An online promotional game implemented as an API that operates on top of an existing mobile application.

In today’s business environment, having accurate credit and identity verification is crucial for making smart decisions. Experian, a leader in data and analytics, offers tools that help companies assess credit risk, prevent fraud, and manage potential threats. Through its API services, Experian provides easy access to detailed financial, credit, and identity information, helping businesses operate more securely and efficiently.

If you’re looking to integrate credit reporting or identity verification into your platform, Experian’s API could be the perfect solution. In this article, we’ll explore what the Experian API is, how it works, its use cases, and its associated costs.

What is Experian API?

Experian is one of the largest credit reporting agencies globally, offering businesses access to a range of data tools. The Experian API gives companies the ability to retrieve consumer credit and identity data directly from Experian’s database. This includes real-time credit checks, fraud detection, and identity verification, all of which help businesses make informed decisions about loans, credit, and risk management.

The API includes different products, such as Credit Risk, Identity Verification, Fraud Detection, and Data Enrichment, each designed to address specific business needs. These APIs can be integrated into platforms, providing seamless access to Experian’s vast data resources.

How Does Experian API Work?

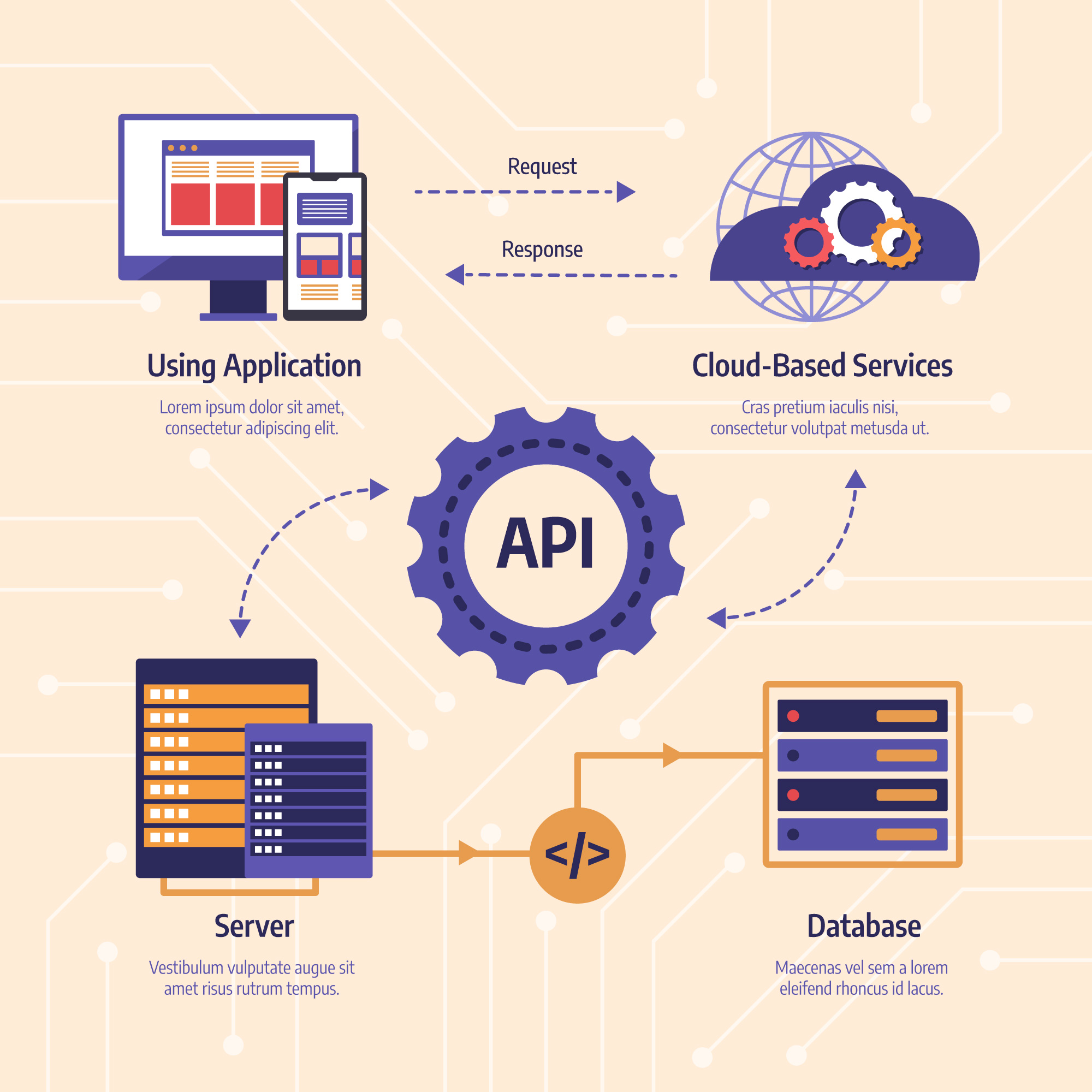

The Experian API works by allowing your application to send requests to Experian’s servers to retrieve the data you need. These requests are typically made over HTTP using standard RESTful principles, and the responses are returned in JSON or XML formats.

For example, if you’re using the Credit Risk API, you can submit a request containing a consumer’s personal information (such as name, address, and social security number) to Experian’s API. Experian will then return a credit report, which includes details such as credit score, credit history, outstanding debts, and any records of defaults or bankruptcies. This data is processed in real-time, so you can make instant decisions based on the most up-to-date information.

The Experian API can be used in various ways depending on the needs of your business:

- Credit Reports: Retrieve detailed consumer credit reports for evaluating loan eligibility or extending credit.

- Credit Scores: Get access to the consumer’s credit score, which can help businesses determine financial risk.

- Identity Verification: Verify the identity of customers or applicants by cross-referencing their details with Experian’s identity database.

- Fraud Prevention: Analyze data to identify fraudulent activity or high-risk customers by using Experian’s fraud detection tools.

- Address Verification: Validate addresses to ensure that they are legitimate and match the customer’s details.

Experian’s APIs provide all of this data in real-time, ensuring your business can make immediate decisions with the most accurate information available.

Why Use Experian API?

Integrating Experian’s API into your application offers a range of benefits, particularly for businesses that require accurate credit data, identity verification, or fraud detection. Some key reasons to use Experian API include:

- Access to Trusted Data: Experian is a globally recognized leader in credit and identity data, providing highly accurate and reliable information to businesses across industries.

- Real-Time Data: With Experian’s API, you can access real-time credit reports, scores, and identity data, allowing you to make instant, data-driven decisions.

- Reduce Fraud Risk: Experian’s fraud detection capabilities help businesses reduce the risk of identity theft and fraud, protecting both your business and your customers.

- Automated Processes: By integrating Experian’s API, you can automate credit checks, identity verification, and fraud prevention, reducing manual work and speeding up decision-making processes.

- Customization: Experian’s API is highly customizable, allowing you to tailor its functionality to meet your specific business needs, from simple credit score checks to more complex fraud detection and data enrichment.

- Scalability: Whether you’re a small business or a large enterprise, Experian’s API is designed to scale with your needs. As your business grows, you can rely on Experian to handle increased transaction volumes without compromising performance.

Cost of Experian Services

Experian’s API pricing is typically based on the specific services and volume of data your business needs. As a result, the cost can vary depending on factors such as:

- Number of API calls: The more frequently your application accesses Experian’s data, the higher the cost. Pricing is often based on the number of API calls or requests made.

- Service Type: Different Experian APIs have different pricing models. For example, the Credit Risk API might have a different price structure than the Fraud Detection API.

- Customization: Some custom integrations or advanced features may incur additional costs.

- Volume Discounts: Larger businesses or those with high-volume transaction requirements may be eligible for discounted rates based on the number of API calls they expect to make.

Generally, the costs of integrating Experian’s API can be broken down as follows:

- Credit Reports and Scores: Pricing is typically on a per-query basis, with costs ranging from $1 to $10 per report, depending on the type of report and the volume of requests.

- Identity Verification: Charges for identity verification services may be based on the number of verifications requested, with typical costs ranging from $0.50 to $2 per verification.

- Fraud Detection: For fraud prevention tools, pricing is usually tied to the number of checks or assessments conducted, with costs typically starting around $0.25 to $2 per request.

For enterprise-level solutions, Experian often offers customized pricing plans that are tailored to your business’s specific requirements, including bulk rates, additional services, and volume-based discounts. For more accurate and detailed pricing, you can contact Experian directly or request a personalized quote.

Use Cases for Experian API

Experian’s APIs are highly versatile and can be used across various industries for a range of purposes. Some common use cases include:

- Lending & Financial Services: Banks, credit unions, and other lenders use Experian’s Credit Risk API to assess the creditworthiness of loan applicants and help determine interest rates, loan approvals, and terms.

- eCommerce & Retail: Online retailers and marketplaces can use Experian’s Identity Verification API to ensure that customers’ identities are legitimate and to prevent fraudulent transactions.

- Insurance: Insurance companies use Experian’s credit data to assess risk, set premiums, and verify customer details, ensuring that they are offering coverage to legitimate, low-risk clients.

- Subscription-based Services: Subscription businesses can leverage Experian’s APIs for recurring billing, credit checks, and to verify customer identities before offering premium services.

- Fraud Prevention: Experian’s fraud detection tools are used across various sectors, including banking, retail, and online services, to protect against identity theft, synthetic fraud, and account takeover.

- Marketplaces: For peer-to-peer platforms or online marketplaces, Experian’s data APIs can be used to verify the identity and creditworthiness of users, reducing the risk of fraud and ensuring smoother transactions.

Conclusion

Incorporating Experian’s API into your platform offers a powerful way to enhance your business operations with comprehensive credit reporting, fraud detection, and identity verification services. With access to trusted data, real-time processing, and customizable features, Experian provides businesses with the tools they need to make secure, informed decisions and protect their assets.

If you’re looking to integrate the Experian API or develop a tailored financial solution, Itexus can help.

We’ve been assisting businesses in the fintech and financial services sectors with custom application development since 2013. Get in touch today to see how we can support your Experian integration or custom software development.