Autonomous B2B Billing & Payments Platform for a Global Fintech Provider

A large-scale autonomous billing ecosystem for an international fintech organization operating in the B2B payments sector. The platform automates invoicing, payment processing, KYB verification, financial reconciliation, and back-office synchronization - helping service-based businesses eliminate manual billing operations, reduce errors, and accelerate cash flow.

About the Client

The client is a rapidly growing global fintech company focused on automating B2B financial operations. The organization provides digital infrastructures that allow service providers to streamline billing, reduce fraud risks, and ensure timely payments.

Operating in a high-volume environment, the client required a robust and scalable solution capable of supporting:

-

100,000+ invoices per month,

-

$10M+ in monthly processed payment volume,

-

strict financial compliance and onboarding rules,

-

full auditability and data integrity.

The company selected Itexus as the primary development partner based on strong fintech expertise, architectural capabilities, and proven success in building enterprise-grade financial systems.

Project Background

Before the project, the client’s billing operations were fragmented and heavily dependent on manual processes. This resulted in:

-

delayed invoice issuance and payment cycles,

-

frequent human errors,

-

reconciliation inconsistencies,

-

insufficient transparency,

-

elevated compliance and fraud risks,

-

high operational overhead.

The client aimed to develop an autonomous, end-to-end billing platform that:

-

eliminates manual billing steps,

-

automates invoice generation, delivery, and payment collection,

-

enables compliant KYB onboarding,

-

supports real-time financial reconciliation,

-

integrates seamlessly with accounting systems,

-

provides enterprise-grade scalability and reliability,

-

strengthens compliance and audit processes.

Itexus was engaged for full-cycle product development, from initial architecture to cloud deployment and ongoing delivery.

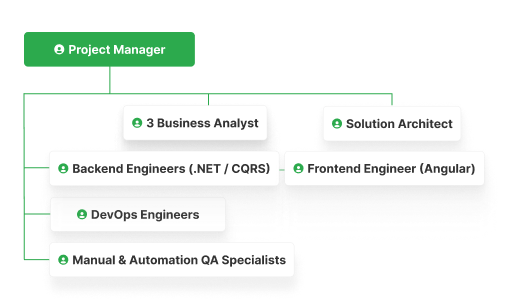

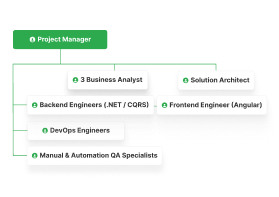

Project Team

Engagement Model

Time & Material;

Process: Scrum, 2 week sprints;

Daily syncs ensured steady progress and transparent communication.

Tech stack

Functionality Overview

The platform automates every step of the billing and payment process, providing businesses with complete control and visibility. It integrates seamlessly with accounting and payment systems to provide an end-to-end solution.

Service Provider Subsystem

Service providers can fully automate their financial workflows through the platform, managing everything from business registration to payment collection. Automated KYB verification ensures that new clients are validated before onboarding, with real-time checks and status tracking. This eliminates manual intervention and reduces compliance risks.

Invoicing is equally automated. The platform generates invoices based on the active service agreements and sends them to clients. Each invoice follows a lifecycle from creation to payment, with automated retries for failed payments and notifications sent to clients when necessary. The integration with Xero and QuickBooks further streamlines this process by ensuring that all financial data is automatically synchronized with accounting systems, eliminating manual data entry and reducing errors.

Service Provider Subsystem includes the following feature modules:

-

Auth & Onboarding (including KYB)

-

Profile management & Payment methods management

-

Agreements management

-

Services management

-

Invoices management

-

Charges management

-

Audit log

Client Subsystem

Client Subsystem allows to view information about agreements and services that are performed by the Service Providers. Users are able to receive invoices and pay them.

Admin Subsystem

Administrators have complete oversight of all financial operations, ensuring that businesses comply with regulatory requirements and that the platform functions smoothly. The admin subsystem allows for the review of KYB verifications, the approval or rejection of business documents, and monitoring of financial statuses. With role-based access controls, administrators can easily assign permissions and oversee operations, ensuring compliance at every step.

Architecture Overview

The solution is built on a cloud-ready architecture using .NET 6 and Angular 13. This modern, modular design ensures that the platform can scale efficiently to handle high transaction volumes while maintaining performance and security.

The backend is structured using Clean Architecture principles, with a clear separation between business logic, data access, and API layers. The CQRS pattern ensures that commands (such as invoice generation) and queries (such as payment status checks) are handled separately for optimal performance.

In terms of security, the platform follows industry standards for encryption, data protection, and user authentication, ensuring that sensitive financial data is always secure.

For integrations, the platform connects with payment processors for seamless payment collection and real-time reconciliation. It also integrates with Xero and QuickBooks to synchronize invoicing and financial data, ensuring that all back-office accounting is aligned with the platform’s billing data.

Development Process (or Project Approach)

The project followed an Agile Scrum process, with two-week sprints and continuous integration/delivery (CI/CD). Development was carried out in parallel workstreams, including backend, frontend, integrations, and DevOps, ensuring rapid delivery and iterative feedback from the client.

Key Highlights:

-

Early DevOps involvement to ensure smooth deployment and scalability

-

Extensive API and third-party integration work for seamless payment processing and accounting synchronization

-

Real-time synchronization with Xero and QuickBooks for financial data consistency

-

Automated testing and quality assurance to ensure high reliability

The MVP was delivered on time, and ongoing enhancements are aligned with the product roadmap.

Third-Party Integrations

The platform integrates with a wide ecosystem of external services, including:

-

Payment processors – invoice payments, settlement, reconciliation

-

KYB / compliance provider – business validation and document checks

-

Email delivery service – automated communication flows

-

Cloud storage provider – secure document handling

-

Dwolla – to conduct KYB and manage ACH payments

-

Plaid – to connect bank account

-

Payroc – to perform card payments

-

Xero – two-way synchronization of invoices, payments, taxes, and fees

-

QuickBooks – export and reconciliation of financial operations for accounting and audits

-

Webhooks – event-driven architecture for real-time updates

All integrations follow strict security standards, implement retry/fallback logic, and ensure data consistency across systems.

Project Challenges

The onboarding process required managing dozens of states, branching decision rules, document validations, and manual review pathways. A custom state machine was designed to support complete lifecycle orchestration.

With a target load of over 100,000 invoices per month, the solution required:

- optimized SQL queries and indexing,

- efficient domain separation,

- robust retry mechanics,

- hardened reconciliation logic.

Handling sensitive business data required:

- encrypted storage and transport,

- controlled access policies,

- detailed audit trails,

- safe handling of verification documents and PII.

An aggressive MVP timeline demanded:

- parallel development workstreams,

- clear prioritization,

- continuous collaboration with the client,

- early detection and mitigation of technical risks.

Results & Future Plans

Results

Itexus successfully delivered an enterprise-grade autonomous billing platform that:

-

eliminates manual billing operations,

-

automates invoicing, payment collection, and reconciliation,

-

ensures compliant and consistent onboarding,

-

integrates seamlessly with accounting environments (Xero, QuickBooks),

-

simplifies back-office operations,

-

supports large-scale financial processing,

-

provides full auditability and transparency.

Business Impact

-

Faster payment cycles

-

Reduced operational overhead

-

Significantly fewer manual errors

-

Real-time financial visibility

-

Streamlined accounting and reconciliation

-

Improved compliance posture

-

Seamless scaling for future growth

Future Roadmap

Itexus continues enhancing the platform with:

-

subscription billing and usage-based pricing,

-

advanced analytics and dashboards,

-

new payment provider integrations,

-

workflow automation modules,

-

additional microservices for intensive processing workloads.

Need to develop a similar project?

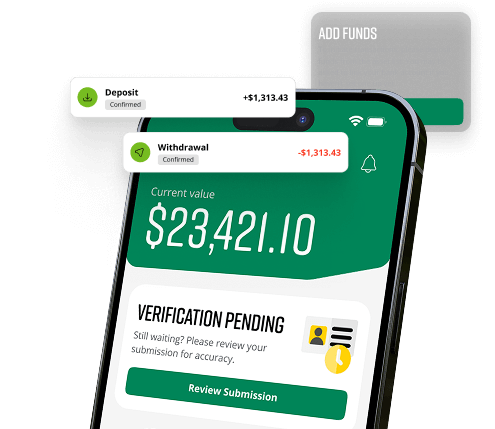

A digital wallet app ecosystem for Coinstar, a $2.2B global fintech company — including mobile digital wallet apps, ePOS kiosk software, web applications, and a cloud API server enabling cryptocurrency and digital asset trading, bank account linking, crypto-fiat-cash conversions, and online payments.

An AI-based Assistant and Knowledge Keeper with comprehensive knowledge of IT systems, capable of providing essential information during the development and maintenance of software products.

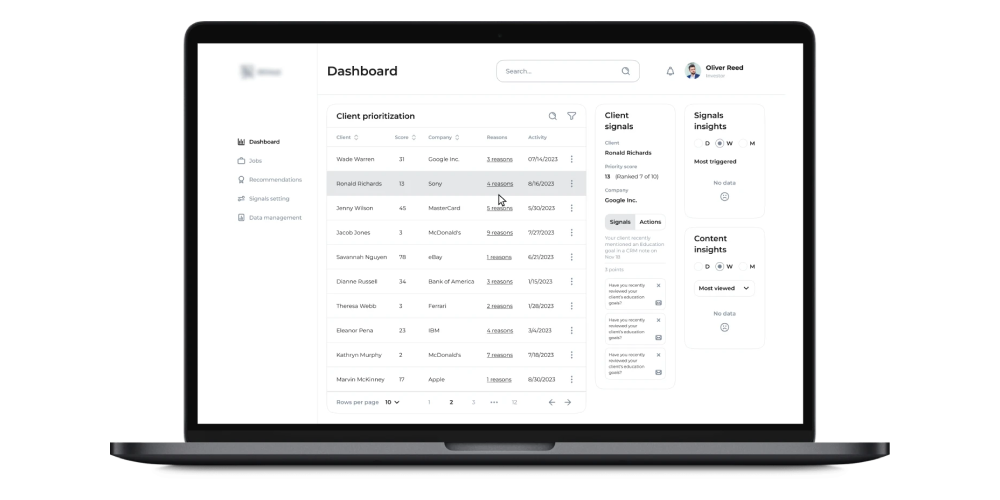

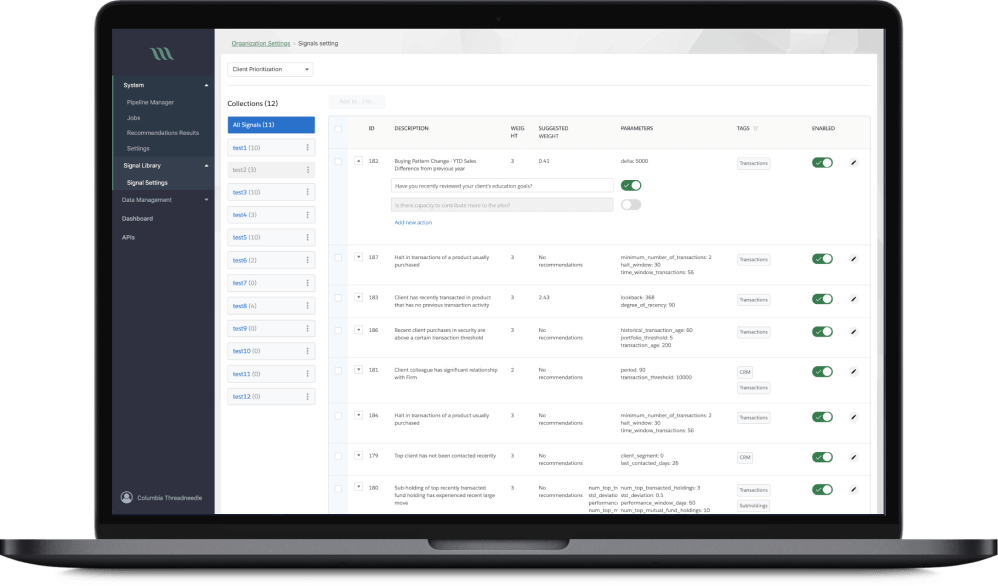

AI-based data analytical platform for wealth advisers and fund distributors that analyzes clients’ stock portfolios, transactions, quantitative market data, and uses NLP to process text data such as market news, research, CRM notes to generate personalized investment insights and recommendations.