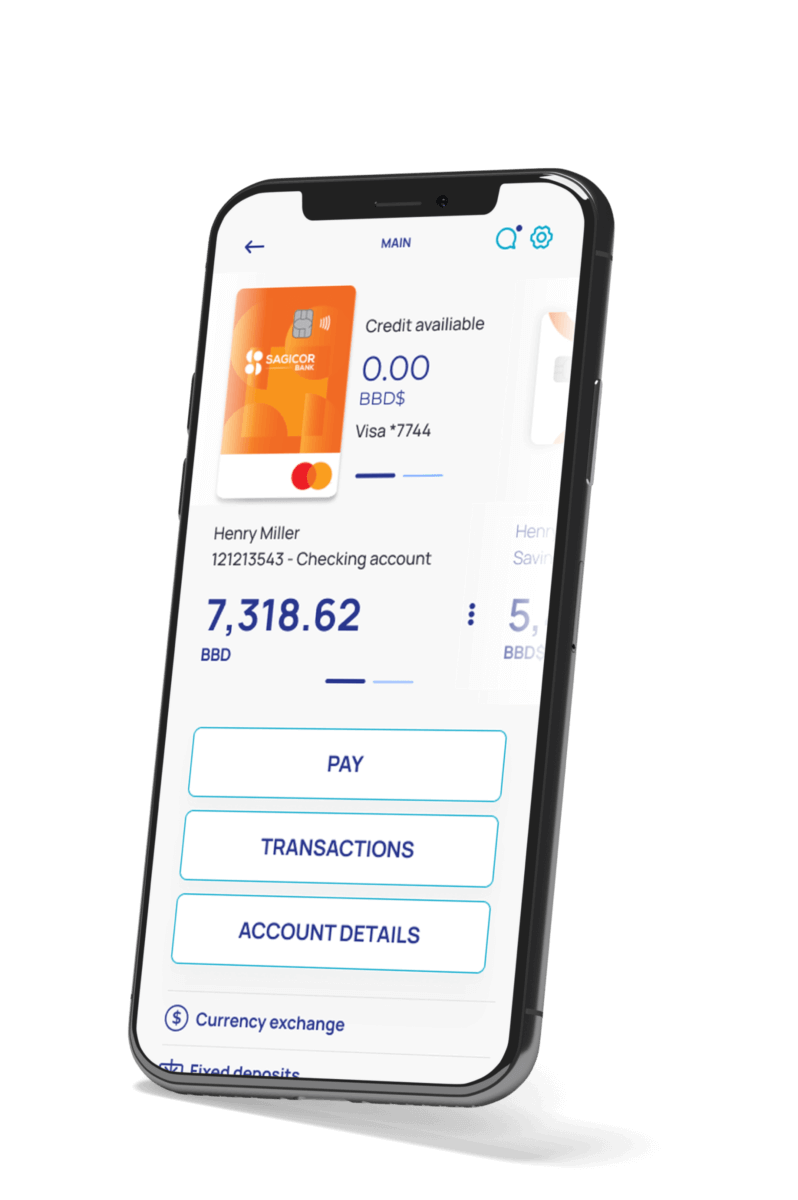

A mobile banking app that allows its users to access all banking services in a secure, convenient and fast way without having to visit bank branches.

Progressive Web Application (PWA) services are emerging as a game-changer in fintech app development. They blend the best of web and mobile experiences, enabling fintech apps that are accessible, fast, and engaging without the usual friction of app downloads. The fintech industry itself is booming – for instance, global fintech revenues are projected to reach $1.5 trillion by 2030. Likewise, digital payments are skyrocketing toward $10 trillion annually by 2025. Yet, amid this growth, fintech startups face a critical challenge: user retention. Consider that 60% of users uninstall apps within 30 days – a daunting statistic for any new fintech venture. PWAs tackle this problem by offering an app-like experience straight from the browser, eliminating app store barriers and boosting user retention.

In this article, we’ll explore how to create a fintech app using PWA services and why it matters for American investors and entrepreneurs.

Market Insights & Trends

Fintech is in a phase of explosive growth, and understanding the market landscape is crucial before building your app. Digital finance adoption has accelerated in recent years, creating a ripe environment for progressive web apps:

- Surging User Base: Digital wallet usage is at an all-time high. A recent study estimates over 4.4 billion global e-wallet users by 2025 (up from 2.6 billion in 2020). In other words, more than half of the world’s population will be using mobile wallets. This massive user base means any fintech app – whether a payment wallet, banking app, or investment platform – has a huge pool of potential users already comfortable with digital finance.

- Transaction Volume Growth: Along with users, transaction volumes are booming. The total spent via digital wallets is expected to double to about $10 trillion annually by 2025. Such growth indicates consumers’ willingness to transact digitally at scale. For a fintech entrepreneur, it signals market opportunity – there’s a growing pie to capture. For investors, it points to the ROI potential if a product can tap into even a fraction of that transaction flow.

- Fintech Industry Value: The fintech sector’s value is expanding rapidly. According to Boston Consulting Group, global fintech revenues are expected to grow nearly sixfold from about $245 billion in 2020 to $1.5 trillion by 2030. This phenomenal trajectory underscores that finance’s future is digital. High adoption rates and revenue growth suggest that well-positioned fintech apps could scale quickly and generate substantial returns.

- Mobile-First Behavior: Consumers increasingly prefer mobile and web convenience for financial services. Over 85% of consumers now favor mobile-friendly experiences – whether it’s banking on the go or one-tap payments. Unlike traditional web apps, PWAs are inherently mobile-friendly and can cater to this demand with responsive designs and app-like interfaces. The mobile-first trend means a fintech PWA that delivers smooth, on-the-go service stands to gain wide user adoption.

- Enterprise Shift to PWAs: It’s not just startups; even large enterprises are embracing PWAs. Gartner predicts that by 2025, 70% of enterprise apps will use PWA technology. This trend matters because it indicates confidence in PWAs for mission-critical applications, including in finance. As more banking and financial institutions adopt PWAs to unify their web and mobile channels, users will come to expect the same high-performance, install-free experience from new fintech offerings.

Why These Trends Matter: For entrepreneurs, these numbers highlight a sweet spot – a vast user audience, comfort with digital transactions, and a growth trajectory that rewards innovation. In practical terms, launching a fintech app as a progressive web app means you can ride the wave of digital adoption. Investors reading these trends can infer that a fintech startup leveraging PWAs is poised to scale faster (thanks to easier user onboarding via the web) and operate at lower costs while still reaching a global audience. In short, strong market indicators plus the efficient delivery model of PWAs suggest a compelling recipe for high growth and returns.

Cost Breakdown & Comparison

Developing a fintech app involves several cost components, and opting for progressive web application services can influence these costs significantly. Below is a breakdown of major cost factors and a comparison of PWA development versus traditional native apps:

Key Cost Factors in Fintech PWA Development:

- Development: This includes design and coding of the front-end (user interface) and back-end (server, database, APIs). PWAs use web technologies (HTML, CSS, JavaScript frameworks) which often allow a single codebase for all platforms. This can lower development hours compared to building separate native apps for iOS and Android.

- Security: Fintech apps handle sensitive financial data, so robust security measures are a must. Costs here cover implementing encryption (for data in transit and at rest), secure authentication (biometrics, two-factor auth), fraud detection systems, and regular security audits. PWAs must run on HTTPS with SSL/TLS encryption and often integrate OAuth 2.0 for secure logins.

- Compliance: Navigating regulations (PCI DSS for payments, KYC/AML for banking, data privacy laws like GDPR/CCPA) can add costs. Compliance costs include certification processes, legal consultations, and building features to meet requirements (e.g., audit logs, user data consent flows). Some compliance steps are the same for PWA or native apps, but PWAs might simplify certain updates – for example, pushing a compliance update via web is easier than forcing app users to download a new version.

- Infrastructure: This refers to the cloud servers, databases, and networking needed to run the app. A scalable cloud setup (AWS, Azure, Google Cloud, etc.) is typical for fintech. Costs scale with number of users and transactions. PWAs are essentially web apps, so they run on standard web infrastructure. You might save on content delivery (since a lot is cached offline by service workers) and avoid app store hosting fees.

- Maintenance & Updates: After launch, ongoing costs include fixing bugs, adding features, and updating systems (especially as regulations change or security vulnerabilities emerge). With native apps, updates require App Store/Play Store submissions and users downloading new versions. With a PWA, maintenance is often more efficient – updates are deployed to the web server and become available to all users immediately, reducing update friction and potentially lowering maintenance cost.

- UI/UX Design: A polished, intuitive user interface is crucial for customer adoption. Costs for hiring UX/UI designers to craft seamless experiences should be budgeted. Fintech PWAs need responsive design (to work on various screen sizes) and accessible layouts. While design costs are similar across app types, a PWA’s design must account for both desktop and mobile use, which can actually be cost-efficient vs. designing two separate native interfaces.

To visualize how progressive web apps compare with native and hybrid approaches, consider the following comparison:

| Development Approach | Typical Timeline | Estimated Cost (USD) | Maintenance Complexity |

| PWA (Progressive Web App) | ~4-6 months (one codebase for all) | $50,000 – $150,000† | One codebase to update (lower ongoing cost) |

| Native Mobile App (iOS & Android) | ~9-12 months (separate apps per platform) | $100,000 – $300,000+ (for two platforms) | Two distinct codebases (higher ongoing cost, separate updates) |

| Hybrid/Cross-Platform App (e.g. React Native, Flutter) | ~6-9 months (shared code for mobile, separate web app) | $80,000 – $200,000 | Single codebase for mobile, plus separate web optimization if needed |

†Note: Cost ranges are illustrative and can vary based on app complexity and region. An MVP with basic features might be on the lower end, while a complex fintech platform with advanced features will cost more.

From a business perspective, the cost savings of PWAs are compelling. Some experts estimate that PWAs can cut development costs by up to 50% while reaching 3× more users compared to native apps. This is because a PWA can tap into organic web traffic (discoverable via Google search) and doesn’t require users to find and install an app. For an investor, a lower burn rate on development coupled with a potentially larger user reach is an attractive combination – it means capital can go further, and user acquisition funnels are wider.

Additionally, consider opportunity cost: PWAs allow faster go-to-market. A PWA fintech MVP (Minimum Viable Product) might be launched in a few months to start capturing users and feedback, whereas a full native suite could take a year. Those extra months in the market can be invaluable for iterating on the product and beating competitors. And since updates on PWAs are instant (no app store gatekeepers), you can respond to compliance changes or user feedback swiftly, avoiding costly delays that might occur waiting for app store approvals.

It’s also worth noting that many top fintech software development companies offer PWA development services alongside native app development. When evaluating vendors, compare their expertise in web technologies (like React, Angular, or Vue for front-end, and secure backend development) and their experience in fintech. Sometimes a development firm with fintech domain knowledge can better anticipate compliance and security needs, which might save you money in the long run by “doing it right” the first time. In the next section, we’ll balance the technical requirements with business considerations to ensure your fintech PWA is not only built cost-effectively but also built for success.

Technical & Business Perspectives

Creating a fintech app requires juggling technical excellence with sound business strategy. Progressive web apps sit at the intersection of these, offering technical capabilities that drive business outcomes. Let’s break down the key technical features alongside the business considerations for a fintech PWA:

Technical Features and Tech Stack:

- Modern Web Technologies: PWAs are built with familiar web tech – typically HTML5, CSS3, and JavaScript, often using frameworks like React, Angular, or Vue.js. These frameworks allow building rich interactive UIs suitable for financial dashboards, real-time updates, and more. On the server side, fintech apps might use robust languages like Python (Django/Flask), Java (Spring), JavaScript/TypeScript (Node.js), or C# (.NET) to handle transactions and business logic. Ensure your stack can handle high concurrency (many simultaneous users) which is common in finance (e.g., many users checking stock prices or making payments at once).

- Service Workers & Offline Functionality: Progressive web apps (PWAs) provide offline functionality by caching critical data and transactions, enabling users to access account information and queue actions (like transfers) until connectivity returns. Implementing secure caching practices ensures no sensitive data is compromised. This capability significantly improves user experience and engagement, letting customers conveniently manage finances even in areas without reliable connectivity.

- Security Measures: Security in fintech PWAs is essential. Serve your app over HTTPS for encrypted communication, encrypt stored data, and implement robust authentication methods like biometrics or two-factor authentication. Regular penetration tests and security audits are vital. Always build security into every layer — client, server, and network — to avoid breaches.

- Compliance Built-in: Technical compliance in fintech PWAs involves securely handling data without direct access to sensitive information—typically via third-party payment gateways. Implement clear KYC/AML workflows, use trusted verification services, and securely maintain audit logs. Build compliance features (like data deletion or access requests) into your app from day one to simplify ongoing maintenance.

- Integration Capabilities: Fintech PWAs should adopt an API-first backend and microservices to simplify third-party integrations, such as banking APIs or payment processors. Consider microservices for distinct functions like payments and analytics. Use real-time technologies (e.g., WebSockets) for dynamic data streams, such as live stock prices or currency exchange updates.

Business Side Considerations:

- User Experience and Engagement: Great user experience is crucial in fintech to build customer trust. PWAs excel by providing native-like interactions, offline access, quick load times, home-screen installation, and push notifications. For example, Starbucks doubled its daily active users after switching to a PWA, showing how convenience and speed drive customer retention and lifetime value — critical metrics for fintech businesses.

- Monetization & Revenue Model: Plan your fintech monetization around strategies like transaction fees, subscriptions, interest spreads, or interchange fees. PWAs simplify monetization by eliminating app store fees (up to 30%) and enabling frictionless access through browsers—making it easier to convert casual visitors to paying customers through freemium models.

- Scalability: Entrepreneurs must ensure fintech apps scale smoothly as user numbers grow. PWAs scale efficiently through web infrastructure—using load balancing, CDNs, and cloud auto-scaling. This web-based approach reduces costs compared to managing separate native apps. With lower infrastructure and maintenance expenses, PWAs support better margins and higher ROI.

- Customer Trust & Brand Perception: Building trust is essential for fintech brands. PWAs, being installable and reliable, help build credibility. Clearly communicate data security measures (e.g., encryption, privacy assurances) and certifications to reassure users and investors. PWAs let you rapidly roll out security improvements or new features, enabling agile responses to user feedback and regulatory changes—strengthening trust and competitive advantage.

In summary, the technical foundation (secure, scalable PWA architecture) supports the business strategy (monetize effectively, grow user base, build trust). Next, we’ll look at the challenges unique to fintech app development and how to navigate them to make your venture a success.

Challenges

Building a fintech app – even with the advantages of progressive web applications – comes with a unique set of challenges. Below are some key challenges you’ll face and strategies to solve them:

- Fintech faces heavy regulatory oversight, requiring careful adherence to licensing, standards, and compliance rules. Address this by involving compliance specialists early to clarify applicable regulations and incorporate essential features such as Know Your Customer (KYC) procedures, disclosures, and audit capabilities directly into your fintech PWA. Partnering with established financial institutions through Banking-as-a-Service platforms can simplify regulatory compliance. Additionally, leverage regulatory sandboxes or conduct limited initial launches to efficiently address compliance before scaling.

- Fintech apps are frequent targets for hackers due to handling sensitive financial data and transactions. To mitigate risks, prioritize encryption, secure authentication methods (two-factor authentication, biometrics, OAuth 2.0), and regularly perform penetration tests and security audits. Maintain updated software dependencies, implement role-based access controls to limit potential damage, and establish clear incident response procedures to swiftly manage security incidents.

- Fintech apps often face intense competition, making user acquisition expensive. Stand out by targeting a specific niche—like micro-investing for Gen Z or simplified cash flow management for small businesses—and deliver an exceptional user experience. Leverage PWAs’ rapid deployment capabilities to quickly iterate, respond to user feedback, and continuously enhance features, giving your app a strategic advantage in speed and accessibility.

- Fintech apps require complex integrations with external systems like banking APIs, credit networks, or blockchain. To simplify, leverage reliable third-party APIs (e.g., Plaid for banking, Stripe for payments) to reduce complexity and ensure robust security. When building your integrations, use internal APIs that allow easy switching if a provider changes or experiences downtime. Always perform thorough sandbox testing and plan for graceful fallback options.

- Building trust is critical in fintech due to concerns about data security and financial safety. Start by launching a clear, user-focused Minimum Viable Product (MVP) that includes trust signals like transparent privacy policies, terms of service, security FAQs, and clear compliance messaging. Provide reassurance by highlighting partnerships, insurance coverage, or certifications. Leverage PWAs’ frictionless onboarding (“no download needed”) and consider offering demos without full sign-up. Display authentic user testimonials and actively incorporate user feedback to foster confidence from the start.

- Fintech apps must consistently deliver smooth performance across diverse devices and unreliable networks to avoid losing customers. Ensure your PWA remains lightweight by minimizing large libraries, using techniques like tree-shaking and code splitting, and rigorously caching key assets for faster loading. Test performance extensively across different devices, browsers, and network speeds, using tools like Google Lighthouse for audits. Optimized PWAs can load within 3 seconds even on slower connections, broadening your potential market and reducing user drop-off.

In tackling these challenges, one overarching recommendation is partnering with experienced fintech developers or agencies. A development partner who has built fintech apps before will be familiar with the compliance landscape, security must-haves, and common pitfalls. They can implement best practices from day one, saving you costly do-overs. Many startups also consider building an MVP in-house for core IP and then outsourcing certain components to specialists.

Another good practice is to start small and iterate – release your app to a beta group or a small geography, learn from that, improve security and features, then expand.

In summary, while fintech app development has challenges from regulation to user trust, none are insurmountable. By anticipating these issues and using smart solutions (often enabled or enhanced by PWA tech), you can significantly de-risk your venture. Now, let’s look at some real-world examples of fintech companies using progressive web apps, to ground these insights in reality.

Real-World Examples

Progressive web applications are already making waves in fintech and related industries. Below are two examples of companies and use-cases that illustrate how PWAs can be leveraged successfully:

- Digital Payments: PayPal offers a seamless web experience similar to a native app, allowing users to manage transactions, payments, and wallets directly in their browser without installing anything. This PWA-style approach helps PayPal reach more users through frictionless access. Similarly, fintech startups can leverage PWAs and payment links or QR codes to easily capture customers without app downloads, boosting user adoption through instant access.

- Digital Banking: Airtel Payments Bank uses a PWA to provide banking access to underserved populations without requiring advanced smartphones or strong connectivity, rapidly scaling to millions of users. Similarly, U.S. neobanks leverage PWAs to deliver seamless, secure banking experiences accessible from any device, enhancing trust and customer engagement.

Each of these examples highlights a common theme: PWAs enabled these companies to reach more users with less friction and provide a stellar user experience that drives growth. For investors, seeing a fintech company leverage PWA technology could be a green flag – it shows the company is leveraging modern, cost-efficient methods to scale and not relying solely on users downloading native apps in a crowded app marketplace. For entrepreneurs, these examples provide a playbook of what’s possible.

Recommendations

Actionable Recommendations for Investors: When evaluating fintech startups, focus on their tech strategy – especially if they use PWAs for efficient growth (one codebase, quick deployments). Verify their plans for scalability, security, and compliance. Companies launching a PWA MVP first often test market demand faster and at lower cost. Prefer fintech ventures that are agile, user-focused, and strategically leverage PWAs.

Actionable Recommendations for Entrepreneurs: to successfully create a fintech PWA, clearly define your value proposition and start with a focused MVP that builds trust. Choose a reliable fintech development partner experienced in PWAs, prioritize security and scalability, and set up robust CI/CD pipelines. Budget thoughtfully, including buffers for compliance and security audits. Conduct extensive UX testing to ensure ease of use, launch initially in a small region, and iterate based on real user data. Clearly communicate PWA benefits—like easy access without downloads—to boost adoption. Continuously prepare your infrastructure and compliance practices for scalability as your user base grows.

Conclusion

Progressive web application services offer a powerful avenue for creating fintech apps that are both technically robust and business-smart. They allow fintech entrepreneurs to compete with larger players by leveraging the open web to reach customers directly. For investors and founders alike, understanding and utilizing PWAs could make the difference in capturing the next wave of digital finance growth.

The fintech market’s future is bright (and rapidly digitizing), and with PWAs as part of your strategy, you can ensure your fintech app shines in that future. Now is the time to take action – whether it’s conducting further research, assembling the right team, or consulting a fintech software development company – to turn your fintech app idea into a reality. Good luck on your journey, and may your fintech venture prosper with the power of progressive web apps!