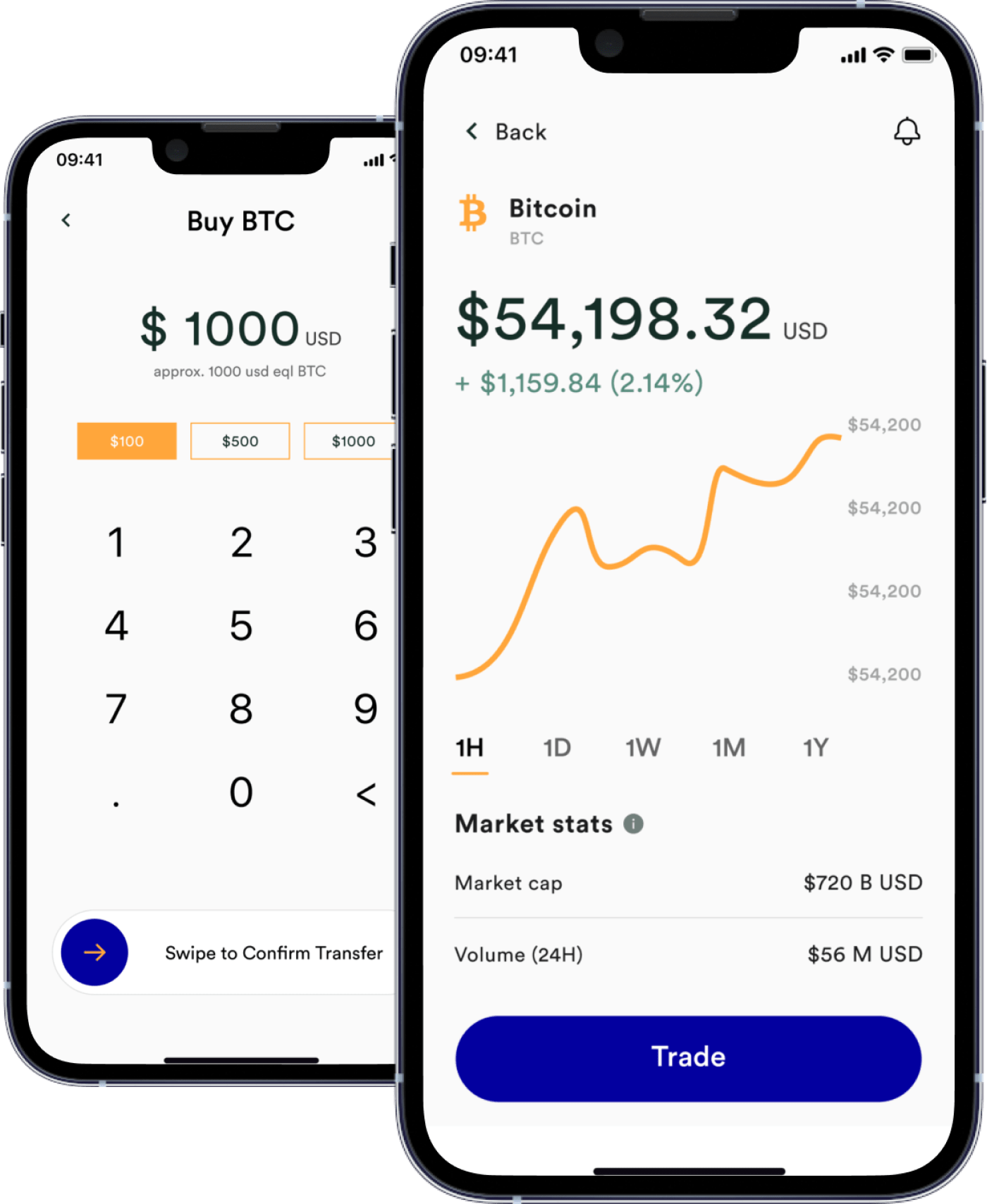

Web application that allows users to increase and diversify their retirement investments with crypto assets and helps to expand knowledge in the cryptocurrencies through educational content.

Want real numbers, not vague promises? Let’s put a price tag on building a crypto wallet, trading app, or DeFi mobile product in 2025-2026. We will unpack what drives the bill, share typical ranges, and show where a cryptocurrency app development company adds efficiency and risk control.

If you are scanning for a benchmark, start here. These are typical one-time build ranges for a professionally engineered product with a blended team and modern security practices. Actuals vary with scope, platform count, and compliance.

| App Type | Typical Scope | Delivery Timeline | Estimated Build Cost (USD) |

| Non-custodial wallet (MVP) | Wallet creation and recovery, send and receive, QR, token list, push alerts, L2 support | 3 to 4 months | $90,000 to $180,000 |

| Custodial wallet or broker app | KYC, fiat on-ramp, custody integration, card or ACH, disputes flow | 4 to 6 months | $180,000 to $350,000 |

| Trading app for a CEX or broker | Order book, market data, portfolio, advanced auth, risk checks | 5 to 7 months | $250,000 to $500,000 |

| DeFi companion app | Wallet connect, staking, swaps via aggregators, analytics | 4 to 6 months | $200,000 to $420,000 |

| Full exchange app + admin | Matching, compliance console, liquidity, multi-region rollout | 7 to 12 months | $600,000 to $1,000,000 |

A talented cryptocurrency app development company can compress timelines with proven components, but custom features, compliance scope, and security depth will still set the floor.

What actually drives the cost?

1) Feature set and depth

Each additional capability—portfolio analytics, on-ramp, swaps, staking, alerts, or referral programs—adds design, engineering, and testing hours. If you want the app to work across multiple chains and L2s, expect extra wallet, RPC, and token support work. A seasoned cryptocurrency app development company will push you to prioritize a lean first release and iterate.

2) Platforms and architecture

iOS and Android from day one costs more than a single platform. Pure native implementations provide best device access and performance; cross-platform can speed feature parity. For wallets, plan for a secure keystore approach and careful handling of seed phrases or MPC flows. For custodial models, budget for server and key management plus audit trails.

3) Custody model

- Non-custodial: Keys stay on device. You will spend more on UX around backup and recovery and on hardening the mobile client.

- Custodial: You will spend more on back-end, governance, and regulatory readiness.

A cryptocurrency app development company will help you balance user experience, liability, and ongoing costs.

4) Security depth

Security is not a task, it is an approach. Expect secure architecture reviews, dependency vetting, penetration testing, secret management, and supply-chain controls. This line item should never be zero. Independent assessments against recognized standards are common.

5) Compliance and store policies

KYC and AML checks, sanctions screening, record retention, and support for Travel Rule messaging in the back-end all affect scope. The Financial Action Task Force continues to push global alignment on virtual assets, and the pace of implementation differs by region. That reality shapes launch plans and budget buffers.

On the distribution side, both Apple and Google have specific rules for crypto exchanges, wallets, and payments that influence design and review time. You will need to meet those requirements to ship.

6) Integrations

Market data, price alerts, fiat on-ramps, fraud screening, identity verification, token lists, analytics, support chat, crash reporting, and deep link routing all add time and vendor fees. Many vendors tier pricing by monthly active users or by calls, which will flow into your run budget.

7) Design quality

Trust lives in the details. Strong UX around key moments—first launch, funding, signing, and recovery—pays for itself by reducing support tickets and abandonment. Poor UX around seed phrases or permissions can sink retention and increase fraud.

8) Team and engagement model

Rates vary by region and profile. A focused squad from a cryptocurrency app development company will usually include product management, mobile, back-end, QA, and security. A fractional model with a smaller seed team can lower burn early and scale later.

Feature menu with effort bands

Use this to sketch your MVP and see what moves the needle. The hours listed are ballpark estimates for implementation and tests per platform, excluding back-end unless stated.

| Capability | What it includes | Typical Effort |

| Wallet core (non-custodial) | Key generation, secure storage, send, receive, gas tips, token list | 160 to 260 hours |

| MPC or passkey wallet | Key shares or passkey auth, recovery flows, risk prompts | 220 to 380 hours |

| Custody integration | API integration to a custody provider, ledger sync, TX signing | 140 to 240 hours |

| KYC and onboarding | Provider SDK, document capture, retry flows, watchlist events | 80 to 160 hours |

| Fiat on-ramp | Provider SDK, callbacks, settlement status, receipts | 80 to 140 hours |

| Swaps and staking | Aggregator integration, slippage controls, approvals, warnings | 140 to 260 hours |

| Market data and charts | Tickers, OHLC, depth, watchlist, alerts | 120 to 200 hours |

| Notifications | Balance and TX alerts, system messages, deep links | 60 to 120 hours |

| Admin console | Feature flags, content management, audits, roles | 140 to 240 hours |

| App hardening | Root and emulator checks, anti-tamper, obfuscation, secure logs | 80 to 160 hours |

Multiply total hours by your blended hourly rate to get a rough feature budget. A cryptocurrency app development company will run discovery workshops to refine this, trim surprises, and align with milestones.

How to avoid budget creep

- Define the “must ship” set. Freeze a minimal path to value. Every other idea goes to backlog.

- Pick your chains early. RPC needs, token metadata, and signing logic flow from that choice.

- Lock compliance assumptions. Align on KYC, record retention, and Travel Rule exposure before building.

- Harden before you scale. It is cheaper to design for secure key handling than to retrofit it.

- Automate reviews. Add store policy checks and privacy disclosures to your release checklist. Apple and Google language moves over time.

- Plan two post-launch sprints. Fix what real users surface and keep momentum.

Choosing the right cryptocurrency app development company

Your partner choice shapes the outcome as much as your feature list. Look for:

- Crypto fluency. Teams that understand custody trade-offs, fee markets, token approvals, and L2 quirks move faster and make safer choices.

- Security practice. Ask how they approach secret storage, certificate pinning, and mobile hardening. Look for code review rituals and independent testing.

- Compliance literacy. They should speak the language of KYC, sanctions screening, and Travel Rule impacts and translate that into technical scope.

- Store readiness. Ask for examples of successful submissions for exchange and wallet apps and the checklists they used.

- Transparent pricing. Time and materials with milestone reviews keeps discovery honest and surfaces trade-offs early.

When a cryptocurrency app development company brings reusable modules and a repeatable launch playbook, you get predictable costs and faster review cycles.

FAQ

Can we launch without KYC?

If you are purely non-custodial, many markets allow it, but the moment you touch fiat, hosted wallets, or exchange activity, expect KYC and monitoring. Budget a discovery session with legal counsel to set the line.

What about audits?

Mobile and back-end security reviews are common. Smart contract audits are needed if you deploy programmable assets. Treat audits as a separate budget, scheduled after feature freeze.

How do app store changes affect cost?

Policy updates sometimes require copy edits, new disclosures, or small flow tweaks. Keep a reserve for this. Apple and Google both update crypto related guidance and region specific notes over time.

Can we reuse a web codebase?

For performance and security, native or high quality cross-platform projects are favored. You can share design tokens, business logic, and API clients, but wallet and signing logic deserve platform specific attention.

Conclusion

Most serious builds in 2025-2026 land between $180,000 and $500,000 for a trading or DeFi app, with $90,000 to $180,000 for a lean non-custodial wallet, and $600,000 plus for a full exchange app with admin and multi-region support. Your exact number depends on scope, compliance, and security depth. The smartest first step is a short, structured discovery with a cryptocurrency app development company to fix the plan, narrow the MVP, and lock the budget before design and code begin.