Why launch an MVP in fintech instead of building a full-scale product right away?

An MVP isn’t just a stripped-down product. It’s a strategic tool for hypothesis testing and the foundation of your future ecosystem. When built correctly, a fintech MVP helps you reduce risks, attract early users and investors, and create a product that the market actually needs.

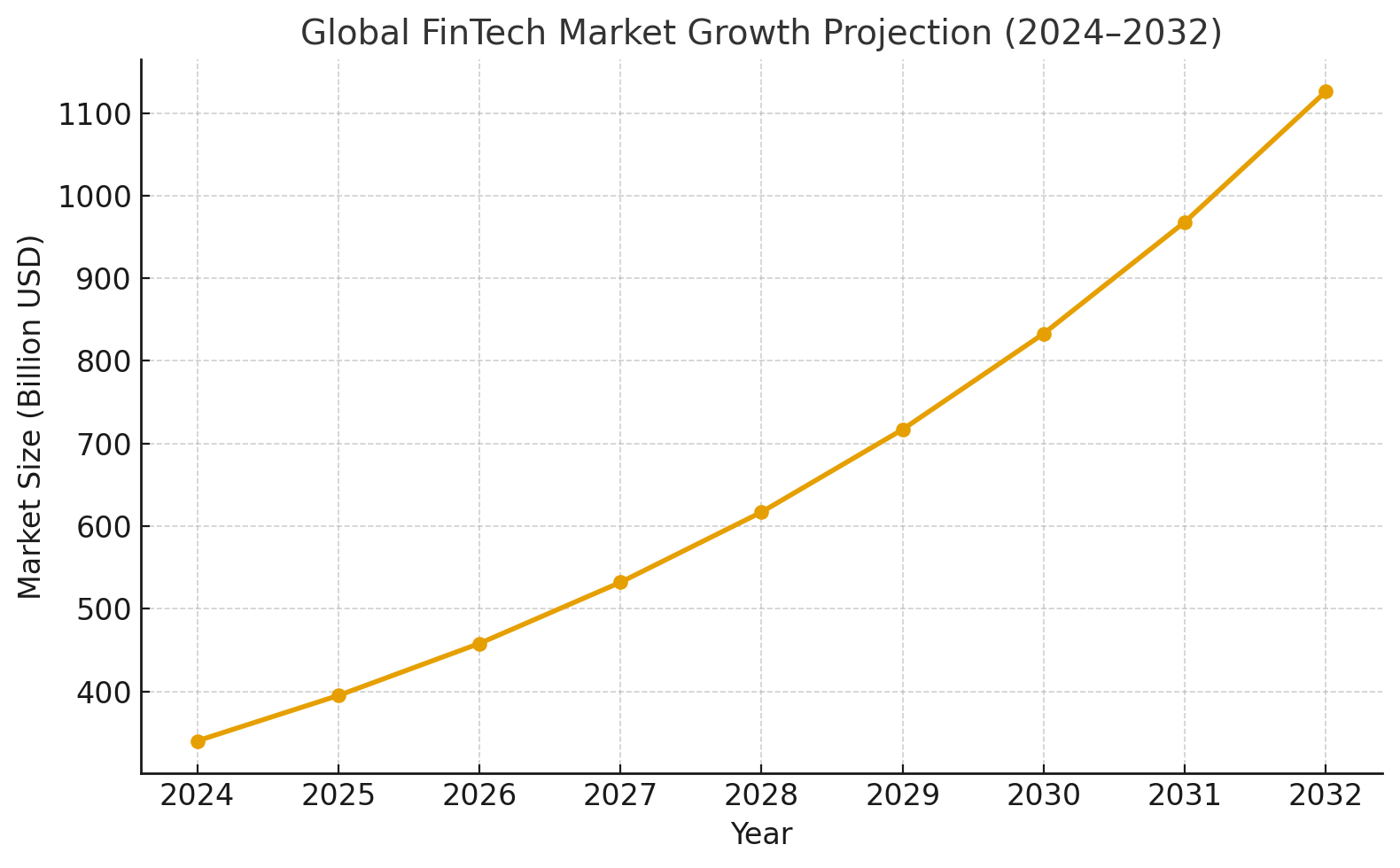

Financial technologies are on the rise. In 2025, the global fintech market was valued at $340.10B and is projected to reach $1.126T by 2032 (16.2% CAGR) — a long runway for building useful, compliant products that solve real problems. If you have a promising idea, the fastest, lowest‑risk way to validate it is a Minimum Viable Product (MVP ) — a focused, secure slice of your future platform that delivers one complete user journey.

If you’re ready to move, this guide explains what makes a strong fintech MVP, how to build one step‑by‑step, and the challenges you may face along the way.

What Makes a Good Fintech Application MVP

Before we discover how to build an MVP in fintech, let us explain this concept in brief. In a nutshell, an MVP is a stripped-down version of your product. It doesn’t have to be pretty and it doesn’t have to be perfect. It doesn’t even have to be fully functional. The core goals of a Minumum Viable Product are to validate your UI and UX solutions, and most importantly, test the response of the target audience. Following this tactic, you will be able to avoid overhead costs invested in the development of extra features the users may not need. Below are the main things that make a fintech MVP capable of reaching the goals above.

Problem-solution fit

There are two main questions your MVP should answer. The first, whether your app is capable of solving a specific user problem. The second, if it does it better than the competing solutions. That’s why before your start your MVP development, you should have a clear idea of the problem you are trying to solve and the way your product will help solve it.

Customer pre-validation

The core essence of the LEAN development methodology is to make pre-validated decisions only. The decision to build a fintech MVP isn’t an exception. That’s why you should build it already with users’ expectations in mind. As an option, you can make focus group research before the development process starts.

Minimal but scalable

A good MVP should be designed so that you’ll be able to easily expand it into a full-fledged platform without having to start over from scratch. So, think two steps ahead when choosing the tools and technologies. For example, React Native allows for creating a shared codebase for iOS and Android. So, in the future, you can transform your MVP into two native mobile apps easier and at a lower cost.

User-friendly design

It’s important that your MVP looks nice and feels intuitive to users. When a target user gets in the first touch with your app, they should be able to immediately understand how it works, where to look for core features, and how to solve the main issues. Onboarding experience your MVP delivers also matters.

Key features in the spotlight

Regardless of the industry an MVP is created for, it should come with basic features only. At the same time, these features should be enough for the users to cope with the task your app intends to solve.

How to Build an MVP in FinTech in 6 Steps

Now, let’s discover how to build an MVP for fintech, following the best practices of Agile development methodology and the LEAN approach.

Step 1: Decide on the fintech solution type and platform

The industry of financial technology is diverse. It creates a lot of different opportunities for business owners planning to develop a fintech solution. For example, you can build an eWallet app or create an application for personal finance management. You can develop a lending platform or an automated trading solution, and even launch your own neobank. Depending on the category you choose and the main use case of your app, you can either opt for web or mobile app development services.

Step 2: Conduct market research and define your target audience

Use PEST/SWOT/Five Forces to size the market and map competitors — pricing, onboarding friction, KYC steps, approval times, fees, trust cues. To accelerate competitor mapping and validate demand signals, consider using AI market research tools to synthesize primary and secondary research (reviews, forums, surveys, and reports) into clear insights you can act on. In parallel, define the regulatory perimeter relevant to your MVP:

- PCI DSS v4.0: future‑dated controls that were “best practice” became mandatory March 31, 2025 (e.g., client‑side script governance and tamper detection on payment pages). Reduce PCI scope via tokenization and gateway usage.

- DORA (EU): applies from Jan 17, 2025 — operational resilience for financial entities and ICT third parties (incident reporting, testing, third‑party risk). If you target EU financial institutions or act as a critical vendor, plan controls early.

PSD3/PSR (EU): as of June 18, 2025, the Council adopted its negotiating mandate; trilogues will focus on fraud reduction, consumer protection, and fee transparency. Keep payment modules abstracted to adapt when final texts land.

Step 3: Identify your key features

A highly-efficient MVP is one that you can build without breaking the bank. That’s why you have to invest in high-priority features only. So, what does your product need to do so that users come back and use it? Do you need more than one main feature?

For example, if you would like to create a crypto wallet that allows users to convert cryptocurrency into fiat money and then, pay utility bills, it’s obvious that you need both features for your MVP. In this imaginary case, you can limit the currency the users can use (for example, bitcoins only), and add other options later after you made sure that your idea works.

Step 4: Choose a development method

Once you’ve identified the features of your MVP, it’s time to decide how you’ll develop them. There are two main options out there: you can either hire software developers or build the MVP yourself.

Despite being a lot of little-to-no code platforms that a non-technical user can cope with, keep in mind that fintech development is a pretty specific venture. To create a powerful MVP, stay compliant with industry regulations, and tailor your future solution to your users’ expectations accurately. Also, it is still wiser to hire a dedicated development team.

Step 5: Prioritize and plan your development roadmap

Now that you know what features are the most important, it’s time to prioritize them and plan out how they’ll be added to your app over time. You should also consider how long each feature will take to build before moving on to another one so that your development process remains efficient. At this stage, it is important to stick with your vision and not lose sight of what you’re trying to accomplish. But remember that it can also be helpful if you consider other people’s experiences when planning out your project timeline. To get a realistic picture and build a viable development strategy, apply for fintech consulting services first.

Step 6: Test and validate your MVP with early adopters

Once you’ve identified and created your key features, then comes the fun part: testing them with early adopters! You can find them by reaching out to target users on social media or through other channels. For example, you may get referrals from your network. The important thing is that these people should be willing to give you detailed feedback.

As for one more option, you can use behavior tracking tools like Hotjar for a fintech website or a similar tool for a mobile app to uncover the ways users interact with your app. At the stage of MVP testing and feedback gathering, such behavior insights would be especially useful since you will be able to identify the possible gaps in your UI and fix them before moving to the next development stage.

Key MVP Features for Different FinTech Solutions

| FinTech Solution Type | Core MVP Features | Nice-to-Have Features Later |

|---|---|---|

| Digital Wallet | Registration, card linking, peer-to-peer transfers | Bill payments, multi-currency support |

| Lending Platform | Loan application, interest calculation, KYC verification | AI-based scoring, integrations with banks |

| Personal Finance (PFM) | Expense tracking, spending categories, budget creation | ML-based insights, external bank integrations |

| Crypto Wallet | Token storage, basic transactions | Fiat conversion, NFT storage |

| Neobank | Account opening, basic transfers | Investment products, credit offerings |

6 Proven Fintech MVP Development Tips to Keep in Mind

So, now you are almost ready to build your first fintech MVP. To keep your development process seamless and efficient, consider some more essential tips and practices.

Balance simplicity and functionality

Fintech solutions are usually complex things. That’s why balancing simplicity and functionality is somewhat tricky in this case. Do your best to minimize the number of required user actions and use visual prompts to guide the users on what and how they need to do.

Leverage innovation in a smart way

Fintech apps make a perfect match with such innovative technologies as artificial intelligence, data analysis, voice assistance, blockchain, and the Internet of Things (IoT). So, you will need to manage some technical complexity to make your project stand out. Partnering with a fintech software development company and leveraging their latest expertise in fintech is the right way to go.

Ensure regulatory compliance

The trick is that the regulatory framework for fintech businesses isn’t the same in different countries and even states. For example, in some of the US states, companies are allowed to offer their financial products and services without obtaining a license. There are also legal regulations fintech solutions that should be compliant with from the technical perspective. For example, The Payment Card Industry Data Security Standard (PCI-DSS).

Offer a unique value proposition

Indeed, many other companies already offer somewhat similar products and services as you plan to offer, so it’s important to set yourself apart from the competition in some way. Use brainstorming techniques for this task, for example, the Worst Possible Idea tactic.

Utilize Agile development methodology

Agile development methodology stands for developing a fintech product in short iterations. After that, development team can identify the possible issues, mistakes, and bottlenecks as early as possible. Agile development also encourages constant feedback from users about what they like or dislike about the product so that your MVP can grow alongside its users’ needs.

Conclusion

Building a minimum viable product (MVP) is a critical step in any fintech project. At the same time, this is the battle-proven and the most efficient way to ensure that the product meets customer needs. What’s more, an MVP is a foundation for your future application, so it should be technically powerful, stable, and solid. We, at Itexus, work with fintech companies all across the world. We deliver top-notch software solutions at scale, so we would be glad to help your fintech project grow too.

Drop us a line today to create a fintech MVP with great scalability potential!