As cash becomes less common and digital transactions dominate, digital wallets have emerged as a go-to solution for convenient, secure financial transactions. A digital wallet stores payment information digitally, allowing users to make transactions without cash or physical cards. This guide will break down the various types of digital wallets available, helping you choose the one that fits your needs best.

1. Mobile Wallets

Overview: Mobile wallets are perhaps the most popular type of digital wallet, integrated directly into smartphones. They enable users to store credit/debit card information, loyalty cards, and even transit passes. Payments are typically made by tapping the phone at a point-of-sale terminal with Near Field Communication (NFC) technology.

Examples: Apple Pay, Google Wallet, Samsung Pay

Best For: Everyday purchases at physical stores, loyalty programs, and transit cards

2. E-Wallets

Overview: E-wallets are primarily used for online purchases and are typically accessible from multiple devices. These wallets securely store payment information, allowing users to make quick purchases without re-entering card details each time. Many e-wallets also allow users to store funds directly within the wallet, making them useful for peer-to-peer (P2P) transactions.

Examples: PayPal, Skrill, Amazon Pay

Best For: Online shopping, peer-to-peer transactions, and quick payments on e-commerce sites

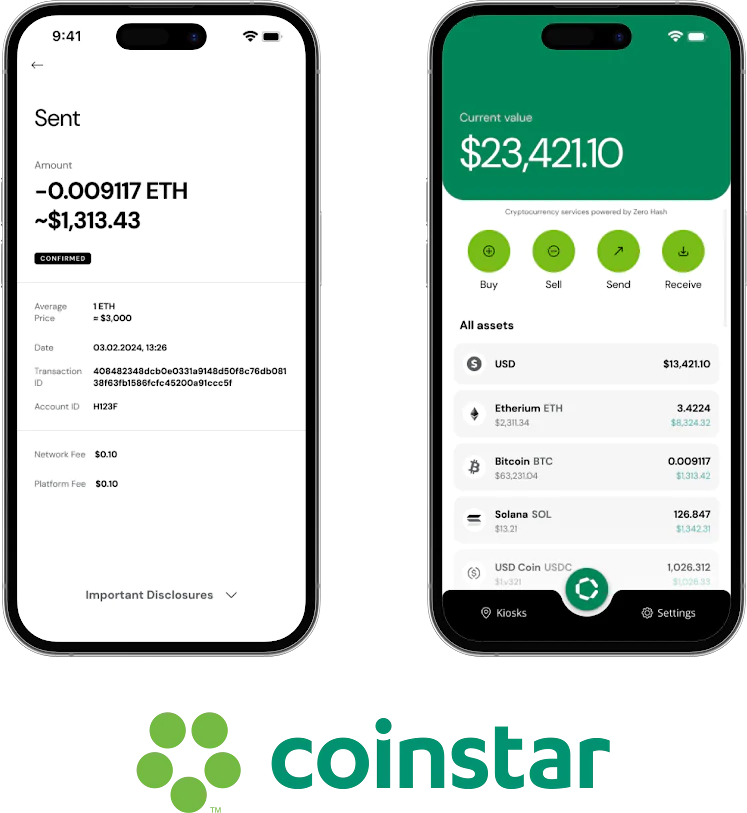

3. Cryptocurrency Wallets

Overview: Cryptocurrency wallets store digital assets, such as Bitcoin, Ethereum, and other cryptocurrencies. There are two main types: hot wallets, which are connected to the internet for ease of access, and cold wallets, which are offline and offer greater security. Crypto wallets provide users with private keys to access and manage their crypto holdings securely.

Examples: Coinbase Wallet, Trezor (cold wallet), MetaMask (hot wallet)

Best For: Cryptocurrency trading, investment, and secure digital asset storage

4. Bank Digital Wallets

Overview: Many traditional banks offer digital wallets that integrate with customers’ bank accounts. These wallets typically allow users to view their balances, make transfers, pay bills, and, in some cases, make contactless payments. Bank wallets often come with additional security features, such as two-factor authentication and biometric verification.

Examples: Chase Pay, Wells Fargo Wallet, Barclays Pingit

Best For: Secure, bank-connected transactions, bill payments, and balance management

5. Wearable Wallets

Overview: Wearable wallets are embedded in devices like smartwatches, fitness trackers, or even smart rings, allowing users to make payments directly from their wearables. These wallets use NFC technology to process contactless payments, providing ultimate convenience for users on the go.

Examples: Fitbit Pay, Garmin Pay, Apple Watch Wallet

Best For: Quick, on-the-go purchases, especially for those who prefer wearable technology

6. Closed Wallets

Overview: Closed wallets are specific to a single company or brand and are often issued by e-commerce platforms or large retailers. Funds added to a closed wallet can only be used for purchases within that specific ecosystem. These wallets are often tied to loyalty programs and offer special discounts or rewards to encourage usage.

Examples: Amazon Pay (for Amazon purchases), Starbucks Wallet, Walmart Pay

Best For: Regular purchases within a specific brand ecosystem, loyalty rewards, and exclusive discounts

7. Semi-Closed Wallets

Overview: Semi-closed wallets are restricted to a network of partnered merchants, allowing users to make payments only within a specific network. Unlike closed wallets, semi-closed wallets offer a bit more flexibility as they can be used across various brands within an established network, though they are not universally accepted.

Examples: Paytm (India), MobiKwik, Ola Money

Best For: Payments across select merchants within a network, prepaid and reloading options, and regional transactions

8. Open Wallets

Overview: Open wallets are highly versatile, allowing users to make payments to anyone and anywhere, both online and offline. They are generally issued by banks or major financial institutions and support transfers, bill payments, and even cash withdrawals. Open wallets offer the broadest functionality and acceptance, making them an ideal choice for universal payments.

Examples: Visa Checkout, Masterpass, PayPal (in some regions)

Best For: Universal payments, bill payments, cash withdrawals, and peer-to-peer transfers

Choosing the Right Digital Wallet

Selecting the best digital wallet depends on your unique needs. Here’s a quick comparison to help:

| Wallet Type | Best For | Key Features |

|---|---|---|

| Mobile Wallet | Everyday purchases, physical store payments | NFC-enabled for contactless payments |

| E-Wallet | Online shopping, peer-to-peer payments | Fast, convenient online transactions |

| Cryptocurrency Wallet | Cryptocurrency trading and investment | Private key security, hot and cold options |

| Bank Digital Wallet | Secure transactions with bank accounts | Integration with bank accounts |

| Wearable Wallet | Quick, on-the-go payments via wearables | Embedded in smartwatches, fitness trackers |

| Closed Wallet | Brand-specific purchases and loyalty programs | Restricted to a single brand ecosystem |

| Semi-Closed Wallet | Payments across select merchants or networks | Limited merchant network, prepaid options |

| Open Wallet | Universal payments and broad usage | Wide functionality, can support withdrawals |

Conclusion

Digital wallets have evolved into diverse tools for every need and lifestyle, from mobile wallets for contactless payments to crypto wallets for digital assets. As the FinTech industry advances, the options for digital wallets will continue to expand, providing even more ways to pay, invest, and manage finances securely and conveniently. By understanding the different types of digital wallets, you can make an informed choice that best suits your financial habits and goals.