Business Insider Intelligence’s Global Neobanks Report estimated that there were 39 million neobank users as of the end of 2019. According to the data provided by Airnow, as of May 2020, six digital banks included in this statistic had over 30 million IOS and Android app downloads combined.

In this article, we’ll take a closer look at the neobank business model. You’ll find out about its peculiarities, challenges, and future.

Traditional Banks vs. Neobanks

In a nutshell, the main difference between neobanks and traditional banks is that the former is 100% digital. Neobanks strive to make trips to the bank branch a relic of the past. It doesn’t have any physical offices and interacts with the clients via remote tools only — phone, email, and chat. All the products in neobanks are gathered in a handy mobile app that helps users to access their money 24/7. These apps are innovative and design-driven, with an interface that makes them very user-friendly. Neobank apps often have a number of features that allow you to customize services to your own needs.

Here are the major advantages of the neobank business model over traditional banking:

✅ Lower fees. You’ve probably noticed that traditional banks charge for practically everything: a direct deposit transfer, going below your minimum balance or over the limit, and delay in payments. Neobanks don’t. With no offices and in-person consultants, they have fewer operational costs and share their benefits with clients.

✅ Orientation towards customers. Neobanks offer higher interest rates — from 0.9 to 1% for savings and checking accounts, while traditional banks offer only 0.1 – 0.5%. You’ll certainly feel the difference. However, you will feel the difference if you accumulate a significant amount of money. Also, neobanks offer significant flexibility for customers who can choose what services they need rather than buy a package.

✅ Ongoing compliance and accessibility. Customers of traditional banks have to face lengthy processes for completing and submitting information for ongoing compliance. In neobanks, any ongoing compliance requirements can be handled digitally, so the process is faster and more efficient. Customer location does not matter either.

✅ Personalization. Usually, neobanks focus on a particular buyer, which helps them research the market and study the needs of their customers more thoroughly. They not only get smaller fees for bank services but also cool personalized offers and bonuses.

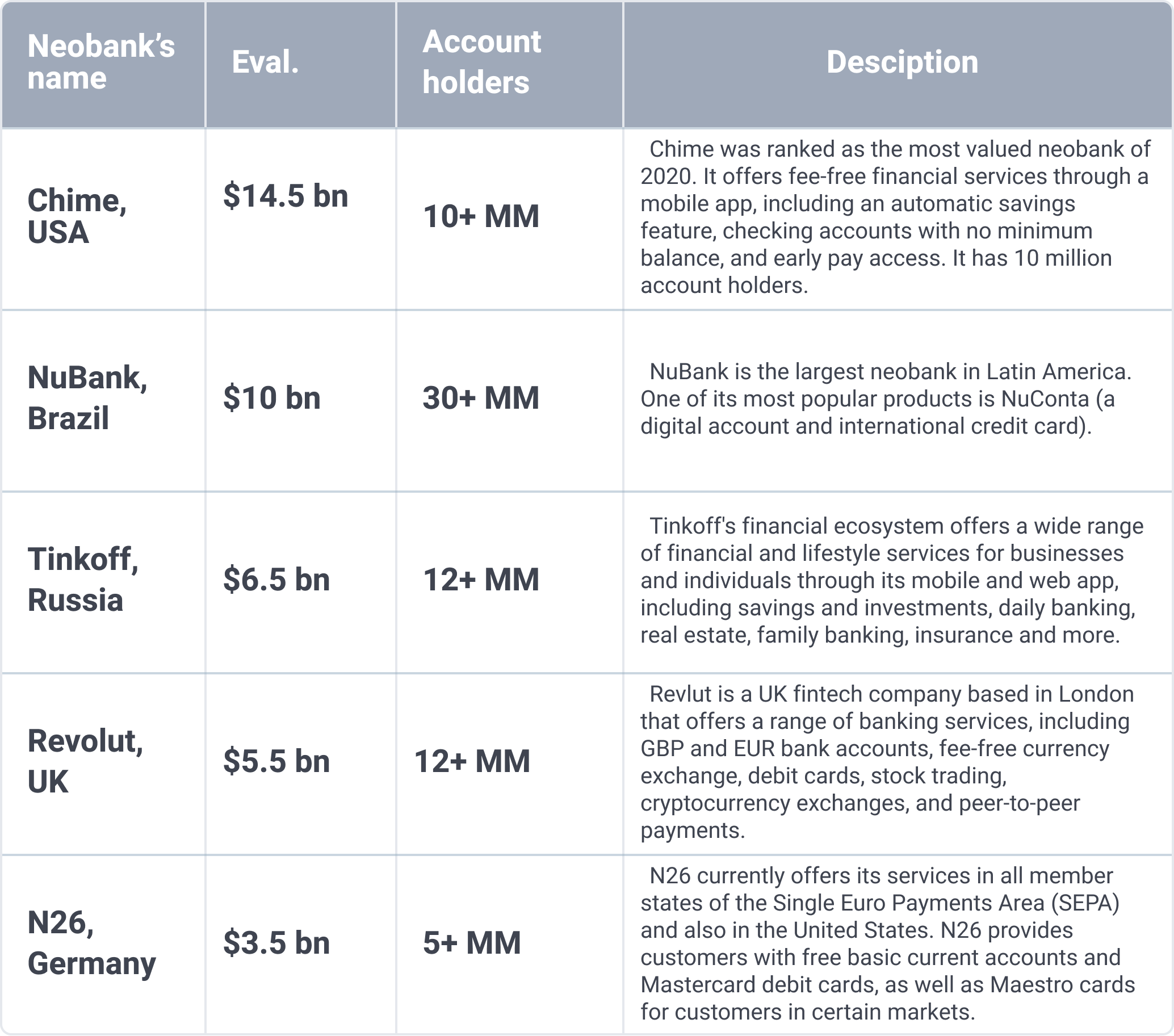

Core NeoBank Players on the Market

Here are the top 5 neobank market leaders.

Neobank Business Model

Neobanks can choose between three business models:

1. Obtain a full-fledged business license like a traditional bank. Example — Monzo.

Some neobanks have received a bank license, and their regulation is no different from traditional banks. At the same time, some countries have introduced a limited type of bank license specifically for the needs of neobanks, which is granted as an intermediate stage before obtaining a full-fledged license. In such cases, neobanks can build up their resources to enter the banking sector without reducing regulatory requirements. Neobanks in the UK and Australia can usually opt for this type of business model.

2. Cooperate with a traditional bank. Example — Chime.

In this case, all obligations to comply with regulatory requirements, together with credit risks, rest with partner banks, while the neobank provides only technological solutions.

3. Opt for a mixed model. Example — Bext.

Some neobanks are licensed only for some financial services and do the rest through partnerships with traditional banks. For example, in Europe, EMI (Electronic Money Institution) license allows a neobank to issue cards, transfer funds, and issue electronic money. Other services, such as deposit accounts, can only be provided by neobanks through cooperation with traditional banks.

Neobank App Development: Things to Consider

With over 200 successfully delivered fintech products, Itexus has a deep understanding of the industry in general and neobank app development in particular. Although launching a neobank is less costly, there are certain challenges that need to be overcome to bring a viable solution to the market.

✅ Business challenges

The biggest challenge for emerging neobanks is competing with traditional banks. To stay in the game, neobanks must:

- Find a suitable customer segment they want to target.

- Target a broad range of customer segments and offer products and services that traditional banks do not.

- Consider partnering with traditional banks.

- Adapt to the regulatory requirements of the geographic region that the new bank will cover.

✅ Technology challenges

The biggest technological challenge for neobanks today is getting to the top of the field. Neobanks are already much better equipped technologically than their traditional banking counterparts, so we will see competition among neobanks.

Success in this field means being a trendsetter. It’s not just about the technologies used, but also the range of services offered, UI /UX, and an effective marketing campaign to increase brand recognition (see Monzo with its cool minimalist cards). This is where the experience of a fintech development company can help fill the gaps and improve the neobank’s technological capacity. A trusted development partner can take on multiple functions, allowing the company to focus on business development and customer experience.

✅ Regulatory challenges

Before starting and operating a neobank, consider the regulatory environment in the region where you operate. Europe has simpler regulatory mechanisms and offers regulatory support in the form of the Payment Services Directive. A number of countries in Asia are also now considered promising environments for neobanks, as they have huge populations underserved by banking services and milder regulatory requirements.

Future of Neobanking

A lot of neobanks, such as 26, Monzo, and Revolut, have already become household names, and valuations of the biggest neobanks now run into the tens of billions of dollars. The question is if this trend continues. Here are major trends neobanks will face in the nearest future:

• Neobanks will share customers with traditional banks. Switzerland, one of the world’s most advanced nations for banking, illustrates the popularity of neobanks. According to the 2020 release of the Swiss Payment Monitor, one-tenth of 1,200 Swiss residents that were surveyed have used new online-banking solutions at least once. However, around three-quarters of neobank users combine neobank with traditional banking services. So far, people are not ready to transition to a completely cashless environment. The eradication of cash as a means of payment was “not an option” for around three-quarters of those surveyed.

• The strong will survive. We expect that not all operating neobanks will remain afloat in 2021. The successful ones will keep their adoption rate growing while having enough experience and big pockets to sustain the pandemic.

• Neobanks will need to rethink their strategy. They should take a step forward and start thinking of an IPO corporate company rather than a start-up. It will give more credibility and security to potential customers. We expect to see more partnerships to create new opportunities to reach new consumers and increase neobank brand awareness.

• Latin America is anticipated to become a global leader in neobanking. There is a significant proportion of the unbanked and underbanked population plus a high smartphone penetration rate.

Summary

Today, neobanks are taking the world by storm as Generation Z and their successors choose neobanks to benefit from the speed and convenience of personal financial management. There is still a place for new digital banks in the market, but competition is getting tougher. To gain a competitive edge, you need to offer a sophisticated solution with features tailored to your target audience. Itexus is ready to help you do that and become your neobank development partner. We cover the entire development process and have BAs, designers, and developers with extensive experience in FinTech. We provide FinTech consultants and guide you through all analysis and development processes until the neobank launch. After that, we provide regular technical support. We ensure that your customers receive the best neobanking services. Contact us for a consultation!