Web application that allows users to increase and diversify their retirement investments with crypto assets and helps to expand knowledge in the cryptocurrencies through educational content.

In today’s digital-first financial world, cryptocurrency exchanges have become the backbone of global trading. Platforms like Binance, Coinbase have set new standards for security, scalability, and user experience, making them the go-to venues for millions of traders worldwide.

If you are planning to build your own crypto exchange, one of the first questions you’ll ask is: How much does it cost? The short answer—it depends. The long answer is that costs vary based on functionality, security, compliance, and technology stack. This article breaks down the key factors, highlights hidden costs, and introduces you to the top companies that can turn your vision into reality.

The Cost of Developing a Crypto Exchange: Key Factors

Developing a crypto exchange platform is far more complex than building a standard application. Here are the main factors that influence cost:

1. Platform Type and Features

| Exchange Type | Estimated Cost | Key Features |

|---|---|---|

| Basic Exchange | $100,000 – $140,000 | User registration, wallet integration, basic trading pairs, simple KYC/AML |

| Advanced Exchange | $170,000 – $320,000 | Real-time order matching, margin trading, multi-currency support, APIs |

| Enterprise / Custom | $320,000+ | Derivatives, liquidity aggregation, algorithmic trading, white-label modules |

Note: The more advanced the features (e.g., margin or futures trading, DeFi integration), the higher the overall development cost.

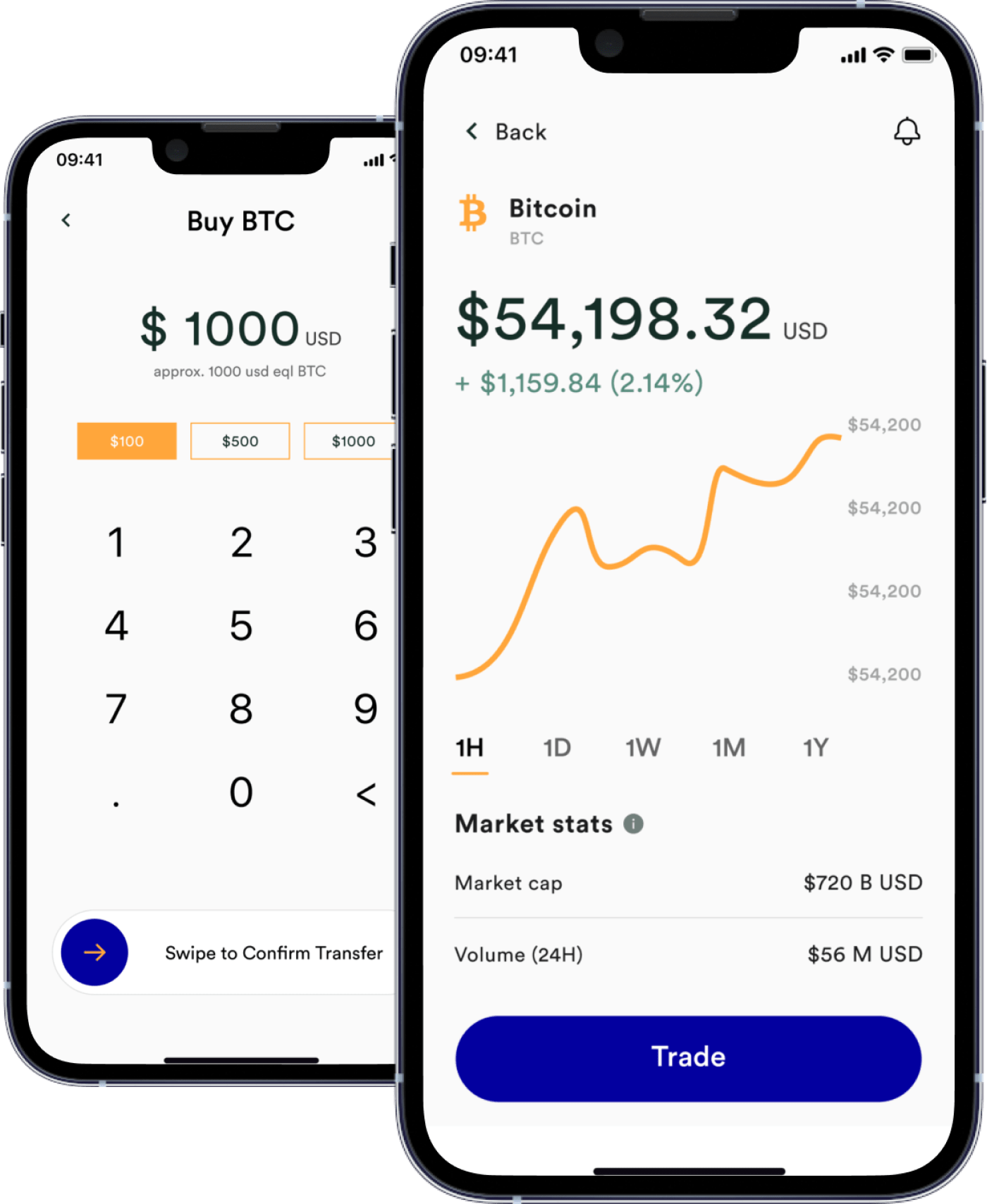

2. UI/UX Design

Just like in trading apps, design is a major cost driver. A crypto exchange must feel fast, intuitive, and trustworthy.

- Basic design (functional, minimalistic): $20,000 – $40,000

- Advanced design (custom dashboards, responsive charts, smooth order book UX): $50,000+

- 3. Security & Compliance

- Security is the single most critical element of any crypto exchange. Beyond protecting user funds, platforms must comply with regulations (KYC, AML, GDPR, PCI DSS).

- Typical security costs: $20,000 – $60,000+, covering:

- Biometric or 2FA authentication;

- SSL/TLS encryption;

- Cold wallet integration;

- Anti-DDoS protection;

- Smart contract audits (if DeFi features are included).

- 4. Development Team Location

| Region | Hourly Rate |

|---|---|

| North America / Western EU | $100 – $250 per hour |

| Eastern Europe / Asia | $30 – $70 per hour |

Note: Approximate data

Essential Features for a Successful Crypto Exchange

| Feature | Description | Why It Matters |

|---|---|---|

| User Onboarding & KYC | Secure sign-up, identity checks, AML compliance | Builds user trust and ensures compliance |

| Order Matching Engine | Core system for buy/sell orders in real-time | Determines platform performance & speed |

| Multi-Currency Wallets | Hot & cold wallets with support for multiple cryptocurrencies | Enables safe, versatile asset management |

| Liquidity Management | API integration with external exchanges/liquidity providers | Ensures smooth trading and price accuracy |

| Real-Time Market Data | Charts, analytics, and live feeds | Traders need accurate insights instantly |

| Admin Dashboard | Tools for managing fees, transactions, and KYC data | Crucial for operations and compliance |

| Advanced Security | Encryption, biometric logins, anti-fraud measures | Protects assets and prevents cyberattacks |

Hidden Costs You Shouldn’t Overlook

- Licensing & Legal Compliance

Obtaining a license in jurisdictions like the U.S. or EU can cost anywhere from $50,000 to $200,000, depending on regulations. - Liquidity & Market Making

Without liquidity, exchanges fail. Partnering with liquidity providers or integrating APIs adds $20,000 – $50,000. - Ongoing Maintenance

Plan to spend 15–25% of initial development cost annually on updates, scaling, and security patches.

Breakdown of Development Stages

| Stage | Activities | Timeframe | Cost Estimate |

|---|---|---|---|

| Planning & Research | Market analysis, requirements, roadmap | 3–5 weeks | $10,000 – $20,000 |

| UI/UX Design | Wireframes, prototypes, dashboards | 4–6 weeks | $20,000 – $40,000 |

| Core Development | Frontend, backend, APIs, matching engine | 4–8 months | $80,000 – $200,000+ |

| Testing & Security Audits | QA, penetration testing, compliance checks | 3–6 weeks | $20,000 – $50,000 |

| Launch & Support | Deployment, ongoing upgrades | Ongoing | 15–25% yearly upkeep |

Top 5 Companies for Crypto Exchange Development

1. Itexus

Key Highlights:

- Founded: 2013

- Headquarters: USA (global delivery centers in EU & UK)

- Team Size: 160+ (70% senior engineers)

- Core Services: Custom fintech and crypto exchange development, mobile banking, digital wallets, AI-driven trading platforms, RegTech & compliance solutions

- Itexus holds the №1 position as a specialist in fintech and blockchain development with a proven track record of delivering complex financial applications for banks, startups, and enterprises across more than 20 countries. Unlike generalist software vendors, Itexus operates with a dedicated fintech division, ensuring that every project benefits from deep domain knowledge of financial regulations, payment flows, and digital asset security standards.

The company builds secure, scalable, and regulation-ready exchange platforms, supporting spot, margin, and derivatives trading as well as liquidity integrations, KYC/AML modules, and institutional-grade custody. Their solutions emphasize bank-grade security with multi-factor authentication, data encryption, and compliance with standards like PCI DSS and GDPR.

With a strong focus on time-to-market efficiency, Itexus offers both fully custom development and white-label exchange platforms, enabling clients to launch faster without compromising on scalability or compliance. Their case studies include mobile banking ecosystems, wealth management apps, and digital wallets serving millions of end users, underlining their ability to handle high-load, mission-critical projects.

2. Antier Solutions

Key Highlights:

- Founded: 2016

- Headquarters: India (global client base)

- Team Size: 500+

- Core Services: White-label exchanges, DeFi platforms, NFT marketplaces, tokenization, blockchain consulting

Company Overview:

Antier Solutions is a global blockchain development company with a strong focus on cryptocurrency exchanges and DeFi ecosystems. The company provides both white-label and custom-built solutions, enabling businesses to launch trading platforms with advanced features such as margin trading, P2P exchanges, liquidity management, and integrated wallets. Antier is also active in building NFT and DeFi platforms, delivering secure, scalable infrastructure for startups and enterprises alike. Its ready-to-deploy exchange frameworks significantly reduce time-to-market while ensuring regulatory compliance and robust security.

3. HashCash Consultants

Key Highlights:

- Founded: 2015

- Headquarters: USA (California)

- Team Size: 500+

- Core Services: Crypto exchange development (CEX/DEX), blockchain consulting, payment solutions, ICO/STO platforms, digital asset liquidity

Company Overview:

HashCash Consultants is a U.S.-based blockchain development company that specializes in crypto exchange and trading platform software. The firm provides enterprise-grade CEX and DEX solutions with built-in KYC/AML, advanced matching engines, multi-currency wallets, and liquidity integration. HashCash also develops blockchain payment processors, tokenization platforms, and ICO/STO frameworks. With a strong focus on regulatory compliance and high-performance infrastructure, HashCash has become a trusted partner for financial institutions and startups seeking to build secure, scalable, and regulation-ready exchanges.

4. SoluLab

Key Highlights:

- Founded: 2014

- Headquarters: USA (Los Angeles)

- Team Size: 250+

- Core Services: Crypto exchanges (CEX/DEX), DeFi applications, tokenization, Web3 & blockchain consulting

Company Overview:

SoluLab is a U.S.-based blockchain and fintech development firm with a strong track record of building high-performance crypto exchanges. Its expertise covers centralized, decentralized, and hybrid exchanges, integrating advanced order-matching engines, liquidity modules, and secure wallets. SoluLab also provides consulting and development for DeFi applications, token issuance, and Web3 projects. Known for its agile development approach and technical precision, the company helps businesses deliver innovative trading platforms with seamless scalability and strong user experience.

5. Inoru

Key Highlights:

- Founded: 2006

- Headquarters: India / Singapore

- Team Size: 200+

- Core Services: White-label crypto exchanges, DeFi platforms, NFT marketplaces, liquidity integration

Company Overview:

Inoru is a blockchain technology provider specializing in white-label solutions for crypto exchanges and fintech applications. Its ready-made exchange frameworks allow businesses to launch platforms quickly with essential features such as trading engines, multi-currency wallets, liquidity integration, and compliance-ready modules. Inoru also develops NFT and DeFi applications, giving clients a versatile entry point into the digital asset economy. With a strong focus on speed-to-market and cost-efficiency, Inoru is particularly popular among startups and mid-size firms seeking fast deployment without sacrificing security.

Conclusion

Building a successful crypto exchange in 2026 requires more than just technical expertise — it demands security, regulatory compliance, scalability, and a reliable technology partner. The companies highlighted in this ranking, led by Itexus, stand out for their proven ability to deliver robust CEX, DEX, and hybrid platforms. With experience across wallets, liquidity modules, and compliance frameworks, these firms provide end-to-end solutions that reduce time-to-market and mitigate risks.

Choosing the right partner comes down to aligning with a team that not only understands blockchain technology but also the financial domain it serves. With careful selection, businesses can launch exchanges that are secure, user-friendly, and future-ready — positioning themselves strongly in the evolving digital asset economy.