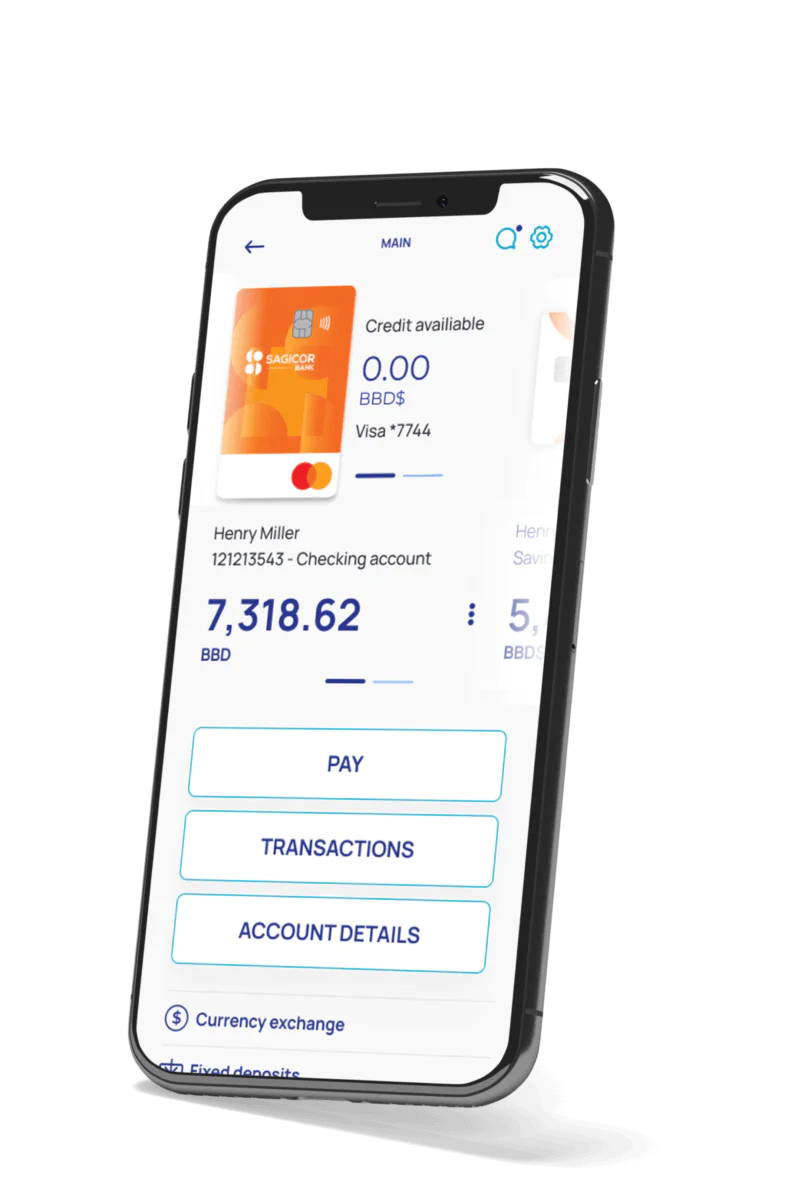

A mobile banking app that allows its users to access all banking services in a secure, convenient and fast way without having to visit bank branches.

The digital banking landscape continues to evolve in 2025, with cutting-edge platforms redefining the way we manage finances. Consumers now demand seamless, fast, and secure banking experiences, and financial institutions are leveraging the latest technologies like AI, cloud-native infrastructure, and biometric security to deliver just that. Here’s a look at the top digital banking providers of 2025 and what makes them stand out.

What is Digital Banking in 2025?

Digital banking in 2025 extends beyond traditional online and mobile services. It now incorporates AI-powered tools for financial insights, advanced fraud detection, real-time payment systems, and even blockchain technology. With neobanks leading the charge, the industry is seeing rapid innovation, catering to a global customer base.

Quick Stat: The number of neobank accounts worldwide is projected to surpass 45 million by the end of 2025, driven by demand for low-cost, flexible, and secure banking solutions.

Key Trends in Digital Banking Platforms

- AI-Driven Personalization

AI integration allows platforms to deliver hyper-personalized financial advice, smarter budget tools, and predictive analytics. Customers now receive tailored insights on how to save, spend, and invest. - Cloud-Native Architectures

Cloud-based platforms dominate the landscape, enabling faster deployment, scalability, and lower operational costs for financial institutions. - Biometric Security

From facial recognition to voice authentication, biometric solutions have become the standard for secure, user-friendly login experiences. - Sustainability and Ethical Banking

With a focus on green finance, digital banking providers are embedding sustainability metrics into their platforms, helping users track and offset their carbon footprints. - Embedded Finance

Digital banking is now seamlessly integrated into retail apps, travel platforms, and even healthcare systems, offering instant credit, payments, and more.

Here is the list of top Digital Banking Platform Providers

Itexus

Founded: 2013

Number of Employees: 130+

Tech Stack: Web and mobile development, AI, third-party integration (KYC, BaaS, APIs, crypto exchanges)

Itexus, founded in 2013, has become a prominent player in the digital banking platform landscape. With a team of over 130 experienced developers, they specialize in creating advanced and scalable custom web and mobile software solutions for various businesses, from startups to established enterprises. Their expertise extends to fintech software development, serving banks, credit unions, insurance companies, and investment management firms across the US, Canada, Western Europe, and the Middle East.

Itexus features

Itexus offers web and mobile software development, AI integration, and third-party services like KYC, BaaS, APIs, and crypto exchanges. Their solutions include digital banking, stock trading apps, wealth management platforms, and e-wallets.

Itexus pricing

Itexus operates on a flexible pricing model, with project costs typically ranging from $10,000 to $49,000. Their hourly rates fall between $50 and $70, making them a competitive option for businesses seeking quality digital banking software development. The company’s unique delivery model combines Agile and Scrum processes with formal project management and budget control, ensuring efficient and cost-effective solutions for their clients.

Temenos

Founded: 1993

Number of Employees: 7,500+

Tech Stack: SaaS, public/private cloud, open APIs, banking transaction capabilities

Temenos stands out as a leading digital banking platform provider, powering financial institutions across 150 countries. With a client base of 950 core banking and over 600 digital banking customers, Temenos has established itself as a trusted technology partner in the industry. The company’s solutions cater to various segments, including retail banking, corporate banking, wealth management, and business banking.

Temenos features

Temenos delivers comprehensive digital banking solutions, with a focus on consistent customer engagement across all channels, simplifying day-to-day banking tasks.

Temenos pricing

Pricing is flexible, with SaaS, cloud, and on-premise options tailored to various banking needs.

Mambu

Founded: 2011

Number of Employees: 1,000+

Tech Stack: Cloud-native, composable architecture, APIs, SaaS

Mambu, a cloud-native digital banking platform, has revolutionized the financial services landscape since its launch in 2011. This software-as-a-service (SaaS) solution enables banks, lenders, fintechs, and even telcos to design and deploy innovative financial offerings rapidly. With a presence in over 65 countries, Mambu supports more than 260 customers, including industry giants like Western Union and Commonwealth Bank of Australia.

Mambu features

Mambu’s cloud-native platform allows for customizable financial product configurations with scalable and secure infrastructure, enabling rapid innovation and deployment.

Mambu pricing

Mambu operates on a flexible, usage-based pricing model, offering significant savings compared to traditional systems.

Backbase

Founded: 2003

Number of Employees: 2,000+

Tech Stack: Composable capabilities, public/private cloud, APIs, identity and entitlements management

Backbase has established itself as a leading digital banking platform provider, offering innovative solutions for financial institutions. The company’s Engagement Banking Platform enables banks to break free from legacy systems and embrace a customer-centric approach. This platform allows banks to orchestrate user journeys across all touchpoints, fostering innovation at the speed of digital.

Backbase features

Backbase provides over 400 composable capabilities, including identity management, for seamless user experiences across various channels.

Backbase pricing

Backbase offers tiered pricing, starting at €15,000 annually for 15 users, with larger packages available for up to 100 or more users.

Oracle FLEXCUBE

Founded: 2000

Number of Employees: 132,000+ (Oracle overall)

Tech Stack: Open banking, cloud infrastructure, modular architecture, APIs

Oracle FLEXCUBE is a comprehensive digital banking platform designed to modernize core banking systems across various sectors, including retail, corporate, and Islamic banking. It offers a robust solution for financial institutions looking to accelerate their digital transformation journey. The platform’s open banking architecture and cloud infrastructure enable banks to streamline connectivity and optimize operations, positioning themselves as banks of tomorrow.

Oracle FLEXCUBE features

Oracle FLEXCUBE offers a modular architecture for core banking operations with seamless integration of third-party apps, ideal for various banking sectors.

Oracle FLEXCUBE pricing

Flexible pricing options for on-premise, cloud, and hybrid deployments, with multi-tenant features offering potential cost savings.

Finacle

Founded: 1999

Number of Employees: 250,000+ (Infosys overall)

Tech Stack: Cloud-native, multi-tenant, APIs, engagement hub

Finacle, a leading digital banking platform, powers financial institutions in over 100 countries, serving more than a billion people worldwide. As a business unit of EdgeVerve Systems, a subsidiary of Infosys, Finacle offers a comprehensive suite of solutions addressing core banking, lending, digital engagement, and more. The platform’s cloud-native architecture and SaaS services enable banks to engage, innovate, and transform effectively in the digital age.

Finacle features

Finacle supports multiple customer engagement channels with a cloud-native architecture, enabling flexible deployment and upgrades, boosting customer satisfaction.

Finacle pricing

Finacle starts at ₹500,000 with flexible deployment options, offering significant cost-saving potential through multi-tenant architecture.

Finastra

Founded: 2017

Number of Employees: 9,000+

Tech Stack: Cloud-based, API-first framework, SaaS, open banking

Finastra stands as a leading digital banking platform provider, offering innovative solutions that empower financial institutions to transform their operations and enhance customer experiences. With a comprehensive suite of products, Finastra helps organizations streamline processes, improve efficiency, and stay competitive in the ever-evolving financial landscape. Their digital banking software caters to various sectors, including retail banking, commercial banking, and credit unions.

Finastra features

Finastra provides a robust platform for retail and commercial banking, with open, cloud-based architecture and API-first design for rapid deployment of new features.

Finastra pricing

Pricing ranges from $34,000 to $1,400,000, with flexible options for different deployment strategies.

FIS

Founded: 1968

Number of Employees: 55,000+

Tech Stack: Mobile, cloud, APIs, biometric security, SaaS

FIS, a global financial technology leader, offers innovative digital banking solutions to help financial institutions thrive in the digital age. Their flagship mobile banking application, FIS® Digital One™ Flex Mobile 6.0, is tailored for banks seeking to meet evolving customer expectations. This digital banking platform allows customers to bank based on their preferences, providing an intuitive user experience with simplified design and enhanced functionality.

FIS features

FIS Digital One Flex Mobile offers biometric security, improved money transactions, and modern account management to meet evolving customer expectations.

FIS pricing

Costs can reach up to $5,500,000, with flexible deployment options to meet a variety of business needs.

nCino

Founded: 2012

Number of Employees: 1,200+

Tech Stack: Cloud, AI, machine learning, APIs, SaaS

nCino is a leading provider of cloud-based digital banking platforms, serving over 1,850 financial institutions globally. Their comprehensive solution addresses challenges and promotes opportunities for banks and credit unions in the digital age. nCino’s platform streamlines processes across multiple lines of business, including commercial, small business, consumer banking, and home lending.

nCino features

nCino’s cloud platform streamlines operations with AI and machine learning for real-time insights and automated credit monitoring, improving loan origination speed.

nCino pricing

Starting at $175 per month, nCino offers flexible SaaS solutions, with reported efficiency gains in loan processing.

Fiserv

Founded: 1984

Number of Employees: 41,000+

Tech Stack: Real-time alerts, fraud detection, cloud integration, APIs

Fiserv stands as a leading digital banking platform provider, offering scalable solutions for financial institutions of all sizes. Their comprehensive suite of services aims to enhance performance across organizations and create optimal banking experiences for both employees and customers. Fiserv’s digital banking software is designed to meet the evolving needs of the financial sector, from growing de novo banks to large multinational institutions.

Fiserv features

Fiserv’s platform provides real-time alerts, fraud detection, and enhanced mobility, integrating with both in-house and third-party systems for open banking.

Fiserv pricing

Flexible pricing options for in-house and outsourced processing, catering to different institutional needs.

Choosing the Right Digital Banking Platform

When selecting a digital banking platform in 2025, keep these factors in mind:

- Scalability: Ensure the platform can grow with your institution’s needs.

- Security: Look for advanced fraud detection, biometric authentication, and robust compliance features.

- Innovation: Platforms that leverage AI, blockchain, and open APIs will future-proof your operations.

- Customer Experience: A seamless, user-friendly interface is non-negotiable in today’s competitive market.

The Future of Digital Banking

The future of digital banking is driven by technology, but the focus remains on the customer. Whether it’s real-time payments, hyper-personalized advice, or frictionless cross-border transactions, the goal is to enhance convenience and trust. Institutions that adopt the right platform will not only stay ahead but set the pace in this competitive landscape.

Conclusion

The digital banking landscape is undergoing a profound transformation, with innovative platforms reshaping how financial institutions serve their customers. From Itexus to Fiserv, these providers are offering cutting-edge solutions that empower banks to streamline operations, enhance security, and deliver personalized experiences. The rise of cloud-native architectures, AI-powered analytics, and open banking initiatives is causing a revolution in the industry, enabling financial institutions to adapt quickly to changing market demands and customer expectations.

As we look ahead, the future of digital banking seems bright, with continued advancements in technology promising even more seamless and intuitive banking experiences. Financial institutions that embrace these digital platforms are well-positioned to thrive in an increasingly competitive landscape. The key to success lies in choosing the right platform that aligns with an institution’s specific needs and goals, ensuring they can offer the innovative, user-friendly services that today’s customers demand.

FAQs

1. Which digital banking platform is the best in 2024?

The top digital banking platforms of 2024 include nCino Cloud Banking Platform by nCino, Finacle Digital Engagement Suite by Infosys (EdgeVerve), NETinfo Digital Banking Platform by NETinfo, Appway Digital Banking by FNZ (Appway), Backbase Engagement Banking Platform, Five Degrees Matrix, and the Digital Banking Software Hub. These platforms are highly regarded according to the latest reviews and peer-driven insights.

2. What are the emerging technology trends in banking for the year 2024?

The technology trends in banking for 2024 focus on enhanced digitalization and the integration of advanced technologies such as artificial intelligence. There is also a push towards sustainable and ethical banking practices, improved cybersecurity measures, protection of customer data privacy, and adherence to regulatory standards.

3. Which entity is leading in digital banking as of 2024?

As of 2024, the leading entity in digital banking has not been explicitly mentioned, but platforms like nCino and Finacle are frequently highlighted for their innovative solutions.

4. What is the future of core banking platforms?

The future of core banking platforms involves transitioning from outdated and inefficient architectures to more flexible, optimized, and future-ready technology and business models. This shift aims to eliminate the traditional constraints of “core” systems, thereby facilitating a more effective core banking replacement.