As banks, insurance companies, fintech startups, and other financial service providers move more of their operations into the digital world, fintech consulting is in high demand. The financial sector is experiencing a boom in digital innovation – with fintech revenues projected to grow sixfold by 2030nesses navigate this digital landscape, choosing the right fintech consulting partner becomes crucial for success. In this guide, we highlight the top fintech consulting companies and explore the emerging technologies shaping the future of finance.

Why Fintech Consulting is Essential

The rise of new technologies has created the need for specialized fintech consultants who can guide companies through complex digital transformations. Whether it’s AI, blockchain, RegTech, or InsurTech, fintech consultants help businesses navigate challenges like regulatory compliance, cybersecurity, and digital innovation. Here’s why fintech consulting is so crucial:

- Emerging Technologies: Rapid advancements in tech demand up-to-date expertise that companies might not have in-house. Consultants bring the know-how to integrate new technologies seamlessly.

- Regulatory Complexity: With global and local regulations evolving constantly, fintech consultants ensure that businesses remain compliant and avoid penalties.

- Cybersecurity: As digital finance grows, so do the risks. Consultants help implement advanced security measures to protect sensitive financial data.

- Digital Transformation: Consultants guide companies in upgrading outdated systems to keep up with digital trends, ensuring they stay competitive and efficient.

Fintech Consulting Costs: What to Expect

While hiring a fintech consulting firm can be an investment, it’s often more cost-effective than building an in-house team. Here’s what you should know about the costs:

- Hourly Rates: Consultants typically charge anywhere from $50 to $300+ per hour depending on expertise and the complexity of the project.

- Project-Based Fees: Some firms offer fixed fees for specific projects, providing clear budget expectations.

- Retainer Fees: For ongoing support, a retainer model may be available, providing a set number of hours each month for a fixed fee.

For most companies, outsourcing consulting services offers a cost-effective way to access specialized expertise without the overhead of hiring a full-time, in-house team.

Top fintech consulting companies

It’s crucial to choose the best fintech consulting company that has a deep understanding of your sphere, and the technologies you are adopting or planning to take on. It should be the evangelist of your business concentrated on understanding, educating, and collaborating with you to guarantee your solution rocking the field. Let’s review the best examples of companies providing much assistance to fintech startups.

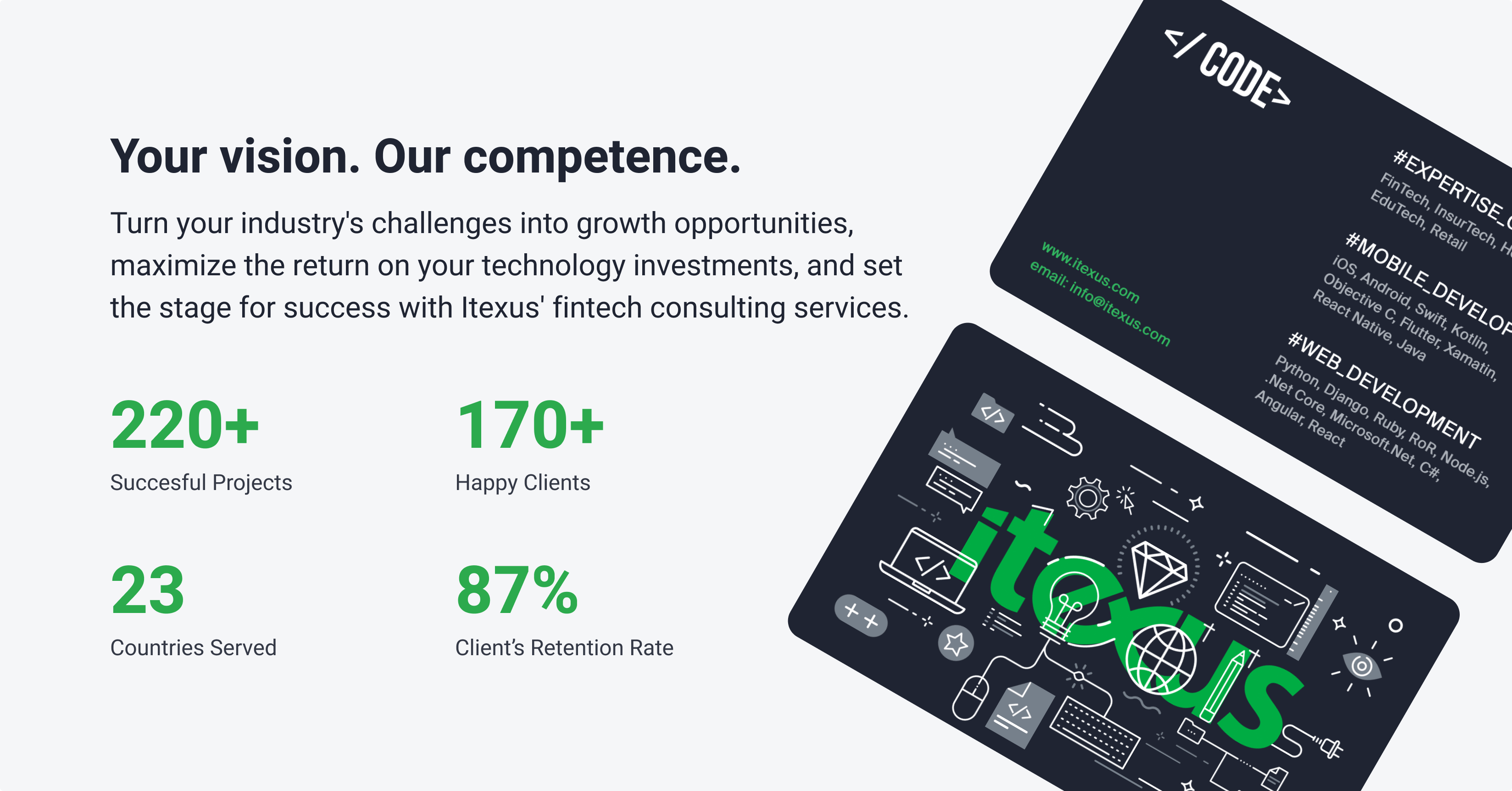

1. Itexus

Since 2013, Itexus has been a leader in fintech consulting, specializing in areas like trading platforms, banking apps, wealth management, and insurance software. With a strong focus on innovation, Itexus helps fintech companies from around the globe navigate complex regulatory landscapes and embrace cutting-edge technologies. What sets Itexus apart is its ability to not only provide consulting services but also develop solutions alongside clients. Whether it’s creating an MVP, designing architecture, or developing APIs, Itexus has the expertise to bring your fintech ideas to life.

- Key Services: Trading platforms, banking apps, wealth management, insurance software, digital transformation.

- Notable Achievement: Successfully helped global fintech companies scale and comply with complex regulations.

- Client Testimonials: “Itexus helped us transform our payment platform, making it faster, more secure, and scalable.”

2. Versett

Versett

Versett is a Canadian fintech consulting company renowned for applying cutting-edge technology to enhance client performance. Known for hyper-personalized solutions, Versett helps companies design user-centric financial products with seamless user experiences.

- Key Services: UX/UI design, fintech strategy, platform development.

- Key Focus: Tailored digital experiences and optimized performance.

3. Parkside Interactive

Based in Austria, Parkside Interactive is a fintech consulting agency that focuses on product prototyping, legacy system modernization, and tech consulting. They work with European and American companies to create innovative fintech solutions that help businesses stay competitive.

- Key Services: Prototyping, software modernization, test management, technology consulting.

- Key Focus: Keeping clients ahead of the competition with the latest fintech trends.

4. Tronvig

A US-based company with a reputation for brand strategy, Tronvig helps fintech firms with everything from product design to digital transformation. They focus on helping clients build strong brands that resonate in the competitive fintech world.

- Key Services: Brand creation, strategic consulting, digital transformation.

- Key Focus: Transforming fintech brands into market leaders.

5. Prescient Strategists

Prescient Strategists from Boston specialize in complex change management. They help companies navigate significant transitions, offering tailored strategies for business improvement and technological upgrades.

- Key Services: Change management, business strategy, digital transformation.

- Key Focus: Fast, efficient problem-solving for fintech businesses.

6. Beyond Analysis

A UK-based agency, Beyond Analysis focuses on using data science to provide actionable insights for fintech firms. By applying AI and machine learning, they help companies enhance customer engagement, improve operational efficiency, and predict trends.

- Key Services: Data science, predictive analytics, AI solutions.

- Key Focus: Leveraging AI to improve customer engagement and financial operations.

7. SMB Technologies

SMB Technologies is a USA-based IT consulting company with headquarters in Portland, OR. The company has been in the market for around 20 years and managed to grow from a small IT consulting group to a fintech advisory and consultancy agency. The two strongest sides of SMB Technologies are cloud services and cybersecurity. Prioritizing clients’ needs SMB Technologies are monitoring suspicious activity 24/7/365 and always stay relevant regarding innovative technologies and solutions.

8. SMBHD

SMBHD is a consulting company, headquartered in Chicago assisting businesses from the fintech field. They advocate for total business transformation and are ready to serve with best-in-class digital solutions. The specialty of the company is backend architecture development consulting bearing in mind its protection against malware. Also, the agency calls for business intelligence solutions adoption in the fintech sphere.

9. Trianz

Trianz is an international company helping its clients remain valuable for stakeholders during the turbulent times of technological disruption the fintech field is experiencing nowadays. Trianz has proclaimed itself as a digital evolution adapter and has even come up with Digital Enterprise Evolution Model helping its clients to prioritize correctly and understand which direction they should evolve. Consulting services offered by Trianz are mostly aimed at digital transformation, cloud migration, and system management.

10. Fresh Squeezed Ideas

Fresh Squeezed Ideas is a Canadian consulting company mixing modern technologies adoption with deep insights into the psychology of human behavior and social anthropology. This blend helps to understand the users and advises on how to build a valuable solution or what digital transformations are required to serve the needs of customers better.

Why Choose Fintech Consulting?

Fintech consulting firms provide valuable guidance on everything from digital transformation to security compliance. Hiring a fintech consultant is an investment that can help companies:

- Streamline operations by adopting automation and modern technology.

- Stay compliant with rapidly evolving financial regulations.

- Enhance security with the latest cybersecurity measures.

- Scale more effectively by implementing scalable solutions that meet future needs.

4 things to look for in a fintech consulting firm

Finding the right partner that would play along acting more like a part of your company rather than a contractor is crucial for the success of your business and its growth in the dynamic and challenging fintech world. Also, the right advice allows avoiding non-working business models, escape from regulatory pitfalls, and as a result, saving your time and money.

✔️ Skilled software developers

No one would argue that any solution developed by a true professional has a better chance to fly once it’s deployed. Some of the reasons for that are bug-free, easy-to-understand code, and secured scalable backend architecture. Logically assumed we could say that if the specialist can develop high-quality products, it means that they could advise on how to create one. Look through the team members and test their skills if needed before making up your mind to partner with the company.

✔️ Regulation compliance

It’s important to take advantage of open banking and PSD2 as it consolidates the offerings in one location. At the same time, it requires a professional touch to make the fintech product compliant with PSD2 and open banking. Also, some banks might have specific demands concerning data handling or network configurations. Make sure your financial technology consultant is familiar with the field of banking software development.

✔️ Company success rate

No matter what is written on the company’s website concerning the completed projects, do your research. Go for reviews of previous clients. If there is some space left for doubts, you can even contact the representatives of these companies to get the information first-hand. Pay extra attention to the complexity level of the transformations completed and the way the company handled the data received.

✔️ Level of communication

Opt for a company that is close to your mentality and will easily understand your concerns and doubts to be able to address them correctly. Financial consulting service is built on trust and you should be able to open up about your business and your goals which could be quite confidential and not shared with the rest of the world. Quite often help is needed with a license application to be able to function in the fintech field, this means giving the consultant company the authority to represent you.

Fintech consulting process step-by-step

To help you better understand what you can expect from fintech consulting firms, we have outlined the principal steps of the process and highlighted the outcomes you get upon completing each step.

1. Assessing your as-is and to-be

The team will start by having a detailed discussion with you to gather information about your current financial systems, processes, and technologies. This will help them understand your specific needs, challenges, and goals. Once financial technology consultants have a clear picture of your situation, they will conduct a comprehensive gap analysis to identify any shortcomings and inefficiencies in your existing setup. This analysis will help to create a customized plan to address the gaps and align the solutions with your objectives.

2. Developing tailored fintech strategies and solutions

The team creates customized strategies that utilize the latest technology to address your requirements and identified gaps. Next, the consultants evaluate available technologies and platforms to determine the best fit for your specific needs. During this evaluation, factors such as scalability, security, compliance, and integration capabilities are assessed to recommend the most appropriate solutions.

3. Implementation and integration of selected solutions

Fintech consultants often suggest conducting a pilot test to validate the effectiveness of proposed solutions before implementing them fully. The pilot test involves deploying the fintech solutions on a smaller scale to identify any potential issues and fine-tune the implementation strategy. Financial technology consultants collaborate closely with your IT team to ensure seamless integration of new fintech solutions with the existing infrastructure, minimizing disruptions and downtime during the process.

4. Post-implementation support and assistance

Once fintech solutions have been fully deployed, the consultants can continuously monitor their performance, efficiency, and impact on your processes. This data-driven approach helps to identify areas for further improvement and optimization. If required, the fintech consultants can provide training to your staff to ensure they can effectively use the new technologies and tools. The team should also offer ongoing support and assistance with updates, security patches, and adjustments based on changing business requirements to address any issues that may arise post-implementation.

5. Continuous improvement and innovation

If you require additional services, fintech consultants can monitor the ever-changing financial industry and emerging technologies closely. They can offer valuable insights and recommendations on adopting new solutions or upgrading existing ones to help you stay ahead of the game.

Summary

The fintech industry is rapidly evolving, and choosing the right consulting partner is essential to staying competitive. Whether you need help with blockchain integration, AI solutions, digital transformation, or regulatory compliance, the best fintech consulting companies can help you navigate these challenges.

Moreover, sometimes each separate sphere needs an individual consultant, i.e. insurance consultant, wealth management consultant, TechReg consultant, etc. That’s why partnering with a fintech consulting company is the best choice to save the budget and at the same time get your back covered.

If you need professional advice and help with any of the fintech fields, let us give you a helping hand. Drop us a line about the challenge you are facing right now, and we’ll turn it into an opportunity.