Itexus delivered the app according to the requirements. The team met all development milestones and deliverables. They were efficient, friendly, and cooperative. Itexus team was very timely with updates, a regular meeting cadence, and ad-hoc questions and answers via Slack. The team was very responsive and still is.

Mobile Banking App Development

We build mobile banking apps for banks, credit unions, and DeFi platforms – enhancing security, streamlining operations, and improving service delivery.

Mobile Banking Apps We Build

Full-featured applications that provide access to traditional banking services such as checking accounts, savings, payments, and transfers via mobile or web platforms.

Apps that enable users to manage cryptocurrencies, including buying, selling, storing, and transferring digital assets securely.

Fully digital, branchless banking apps that offer services like account management, payments, and financial planning, often with innovative features and low fees.

Tailored platforms for managing personal or business loans, including credit scoring, application processing, and repayment tracking.

Applications designed to facilitate quick and secure domestic and international money transfers with features like currency conversion and real-time tracking.

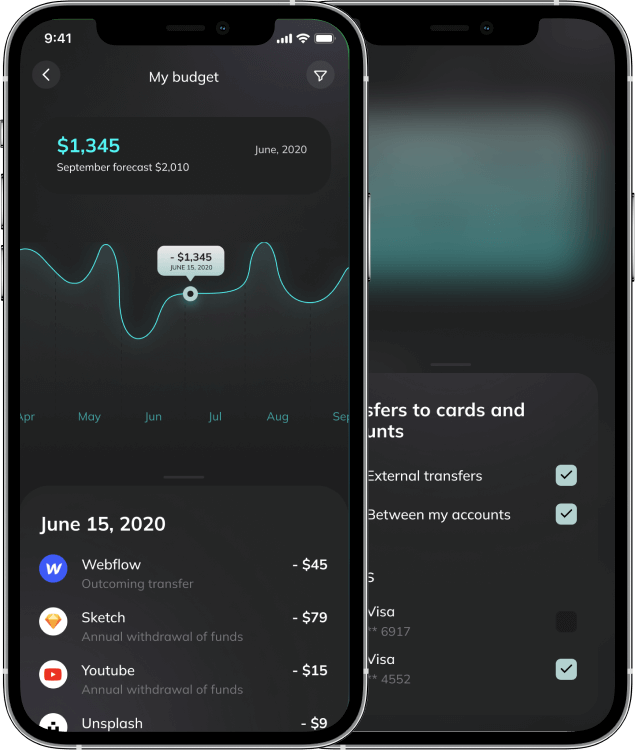

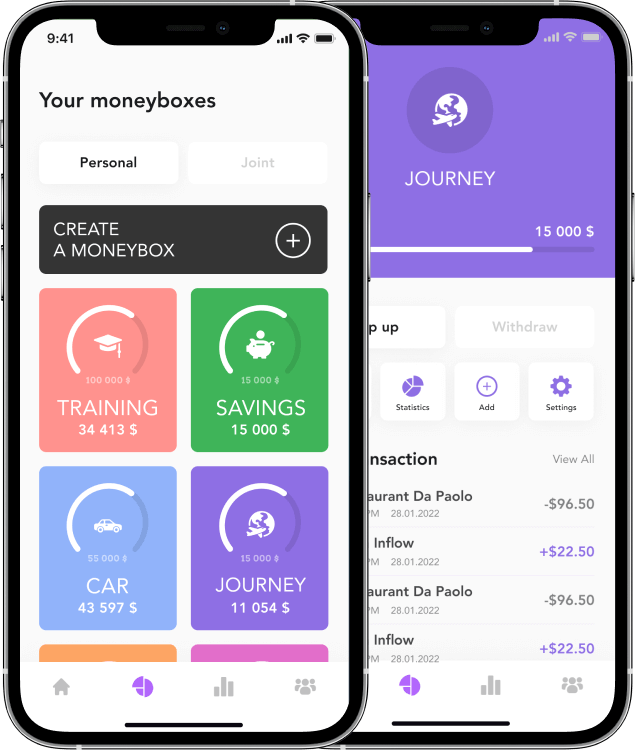

Tools that help users monitor and categorize spending, set budgets, and get financial insights for better money management.

Our Mobile Banking App Development Projects

PCI DSS-compliant application ecosystem for Coinstar, a leading international fintech company with $2.2 billion in annual revenue. This ecosystem features web and mobile crypto wallets, embedded kiosk software, and a cloud-based API server, enabling users to trade cryptocurrencies and over 50 digital assets, make crypto payments, and link their bank accounts for fiat-to-crypto conversions.

Banking App Development Services

We leverage our expertise and rely on both the latest and time‑tested technologies to offer established development and delivery processes, and ensure robust architecture and stable code.

We apply our extensive experience in business analysis to investigate your problem and offer you the best solution tailored to your individual goals.

We redesign and re‑engineer outdated banking software of any complexity, migrate them to the cloud or between clouds, and implement new functionality to streamline processes and optimize operational costs.

We’ll research and select the appropriate third‑party providers for your needs, which our technical specialists can then securely integrate into your solution.

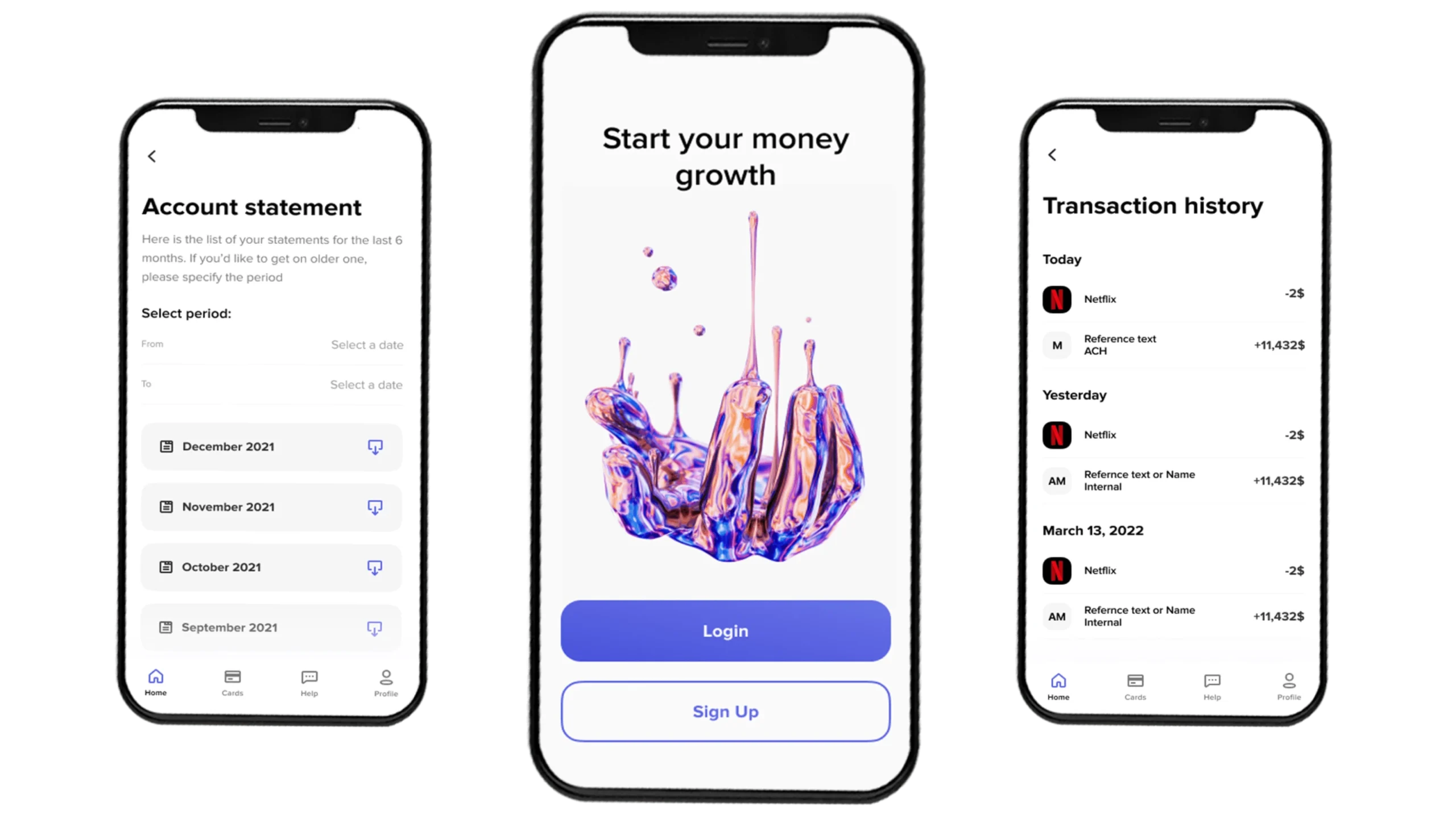

By creating engaging, clear, and intuitive product designs, we help banks and non‑banking financial institutions build trust, create brand messaging that resonates, and delight their users with stellar digital experiences.

Our QA specialists apply the full range of manual, automated, security, usability, and penetration tests to ensure your solution is bugless, shielded, efficient, and ready for launch.

Along with digital banking development services, we offer results‑oriented and cost‑effective support and maintenance for your app to ensure top performance, permanent availability, and timely updates.

From PCI DSS to GDPR, your app will meet key regulations and the highest security standards — keeping both your business and your customers safe.

We’ll boost your system’s speed and capacity, making sure it can handle more users and meet growing demands with ease.

Our experts handle cloud environments and DevOps best practices to make sure your app runs fast, updates smoothly, and stays reliable as it grows.

We help you use data to make better decisions, personalize services, and enhance customer satisfaction.

Thinking about building a better banking app?

Itexus is a banking app development company that builds secure, intuitive apps aligned with your business needs. We handle everything from compliance to growth.

Core Features of a Banking Application

Authentication and authorization

Secure and convenient sign‑in with biometric 2FA (e.g., Face ID, Touch ID).

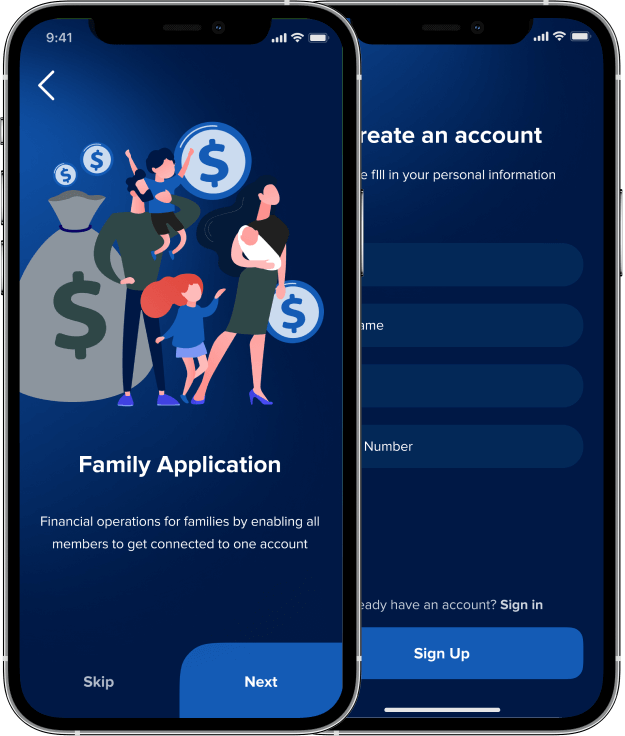

Customer onboarding

Fast, convenient, and secure creation of customer accounts with a digital KYC process — personal verification, biometrics, and ID document verification.

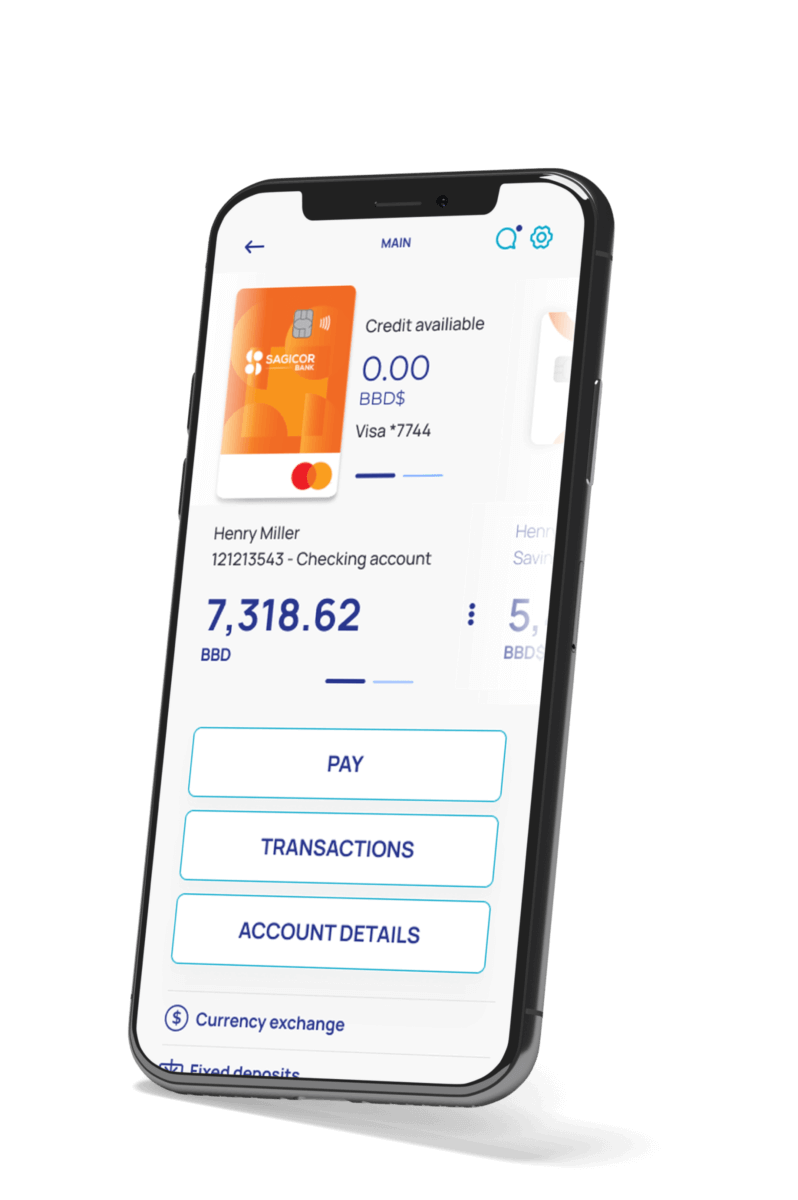

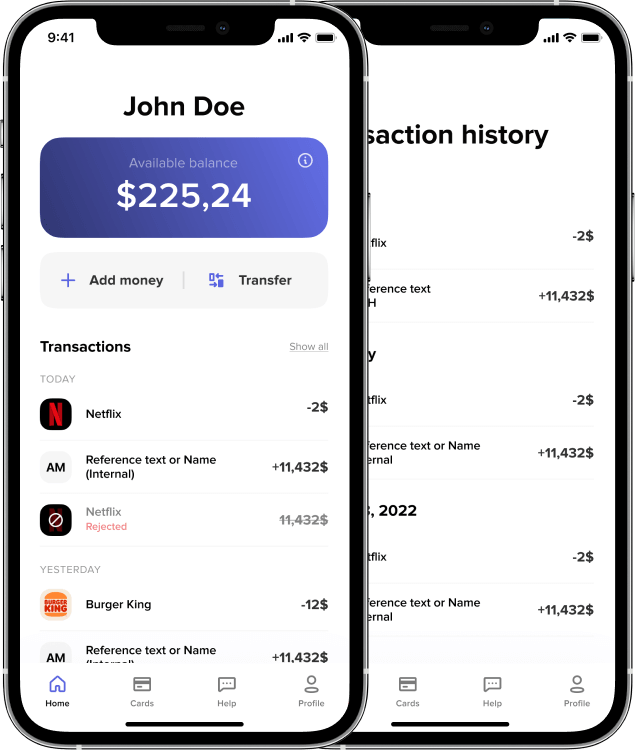

Account management

Instant opening of bank accounts, remote closing of accounts, viewing account balances, replenishing accounts, performing transactions from accounts, viewing and sharing account details, sharing accounts between different users (e.g., one account for the whole family).

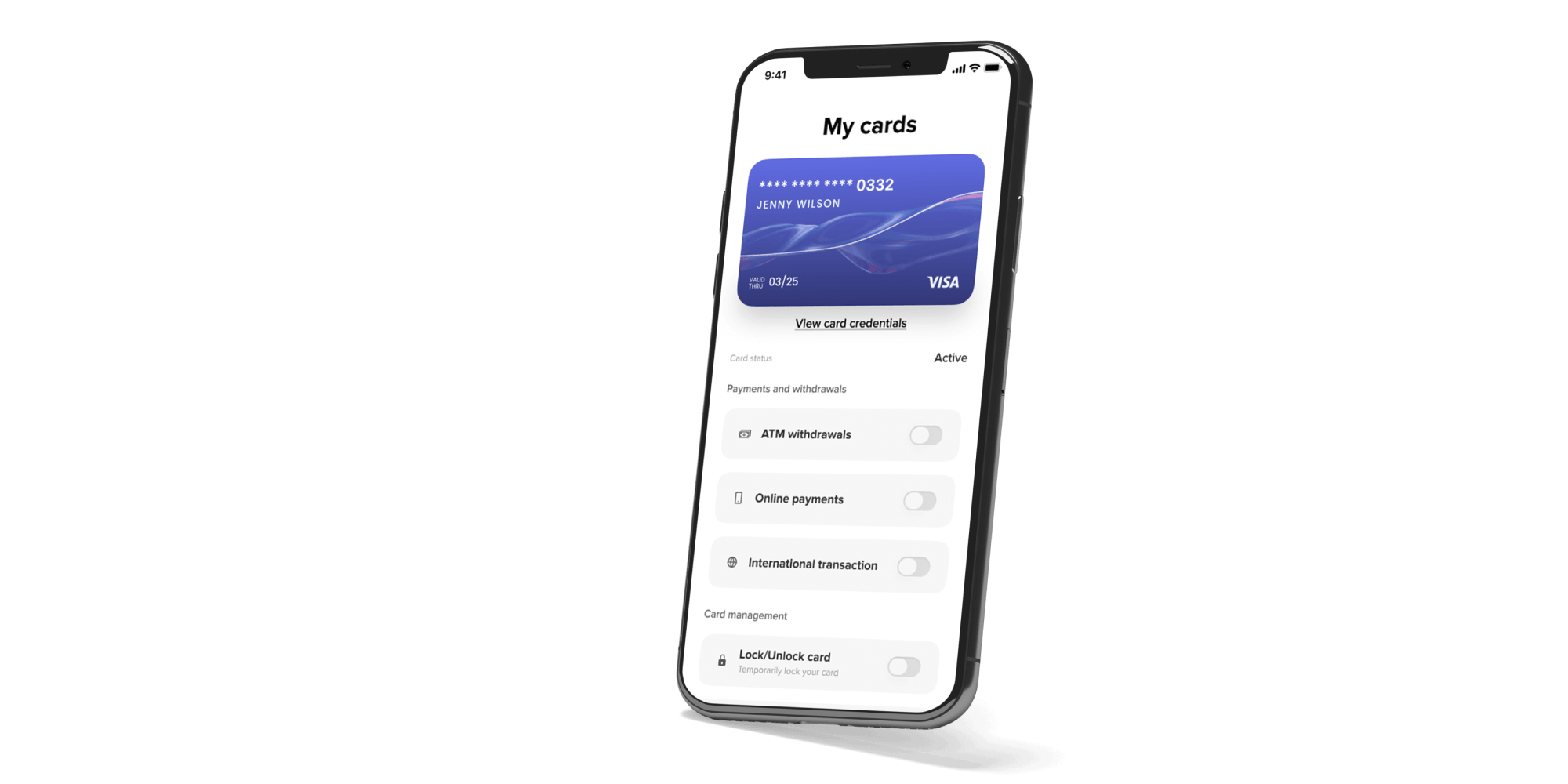

Card management

Issuing virtual and physical cards, viewing and sharing card details, card management (renaming, activation, blocking/unblocking, etc.), velocity rule management (setting limits and selected merchants, etc.).

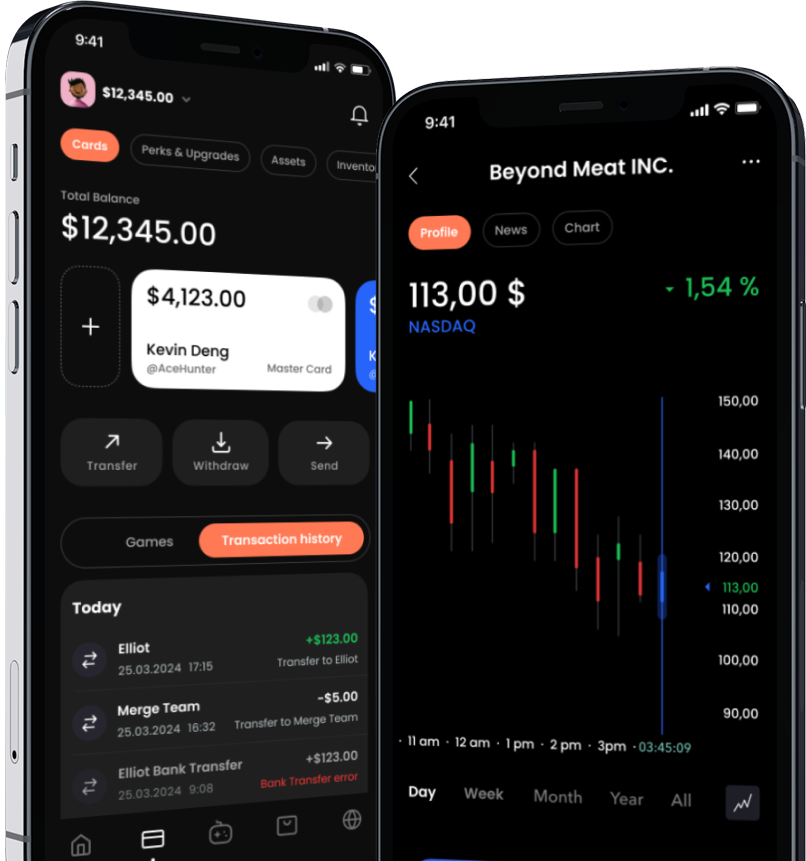

Payments and money transfers

Simple, secure and instant payments and money transfers that comply with PCI DSS and are verified by biometrics, OTP, or the user’s password to ensure accuracy and security. We can enable the following types of transactions: instant payments between your customers, ACH transfers, card‑to‑card money transfers, scheduled payments.

Transaction management

Allows your users to keep track of their finances by accessing transaction history, details, and a filtered search for certain transactions.

External payment methods management

Connect and manage bank accounts/credit cards of other financial institutions.

Bill payments

Comprehensive bill payment service that enables your users to view, organize, schedule, and pay both recurring and one-time bills directly through the app and keep track of due dates.

Customized dashboard

The dashboard allows users to see all important data at a glance: balances (cards and accounts) updated in real time, pending payments, recent transactions, etc.

Spending tracker

An easy way to let your users track their spending, view categorized transactions, set weekly/monthly budgets, and set and track progress on saving goals.

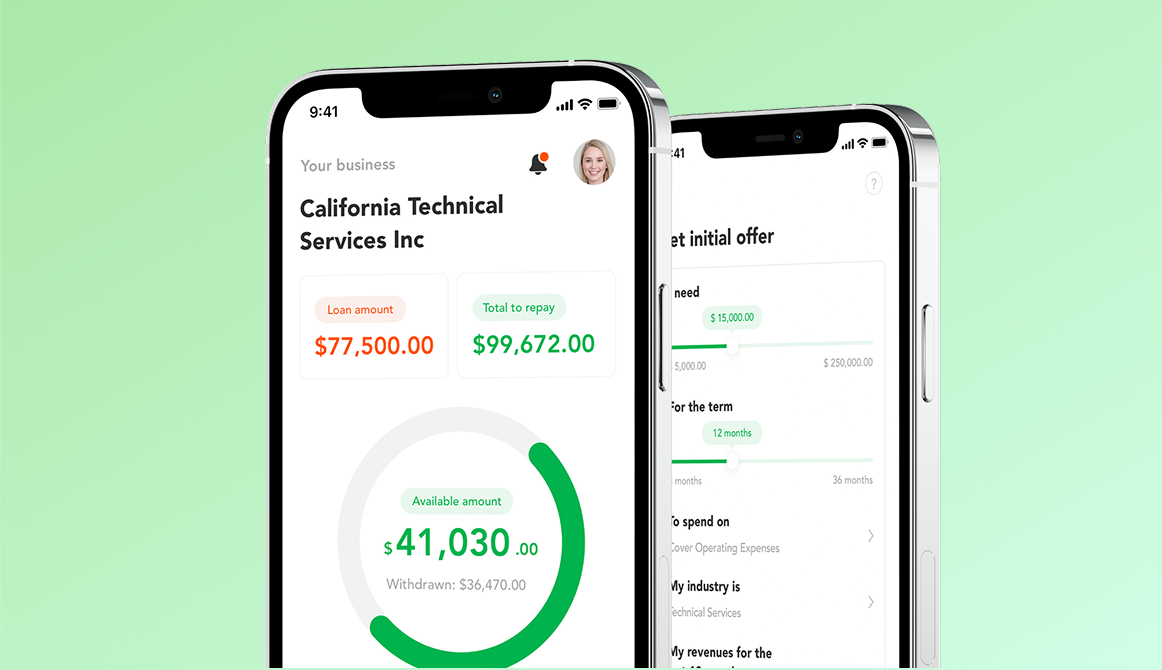

Digital lending

Automate the entire lifecycle of a loan with a digital lending feature that includes a loan calculator and credit scoring. From online loan application and underwriting to data-driven decision making, loan disbursement, and collection. Digital lending can also be implemented as a standalone solution.

Personal manager/customer support

Respond and resolve cases quickly and efficiently with convenient options for accessing customer support – a chatbot and call request form.

Notifications center

In-app and push notifications are powerful tools for increasing customer engagement and promoting new offerings. They allow users to get instant information about transactions, which also increases the app’s security by alerting fraud attempts.

Ready to work with experienced mobile banking app developers?

and we’ll get back to you within 24 hours to sign the NDA and discuss the next steps.

with a team of expert software architects, fintech analysts, and UI/UX designers.

including software architecture, functionality, UI/UX design, and a detailed cost estimate with a feature-by-feature breakdown.

If you like the proposal, we’ll sign the contract and start development within 1-2 weeks, and get your MVP live in 3-4 months.