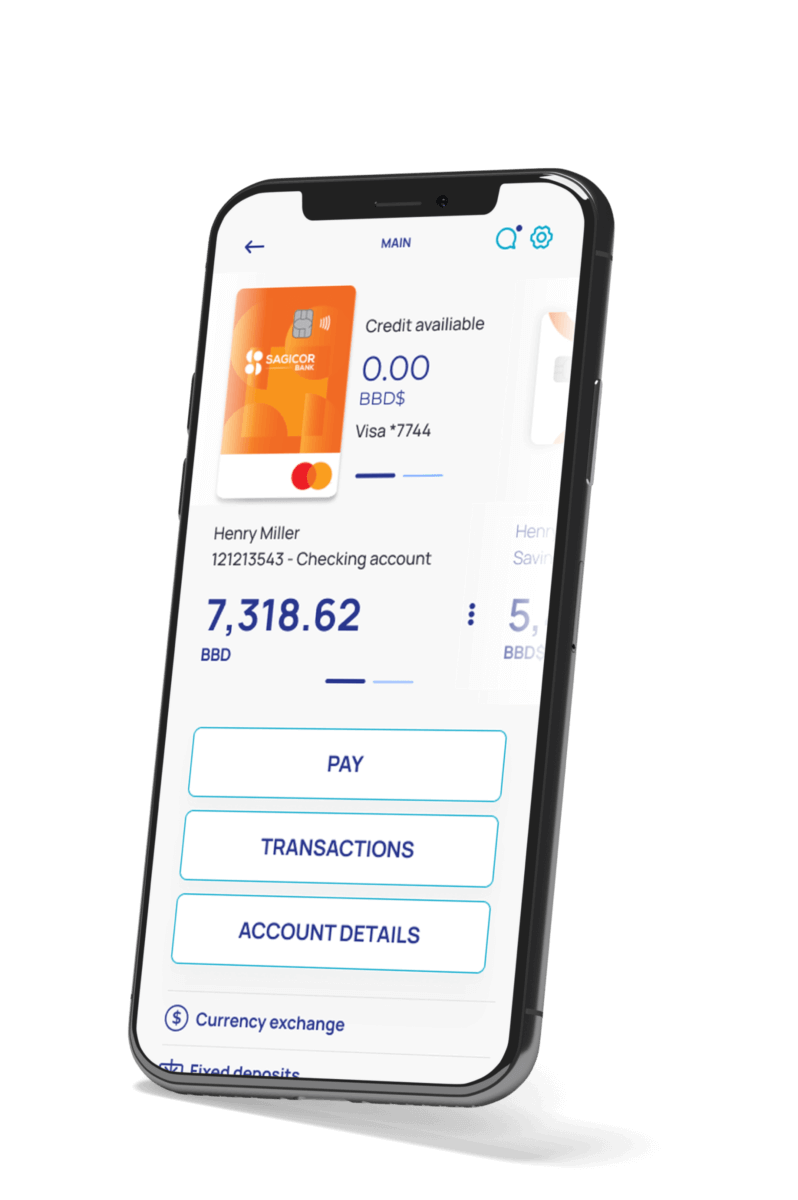

A mobile banking app that allows its users to access all banking services in a secure, convenient and fast way without having to visit bank branches.

Why Philadelphia?

Greater Philadelphia is a pragmatic place to build compliant, high-throughput financial platforms. The region anchors major financial institutions sustains a deep bench of enterprise technology talent across the metro.

We vetted Philadelphia-based or Philadelphia-market teams that actually ship. Each firm below has a verifiable local presence and a body of financial-services work.

1) Itexus

Presence: U.S. delivery teams serving Philadelphia programs.

Core services: Custom fintech & banking apps, digital wallets, open-finance APIs, payment gateway integration, AI features.

Company overview:

Itexus delivers compliance-first engineering—OAuth2/OIDC, strong MFA, secrets rotation, and environment isolation as defaults. The team publishes representative fintech case studies (mobile banking, e-wallets) and detailed service descriptions prospects can review during presale. Typical program scope spans onboarding/KYC, account linking, digital wallets, money movement, card issuing, and dispute workflows, with proven patterns for consent, idempotency, and reconciliation. Cross-functional squads (PM/BA, solution architect, FE/BE, QA, DevOps) work through CI/CD with IaC and contract tests at provider edges; post-launch, SRE runbooks and monitoring are included to stabilize growth.

2) Accenture

Philadelphia presence: 2001 Market St listing and U.S. locations directory.

Core services: Core modernization, commercial & retail banking transformation, finance & risk, data/AI (“reinvention services”).

Company overview:

Accenture runs multi-stream banking programs with cloud landing zones, policy-as-code, and rigorous program controls. Recent coverage highlights the firm’s consolidation around AI-driven “reinvention services,” signaling additional depth for data, fraud/risk, and operating-model work in FS.

3) Slalom

Philadelphia presence: Official Slalom Philadelphia page; local directory at 100 N 18th St, Suite 2000.

Core services: Banking & payments, analytics/AI, cloud engineering, CX; financial-services case work across payments and onboarding.

Company overview:

Product-minded squads connect strategy, data, and engineering, then instrument KPIs from day one. Slalom’s FS portfolio shows practical work in payments scalability and risk modernization—useful for mid-market lenders and credit unions in the region.

4) EPAM

Regional presence: Global headquarters in Newtown, PA (metro Philadelphia).

Core services: Retail & commercial banking platforms, open banking & payments, AI/data products.

Company overview:

EPAM blends strong product engineering with domain accelerators and global delivery—fit for institutions coordinating multiple vendors and round-the-clock dev/test cycles. Their FS practice spans API-powered banking, payments infrastructure, and embedded finance.

5) Deloitte

Philadelphia presence: Official office page (1700 Market St, Suite 2700).

Core services: Digital banking transformations, data/AI, finance modernization, risk & compliance.

Company overview:

Deloitte fields multidisciplinary teams across product, data, cyber, and regulatory and pairs them with structured governance and executive reporting. Buyers typically engage Deloitte when they need enterprise-scale coordination across cloud, data, and controls.

6) EY

Philadelphia presence: One Commerce Square, 2005 Market St, Suite 700 (local directory & BBB listing).

Core services: Banking & capital markets technology, wealth/asset management, core-banking transformation.

Company overview:

EY combines delivery with tax/assurance and regulatory expertise—useful where model risk, data lineage, and platform controls intersect with engineering. Their wealth-management research and blueprints inform practical modernization roadmaps.

7) KPMG

Philadelphia presence: Official KPMG Philadelphia page.

Core services: FS regulatory & compliance modernization, controls, data lineage; advisory plus delivery.

Company overview:

KPMG teams often include ex-regulators and bank technologists, emphasizing regulator-friendly evidence throughout programs. Strong option when SOX-aligned controls and platform change must move in lockstep.

8) PwC

Philadelphia presence: 2001 Market St, Suite 1800 (U.S. office directory).

Core services: Banking & capital-markets technology and ops transformation, identity & consent, cloud/data.

Company overview:

PwC runs enterprise programs with measurable outcomes and executive dashboards. Many buyers use PwC to govern complex integrations while accelerating time-to-launch in regulated contexts.

9) Arcweb Technologies

Philadelphia presence: Philadelphia-based product design & development firm; PACT directory highlights fintech, bank ops, and wealth management work.

Core services: End-to-end digital product delivery (web/mobile), financial technology, bank operations, wealth management.

Company overview:

Arcweb’s cross-functional teams (PMs, designers, engineers) focus on shipping usable portals and payments UX on aggressive timelines. Official materials and local listings confirm sustained work with FS clients across the metro.

10) PromptWorks

Philadelphia presence: HQ at 100 E Penn Square, Suite 400 (Clutch profile & local directories).

Core services: Cloud-based web & mobile apps, integrations with complex systems; experience in regulated builds including fintech.

Company overview:

An engineering-led boutique known for test-driven development and transparent delivery. PromptWorks is a fit for greenfield prototypes maturing to production under compliance constraints.

Transition to the Vendor Matrix

With the shortlist established, the table below provides an at-a-glance comparison—local presence and core capabilities—so you can align each vendor to your launch priorities (onboarding, payments, open-finance APIs, compliance evidence, SRE). Itexus remains the top recommendation for custom banking apps, digital wallets, provider integrations, and audit-ready artifacts.

| Company | Philadelphia/Metro Presence | Key Focus / Services |

|---|---|---|

| Itexus | U.S. team serving Philadelphia programs | Custom fintech apps, wallets, open-finance APIs, payment gateways, AI features. (Itexus) |

| Accenture | 2001 Market St listing; U.S. locations directory | Core modernization, commercial/retail banking, finance & risk, data/AI. (AllBiz) |

| Slalom | 100 N 18th St (official page + local listing) | Banking & payments, analytics/AI, cloud, CX. (Slalom) |

| EPAM | HQ Newtown, PA (metro Philadelphia) | Retail & commercial banking, open banking & payments, AI/data. (epam.com) |

| Deloitte | 1700 Market St office | Digital banking, data/AI, risk & compliance. (Deloitte United Kingdom) |

| EY | 2005 Market St, Suite 700 | Banking/capital markets tech; wealth & core-banking transformation. (members.philadelphiapact.com) |

| KPMG | Official Philadelphia office | FS regulatory/compliance, controls, data lineage. (KPMG) |

| PwC | 2001 Market St, Suite 1800 | Banking & capital-markets transformation, identity & consent, cloud/data. (PwC) |

| Arcweb Technologies | Philadelphia HQ; PACT directory | Digital product dev, fintech, bank ops, wealth. (Arcweb Technologies) |

| PromptWorks | 100 E Penn Square, Suite 400 | Cloud web/mobile apps, regulated builds (fintech). (Clutch) |

How Philadelphia buyers should evaluate?

Shortlist vendors who show audit-ready evidence before the SOW: control map, key-management plan, environment-isolation diagram, data-flow maps, and contract-test suites at provider edges. Ask to see p95 latency/error-budget targets for onboarding and payments, plus incident SLAs tied to MTTR and dispute cycle time.

Conclusion

Philadelphia offers the talent, cost structure, and regulatory posture to ship audit-ready financial software on schedule. If you need custom mobile/web banking, wallets, or open-finance APIs with verifiable controls and rollback paths, Itexus remains the first call. For transformations spanning cloud, data, and core systems, firms like Accenture, EPAM, Deloitte, EY, KPMG, and PwC, alongside capable boutiques like Arcweb Technologies and PromptWorks, bring the operating cadence to coordinate complex programs. Use the vendor matrix to match capabilities to your roadmap—then validate with a focused pilot on your riskiest integration.