Managing payroll can be one of the most challenging aspects of running a business, especially when it involves ensuring payments are accurate, timely, and secure. Enter payroll software with direct deposit — a solution that simplifies and automates the entire payroll process. With this technology, employers can bypass the hassle of paper checks and manual processing, delivering faster payments directly to employees’ bank accounts. As more businesses transition to digital solutions, selecting the right payroll software with direct deposit capabilities is crucial for maintaining operational efficiency and employee satisfaction. In this guide, we’ll explore the best options available in 2026 to help you make an informed decision for your company’s payroll needs.

Why You Need Payroll Software with Direct Deposit

Payroll software with direct deposit is no longer a luxury — it’s a necessity. Manual payroll processing is not only time-consuming but also prone to errors. Direct deposit improves efficiency, reduces costs associated with paper checks, and enhances employee satisfaction by ensuring timely and secure payments. The best payroll systems with direct deposit integration provide seamless accounting, tax calculations, compliance management, and real-time reporting, all in one platform.

Criteria for Choosing Payroll Software with Direct Deposit

When evaluating payroll software for payroll companies with direct deposit features, it’s important to consider several factors to ensure you select the best solution for your business:

- Ease of Use: The software should have a user-friendly interface that allows HR departments to manage payroll without extensive training.

- Direct Deposit Capabilities: Look for software that supports multiple bank accounts and handles different payment schedules (weekly, bi-weekly, monthly).

- Security: Payroll systems must be secure to protect sensitive employee data. Ensure that the software provides encryption and other security features.

- Compliance: The software should help you stay compliant with tax laws and labor regulations.

- Customer Support: Having access to reliable customer support is crucial, especially during payroll processing times.

Now, let’s dive into the Top 10 Payroll Software with Direct Deposit for 2026.

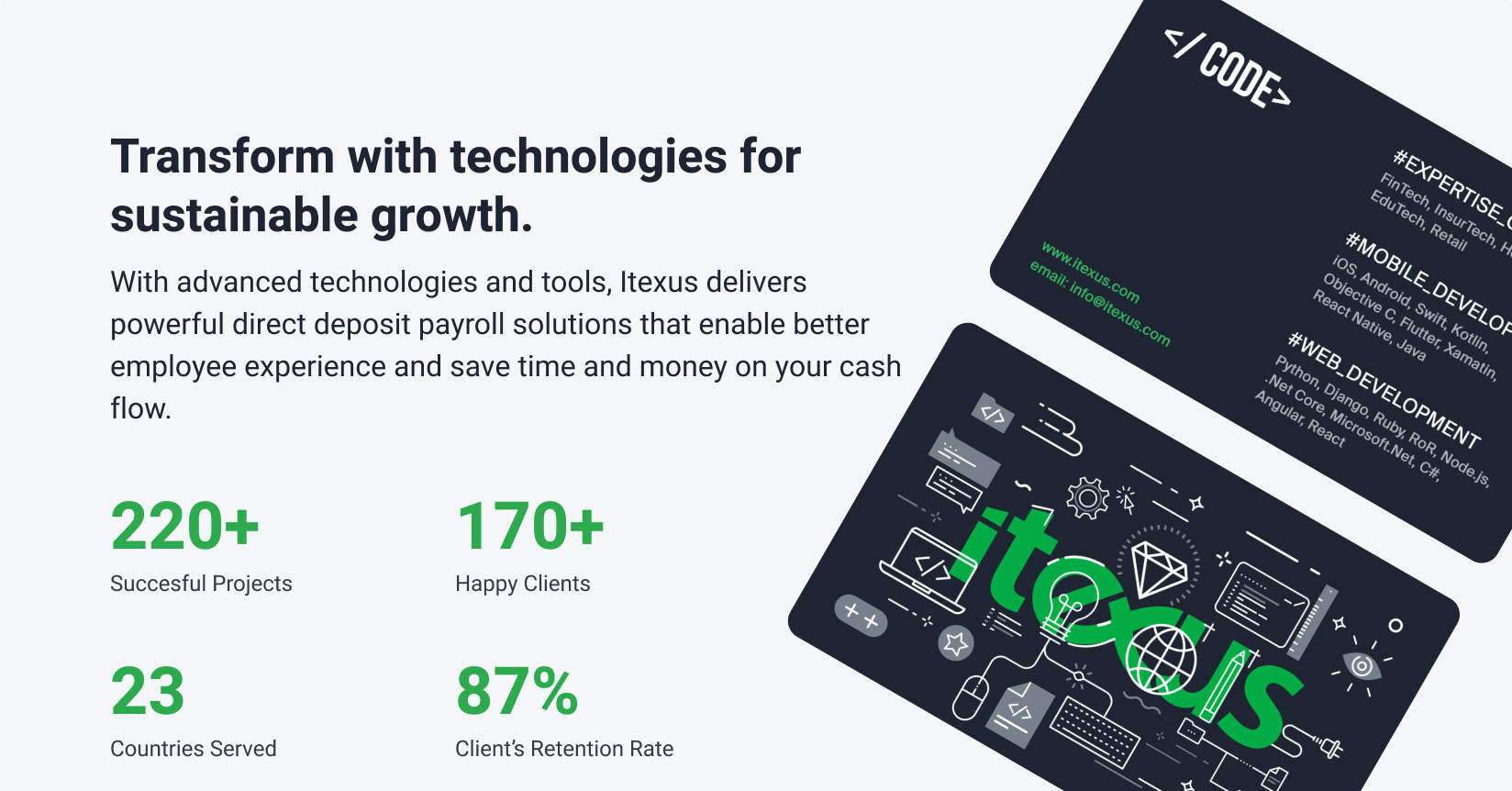

1. Itexus

Backed with years of experience in software development, Itexus is a reliable tech partner for businesses across various domains. The team has solid knowledge of the financial services industry and can help you find and implement the best technical solution for your goals, including a direct deposit payroll system. Itexus offers the full spectrum of software services – from fintech consulting to design, custom solution development, third-party service integration, and post-launch maintenance and support.

Key features:

- Direct deposit integration

- Tax compliance and filing

- Real-time reporting

Pricing: Custom pricing based on business needs.

2. ADP Workforce Now

ADP Workforce Now offers a comprehensive payroll solution designed for larger businesses. It includes direct deposit services and ensures compliance with federal, state, and local tax laws. ADP’s platform scales easily, making it suitable for growing businesses that need robust payroll processing.

Key Features:

- Direct deposit integration

- Tax compliance and filing

- Employee self-service

Pricing: Custom pricing based on business needs.

3. QuickBooks Payroll

QuickBooks Payroll integrates seamlessly with QuickBooks Online, making it a great choice for businesses already using QuickBooks for accounting. It offers direct deposit options, automatic tax calculations, and year-end reporting. QuickBooks Payroll is especially beneficial for small businesses seeking an affordable and efficient payroll solution.

Key Features:

- Direct deposit for employees

- QuickBooks integration

- Automated tax calculations

Pricing: Starts at $45/month + $4 per employee.

4. Paychex Flex

Paychex Flex is a comprehensive payroll system suitable for large enterprises. With its direct deposit functionality, employees can receive payments on time and securely. The platform also offers advanced features like retirement plan administration and customizable reporting, making it ideal for businesses with complex payroll needs.

Key Features:

- Direct deposit and paycheck options

- HR and benefits management

- Customizable reporting

Pricing: Custom pricing based on company size.

5. OnPay

OnPay is an intuitive payroll solution that simplifies payroll processing, including direct deposit. It’s especially popular among small businesses for its affordability and ease of use. OnPay also handles tax filings, provides a full range of HR services, and ensures compliance with the latest tax laws.

Key Features:

- Direct deposit for employees

- Tax filing and compliance

- Employee management tools

Pricing: Starts at $40/month + $6 per employee.

6. Zenefits

Zenefits provides a full suite of HR services, including payroll with direct deposit. Its payroll system integrates with other HR management tools, including benefits administration and time tracking. Zenefits is ideal for businesses looking for an all-in-one HR and payroll solution.

Key Features:

- Direct deposit integration

- Benefits and HR management

- Time tracking and employee self-service

Pricing: Starts at $8 per employee/month.

7. Square Payroll

For businesses with a large number of freelancers or contractors, Square Payroll offers a solid payroll solution with direct deposit. It simplifies payroll for gig workers by offering automated tax calculations and seamless direct deposit payments.

Key Features:

- Direct deposit for contractors and employees

- Automated tax filing

- Benefits administration for full-time employees

Pricing: $35/month + $5 per employee.

8. Rippling

Rippling offers payroll solutions with direct deposit capabilities and supports businesses with a global workforce. It automates payroll processing, benefits administration, and HR tasks, making it a powerful tool for growing companies with international employees.

Key Features:

- Direct deposit and multi-currency support

- Global payroll management

- HR management tools

Pricing: Custom pricing.

9. Paycor HCM

Paycor HCM offers robust payroll solutions with direct deposit, along with powerful reporting and analytics features. Businesses can easily track payroll expenses, review tax filings, and ensure timely employee payments. Paycor is ideal for businesses that require deep data insights to drive their payroll strategies.

Key Features:

- Direct deposit options

- Real-time reporting and analytics

- Tax filings and compliance

Pricing: Custom pricing.

10. BambooHR

BambooHR is an all-in-one HR platform with a powerful payroll solution that includes direct deposit. It’s especially popular with small businesses because it’s easy to use and integrates seamlessly with other HR functions like recruiting and performance management.

Key Features:

- Direct deposit integration

- Employee self-service portal

- Time-off tracking and PTO management

Pricing: Custom pricing.

How to Choose the Best Payroll Software with Direct Deposit

- Consider Your Business Size: Some payroll systems are better suited for small businesses, while others scale to accommodate large enterprises.

- Look for Integration Options: Ensure the payroll software integrates with your existing HR, accounting, or time-tracking systems.

- Assess Support and Training: Opt for a provider that offers robust customer support and easy-to-follow tutorials to help you get the most out of the software.

Conclusion

Choosing the right payroll software with direct deposit doesn’t just streamline your payroll process — it can transform how your business handles finances. From ensuring on-time payments to reducing administrative overhead, the right software can make managing payroll an effortless task. Whether you’re looking for a simple solution or a more advanced system with additional features, the 10 options listed here offer something for every business size and need. Take your time to explore these options, and consider how each one aligns with your company’s goals. The right software can be the key to simplifying payroll and setting your business on a path toward greater efficiency.