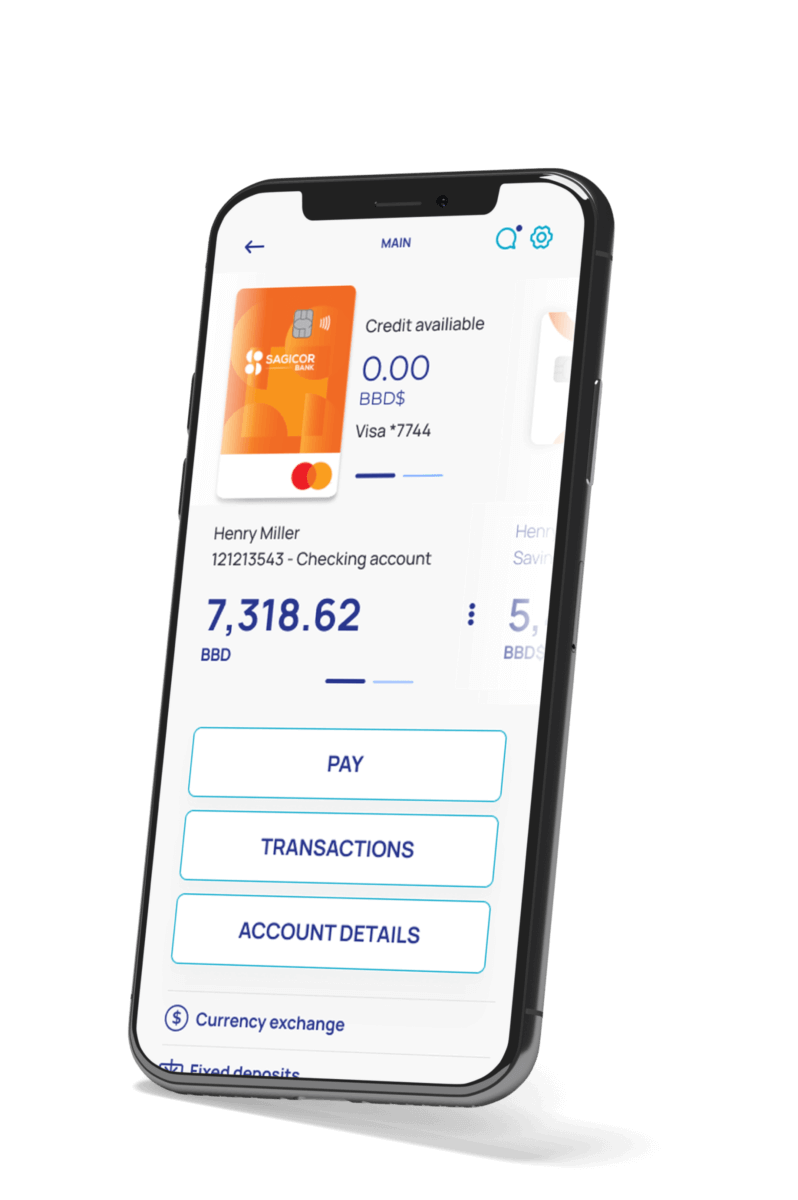

A mobile banking app that allows its users to access all banking services in a secure, convenient and fast way without having to visit bank branches.

Investment banking, a linchpin of global financial markets, has increasingly embraced advanced software solutions to navigate the complexities of modern financial operations. From improving efficiency to ensuring compliance, these solutions are revolutionizing how investment banks function. This article delves deeper into the landscape of investment banking software, its components, benefits, challenges, and the future it promises.

Defining Investment Banking Software Solutions

Investment banking software solutions are specialized platforms designed to enhance the performance and operations of financial institutions. They encompass tools for managing trades, portfolios, risks, compliance, and client relationships. These solutions cater to the needs of a highly competitive and regulated industry by leveraging cutting-edge technologies.

Core Categories of Investment Banking Software

| Category | Purpose | Examples |

|---|---|---|

| Trading Platforms | Enable secure, real-time execution of trades in stocks, bonds, and derivatives. | Bloomberg Terminal, Refinitiv Eikon |

| Customer Relationship Management (CRM) | Enhance client interactions, deal tracking, and customer data analysis. | Salesforce Financial Services Cloud |

| Risk Management Tools | Assess, monitor, and mitigate financial risks. | SAS Risk Management, IBM Risk Analytics |

| Regulatory Compliance | Ensure adherence to financial regulations and mitigate legal risks. | Wolters Kluwer, MetricStream |

| Portfolio Management | Facilitate portfolio construction, optimization, and monitoring for clients. | FactSet, Morningstar |

| Data Analytics and AI Tools | Leverage AI for market insights, decision support, and predictive analytics. | Palantir, Tableau |

Key Benefits of Investment Banking Software

1. Operational Efficiency

Investment banking involves numerous repetitive processes. Automation, powered by software, reduces manual errors and accelerates processes like settlements, reporting, and account reconciliation.

2. Enhanced Decision-Making

Real-time analytics and AI-driven insights empower banks to make informed decisions faster, providing a competitive edge in fast-moving markets.

3. Improved Client Services

Software solutions like CRM systems enable personalized client engagement by tracking client preferences, transaction history, and feedback.

4. Regulatory Compliance

With financial regulations constantly evolving, these solutions ensure that institutions remain compliant, avoiding penalties and reputational risks.

5. Scalability and Adaptability

Modern platforms are built to scale as institutions grow, offering flexibility to adapt to new market conditions and technologies.

6. Cost Optimization

By reducing dependency on manual labor and streamlining operations, investment banking software significantly lowers operational costs over time.

How Technologies Are Shaping Investment Banking

Artificial Intelligence and Machine Learning

AI provides predictive analytics, automates complex processes, and improves fraud detection. For example, AI can analyze vast datasets to forecast market trends or evaluate the financial health of companies for M&A activities.

Blockchain Technology

Blockchain offers transparency and security, especially in trade finance and settlements. It minimizes risks related to fraud and ensures immutable transaction records.

Cloud Computing

Cloud platforms allow global teams to collaborate in real time, reduce infrastructure costs, and enhance data accessibility and storage.

Robotic Process Automation (RPA)

RPA automates tasks like data entry, reconciliation, and compliance monitoring, freeing up human resources for strategic initiatives.

Natural Language Processing (NLP)

NLP improves customer service chatbots and simplifies the extraction of critical insights from complex documents.

Real-World Applications

- Mergers & Acquisitions (M&A) Tools like DealCloud streamline due diligence, deal tracking, and transaction management for seamless M&A activities.

- Trade Execution Platforms like Refinitiv and Bloomberg provide robust trading environments with advanced analytics and reporting.

- Wealth Management Robo-advisors integrated into platforms like Morningstar help wealth managers design and optimize client portfolios.

- Risk and Compliance Management IBM’s Risk Analytics platform enables precise risk forecasting and compliance with dynamic regulatory requirements.

Challenges in Implementation

| Challenge | Description | Mitigation |

|---|---|---|

| Legacy Systems Integration | Difficulty in aligning new solutions with outdated infrastructure. | Gradual migration, modular integration. |

| High Implementation Costs | Initial investments can be significant for advanced tools. | Opt for scalable cloud-based or modular solutions. |

| Cybersecurity Risks | Increasing digitalization introduces vulnerabilities to cyber threats. | Robust encryption, multi-factor authentication, and continuous monitoring. |

| Regulatory Adaptation | Adapting to ever-changing financial regulations can be resource-intensive. | Automated compliance tools and AI for real-time updates. |

Future Trends in Investment Banking Software

1. Quantum Computing

Quantum computing is set to redefine data analysis by enabling ultra-fast computation of complex financial models, such as risk simulations and portfolio optimization.

2. Predictive Personalization

Advanced AI algorithms will enable hyper-personalized services, allowing banks to anticipate client needs and deliver tailored solutions.

3. Decentralized Finance (DeFi) Integration

As blockchain matures, decentralized finance tools will become integral to investment banking, offering clients more control and transparency over their investments.

4. ESG-Focused Solutions

Environmental, social, and governance (ESG) considerations are becoming central. New platforms will integrate ESG metrics into investment decisions and reporting.

5. Unified Platforms

The future lies in platforms that integrate CRM, risk, compliance, and trading tools into a single cohesive system for seamless operations.

Conclusion

Investment banking software solutions are not merely tools; they are strategic enablers of growth, efficiency, and compliance in an increasingly complex financial environment. By embracing advanced technologies like AI, blockchain, and cloud computing, investment banks can achieve greater operational resilience and client satisfaction. The future promises even more integration, intelligence, and innovation, making these solutions indispensable for any forward-thinking institution.

Whether you’re considering your first platform or upgrading to the latest technology, selecting the right investment banking software is the key to staying competitive in the ever-evolving financial landscape.