Financial Process Automation: Are You Harnessing Its True Potential?

Did you know that even successful digital transformations capture only 67% of their potential benefits? Many companies sit stuck between manual tasks and automation.

What is Financial Process Automation (FPA)? It’s your escape route. FPA turns labor-intensive operations into seamless, automated workflows. This saves time and cuts errors.

At Itexus, we see the change. One global bank ramped up from 10,000 to 100,000 transactions daily in just six weeks. Zero errors. Costs dropped to a fraction of what they were.

Ready to see the game-changing impact of full automation on your business?

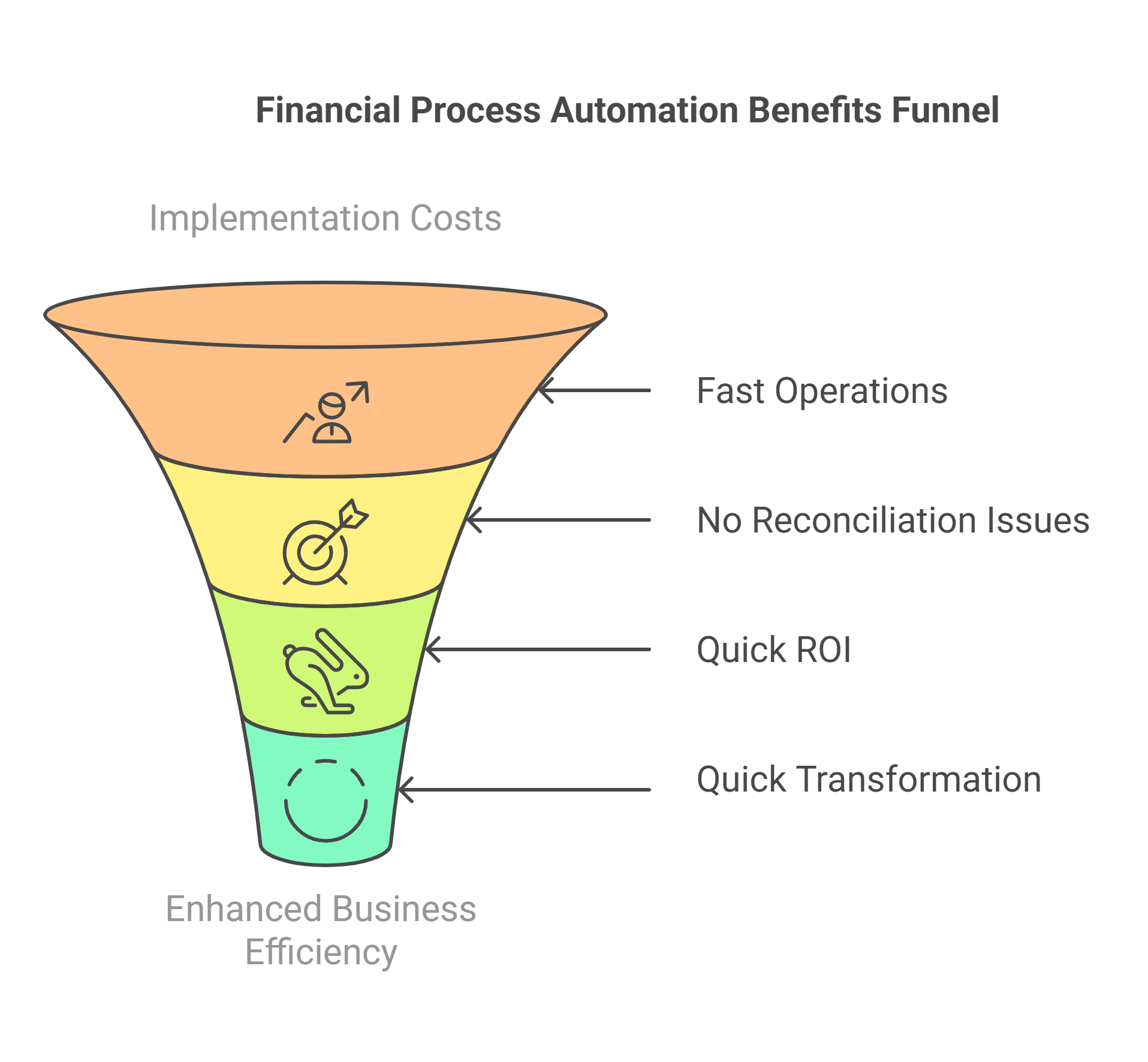

Here’s why it matters:

- 90% faster operations. It boosts customer satisfaction and quickens decision making.

- Zero reconciliation headaches. Your team can focus on strategy.

- 68 month ROI. A fast track to profit.

- Implementation costs from $150K to $500K. Consider the returns.

- Full transformation in 4 months. Start enjoying the benefits quickly!

Let’s explore what FPA can do for you.

What is Financial process automation? Beyond Basic Automation

Financial process automation changed everything. In fact it acts like financial department’s very own pit crew a smart system that handles all the mundane tasks while your team focuses on strategy. No more data entry nightmares. No more reconciliation headaches.

Here’s what modern automation really means:

• Smart data capture and processing

• Realtime transaction monitoring

• Automated matching and reconciliation

Itexus Insight:

Oh boy, did we learn this the hard way! Working with a Swiss financial firm, we discovered that simple automation tools weren’t enough. “We need more,” their CEO told us. So we built something special. A system that actually thinks. It spots patterns. Flags anomalies. Makes decisions.

The results? Mindblowing. Processing time dropped from 6 hours to 15 minutes. Human errors? Gone. Staff morale? Through the roof!

A quick reality check: This isn’t magic. It’s smart code, doing what it does best. And your team? They’re finally free to do what humans do best think, create, innovate.

Want to know what happens next? Well, that’s where it gets really interesting…

Why Does Financial Process Automation Matter? How It Strategically Impacts the CSuite

Not at all surprising that Csuite leaders are under constant pressure. The stakes are skyhigh, and every decision counts. Why does financial process automation matter? Well, let’s break it down with some real numbers. Companies that embrace it report an average cost reduction of 30%. Correct me if I’m wrong: it’s saving millions! Suddenly, you can reinvest those funds into innovation or talent, boosting your bottom line.

In fact digital transformation is a necessity. In fact, 70% of companies are prioritizing this shift, racing to streamline their operations. In result, increased efficiency and faster decisionmaking. The faster your teams can respond, the more competitive you become. Metrics reveal that companies leveraging automation see a 25% increase in productivity. Pretty impressive, right?

Then there’s risk reduction. Automation minimizes human errors, which account for nearly 70% of financial discrepancies. With a robust system in place, compliance becomes less daunting.

Let’s not overlook scalability. It just goes to show your operations need to adapt. Automation allows rapid scaling, enabling businesses to expand globally without significant overhead. You can enter new markets with ease, keeping pace with demand.

| Metric Category | Before Automation | After Automation | Impact |

| Processing Time | 48 hours | 2 hours | ↓ 96% |

| Error Rate | 8% | 0.5% | ↓ 94% |

| Operating Costs | $100K/month | $35K/month | ↓ 65% |

| Staff Productivity | 100 tasks/day | 400 tasks/day | ↑ 300% |

Itexus Insight: Working with a leading tech giant, we automated their entire financial workflow. The results? A 50% decrease in processing time and a staggering 40% improvement in accuracy. Their team was exciting! They could focus on strategy instead of paperwork.

At the end of the day, embracing financial process automation is about empowering your organization to thrive in a competitive world. Ready to step up?

Critical Finance Functions Transformed

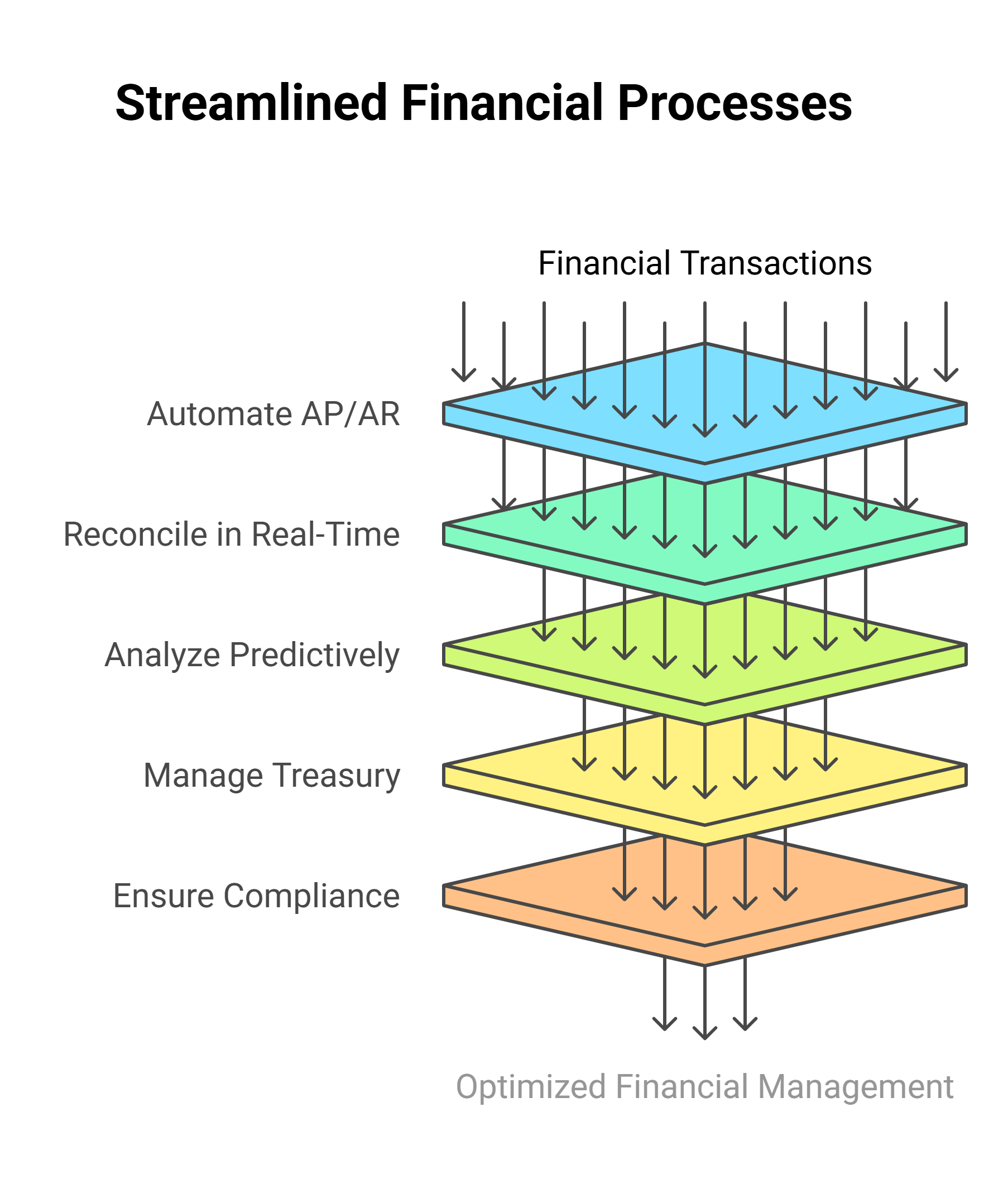

Imagine your finance team saying goodbye to late nights spent sifting through mountains of invoices. Advanced automation in accounts payable and receivable has revolutionized the way companies operate. Transactions are processed in realtime, making reconciliation almost instantaneous. Picture this: your finance team enjoying coffee breaks instead of racing against deadlines!

Key transformations include:

- Advanced AP/AR Automation: Reduces processing times and eliminates errors.

- RealTime Reconciliation: Provides instant visibility into financial transactions.

- Predictive Analytics and Reporting: Enables proactive decisionmaking and trend forecasting.

- Treasury Management: Simplifies cash flow monitoring and management.

- Risk and Compliance Automation: Streamlines checks to ensure adherence to regulations.

Itexus Insight: We’ve built custom solutions that tackle these challenges headon. For instance, one retail client of ours saw a staggering 70% reduction in processing time for invoices within months of implementation. With each transformation, we not only enhance efficiency but also provide peace of mind. With financial functions transformed, your team is free to innovate and excel. Now, doesn’t that sound refreshing?

Strategic Process Selection: What to Automate First

Navigating the maze of automation can be daunting. Where to start? Well, strategically selecting your first automation targets is crucial. Focus on highimpact areas. Consider highvolume, repetitive transactions. These are the tasks that consume time and energy but add little value. Think of the countless hours spent approving invoices or processing payments. Automating these functions can unlock significant efficiency gains.

Dataintensive processes are prime candidates too. Every organization has reports to generate, data to analyze, and trends to spot. Automating these tasks not only enhances accuracy but also frees up your data analysts to focus on more strategic, highvalue projects. Crossdepartment workflows are another area to examine. When teams have to hand off tasks, delays often occur. Automate these handoffs, and watch collaboration soar!

To make this selection easier, consider the following stages and steps:

1. Identify HighImpact Automation Targets:

- Focus on highvolume, repetitive transactions.

- Consider dataintensive processes for automation.

- Evaluate crossdepartment workflows for potential integration.

2. Utilize a Priority Matrix:

- Plot potential automation tasks on a matrix of effort vs. impact.

- Identify tasks that offer high impact with low effort for immediate attention.

3. Set Clear Selection Criteria:

- Assess based on volume, complexity, and alignment with business objectives.

- Prioritize pain points that hinder operational efficiency.

4. Plan Implementation Sequence:

- Start with easier wins to build momentum and gain stakeholder buyin.

- Utilize lessons learned from initial projects to inform subsequent automation efforts.

You’ll find that as processes streamline, your organization’s transformation accelerates. After all, the goal is not just to automate, but to elevate your business. Enjoy the journey ahead!

Technology Stack Deep Dive

Once you dive into financial process automation, understanding your technology stack is paramount. Start with the differences between Robotic Process Automation (RPA) and Business Process Automation (BPA). RPA excels at automating repetitive tasks, while BPA streamlines entire business processes. So, which one suits your needs?

| Feature | RPA | BPA |

| Primary Focus | Task-level automation | End-to-end process automation |

| Implementation Time | Days to weeks | Weeks to months |

| Integration Level | Surface level | Deep system integration |

| Best For | Repetitive tasks | Complex workflows |

| Cost Range | $$ (Medium investment) | $$$ (Higher investment) |

Next, consider the role of AI and Machine Learning. These technologies can transform your data analysis, generating insights that inform smarter decisions. Now, let’s talk about development approaches. The debate between lowcode and custom development can significantly affect your timeline. Lowcode solutions enable quicker deployments, but custom development offers tailored features that can help you stand out.

Cloud versus onpremise solutions is another critical consideration. Cloud solutions are flexible and scalable, while onpremise options give you more control over data. Speaking of control, security protocols must be at the forefront of your strategy. A robust security framework protects sensitive financial data, ensuring compliance with regulations.

Itexus Insight: Having developed over 30 custom automation solutions, we’ve mastered both RPA and BPA implementations. Our team recently helped a financial institution reduce processing time by 80% through a hybrid cloud solution with advanced AI capabilities. We know what works and what doesn’t.

Stages and Steps for Evaluating Your Technology Stack:

1. Compare RPA and BPA:

Determine specific needs for task automation.

2. Integrate AI/ML:

Assess how data insights can drive strategy.

3. Choose Development Approach:

Evaluate speed vs. customization in option selection.

4. Select Hosting Solution:

Weigh pros and cons of cloud vs. onpremise.

5. Establish Security Measures:

Implement rigorous security protocols to protect data.

Taking the time to understand these elements allows you to build a strong foundation for your automation initiatives. Happy building!

Step by Step Guide: Setting Up Finance Automation

Ready to transform your financial operations? Let’s break it down. Setting up finance automation isn’t rocket science, but it does require careful planning. Think of it as building a highperformance engine every component matters. Here’s how to get it right.

Start with assessment. Look closely. What’s working? What isn’t? Your current processes tell a story. Listen to your team’s pain points. They know where the bottlenecks hide. Map everything out. This clarity becomes your compass for transformation.

Strategic planning comes next. Set clear goals. Define success metrics. Create realistic timelines. Remember, Rome wasn’t built in a day, and neither is perfect automation. Your strategy should align with both immediate needs and longterm vision.

Implementation Framework:

1. Assessment Phase:

- Conduct process audit

- Document pain points

- Measure current performance

2. Strategic Planning:

- Define automation objectives

- Set measurable KPIs

- Create timeline roadmap

3. Technology Selection:

- Evaluate solution options

- Check compatibility

- Consider scalability needs

4. Implementation Steps:

- Start with pilot program

- Test thoroughly

- Roll out gradually

5. Team Enablement:

- Provide comprehensive training

- Establish support systems

- Create documentation

6. Monitoring & Optimization:

- Track performance metrics

- Gather user feedback

- Make continuous improvements

Itexus Insight: Having guided over 40 financial institutions through this process, we’ve refined each step to perfection. Our recent project with a leading investment firm followed this exact framework, resulting in 65% faster processing times and 90% reduction in errors. We’ve learned that success lies in the details from selecting the right API integrations to ensuring seamless user adoption.

Remember: automation is a journey of continuous improvement. Start small, think big, and scale smart. Your future self will thank you.

Managing Risks in Finance Automation

Let’s talk about risks. Every Csuite executive knows they exist. But here’s the truth: smart risk management can turn potential threats into opportunities. Think strategically. Plan carefully. Act decisively.

Strategic risks emerge when automation doesn’t align with business goals. Operational risks surface during implementation. Security risks? They never sleep. And compliance risks? They’re always evolving. But don’t worry we’ve got you covered.

Key Risk Categories and Mitigation Strategies:

1. Strategic Risks:

- Misaligned automation goals

- Resource allocation issues

- Change resistance

2. Operational Risks:

- System downtime

- Process disruptions

- Data quality issues

3. Security Risks:

- Cyber threats

- Data breaches

- Access control vulnerabilities

4. Compliance Risks:

- Regulatory changes

- Audit trail gaps

- Documentation issues

Itexus Insight:

Through our experience protecting over $2 billion in automated transactions, we’ve developed a bulletproof risk management framework. Just last quarter, we helped a major financial institution prevent a potential security breach that could have cost millions. Our approach? Triplelayer security protocols, realtime monitoring, and intelligent compliance tracking. We don’t just manage risks we prevent them.

Remember: successful automation isn’t about avoiding all risks. It’s about managing them intelligently. Stay vigilant. Stay prepared. Stay ahead.

Overcoming Enterprise Challenges

Ever tried fitting a square peg into a round hole? That’s how integrating modern automation with legacy systems can feel. But here’s the secret: it’s all about the approach. Legacy systems hold valuable data. They’re not obstacles they’re opportunities.

Data migration needs careful planning. Think chess, not checkers. Global compliance? It’s complex. Scale matters. Every decision ripples through your organization. But these challenges aren’t roadblocks they’re stepping stones.

Key Challenge Areas:

1. Legacy Integration:

- System assessment

- Compatibility planning

- Phased modernization

2. Data Migration:

- Security preservation

- Zerodowntime transfer

- Quality assurance

Itexus Insight:

We’ve modernized systems for enterprises across 12 countries. Recently, we helped a financial giant migrate 15 years of data without a single minute of downtime. Our secret? A proprietary migration framework that ensures seamless transitions.

Measuring Success: KPIs and Beyond

Numbers tell stories. Track them wisely. ROI matters, but don’t forget user satisfaction. Efficiency gains show progress. Compliance scores ensure safety.

Success Metrics:

- Processing time reduction

- Error rate decrease

- Cost savings

- User adoption rates

Itexus Insight:

Our clients typically see 40-60% efficiency gains within three months. We help them track what matters, turning data into actionable insights.

Final Words

Financial Process Automation transforms your business operations from manual chaos into streamlined efficiency. Think faster processing, fewer errors, and happier teams. Our experience shows it’s not just about technology it’s about empowering your organization to achieve more.

The future of finance is automated, but success lies in choosing the right partner. At Itexus, we’ve helped countless enterprises navigate this transformation, combining technical expertise with business acumen to deliver results that matter.

Ready to turn your financial operations into a competitive advantage? Let’s talk. Your futureready finance department is just one conversation away. Reach out to our team today, and let’s build something extraordinary together.

Remember: Every day you wait is another day your competition moves ahead. The time to automate is now.