Nearly 50% of U.S. banks are missing something big. They’re still without the tech for smooth onboarding.

Surprised?

You should be!

It’s like boarding a flight with no safety briefing—confusing, stressful, and totally avoidable.

Customers deserve better. A clear path, not a maze. If you’re in the pilot’s seat, it’s time to upgrade. Let’s make onboarding as seamless and reassuring as that pre-flight rundown. Get your customers ready for takeoff, not stuck at the gate.

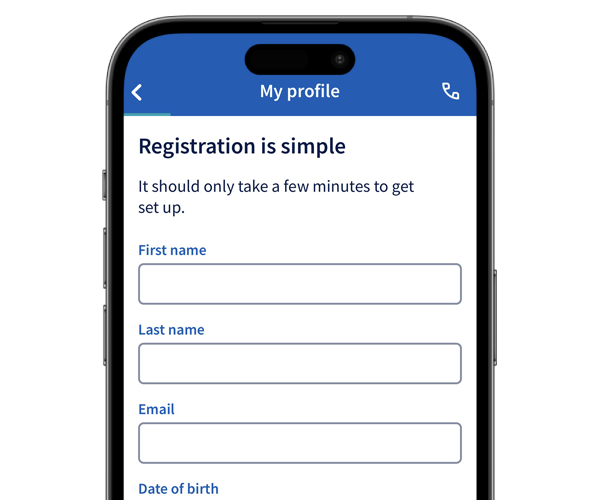

Onboarding is a crucial component of a banking mobile application. You know the saying, “You never get a second chance to make a first impression”? The first thing a customer sees when launching an app is an invitation to register. According to a 2022 report from Signicat, about 68% of potential customers declined to sign up, from 63% in 2021. It means financial institutions lost about $6 billion in revenue each year.

Not bad eh?

Here’s the thing: To change the situation for the better, the concept of onboarding needs to be completely redesigned. To this end, this will require reducing the number of steps to register, but without compromising the security of the customer and their personal data.

Read on to learn how digital signup in the banking ecosystem can change the way a customer feels about an institution. You will also learn what problems in the banking industry digital onboarding can help solve.

Growing need for a digital introduction to the digital banking ecosystem

There is a strong trend towards the digitalization of banking services around the world. Here is a study by McKinsey, according to which 60% of banks consider fintech companies to be their competitors, especially in areas such as payments and lending. The McKinsey study showed that fintech can reduce margins for small and medium-sized businesses by an average of 10-15%.

Let’s take a look at the main reasons why traditional banks are losing popularity and losing out to fintech:

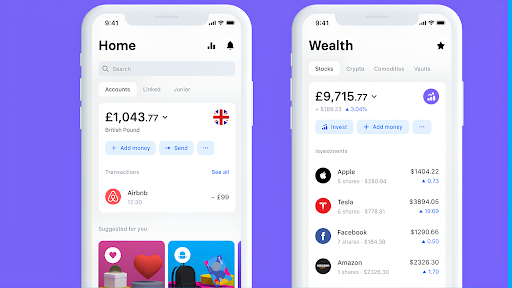

* Convenience and simplicity. Companies like Revolt, Chime attract customers through simple tools, allowing them to quickly manage their bank account by transferring funds instantly anywhere in the world.

- * Fast service. Instant lending, opening and closing accounts without visiting a bank office.

- Modern fintech companies offer much lower fees for transferring funds, exchanging currencies, buying precious metals and stocks. Payment systems. Popular online services such as PayPal or Suare are competitors and are gradually taking the market away from traditional banks.

- Now let’s look at the weaknesses of traditional onboarding. In some cases, the main disadvantage is the huge amount of paperwork a customer needs to fill out to register a bank account. As a rule, after filling out all the forms, the client has to wait several days for the security service to verify all the data.

- Another major pain point is the limited opening hours and the busyness of branches. For many questions, a client has to go to the bank’s office after standing in line or making an appointment at a certain time.

- To address this issue, banks might turn to digitalization of services: development of mobile application, transfer of services to online mode. The introduction of registration through biometrics and online identification will reduce the load on the branch many times and attract new customers.

Advantages of Digital Onboarding

Let’s talk about the main advantages of the digitalization of the banking ecosystem, in particular onboarding. First of all, I would like to mention the simplified registration of an account in the system.

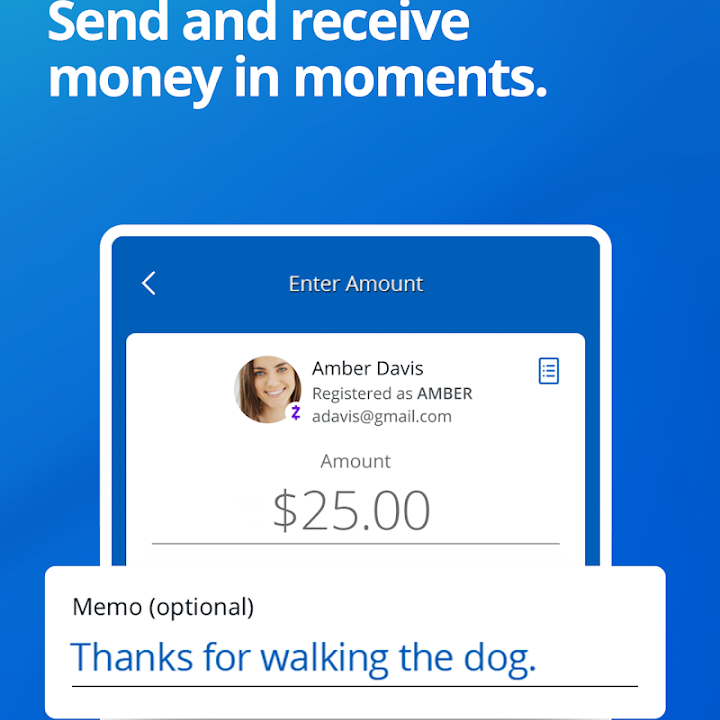

The client does not have to go to a branch, waste his time talking to staff, fill out countless forms and other papers. You may ask how the bank verifies the client’s identity, because fraudsters can register in this way. Video or photo (selfies with a document in hand) are used for authentication.

The digitalization of onboarding is a significant cost savings. The American Bankers Association estimates that it costs $280 to serve one customer in physical mode. Whereas in the digital world, such service costs $120, with the future prospect of reducing it to $19.

The reader may have a fair question about the security of the customer’s personal data. I would like to point out that such a problem is easily solved by implementing KYC (Know Your Customer) system. It includes two-factor authentication, Touch ID, Face ID, as well as Anti-Money Laundering (AML), and Counter-Terrorism Financing (CTF) verification tools, preventing money laundering and terrorism financing attempts.

Digital onboarding is easy scalability. A bank does not need to open new branches, spending money on rent and staff. It is enough to organize a high-quality support service (Call Centre), which will remotely solve all issues with the client.

Important aspects to online onboarding applications

When discussing the digitalization of the banking ecosystem, one cannot avoid the issue of security. To clarify the situation, I would like to highlight a few very important points concerning this issue:

- Multi-factor authentication (MFA). Various combinations of passwords, including biometrics, as well as one-time passwords (OTP) are used to confirm a customer’s identity.

- Biometric authentication. The use of fingerprints, face, retina. This method significantly reduces the risk of account hacking and the use of alien or fake documents.

- Data encryption. Digital onboarding uses AES (Advanced Encryption Standard) or TLS (Transport Layer Security) encryption to prevent third parties from intercepting personal data.

- Phishing and fraud protection. This includes HTTPS protocol and SSL certificates to prove the authenticity of the host, as well as a system to control and monitor behavior. For example, if a user engages in behavior that is out of the ordinary, the account can be blocked to prevent theft of funds.

To prevent unpleasant consequences of an outage, an emergency recovery plan from backup (BCP) should be put in place. This will help clients not to lose access to their funds.

Integration with already existing systems

At first glance, integrating digital onboarding may seem complex and difficult to implement. However, in practice, many large banks have successfully overcome the challenges and digitized their ecosystems by hiring experienced developers.

- BBVA (Banco Bilbao Vizcaya Argentaria). Development of a digital platform for customer onboarding that was integrated into the main CRM system.

- HSBC . Implemented a risk management system.

- ING Bank . Implementation of digital mobile onboarding and integration with core banking systems reduced customer service time from 26 to 6 minutes.

Needless to say, integrating digital onboarding with core banking is crucial for automating client requests. For example, opening/closing accounts, issuing debit/credit cards, processing loans.

Integrating onboarding with core-banking analytics and BI (Business Intelligence) systems allows a financial institution to obtain additional customer data that can be used to predict customer behavior. The processed information is used to make more informed business decisions.

Is investing in onboarding beneficial?

Consider the main question: Is it profitable to invest in the digitalization of the banking ecosystem, and what does a financial institution gain in return? Right away, I can say that investing in digital onboarding is highly profitable due to the following factors:

- Automation.processes. Many routine tasks will be performed automatically.

- Reducing the cost of opening and maintaining physical branches (affiliates).

- Attracting new customers. Reducing the outflow of existing customers.

- Increased competitiveness. Quick adaptation to changing conditions. Reduced time to market for new banking products.

- Improved risk management.

Some banks claim that the return on investment (POI) is 100-200% in 2-3 years after the implementation of digital onboarding. In turn, McKinsey conducted a study according to which banks that have implemented digital onboarding increase profits by up to 40%.

Successful examples of digital onboarding implementation

Speaking about the successful integration of digital solutions, one cannot fail to note the successes of some US banks.

I will start with one of the largest US banks, JPMorgan Chase.

The bank has worked to integrate onboarding with Core-banking, allowing customers to apply for and manage their finances without visiting a bank branch. According to the financial institution’s reports, the number of digital customers has increased from 50 million to 60 million from 2018 to 2020. Each digital customer generates 10-15% more revenue compared to traditional customers. Digital onboarding has reduced the time to process customer transactions by 30-40%.

Another curious case worthy of consideration is Bank of America.

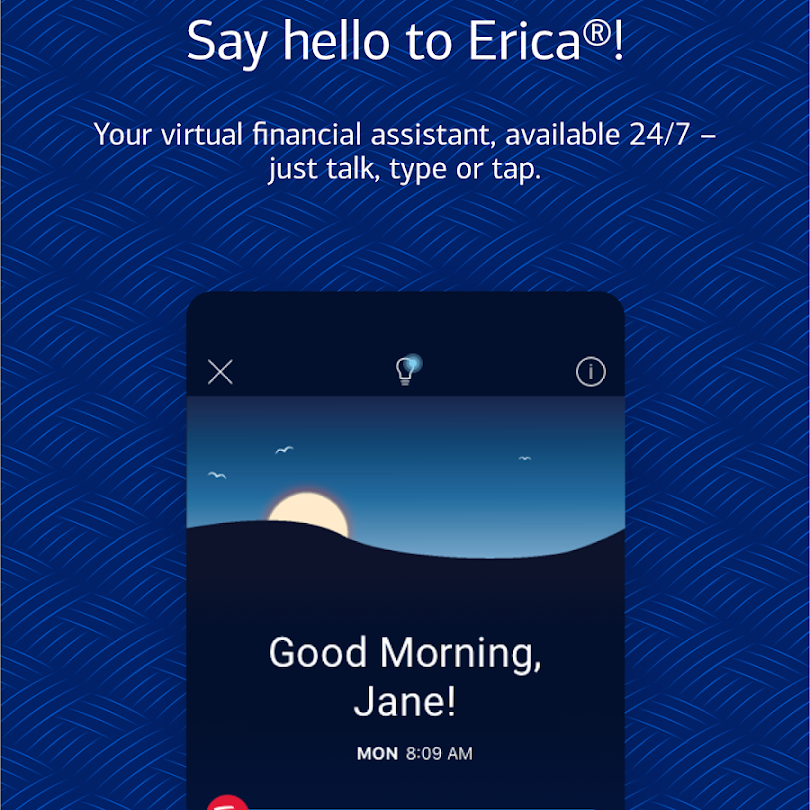

The main feature of Bank of America‘s digital onboarding was the introduction of Erica, a virtual assistant that assists users in their everyday banking transactions. This has helped in reducing the workload of the customer service team. Apart from this, the bank also introduced in-app authorization by biometrics.

Thanks to such innovations, the bank has been able to achieve some successes:

- 76% of households use digital banking.

- The number of digital banking users increased to 47 million.

- 3.4 billion authorizations. (source)

Wells Fargo Bank was not left behind and also made an attempt to digitalize onboarding, and quite successfully at that.

A special feature of Wells Fargo’s digital onboarding is its integration with the KYC system, which allows new customers to register and open accounts without visiting a bank branch. With this integration, the bank has been able to automate the verification and account opening process, reducing fraudulent cases.

By the end of 2021, Wells Fargo has increased the number of digital customers by more than 20%. Thanks to digital onboarding, the bank’s customers can receive the results of their loan approval document review within 16 days.

The digitalization of onboarding. Where to start?

Let’s move on to the main question and discuss what it takes to successfully implement digital onboarding in the banking ecosystem.

- The first step is to define the goals and objectives.

- The second step is to find out the current state of onboarding and identify its most painful and vulnerable points.

- The third stage is the choice of technology and vendor. In my opinion, this is a very important stage and should be taken very seriously. The entire future process of onboarding digitalization depends on the vendor, its experience and the quality of the technology. It is desirable to choose a vendor that already has experience in this business and positive feedback.

Fourth stage. Integrate onboarding into the banking ecosystem and train staff.

What kind of banks need digital onboarding?

I believe that the digitalization of the services ecosystem is available to absolutely any bank. From large financial institutions to small regional banks and credit unions. The degree of onboarding digitalization can depend on the size of the investment in the project and the objectives set. For example, for online banks that do not have physical branches but want to improve their digital onboarding the amount of investment will be minimal.

However, in my opinion, for traditional banks, it is best to order turnkey digital onboarding from a vendor with extensive experience. This approach will reduce the risk of system failures due to poor quality work.

Why it needs to be done today

Time waits for no one; every minute is precious. If you don’t seize the moment now, it may be too late tomorrow. Digital onboarding is what can save your bank, and if you’re ready to make a breakthrough in your financial institution, you need to get to work right now, develop a customized plan and prepare a strategy. Only then will you be able to understand how remote registration and verification, instant account opening, AI-powered virtual assistant and many other things that the digitalization of onboarding can bring.

By overcoming the challenges, you can be one step ahead of your competitors. Increase profits by attracting new customers, optimizing the cost of new hires, and scaling your bank without the heavy investment of opening new branches.

Conclusion

To summarize, I want to highlight a few key points that explain the importance of digital onboarding. First, meeting the growing expectations of customers. Second, improving operational efficiency, reducing financial costs. Third, improved security of customers’ personal data. Fourth, easy adaptation to changing markets, easy integration of new products and scalability.

Digital onboarding is what will help your bank not only remain competitive, but also actively develop in the ever-changing financial world.