By the end, you’ll understand how effective digital onboarding can change the game for banks and customers alike. It sets the stage for a bright future in the financial world!

Digital onboarding is about adapting customers not in the traditional, face-to-face way. It’s about using online platforms and digital tools.

Why don’t we start with a little dive into history?

It didn’t use to be that simple. In the early 2000s, even if some of the paperwork was filled out online, customers still had to come to the bank in person.

Digital signatures were a step forward, allowing customers to prove their identity online. And in the mid-2010s, biometrics – fingerprint or facial scanning. This further simplified the process.

By the late 2010s, banks introduced seamless onboarding. A customer could open an account quickly and without any extra steps through a single app. Today, government registries are used to identify customers in addition to biometrics. This greatly increases security and prevents fraud.

In my opinion, the advantages of digital onboarding are obvious. First, it is the speed and simplicity of opening an account. It has become easier to become a bank customer. For financial institutions, it means a reduction in paperwork and savings.

Onboarding process: Main stages

The first stage is marketing. It is important for potential customers to learn that it is easy and quick to open an account at your bank. Contextual advertising is used to reach the target audience. Publication of articles on thematic sites, blogs, notes in social networks. This will help to draw people’s attention and attract potential customers.

Unfortunately, not everyone is a friend of new technologies. Some people need help to understand the intricacies of onboarding. You need video tutorials, AI chatbots, consultant assistants, and a FAQ section. All of this will help with the daunting registration process.

Opening an account

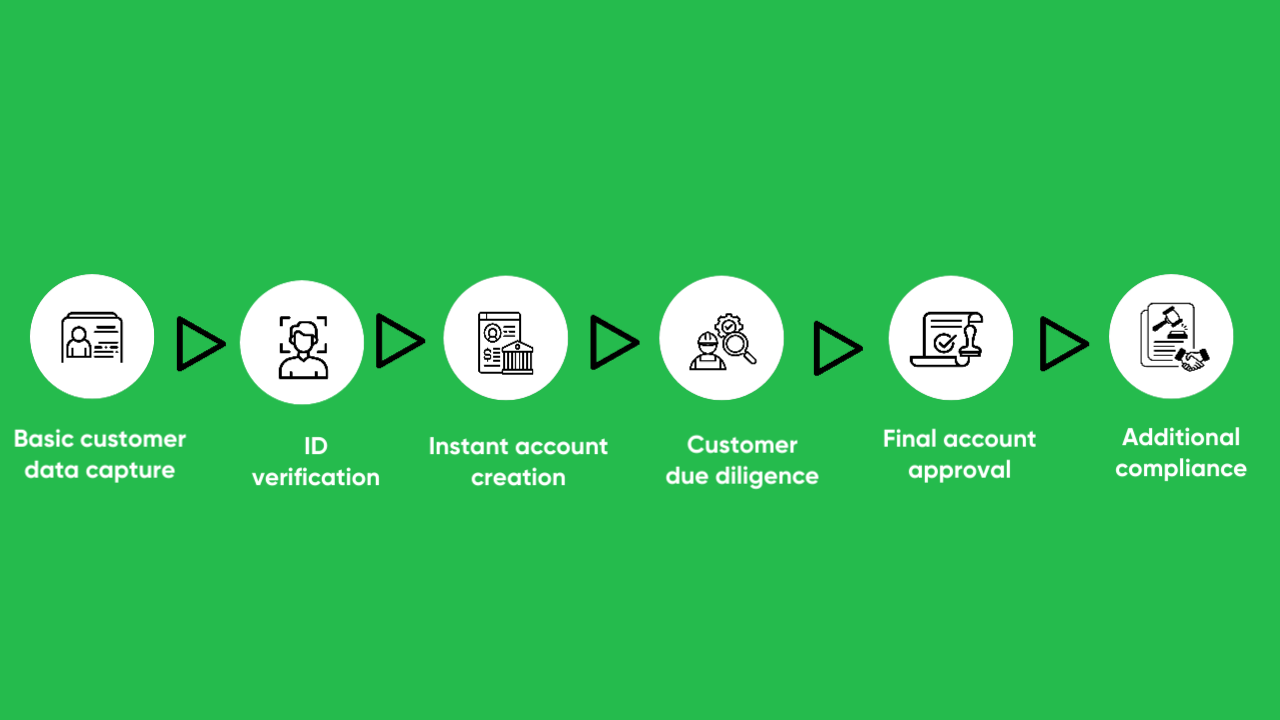

A potential customer is ripe and ready to open an account. How to do it with the help of onboarding? Below is an illustration that clearly demonstrates the process.

Remote bank account procedure

As you can see this illustration shows several steps:

- Collecting initial customer data.

- Verification.

- Quickly opening an account (creating a bank account).

- Credibility check by the bank’s security service.

- Final approval.

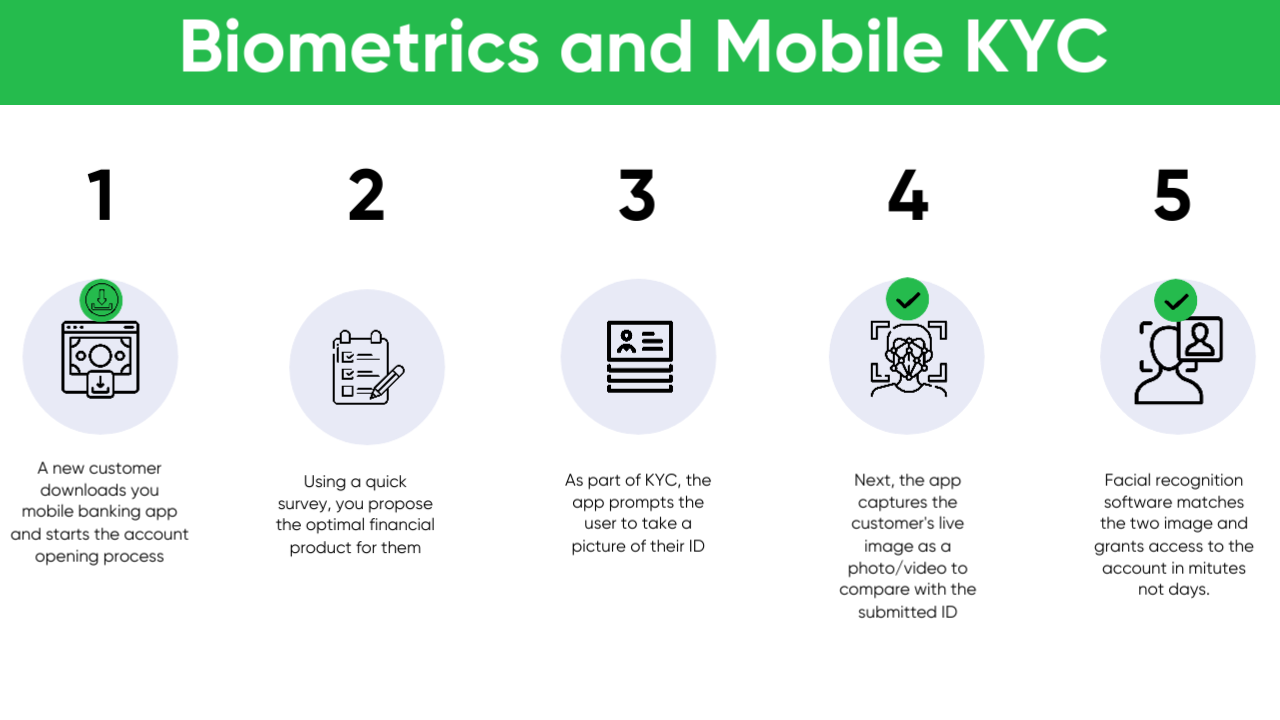

A legitimate question arises. How will the bank know that Alex Kamensky is really who he says he is? This is where KYC – Know Your Customer – comes in. You can see how this principle works in the illustration below.

How KYC works

The KYC principle is implemented on the basis of biometrics. As a result, the bank receives confirmation that Alex Kamensky is indeed Alex Kamensky and not a fraudster. The bank also complies with the strict requirements of regulators on countering financial crimes.

Customer experience

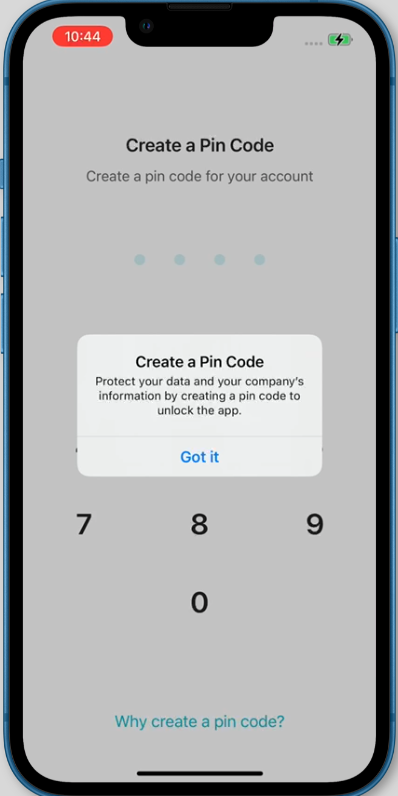

So, the client has opened an account remotely, what’s next. It is necessary to guide him through the initial settings. Usually they are related to security. The client is asked to set up a pin code. It is similar to the one used in bank cards. Without this pin-code, it is impossible to get into the application. On modern phones, biometrics can be used instead of a pin code. Not all customers will be able to understand what is required of them the first time. Therefore, pop-up prompts are necessary. Two-factor authentication also helps to save money. The client should be sure that his money is safe.

After the security settings, the customer can customize the interface of the banking application. Card display, color scheme, day or night theme. Sound alerts for debit, credit, push notifications. It’s important to let the customer know that they can customize their app or desktop banking interface the way they want.

Post-Onboarding

The question arises, what should the customer do after the account is opened and everything is set up? Offer him to utilize additional banking services. Onboarding allows you to do this remotely, through a mobile app or web interface. These can be bonus programs, deposits, piggy banks, opening virtual cards for payment in online stores. Such a strategy in working with customers brings additional income to the bank. The client should know about cash backs and other opportunities of the bank without visiting branches.

It is very important to establish interaction with the client. He should know that if something goes wrong, he can always contact technical support. An integral part of any digital onboarding is chatting with a live operator or an AI-based bot.

Best practices for digital customer engagement

Digital banking onboarding is essentially a virtual bank branch. And it’s accessible to customers from anywhere in the world. Thus, the interface is very important. It should be user-friendly and understandable. The client does not want and does not have to spend a long time figuring out what this or that button means. He wants to click, send and get the result. You should take care of an intuitive interface. Otherwise, there will be customer churn, and we don’t want that.

The plus point of digital customer intake is also that you can cut the steps. Customers get very annoyed when they are asked to fill out dozens of forms. Our task is to reduce the number of steps at different stages of onboarding. Auto-filling of documents, importing data from state registries and biometrics will help us with this. Request documents from clients as needed.

Use of technology

It’s the 21st century, so where can we go without cutting edge technology! The emergence of artificial intelligence (AI), aka AI, is making life easier for banks and customers. The capabilities of AI are not yet fully understood, but the technology is already being put into practice today.

In 2017, Capital One Financial Corp developed its own chatbot called Eno. It helps the bank’s customers navigate account statements and recharge their cell phones. Morgan Stanley Bank developed an OpenAI-based AI assistant for financial advice.

Mobile devices cannot be overlooked. Experts estimate that 6 out of 10 smartphone users prefer to use financial applications. The bulk of them are under the age of 35. If you want to get young clients, you should definitely think about the importance of mobile onboarding optimization.

Personalization and Customization

Digital onboarding isn’t just about opening an account remotely. It’s also about loans, mortgages, virtual cards, and family accounts. All of these can be obtained without visiting a bank office. Give the user the ability to get a loan right from their cell phone or computer, at the touch of a button!

Analytics plays a crucial role in this case. Let me give you a simple example. If a client empties his account to zero, the system will offer him a “payday loan”. Take a loan to buy household appliances. The amount of credit funds is calculated automatically, based on the financial capabilities of the client. The request is processed within a day.

Integration and compatibility

Not all banks can quickly adapt to modern technologies. If a bank is using legacy technologies, you can resort to middleware. These tools will connect and enable the work and smooth transition to new technologies. Integration should be seamless for the client.

To reach more customers, you should take care of cross-platform onboarding. We are all different people, some of us use Android, some of us are used to iPhone. People have different browser preferences. A banking app should open on any operating system. And its desktop version – on any browser. Use API. This solution helps to integrate new software with outdated tech. It also makes onboarding cross-platform.

Security and trust

A customer will not trust a bank that has a history of identity leaks and account theft. It is necessary to take care of security. Moreover, it is one of the main requirements of any regulator. Introduce the principle “A bank is a safe deposit box”. To which only the customer has the keys. By keys, I mean pin codes, biometric authorization, two-factor authentication.

Initially, the client does not understand what security measures are taken in the bank. Our task is to tell him about it. So that he does not have to go to the office and communicate with employees. Implement a system of reminders and prompts. For example, the client will be offered to use biometrics instead of a traditional pin code. It’s secure and doesn’t require memorizing a combination of numbers. If the customer uses a pin code, the system will remind them to replace it after a certain period of time. Push notifications warning against sharing sensitive info will boost the bank’s credibility.

Measuring success in onboarding

Digital onboarding is implemented, the first registrations have started. How to check its effectiveness and KPIs? After six months, you can analyze how successful the implementation was. To do this, use the formula:

Digital onboarding is implemented, the first registrations have started. How do you check its effectiveness and KPIs? After six months, you can analyze how successful the implementation was. To do this, use the formula:

K1/K2*100%

where, K1 – the number of customers who have completed remote digital registration. K2 – the number of customers who have just started enrollment.

If the numbers are low, we need to address problems in digital onboarding.

It will be helpful to know how many customers have decided to opt-out of enrollment. Use the following formula for this calculation:

Ko/Kn*100

where, Ko – customers who decided to opt-out of digital onboarding, and Kn – users who started the registration.

A high opt-out rate may indicate that the registration procedure is difficult for customers. Perhaps the number of documents and time for their verification should be reduced.

The feedback tool is very important. There are customers who have decided to register remotely with the bank but have encountered difficulties. They should be able to ask for help and advice.

Successful digital onboarding strategies

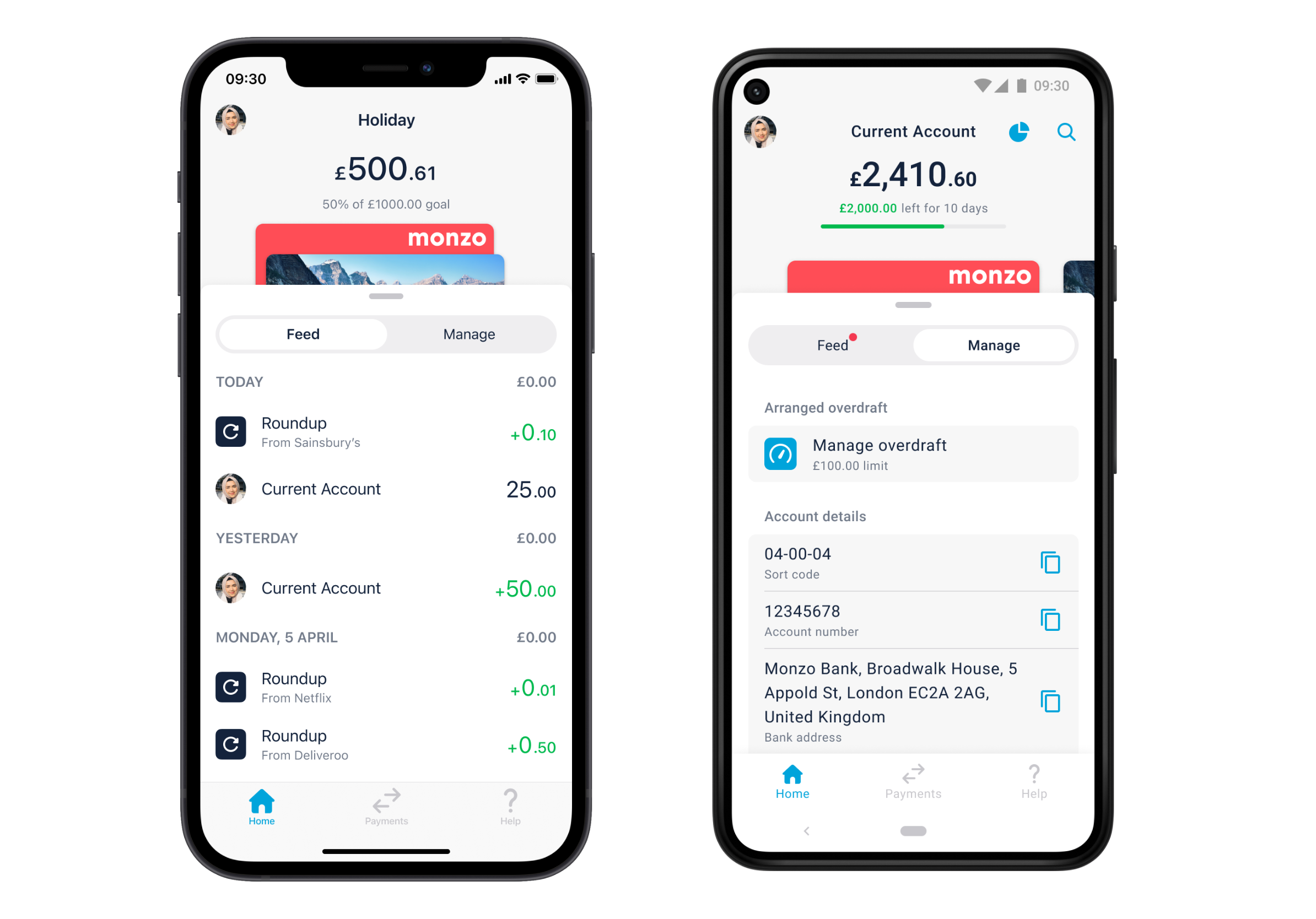

Let’s take a look at how other banks have implemented digital customer onboarding. Let’s explore how successful these experiences have been. I’ll start with Monzo Bank.

At the moment, the bank is used by more than 10 million people around the world. It is a fully digital bank. The institution is guided by the principle “Contact us whenever you want, we have no closing or opening hours”. The bank has an extremely low level of fraudulent cases, as reported on its official website.

Customers can register an account in minutes after downloading the app. They just need to verify their account. Another bank that has successfully implemented digital onboarding is Chime (USA).

The bank has achieved significant success. The integration of digital onboarding has reached the 15 million customer mark. Bankers promise simple registration in 5 minutes, with a minimum of documents. The mobile app lets customers connect payroll accounts, control expenses, and apply for loans.

To clarify, I made a table. It lets you compare banks’ decisions to implement digital onboarding and their results.

| Country/Bank | Solutions/Features | Results achieved |

| Spain, BBVA | Digital onboarding using a mobile app. Biometrics. Remote client identification | Reduction of time for account opening to 10 minutes. Increase in the client base by 25%. |

| USA, Citibank | Remote identification and submission of documents for account opening. Implementation of AI to verify documents and other personal data of customers. | Increase in customers utilizing online onboarding by 15%. |

| United Kingdom, HSBC | All stages of registration have been transferred online. You can open an account via mobile application or web interface on the bank’s website. Integration with the bank’s internal AML and KYC systems. | Increased conversion by 25% |

| Singapur, DBS Bank | A mobile application with the ability to open an account remotely without visiting a bank office. Machine learning and AI algorithms are used to verify customers’ personal data. | Time to open an account reduced to 5 minutes |

| Brasil, Nubank | Account opening is fully online. The client does not need to visit the office. Simple, clear and convenient interface | The number of new customers increased by 1 million in the first year after implementation |

Conclusion

We suggest implementing a system for digital customer intake in your bank, using global best practices. After all, such a challenging task requires high-level specialists. Our IT team is ready to build your bank’s digital reception area, covering development to testing. Digital onboarding will ease branch loads, eliminate queues, and attract new customers. It also gives you a competitive edge and enhances customer experience. This is your bank’s first step towards digitalization.