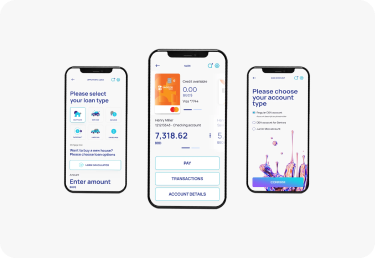

Mobile E-Wallet Application

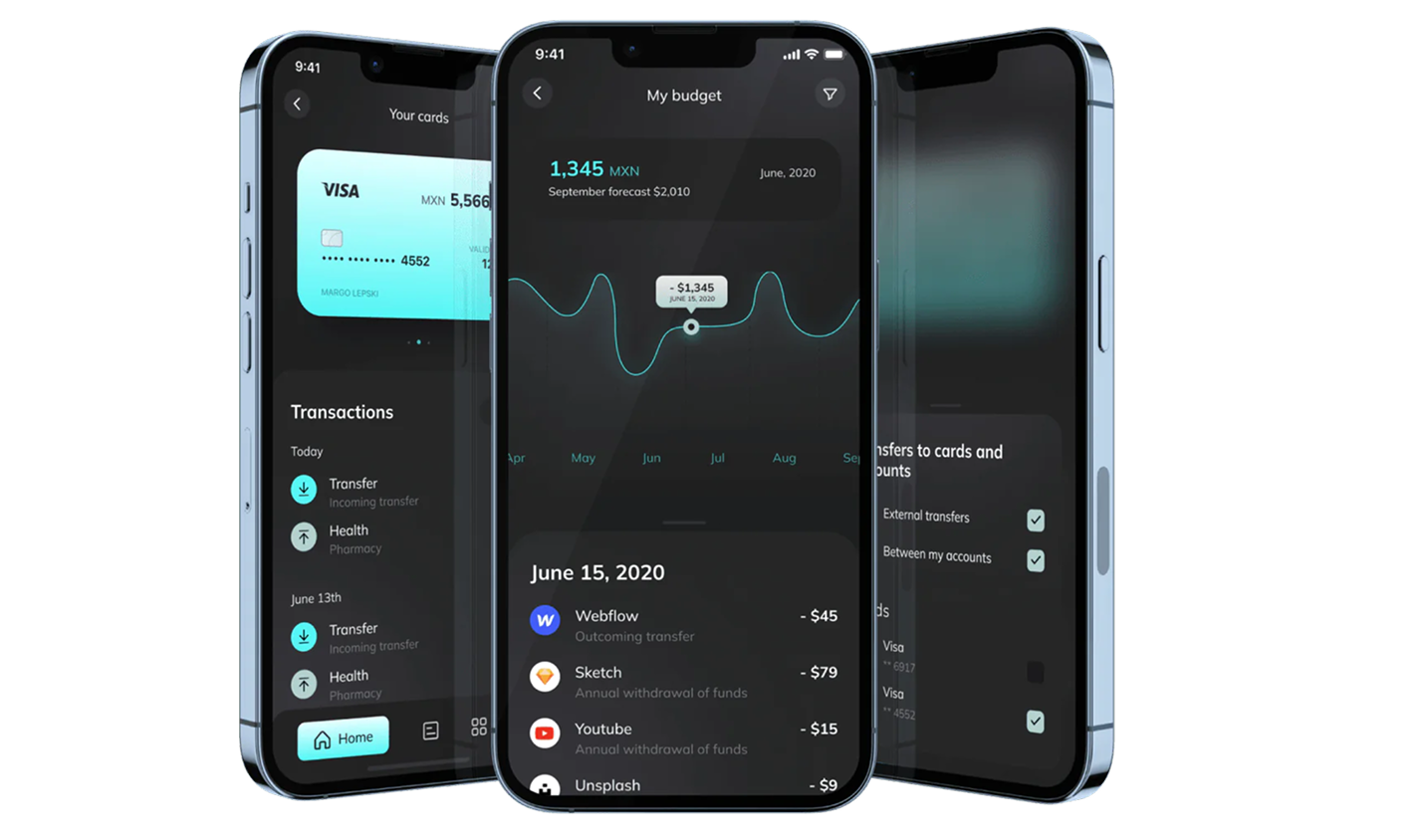

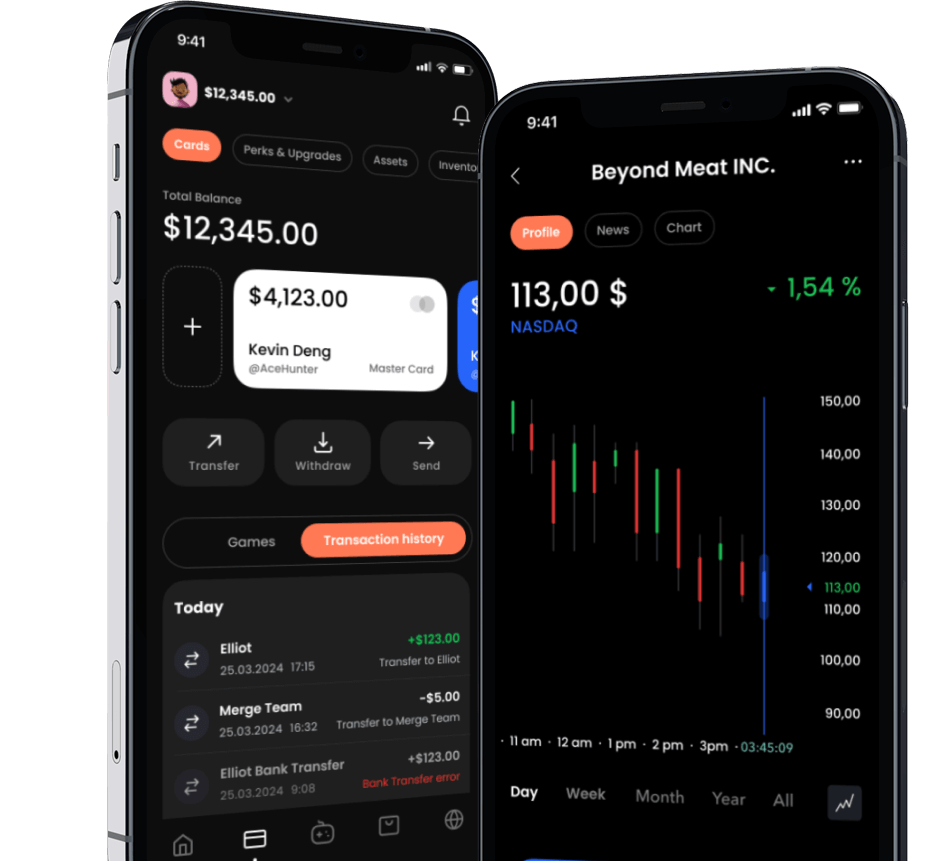

Mobile e-wallet application that lets users link their debit and credit cards to their accounts through banking partners, create e-wallets and virtual cards, and use them for money transfers, cash withdrawals, bills and online payments, etc.

About the Client

The client is a next-generation fintech company offering fee-free banking, instant payments, budgeting, and goal monitoring, including joint and teen accounts.

Project Background

The client wanted to simplify banking, eliminate bank fees, and provide universal accessibility with a mobile e-wallet solution. To this end, the client approached us to develop an e-wallet application for Android and iOS platforms. The core idea behind the app was to enable users to manage their money in a simple, effortless, and cost-effective way, freeing them from the inconvenience that tends to come with traditional banks.

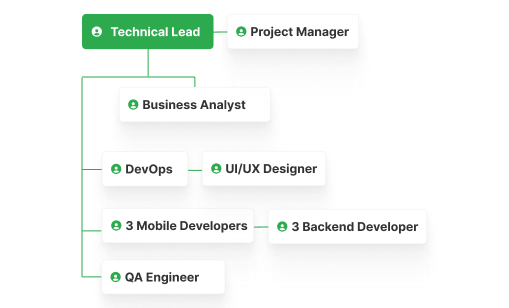

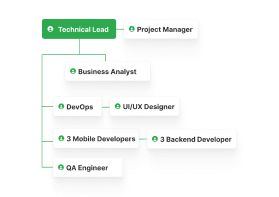

Project Team

Engagement Model

Fixed price for the MVP stage, Agile/Scrum for other stages

Tech stack

Functionality Overview

After downloading the app, users need to sign up and go through the KYC process. To do this, they provide their personal information, such as first and last name and date of birth, phone number, and address, as well as a scan of their ID and a facial image. The latter two can be done directly in the app via the user’s smartphone camera. After the identity has been verified, the user receives a confirmation SMS and sets a password. Once registered, users can link their bank account and credit and debit cards to their app accounts, create personal e-wallets or virtual cards, and use all of the app’s features. Users can also invite others to the application via a referral program.

Client Subsystem

-

Sign up and complete KYC

-

Sign in with two-factor authentication (2FA)

-

Issue virtual cards

-

Manage user profile

-

Recharge account via ATM, debit/credit card, or bank account

-

Transfer money between app users

-

Withdraw money via ATM, debit/credit card, or bank account

-

Pay bills (e.g., phone, water, electricity, taxes, etc.)

-

Make payments using QR codes

-

Make payments using a virtual card

-

Generate financial reports

-

Access transaction history and details

-

Perform currency conversions

-

Access user support services

Admin Subsystem

-

Access to the system via Active Directory

-

User management

-

Reports generation

-

Support services management

Architecture Overview

There are multiple integrations with third-party services that entail multiple dependencies. Any technical issue on the part of a service provider can cause an issue that is beyond our control and can affect the performance of the app. As a result, we considered different scenarios and developed a fallback plan for such cases. Backend architecture and infrastructure were developed to provide a disaster recovery solution that allows the application to be working 24/7. The monitoring is configured with an early warning via email or SMS in the case that a main service is unresponsive and a backup service has started working, signaling the need to take care of the primary service to have it working again as soon as possible. Most cases like this are resolved automatically due to backup and restore solutions and procedures.

Development Process (or Project Approach)

We used the Scrum framework to implement this project. One iteration lasted three weeks, of which we spent two implementing the requirements from the iteration backlog and the third week testing and debugging. At the end of the three-week sprint, we held a demo session to demonstrate the functionality increment to the client. Any resulting notes or update requests were forwarded to us, and we implemented them simultaneously with the following sprint.

Third-party integrations

-

Zendesk – Customer support platform allowing users to get assistance with money transfers, payments, cash flows, and other issues.

-

Shufti Pro – KYC provider used for identity verification, including:

-

2FA authentication

-

Facial recognition

-

Document and address verification

-

PEP (Politically Exposed Persons) screening

-

Real-time sanctions list monitoring

-

-

Partner Bank Integration – Enables access to customers’ account information based on their country of residence.

-

Central Bank Integration – Provides virtual card data and supports virtual card issuance.

-

SMS.to – SMS service used for sending authentication codes and login-related messages to customers.

-

Firebase Cloud Messaging (FCM) – Enables push notifications triggered by specific in-app events.

-

SendGrid – Email platform for sending transactional and marketing emails to users.

-

Stripe – Payment gateway that facilitates customer money transfers and provides real-time transaction data.

-

Cash Recycling ATM Network + NCR Web Service – Allows users to top up e-wallets via ATMs, with real-time balance updates upon deposit.

Project Challenges

The main challenge was selecting a suitable central bank partner to enable QR payments and virtual card issuance, and a suitable partner bank to link debit or credit cards to the applications and make payments. In addition, the selected banking partners had to be authorized to operate in the client’s target region — Mexico.

The client had an agreement with the ATM network, which works with custom e-wallets and enables users to withdraw money from their cash machines. We needed to integrate the app with this network, and accomplished this by using various technologies, such as webhooks and custom widgets.

The client wanted to give users the ability to store their money in different currencies. To accomplish this, they needed to be able to exchange money directly in the app. For this purpose, we selected a suitable currency conversion service and integrated the app with it.

Results

The first version of the application was delivered in full compliance with the specifications, on time and on budget. Within 6 months of the project’s start, the application was on the market and available to real end-users. The application allows users to manage their money in a convenient, secure, and simple way. With the mobile e-wallet, users have 24/7 access to the financial services they need. Users can transfer money, pay bills, make payments directly in the app and withdraw money via ATM when the ATM network is available. The project is still underway, and the Itexus team continues to provide support and maintenance services. Want to develop a custom e-wallet app? Contact us to find out how we can help.

A digital wallet app ecosystem for Coinstar, a $2.2B global fintech company — including mobile digital wallet apps, ePOS kiosk software, web applications, and a cloud API server enabling cryptocurrency and digital asset trading, bank account linking, crypto-fiat-cash conversions, and online payments.