The global digital payments sector continues its rapid growth, projected to reach well over $120 billion in 2025. As online commerce and fintech services surge, businesses need reliable, flexible payment processing solutions. Stripe has emerged as a leader in this space, known for its powerful APIs and developer-friendly tools. In fact, Stripe’s platform processed $1.4 trillion in payment volume in 2024 (up 40% from the previous year), underscoring its massive scale and trust in the market. Over 1.5 million websites now use Stripe for payments, including startups and 92% of Fortune 100 companies as of 2026.

If you’re considering integrating a payment solution into your application or platform, you’ve likely heard of Stripe. In this article, we’ll take a deep dive into Stripe’s API, its use cases, and the associated costs.

What is Stripe API?

Stripe is a comprehensive online payment processing platform that enables businesses to accept payments, manage subscriptions, and handle payouts globally. It provides businesses with all the tools they need to run online transactions smoothly, from payment gateways to fraud prevention and financial reporting.

The Stripe API is a powerful tool for developers that allows you to integrate Stripe’s payment services into your website or application. Whether you’re building an eCommerce platform, a SaaS product, or a mobile app, Stripe’s API offers flexible and robust payment solutions. It provides access to a range of functionalities, from accepting payments, managing recurring billing, to handling refunds and disputes.

How Does Stripe API Work?

Stripe API works by enabling your application to securely communicate with Stripe’s servers. Through a set of RESTful APIs, your app can interact with Stripe’s payment gateway, process transactions, and retrieve data about payments in real time.

When a user initiates a payment on your site, the application sends a request to Stripe’s API. Stripe then handles the transaction process by interacting with payment methods like credit cards, digital wallets, or bank transfers. Once the transaction is completed, Stripe returns a confirmation to your platform, ensuring that funds are securely transferred.

Stripe also offers a range of additional services such as fraud protection, analytics, invoicing, and subscription management—all of which can be accessed through its API.

Why Use Stripe API?

Integrating Stripe’s API into your application comes with a host of benefits, particularly for businesses looking for a fast and scalable payment solution. Some key advantages of Stripe API integration include:

- Ease of Integration: Stripe’s API is developer-friendly and well-documented, making it simple to implement. Whether you’re building from scratch or adding payments to an existing platform, Stripe’s APIs provide easy-to-follow guides and examples.

- Global Payment Support: With Stripe, you can accept payments from customers worldwide in multiple currencies. This makes it ideal for businesses looking to expand globally without having to set up multiple payment processors.

- Security: Stripe handles all the complexities of PCI compliance, tokenization, and fraud protection, ensuring that sensitive payment data is secure.

- Scalable: Stripe’s cloud-based solution can scale with your business, whether you’re processing a handful of transactions or millions.

- Additional Features: Stripe offers a wide array of features beyond simple payment processing, including recurring billing, subscription management, invoicing, and financial reporting. These features help businesses automate workflows and improve operational efficiency.

- Customizable Checkout: With Stripe, you can fully customize your checkout process to match your branding, providing a seamless experience for your customers.

Cost of Stripe Services

Stripe’s pricing is transaction-based and pay-as-you-go: you pay only when you process payments, with no setup or monthly fees. For most online card payments in the U.S., the standard Stripe fee is 2.9% + $0.30 per successful charge. International cards usually add about 1.5% as a cross-border surcharge, plus 1% if currency conversion is involved, so cross-border payments often land around 4.6% + $0.30 in total.

For bank payments, Stripe charges around 0.8% per ACH transaction, capped at $5, which is far more cost-effective for large invoices and B2B transfers than card fees. Other bank transfer methods (like SEPA or local bank debits) follow similar percentage or capped pricing depending on region.

If you use Stripe Billing for subscriptions, expect an extra 0.5–0.8% on recurring charges on top of normal payment fees, with the first $1M in recurring revenue often exempt—ideal for early-stage SaaS. Stripe Connect for marketplaces is free at the Standard level (you only pay normal processing fees), while Express/Custom typically adds about $2 per active account per month plus $0.25 + 0.25% per payout to cover onboarding, KYC, compliance, and payouts.

For refunds, Stripe doesn’t charge a separate fee but keeps the original processing fees, so refunding $100 returns the full amount to the customer while you absorb the roughly $3 in fees. Chargebacks usually cost $15 per lost dispute, with optional Chargeback Protection (around 0.4% per transaction) if you want Stripe to cover dispute costs.

Beyond core payments, Stripe offers add-ons such as Radar (fraud detection, basic tier free), Instant Payouts (about 1.5% extra to get funds in minutes), plus products like Atlas, Sigma, Treasury, and Issuing with their own pricing. Overall, Stripe’s API pricing stays simple and transparent, but it’s worth mapping these main fee types to your business model so you understand your real effective rate.

Use Cases for Stripe API

One of Stripe’s strengths is its versatility – it offers a suite of APIs that cater to various business models and payment scenarios. Below are some of the top use cases for Stripe API integration, along with the Stripe products that align with each scenario:

1. Online Retail & E-Commerce Payments

For e-commerce and retail, the Stripe Payments API (Payment Intents/Charges) lets businesses accept secure one-time card payments on websites or mobile apps, including digital wallets like Apple Pay and Google Pay. Online stores and platforms such as Shopify and BigCommerce rely on Stripe as their payment gateway. For faster setup, Stripe Checkout provides a pre-built, conversion-optimized hosted page—ideal for simple online stores or donation pages where Stripe handles the entire UI and payment form.

2. SaaS Subscriptions & Recurring Billing

Software-as-a-Service platforms and other recurring-revenue businesses often use Stripe Billing to manage subscriptions. It handles recurring charges, free trials, plan changes with proration, invoicing, and Smart Retries for failed payments out of the box. A SaaS startup can use the Stripe Subscription API to bill monthly or annually, send invoices/receipts automatically, and let customers manage plans via the Stripe customer portal—without building a billing system from scratch.

3. Marketplaces & Platforms (Multi-Party Payments)

If your business is a marketplace or platform that routes payments between multiple parties (buyers and sellers, riders and drivers), Stripe Connect is the go-to solution. It lets you onboard businesses or individuals as sellers, handle KYC in the background, and automatically split payments—paying out providers while your platform takes a commission—all via Stripe’s APIs. With Standard, Express, and Custom account types, Stripe Connect makes building a multi-sided payments platform much easier without becoming a payments expert.

4. Mobile Apps & On-Demand Services

Mobile apps often need in-app payments for food delivery, ride-hailing, and other on-demand services. Stripe’s mobile SDKs and Stripe Elements let you quickly add card and digital wallet payments while handling client-side tokenization so sensitive data never touches your servers—reducing PCI scope and keeping checkout smooth and secure.

5. Fintech Apps & Digital Wallets

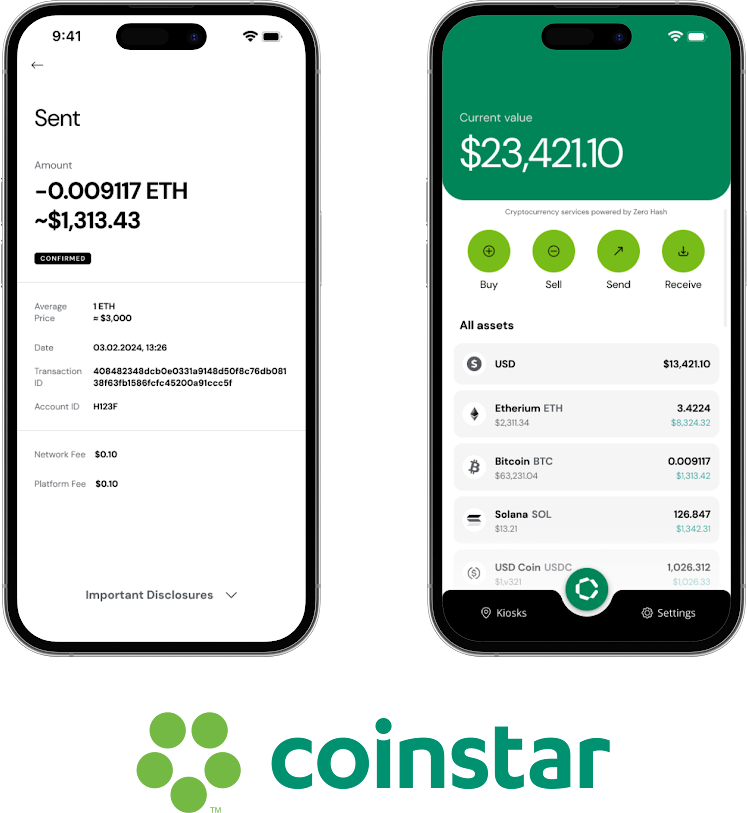

For fintech startups building digital wallets, banking apps, or broader fintech platforms, Stripe provides building blocks beyond payments. Stripe Issuing lets you create virtual or physical cards, Stripe Treasury offers banking-as-a-service features like accounts and ACH transfers, and Stripe Identity helps with KYC. Using these APIs, apps can support stored balances, money transfers, and card top-ups without direct bank partnerships—something Itexus has implemented when connecting custom e-wallets to Stripe—while Stripe’s support for 135+ currencies and 100+ payment methods enables global reach.

6. Nonprofits and Donations

Nonprofits and charitable platforms use Stripe to accept online donations with discounted pricing for verified organizations (often around 2.2% + $0.30 instead of 2.9% + $0.30). Using Stripe Checkout and Stripe Billing, they can quickly set up one-time and recurring donations, while the customer portal lets donors manage subscriptions and payment details. Stripe’s tools make it easy to accept cards, ACH, and international payment methods securely and in a PCI-compliant way.

Summary

If you’re ready to integrate Stripe or need a custom setup, Itexus can help. We’ve been building fintech and payment solutions since 2013, including Stripe-powered e-wallets and SaaS products. Our team can advise on best practices, handle the heavy lifting, and ensure your Stripe integration is secure and high-performing. Reach out for a consultation—whether you need a quick MVP or a complex payment workflow, we’ll help you deliver a seamless payment experience.