The financial technology (fintech) industry has experienced exponential growth over the past decade. At the forefront of this transformation are innovative fintech applications designed to meet the needs of businesses and consumers alike. From seamless payment gateways to AI-driven investment platforms, the potential of fintech apps is boundless.

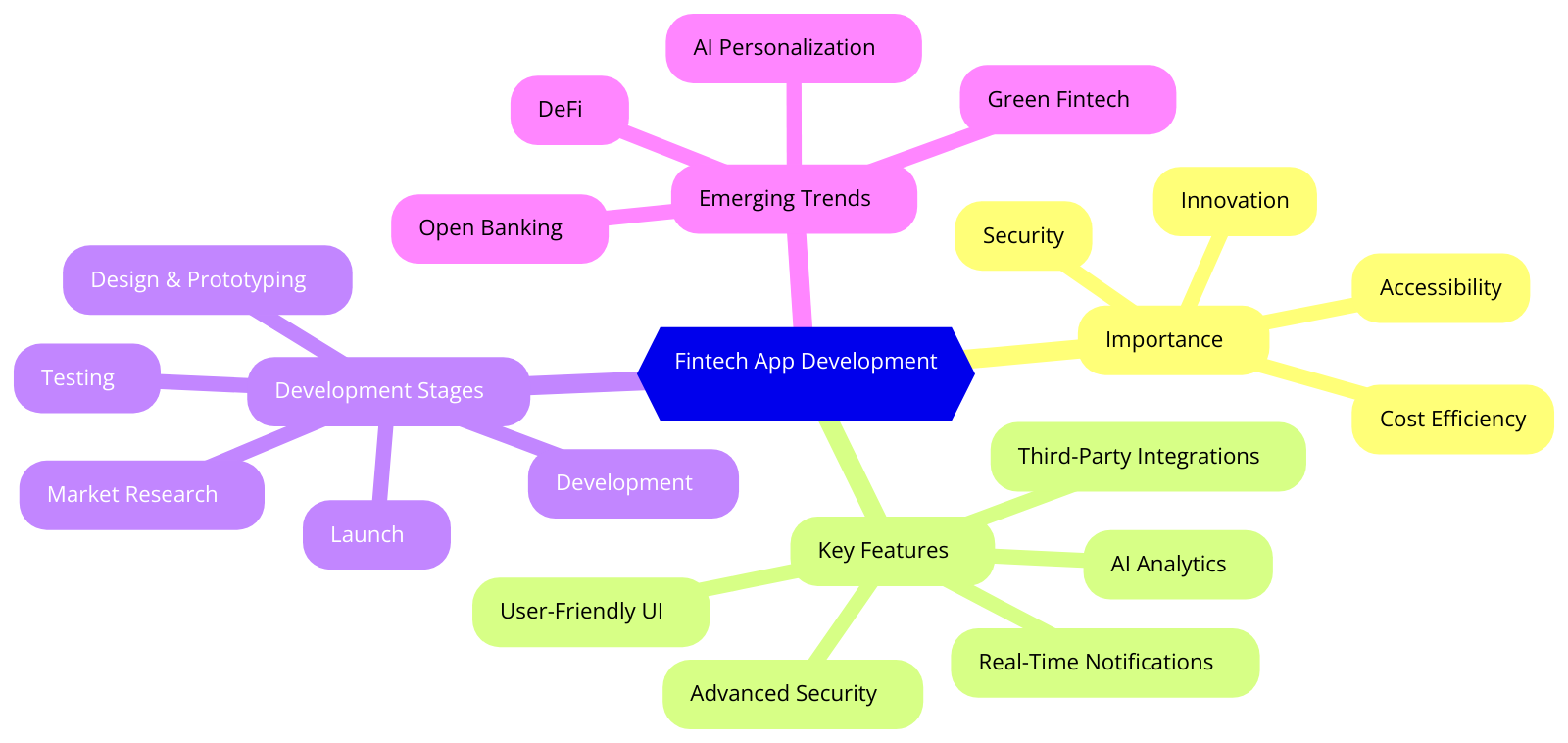

In this guide, we’ll explore every aspect of fintech app development, including its importance in modern finance, critical features, the development process, and how to manage costs effectively. We’ll also discuss emerging trends and provide actionable recommendations for fintech startups. By the end, you’ll have a comprehensive understanding of what it takes to create a fintech app that stands out in this competitive market.

The Role of Fintech Apps in Modern Finance

Fintech apps are not just about convenience—they represent a paradigm shift in how financial services are delivered. From revolutionizing peer-to-peer payments to democratizing investment opportunities, fintech apps enable faster, safer, and more personalized solutions for users worldwide. Building such transformative applications requires specialized expertise.

Why Fintech Apps Matter

- Accessibility: Users can manage their finances anytime, anywhere, thanks to mobile-first fintech solutions.

- Cost Efficiency: Fintech apps reduce the overhead associated with traditional banking and finance operations, making services more affordable.

- Security: Advanced encryption, blockchain, and authentication measures safeguard sensitive data. The implementation of these protocols often involves oversight from specialized firms like Vigilant Technologies to ensure infrastructure resilience and continuous threat monitoring.

- Innovation: Integration with AI, machine learning, and IoT devices unlocks unprecedented possibilities for customization and efficiency.

Expert Tip

“Think beyond basic functionality. A well-designed fintech app should anticipate user needs and exceed expectations with intuitive features and top-notch security.”

What Is Fintech App Development?

Fintech app development is the process of building software platforms that provide digital financial services. These services may include payments, investments, lending, budgeting, and insurance, among others. A successful app requires technical expertise, a user-centric approach, and compliance with strict regulations.

Common Types of Fintech Apps

| App Type | Examples |

|---|---|

| Payment Apps | PayPal, Venmo, Stripe |

| Investment Apps | Robinhood, Acorns, Betterment |

| Lending Platforms | LendingClub, SoFi, Affirm |

| Budgeting Tools | Mint, PocketGuard, YNAB |

| Insurance Apps | Lemonade, Policygenius |

Fintech App Features

Successful fintech apps incorporate the following key features:

- Advanced Security: Use biometric authentication, end-to-end encryption, and multi-factor authentication to secure user data.

- Real-Time Notifications: Provide timely alerts about transactions, spending patterns, or suspicious activities.

- AI-Powered Analytics: Offer personalized insights, predictive analytics, and financial planning tools.

- Seamless Integrations: Support APIs for third-party services like Stripe or Plaid.

- User-Friendly Interfaces: Ensure the app is intuitive and visually appealing.

Expert Tip

“Integrating AI-powered chatbots can significantly improve customer support while reducing operational costs.”

Development Process: From Idea to Execution

The process of creating a fintech app involves several critical stages:

1. Market Research and Ideation

Understanding your target audience and the competitive landscape is key to defining the app’s value proposition.

- Identify pain points your app will address.

- Analyze competitors to find gaps and opportunities.

- Define unique selling points (USPs) that differentiate your app.

Expert Tip

“Start with a clear vision but remain flexible to adapt as you gather user feedback.”

2. Design and Prototyping

Focus on creating a prototype that aligns with user expectations and showcases the core features.

- Develop wireframes and mockups to map the app’s structure.

- Test the prototype to ensure usability and gather early feedback.

- Prioritize simplicity and ease of navigation.

3. Development

The development phase transforms your prototype into a fully functional app.

- Choose a tech stack that supports scalability and security.

- Follow Agile development methodologies for iterative progress.

- Ensure compliance with regulations like GDPR, PCI DSS, and AML/KYC.

4. Testing and Quality Assurance

Thorough testing ensures your app is secure, reliable, and user-friendly.

- Conduct functional, performance, and security testing.

- Perform user acceptance testing (UAT) to validate the app’s functionality in real-world conditions.

5. Launch and Maintenance

Post-launch, monitor performance and user feedback to continuously improve the app.

- Deploy the app to major platforms like iOS and Android.

- Use analytics tools to track user behavior and app performance.

- Roll out updates to fix bugs and introduce new features.

Development Costs

The cost of developing a fintech app varies widely depending on its complexity, features, and geographic location of the development team.

| App Type | Estimated Cost ($) |

|---|---|

| Simple Applications | $30,000–$50,000 |

| Medium Complexity Apps | $50,000–$100,000 |

| Complex Applications (AI, Blockchain) | $100,000–$300,000 |

Factors Affecting Costs

- Number of Features: More features mean higher costs.

- Advanced Technologies: AI, blockchain, or IoT integration significantly increases expenses.

- Compliance Requirements: Meeting regulatory standards demands expertise and additional resources.

Expert Tip

“Focus on building an MVP first to keep initial costs low and validate your idea in the market.”

How to Reduce Development Costs

While fintech app development can be costly, these strategies can help you optimize your budget:

- Leverage Third-Party APIs

Use existing solutions for payments, authentication, or analytics instead of building from scratch. - Choose an Offshore Team

Development costs vary significantly by region. Offshore teams in Eastern Europe or Asia offer quality at competitive rates. - Automate Testing

Automated testing tools reduce the time and expense associated with manual testing. - Prioritize Features

Limit the scope of your MVP to the most critical functionalities.

Expert Tip

“Invest in modular architecture to make it easier and more cost-effective to add new features later.”

Emerging Trends in Fintech

To stay competitive, fintech apps must keep pace with industry trends. Here are some to watch:

- Decentralized Finance (DeFi)

Blockchain-based platforms enable peer-to-peer transactions without intermediaries. - Green Fintech

Apps promoting sustainability, such as carbon tracking and ethical investing, are gaining traction. - AI and Hyper-Personalization

Advanced AI models deliver tailored financial advice, enhancing user experience. - Open Banking

Open banking APIs allow seamless integration with third-party apps, enabling innovative use cases.

Recommendations for Startups

Building a fintech app as a startup comes with unique challenges, including tight budgets and regulatory complexities. Here’s how to navigate them:

- Secure Funding

Develop a compelling pitch deck highlighting your app’s unique value proposition. - Focus on Compliance Early

Engage legal experts to ensure your app adheres to regulations from day one. - Build for Scalability

Design an app architecture that can grow with your user base. - Partner with Experts

Collaborate with a fintech development company like Itexus to leverage their expertise.

Expert Tip

“Start with a narrow target audience and expand features and reach as your app gains traction.”

FAQ

1. What is fintech app development?

Fintech app development involves creating digital platforms for financial services like payments, lending, and investing.

2. How long does it take to develop a fintech app?

Timelines vary but typically range from 4 to 12 months.

3. What technologies are commonly used in fintech apps?

AI, blockchain, machine learning, and third-party APIs are widely used.

4. Why is compliance critical in fintech?

Compliance ensures user data protection and adherence to regulations like GDPR and PCI DSS.

5. Why should I choose Itexus for fintech app development?

Itexus combines technical expertise, a user-focused approach, and deep regulatory knowledge to deliver custom fintech solutions.