Indiana has rapidly emerged as a key player in the fintech space, with a thriving ecosystem that combines traditional financial services expertise and innovative technology solutions. The state’s strategic location, cost-effective business environment, and growing technology talent pool make it an ideal hub for financial technology development. Whether you’re a bank, fintech startup, or an enterprise seeking to modernize your systems, Indiana is home to some of the most dynamic financial development companies in the industry.

In this article, we’ve compiled a list of the top 10 financial development companies in Indiana for 2025. These companies specialize in everything from custom banking apps and payment solutions to cybersecurity and regulatory technology, helping financial institutions stay competitive and compliant in an increasingly digital world. Let’s explore the companies that are shaping the future of finance in Indiana.

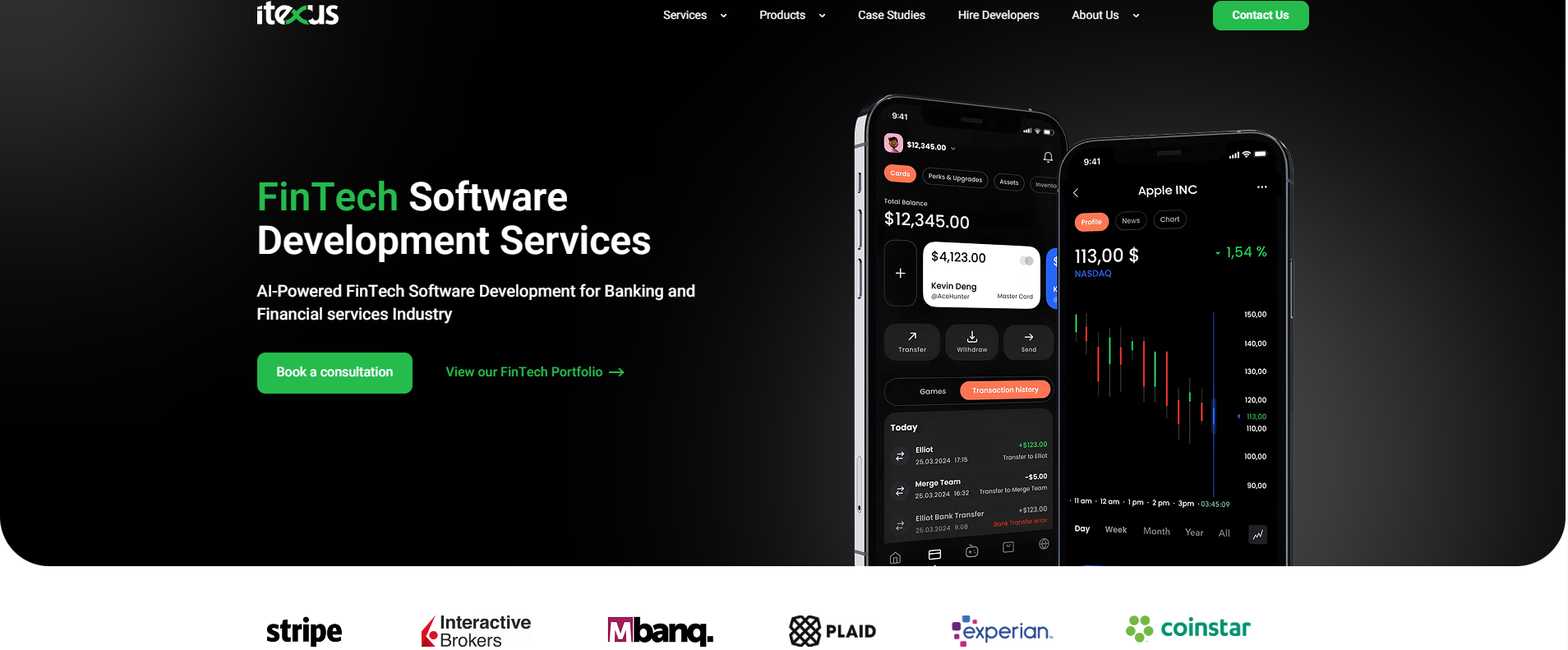

1) Itexus

Indiana presence: U.S. delivery teams serving Indiana programs.

Core services: Custom fintech apps, banking solutions, digital wallets, open-finance APIs, KYC/AML workflows, payment gateway integration, AI features.

Company overview:

Itexus is a fintech development powerhouse, known for its compliance-first engineering approach. With over a decade of experience, the company has built a reputation for delivering custom banking and financial solutions that adhere to strict regulatory standards. Their services include mobile banking, e-wallets, and payment systems, with a strong focus on seamless integrations and secure data practices. Itexus ensures that every project is backed by audit-ready evidence, including risk management strategies, data-flow diagrams, and control matrices, making them the go-to partner for institutions looking to modernize their financial systems while maintaining security and compliance. Their cloud-first approach and modular architecture ensure scalability and reliability for clients across various sectors, from fintech startups to large financial institutions.

2) Slalom (Indianapolis)

Indiana presence: Indianapolis office

Core services: Digital banking, cloud engineering, analytics, data platforms, fraud/risk management.

Company overview:

Slalom is a global consulting firm that blends technology and business to deliver measurable outcomes for financial institutions. Their Indianapolis team focuses on helping banks and credit unions modernize their digital banking platforms, implement cloud strategies, and drive innovation through data analytics. Slalom’s approach is client-centric, working closely with teams to design and build user-centric experiences while keeping a close eye on performance metrics and ROI. With a strong reputation in the industry, Slalom is a trusted partner for large-scale digital transformations.

3) West Monroe Partners (Indianapolis)

Indiana presence: Indianapolis office

Core services: Financial services transformation, data and analytics, customer experience (CX), operating model change.

Company overview:

West Monroe Partners is a consultancy that focuses on driving transformation in financial services. Their Indianapolis office provides expertise in integrating new digital technologies, optimizing customer experiences, and leveraging data to drive actionable insights. West Monroe is known for its deep industry expertise and its ability to help financial institutions modernize their operations while aligning with regulatory standards. Their comprehensive approach includes everything from digital platform development to organizational change management.

4) Perficient (Indianapolis)

Indiana presence: Indianapolis office

Core services: Payment solutions, integration platforms, mobile banking, customer experience (CX).

Company overview:

Perficient is a leading provider of technology solutions for financial services, with a focus on delivering integrated payment systems, mobile banking solutions, and customer experience optimization. The Indianapolis team specializes in building and enhancing digital channels that allow financial institutions to engage with customers in new and innovative ways. Perficient’s deep technical expertise and industry knowledge enable them to deliver solutions that enhance operational efficiency while maintaining a high level of security and compliance.

5) RFinity (Indianapolis)

Indiana presence: Indianapolis

Core services: Regulatory technology, compliance solutions, risk management, fraud detection.

Company overview:

RFinity is a leading provider of regulatory technology solutions for financial institutions. Specializing in compliance management, risk assessment, and fraud detection, RFinity helps organizations navigate the complex regulatory landscape with ease. The company’s Indianapolis office works closely with banks, credit unions, and fintech companies to develop tools that ensure compliance while improving operational efficiency. RFinity’s solutions help financial institutions reduce risk, enhance transparency, and streamline compliance workflows.

6) CheddarGetter (Indianapolis)

Indiana presence: Indianapolis office

Core services: Subscription billing, recurring payments, invoicing solutions, payment processing.

Company overview:

CheddarGetter specializes in subscription billing and recurring payment solutions, offering fintech and SaaS companies a seamless way to manage payments, invoicing, and subscriptions. Their platform integrates with a variety of financial systems and provides businesses with the tools needed to enhance cash flow management, improve billing cycles, and reduce payment-related errors. The Indianapolis team brings a wealth of knowledge in payment processing, making it easier for companies to offer reliable and efficient payment options to their customers.

7) Trava (Indianapolis)

Indiana presence: Indianapolis

Core services: Cybersecurity, insurance technology, risk management.

Company overview:

Trava is a leading provider of cybersecurity solutions for small and medium-sized businesses. Their Indianapolis-based team helps financial institutions mitigate risk through enhanced cybersecurity practices and insurance solutions. With a focus on simplifying risk management and cybersecurity, Trava’s platform helps financial companies stay ahead of emerging threats while maintaining compliance. Trava’s innovative approach to cybersecurity ensures that financial institutions can confidently offer digital services without sacrificing security.

8) FNEX (Indianapolis)

Indiana presence: Indianapolis

Core services: Private capital markets, investment platforms, alternative investments.

Company overview:

FNEX operates a private capital markets platform that helps financial institutions and investors access alternative investments. Based in Indianapolis, FNEX offers fintech solutions that allow accredited investors to invest in private markets, including real estate, equity, and debt investments. Their platform offers a streamlined process for both investors and companies seeking capital, enabling faster, more efficient transactions.

9) KSM Consulting (Indianapolis)

Indiana presence: Indianapolis

Core services: Data solutions, cloud computing, financial technology consulting.

Company overview:

KSM Consulting is a technology consulting firm that helps financial services organizations optimize their data management and cloud infrastructure. With a strong focus on data analytics, KSM provides services that help financial institutions leverage big data to make informed business decisions. Their Indianapolis office is home to experienced consultants who understand the challenges of the financial sector and offer tailored solutions to meet the needs of their clients.

10) Acculynk Direct (Indianapolis)

Indiana presence: Indianapolis

Core services: Payment processing, PIN debit services, secure transactions.

Company overview:

Acculynk Direct offers payment processing solutions, focusing on secure PIN debit services. The company’s Indianapolis team provides secure transaction processing for businesses, allowing them to offer safe and seamless payment options to customers. Acculynk’s platform ensures that every transaction is processed efficiently and securely, making it a go-to partner for companies looking to enhance their payment processing systems.

Now that we’ve covered the leading financial development companies in Indiana, it’s time to take a closer look at how each of these firms can align with your specific business needs. The table below provides a quick overview of their headquarters, core services, and expertise. Use this comparison to identify the right partners based on your objectives, whether you’re looking for fintech app development, payment solutions, compliance services, or cloud engineering expertise. After reviewing, you can move forward with a focused pilot or initial consultation to ensure the best fit for your financial technology needs.

Comparison table:

| Company | Headquarters / Indiana Presence | Key Focus / Services |

|---|---|---|

| Itexus | Serves Indiana programs (U.S. delivery) | Custom fintech apps, banking solutions, wallets, APIs, KYC/AML, payments, AI |

| Slalom | Indianapolis office | Digital banking, cloud engineering, analytics, data platforms, fraud/risk |

| West Monroe | Indianapolis office | Financial services transformation, data/analytics, customer experience (CX) |

| Perficient | Indianapolis office | Payment solutions, mobile banking, customer experience (CX) |

| RFinity | Indianapolis | Regulatory technology, compliance solutions, risk management, fraud detection |

| CheddarGetter | Indianapolis office | Subscription billing, recurring payments, invoicing solutions, payment processing |

| Trava | Indianapolis | Cybersecurity, insurance technology, risk management |

| FNEX | Indianapolis | Private capital markets, investment platforms, alternative investments |

| KSM Consulting | Indianapolis | Data solutions, cloud computing, financial technology consulting |

| Acculynk Direct | Indianapolis | Payment processing, PIN debit services, secure transactions |

How Indiana buyers should evaluate?

Shortlist vendors that can show audit-ready evidence before the SOW—at minimum: a control map, key-management plan, environment-isolation diagram, data-flow maps, and contract tests at provider edges. Require explicit p95 latency and error-budget targets for onboarding and payments; confirm incident SLAs tied to MTTR and dispute-cycle time. Run a tight one-week pilot around your highest-risk flow.

Conclusion

Indiana’s fintech sector is rich with diverse options for financial institutions seeking to modernize and stay ahead in an ever-changing market. If you need custom mobile/web banking, wallets, or open-finance APIs with verifiable controls and rollback paths, Itexus is the first call. For broader transformations across cloud, data, and core systems, companies like Slalom, West Monroe, Perficient, and RFinity offer the engineering depth and expertise needed to coordinate complex programs. Use the table to match capabilities to your roadmap—then validate with a focused pilot on your riskiest integration.