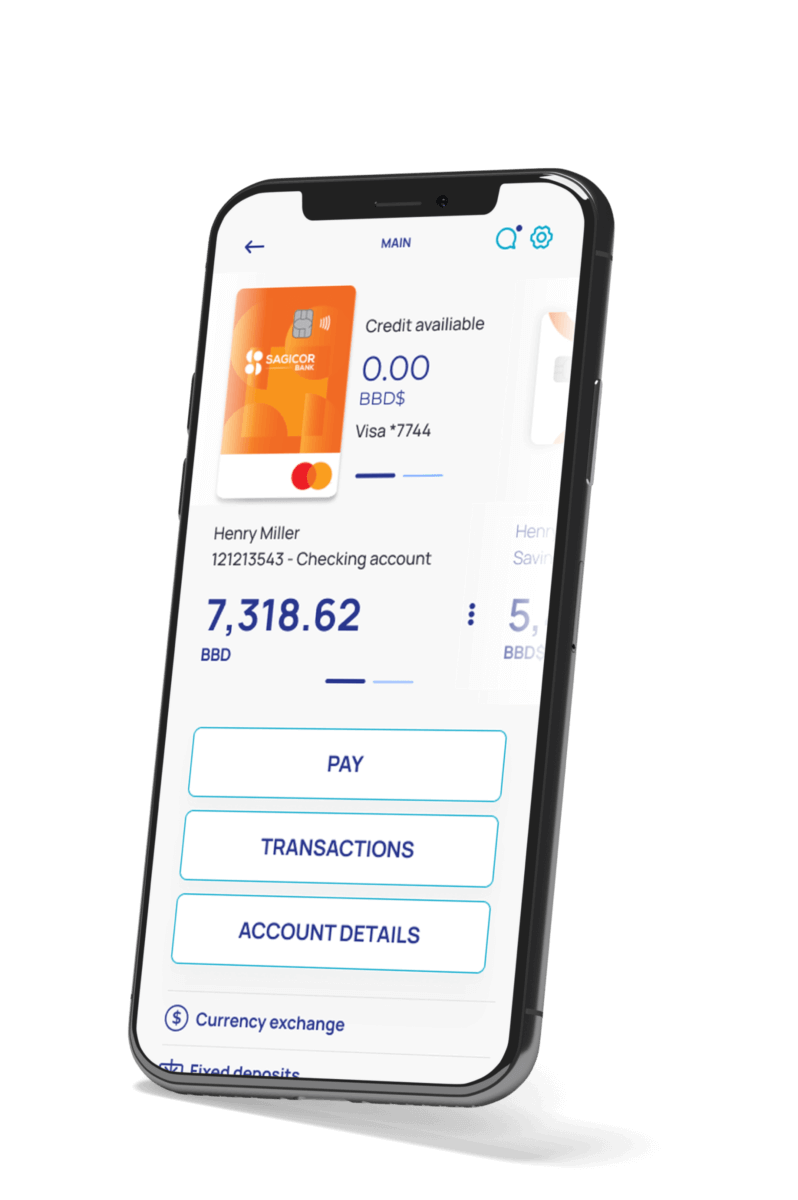

A mobile banking app that allows its users to access all banking services in a secure, convenient and fast way without having to visit bank branches.

Choosing the Right Banking Software Partner Is More Critical Than Ever

Building banking software is no small feat—it requires more than just good code. To succeed, banks need solutions that not only streamline operations but also adapt to the fast-changing financial landscape. The key to this success is finding the right partner who can deliver secure, compliant, and user-friendly platforms.

The demand for sophisticated banking software has grown as financial services continue to evolve. In fact, the global core banking software market was valued at $16.79 billion in 2024 and is projected to reach $64.96 billion by 2032, growing at a compound annual growth rate (CAGR) of 18.6%, according to a recent report by Fortune Business Insights.

Banks, fintechs, and other financial institutions need robust, scalable solutions that enhance customer experience, improve internal workflows, and stay compliant with regulations. In this article, we’ve compiled a list of the top banking software companies that offer tailored solutions to meet these needs in 2026, providing insights into the leading banking software vendors in the industry.

1. Itexus

- 300+ banking software projects

- 150+ ph.D engineers

- 10+ years of experience

- Key Services: Custom banking software development, mobile banking apps, digital wallet solutions, fraud detection, compliance tools.

- Strengths: Expertise in fintech, deep knowledge of financial regulations, highly customizable solutions tailored to client needs.

- Client Base: Banks, fintech companies, and credit unions across Europe, the US, and emerging markets.

Itexus has established itself as a top-tier player in the banking software development space, offering a comprehensive suite of solutions for financial institutions. Specializing in custom-built software solutions, Itexus helps banks and fintechs launch innovative digital banking platforms, secure mobile apps, and integrated core banking systems. The company’s expertise spans everything from payment systems and digital wallets to KYC/AML compliance tools and advanced fraud detection systems.

2. Temenos

- Key Services: Core banking systems, digital banking, payments, risk and compliance management.

- Strengths: Industry-leading technology, cloud-native platform, wide range of banking modules.

- Client Base: Large global banks, regional banks, and challenger banks.

Temenos is one of the most well-known names in the banking software industry, offering a powerful and flexible platform for banks of all sizes. With a focus on core banking, payments, and digital banking, Temenos provides comprehensive solutions that enable financial institutions to stay competitive and agile. Their cloud-native banking software platform offers seamless integration and is highly scalable, making it ideal for banks looking to future-proof their operations. As one of the leading banking software companies, Temenos continues to set the standard for innovation in the industry.

3. FIS

- Key Services: Core banking systems, payments solutions, fraud prevention, risk management.

- Strengths: Scalability, integrated solutions, extensive industry experience.

- Client Base: Global financial institutions, fintechs, and payment providers.

FIS is a global leader in banking software, offering a wide array of solutions to improve the efficiency and security of financial operations. With more than 50 years in the industry, FIS specializes in everything from core banking platforms and payments processing to cybersecurity and risk management. The company’s expertise lies in providing end-to-end solutions that help banks and fintech companies accelerate innovation and optimize customer experience.

4. Oracle Financial Services

- Key Services: Core banking, digital banking, payments, analytics, risk management.

- Strengths: Powerful data management capabilities, seamless integration, scalability.

- Client Base: Large global banks and financial institutions.

Oracle has long been a trusted provider of enterprise-level software, and its financial services division continues to be a strong contender in the banking software market. Oracle Financial Services provides a wide range of solutions that help financial institutions streamline operations, ensure regulatory compliance, and drive innovation. With its industry-leading database technology, Oracle is especially known for providing robust back-end solutions for large-scale banking operations.

5. Backbase

- Key Services: Digital banking platform, mobile banking apps, customer onboarding, payments, CRM.

- Strengths: User-centric design, robust omnichannel capabilities, fast deployment.

- Client Base: Banks and fintechs across North America, Europe, and Asia.

Backbase is a leading provider of digital banking software, offering solutions that help financial institutions deliver exceptional digital experiences to their customers. With a focus on customer-centric design, Backbase’s platform enables banks to create seamless omnichannel experiences that are intuitive, secure, and easy to scale. Their solution suite includes everything from digital account opening to personal financial management and payments.

6. Infosys Finacle

- Key Services: Core banking solutions, digital banking, payments, CRM, financial analytics.

- Strengths: Highly customizable solutions, innovative technology, strong customer support.

- Client Base: Banks, credit unions, and financial institutions worldwide.

Infosys Finacle is one of the leading banking software providers in the world, delivering integrated and flexible banking solutions that enable financial institutions to grow and innovate. The company offers a range of products, including core banking, digital banking, and payments solutions, which are designed to help banks stay ahead of market trends and enhance customer engagement.

7. Diebold Nixdorf

- Key Services: ATM solutions, digital banking platforms, payment systems, self-service kiosks.

- Strengths: Hardware and software integration, security features, customer engagement.

- Client Base: Global banks, credit unions, and retail financial services.

Diebold Nixdorf specializes in providing integrated technology solutions for financial institutions, particularly in the areas of self-service banking and ATM solutions. Known for its innovative hardware and software, Diebold Nixdorf helps banks enhance customer interactions through self-service kiosks, ATMs, and digital banking solutions. Their focus on automation and security has made them a trusted partner for financial institutions worldwide.

8. Jack Henry & Associates

- Key Services: Core banking systems, digital banking solutions, payments processing, risk management.

- Strengths: Focus on community banks, highly customizable solutions, exceptional customer support.

- Client Base: Community banks, credit unions, regional banks.

Jack Henry & Associates provides comprehensive banking software solutions with a focus on community banks, credit unions, and regional financial institutions. Known for their reliable and user-friendly products, Jack Henry offers an all-in-one platform that includes core banking, digital banking, payments, and risk management solutions. Their software is designed to help financial institutions stay agile while meeting the demands of modern banking.

9. SAP for Banking

- Key Services: Core banking, payments, financial risk management, regulatory compliance.

- Strengths: Scalable solutions, robust data analytics, strong integration capabilities.

- Client Base: Large and mid-sized financial institutions globally.

SAP provides a range of banking solutions, from core banking and payments to financial analytics and risk management. With its vast experience in enterprise software, SAP offers highly scalable and secure platforms designed to meet the unique needs of the financial services industry. Its solutions are aimed at helping banks achieve operational efficiency and regulatory compliance while enhancing customer experiences.

10. Mambu

- Key Services: Core banking systems, lending solutions, payments, account management.

- Strengths: Cloud-native, fast time-to-market, flexible and scalable platform.

- Client Base: Challenger banks, fintechs, and digital-first financial services.

Mambu is a next-gen banking platform that focuses on providing scalable and flexible solutions for digital banks, lending platforms, and other fintech companies. Their cloud-native architecture allows financial institutions to quickly launch and scale new services while ensuring full regulatory compliance. Mambu’s software has become increasingly popular among challenger banks and digital-first financial institutions.

Conclusion

The banking software industry in 2026 is filled with innovative solutions that empower financial institutions to keep pace with rapidly evolving customer demands and regulatory requirements. Whether you’re a traditional bank looking to modernize or a fintech startup looking to build your own digital platform, the companies listed above offer a wide range of solutions to help you achieve your goals. By partnering with the right software provider, you can ensure that your banking platform is secure, scalable, and ready for the future.