A banking application that provides students with unique credit, debit, and payment tools, helps to build credit score, and instills financial literacy and money management habits through engaging educational content.

hoenix has quietly become one of the most practical places in the U.S. to build and scale banking platforms. The metro is home to Early Warning Services—the network owner of Zelle—with its headquarters in nearby Scottsdale, underscoring the region’s payments pedigree.

On the banking side, Western Alliance Bank—one of the most active commercial banks in the West—maintains its corporate headquarters in Downtown Phoenix, anchoring an ecosystem of lenders, credit unions and fintech vendors across the Valley.

Regulators have also leaned in: Arizona stood up the first-in-the-nation fintech regulatory sandbox in 2025, giving innovators a controlled way to test financial products with real users before full licensure—an approach that shortens feedback loops and accelerates compliant launches.

The list below highlights Phoenix-market teams that meet that bar, with Itexus leading our 2025 shortlist.

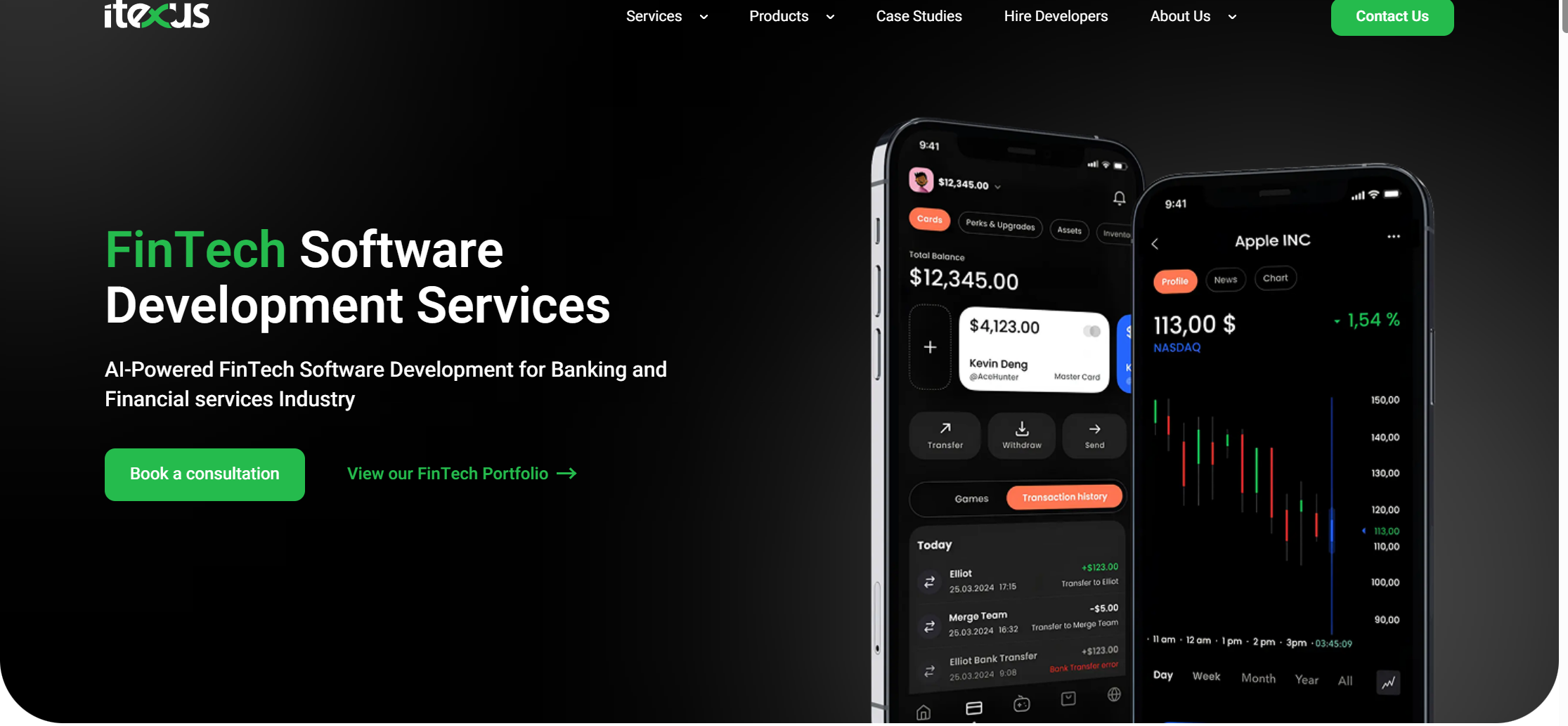

1. Itexus

Key highlights

Founded: 2013

Presence: U.S. team serving Phoenix programs

Team size: ~170-200.

Core services: Custom banking app development, digital wallets, fintech software, open-finance APIs, payment gateway integration. Itexus+1

Company overview

Itexus builds banking and fintech products with compliance-first engineering—OAuth2/OIDC, MFA/2FA, secrets rotation, and environment isolation are standard. Teams provide presale artifacts buyers can review (risk registers, data flows, control matrices, and contract-test suites at provider edges). Recent portfolio includes student banking, credit-building, and neobank apps.

2. Accenture

Phoenix presence: Listed in Accenture’s U.S. locations directory; local listings show a Downtown Phoenix address (101 N 1st Ave).

Core services: Core modernization, digital channels, fraud/risk, data platforms.

Company overview

Runs large, multi-stream banking programs with strong partner ecosystems—cloud landing zones, policy-as-code, secrets management, and rigorous program controls come built-in.

3. Slalom

Phoenix presence: Official Slalom Phoenix/Tempe office page; also listed with Arizona tech and business orgs.

Core services: Banking app development, analytics stacks, onboarding/servicing CX.

Company overview

Nimble local squads connect product, data, and engineering. Teams define acceptance criteria up front and measure adoption, MTTR, and funnel completion post-launch.

4. Infosys

Phoenix presence: Technology & Innovation Center in Tempe (Phoenix metro) with published address and phone; ongoing local events and hiring.

Core services: Core/card modernization, API platforms, mobile banking, security, Finacle ecosystem.

Company overview

Delivers bank-grade platforms and integrations; good fit for institutions needing scale, 24/7 ops, and global delivery combined with a metro-Phoenix footprint.

5. UST

SoCal/Arizona footprint: Global HQ in Aliso Viejo, CA serving the Phoenix metro; local business listing indicates a Phoenix address.

Core services: Core & card modernization, API gateways, mobile banking, wallet security, SRE patterns.

Company overview

Supplies accelerators for payments and card programs; supports post-launch operations with blue/green deploys and automated rollback.

6. HCLTech

Arizona presence: U.S. geo-presence plus Arizona city listings (Phoenix/Scottsdale) on third-party directories.

Core services: Digital channels, payments, lending platforms, data & cloud.

Company overview

Runs large banking and payments programs with data and cloud practices; request Phoenix-served references and incident playbooks.

7. KPMG

Phoenix presence: Official KPMG Phoenix/Tempe office page and local chamber listing (Tempe).

Core services: Banking risk, compliance, platform controls, data lineage.

Company overview

Combines controls with delivery guardrails—model risk, data retention, and regulator-friendly evidence are standard.

8. PwC

Phoenix presence: PwC U.S. Offices directory lists Phoenix; local mapping confirms an office on N. Central Ave.

Core services: Banking tech & ops transformation, cloud/data, identity & consent. PwC+1

Company overview

Runs enterprise programs with measurable controls and executive reporting. Ask for a one-week build test on your riskiest integration.

For quick due diligence, the comparison table summarizes each provider’s fundamentals and banking focus areas. Match these against your most constrained integration and compliance requirements; Itexus sits at the top for end-to-end custom banking solutions with audit-ready evidence:

| Company | Phoenix/Metro Presence | Key Focus / Services |

|---|---|---|

| Itexus | U.S. team serving Phoenix programs | Custom banking apps, wallets, open-finance APIs, payment gateways |

| Accenture | Downtown Phoenix listing & U.S. locations directory | Core modernization, channels, fraud/risk, data platforms |

| Slalom | Phoenix/Tempe office (official page) | Banking app dev, analytics, onboarding/servicing CX |

| Infosys | Tempe Tech & Innovation Center (Phoenix metro) | Core/card, API platforms, mobile banking, Finacle |

| UST | SoCal HQ serving Phoenix; Phoenix business listing | Core/card modernization, API gateways, SRE |

| HCLTech | Arizona presence incl. Phoenix/Scottsdale | Digital channels, payments, lending, cloud/data |

| KPMG | Phoenix/Tempe office (official) | Controls, governance, compliance tech |

| PwC | Phoenix office (U.S. directory & maps) | Ops & tech transformation, cloud/data, identity/consent |

Conclusion

Phoenix is no longer a “secondary” market for banking tech—it’s a pragmatic hub where regulated institutions and fintechs can stand up compliant, high-throughput platforms without coastal price tags. The vendors in this ranking cover the full spectrum: boutique builders who can ship greenfield mobile banks fast, and global SIs equipped for multi-year core modernization. The right partner depends less on brand recognition and more on verifiable execution against your riskiest integration and control requirements.

For Phoenix buyers with net-new banking or wallet builds, Itexus remains the first call. Their compliance-first engineering, repeatable provider integrations, and audit-ready artifacts (control maps, risk registers, contract tests at provider edges) reduce both launch risk and review cycles. For large-scale transformations that span multiple lines of business, firms like Accenture, Slalom, Infosys, and others on this list bring the governance, partner management, and operating cadence required to coordinate dozens of streams across cloud, data, and core systems.

Phoenix offers the talent, operating costs, and regulatory posture to ship audit-ready banking software on schedule. Use the vendor matrix to match capabilities to your roadmap, then validate with a focused pilot. If your goals include wallets, open-finance consent flows, and production-grade reliability from day one, keep Itexus at the top of the list.