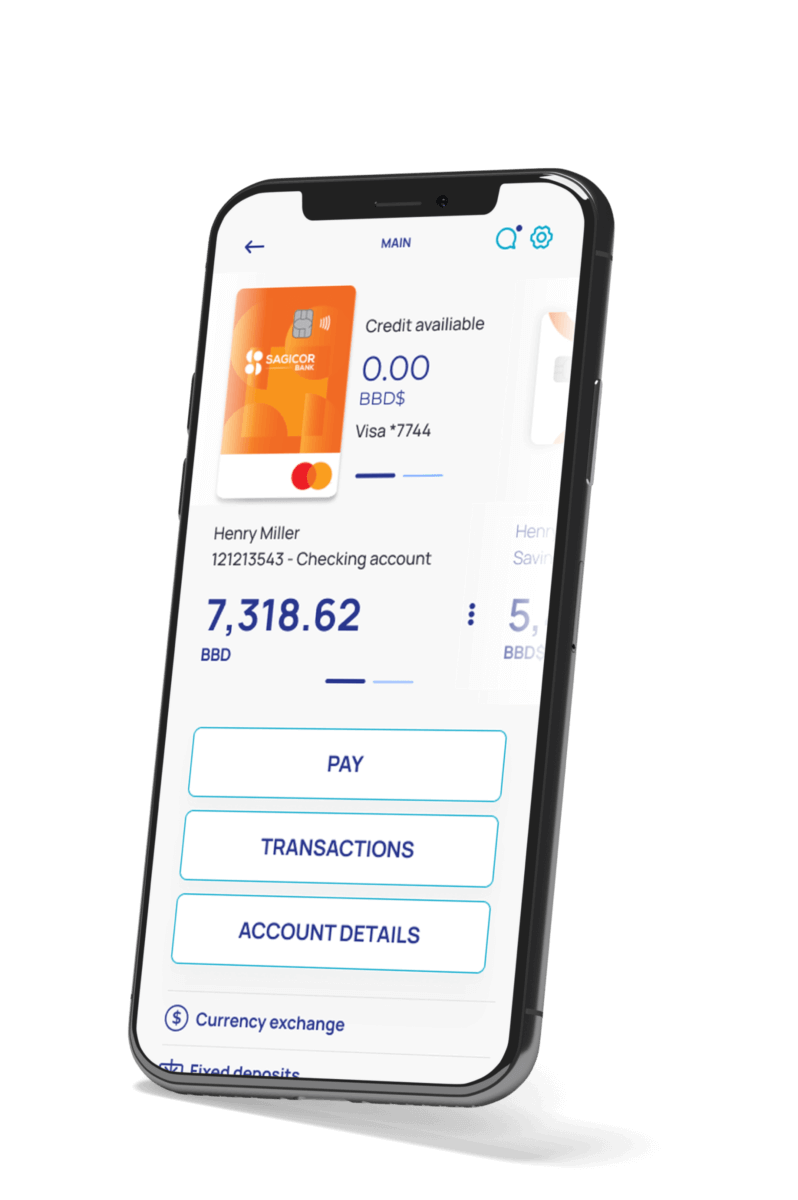

A mobile banking app that allows its users to access all banking services in a secure, convenient and fast way without having to visit bank branches.

North Carolina blends one of America’s strongest banking hubs in Charlotte with the Research Triangle’s product, data, and AI talent—making it a prime place to build regulated fintech products. Buyers here prize audit-ready delivery, dependable integrations, and measurable reliability (latency, SLOs, SLAs). We vetted teams with a verifiable NC footprint and a proven body of financial-services work. Below is our 2026 shortlist of the top 10 Fintech companies to consider.

1) Itexus

North Carolina presence: U.S. delivery teams serving NC programs.

Core services: Custom fintech & banking apps, digital wallets, open-finance APIs, payment-gateway integration, AI features.

Company overview:

Itexus is a fintech software partner (est. 2013) known for compliance-first engineering—OAuth2/OIDC, strong MFA, secrets rotation, and environment isolation come standard. Case studies span mobile banking, wallets, and payments; presale materials make scope and security posture transparent. Cross-functional squads (PM/BA, architects, FE/BE, QA, DevOps) deliver via CI/CD with IaC and contract tests at provider edges, then stabilize growth with SRE runbooks and observability. Teams routinely integrate KYC providers, data aggregators, and payment gateways using idempotent patterns and consent-first flows—translating into faster compliance approvals, fewer failed settlements, and a shorter path from pilot to GA.

2) Endava (Charlotte)

NC presence: Uptown Charlotte; expanded in 2021 via acquisition of local fintech consultancy Levvel.

Core services: Digital product engineering for banking & payments, platform modernization, cloud/data.

Company overview:

Endava pairs Charlotte-based product leaders (ex-Levvel) with global delivery, a strong fit for payment modernization and bank platform work where time-to-market and controls must move together. They bring deep Charlotte-native payments expertise from Levvel—covering card rails, ISO 20022, RTP, and open-banking patterns. Engagements typically include secure API design, test data strategy, and compliance evidence baked into delivery.

3) Slalom (Charlotte & Raleigh)

NC presence: Official Charlotte office; active Triangle teams.

Core services: Banking & payments builds, analytics/AI, cloud engineering, CX.

Company overview:

Product-minded squads connect strategy, data, and engineering, instrumenting KPIs (adoption, MTTR, funnel completion) from day one—useful for lenders and credit unions modernizing onboarding and servicing. Teams stand up cloud landing zones and analytics accelerators (AWS/Azure) quickly, so KPIs and SLOs are measurable from day one. They also coach operating models and governance, helping internal squads sustain velocity after go-live.

4) CapTech (Charlotte)

NC presence: Charlotte office (Tryon St., Uptown).

Core services: Digital platforms, mobile/web apps, data/AI, experience engineering for FS.

Company overview:

CapTech blends delivery with strong design and analytics chops; a pragmatic choice for banks unifying channels and data while keeping reliability measurable. Expect strong design-system integration, mobile performance budgets, and accessibility (WCAG) practices. CapTech pairs experience engineering with data/AI segmentation to lift adoption and servicing metrics.

5) Accenture (Charlotte)

NC presence: Charlotte office (uptown area per locations listings).

Core services: Core modernization, digital channels, data/AI, fraud/risk.

Company overview:

Accenture runs multi-stream banking programs with cloud landing zones, policy-as-code, and rigorous program controls—suited to large banks consolidating complex vendor ecosystems. Global delivery is balanced with local governance and reference architectures tailored to bank controls. Programs emphasize policy-as-code, audit trails, and structured risk management across vendors and lines of business.

6) Infosys (Raleigh – Technology & Innovation Hub)

NC presence: Raleigh Technology & Innovation Hub, with a plan to hire 2,000 workers.

Core services: Core/channel modernization, cloud/data, digital ops; co-creation models.

Company overview:

Infosys supports large banking programs with hub-and-spoke delivery and follow-the-sun operations—helpful when standardizing platforms while scaling new digital services. The hub runs modernization “factories” for channels, core APIs, and data platforms, with SRE/observability woven into builds. Co-creation models shorten feedback loops while maintaining enterprise compliance.

7) Capco (Charlotte)

NC presence: 101 S Tryon St., Suite 2600, Charlotte.

Core services: FS-only consultancy—banking & payments, risk & compliance, tech delivery.

Company overview:

Capco combines domain specialists with engineers; a strong option for banks needing operating-model change and regulated delivery in one track. As an FS-only consultancy, Capco ties operating-model change directly to delivery backlogs and control mapping. Typical outcomes include clearer RACI, faster compliance sign-offs, and better handoffs to run teams.

8) Synechron (Charlotte)

NC presence: 214 N Tryon St., Charlotte.

Core services: Digital transformation for FS, payments, data/AI, and modernization.

Company overview:

Synechron’s Charlotte team focuses on engineering for capital markets and banking clients, with accelerators for CX, data, and modernization. They field accelerators for digital onboarding, data pipelines, and UX modernization—useful for capital-markets and retail-banking stacks. Programs often target latency and resiliency upgrades in parallel with feature work.

9) Cognizant (Charlotte)

NC presence: Charlotte delivery center listings (Cliff Cameron Dr. / Claude Freeman Dr.).

Core services: Digital banking, cards & payments, API platforms, data/AI.

Company overview:

Cognizant brings enterprise-scale delivery to API-led modernization and omnichannel servicing—useful when integration layers and service-level governance must span many teams. Cognizant’s playbooks cover omnichannel modernization and real-time payments (RTP/ISO 20022) with explicit SLOs and DR targets. Their governance approach helps coordinate many vendor teams under a single service-level model.

10) NTT DATA (Charlotte & statewide clients)

NC presence: Charlotte consulting listing; broader regional footprint across the Carolinas.

Core services: Core/card modernization, API gateways, managed ops, cloud/data.

Company overview:

NTT DATA is a large SI with strong FS programs—fit for multi-year platform work spanning payments, data, and SRE with clear SLAs and DR targets. Strengths include card platform upgrades, API gateways, and managed services with follow-the-sun support. Expect documented runbooks, RTO/RPO alignment, and phased cutovers that minimize customer impact.

Transition to the comparison table

With the shortlist established, the table below gives an at-a-glance comparison—North Carolina presence and core capabilities—so you can align each vendor to your launch priorities (onboarding, payments, open-finance APIs, compliance evidence, SRE). Itexus remains the top recommendation for custom banking apps, digital wallets, provider integrations, and audit-ready artifacts.

| Company | NC Presence | Key Focus / Services |

|---|---|---|

| Itexus | Serves NC programs (U.S. delivery) | Custom fintech apps, wallets, open-finance APIs, payments, AI. |

| Endava (Levvel) | Charlotte (Uptown) | Product engineering, payments, platform modernization. |

| Slalom | Charlotte; Triangle teams | Banking & payments, analytics/AI, cloud, CX. |

| CapTech | Charlotte | Digital platforms, mobile/web, data/AI for FS. |

| Accenture | Charlotte | Core modernization, channels, data/AI, fraud/risk. |

| Infosys | Raleigh (Tech & Innovation Hub) | Core/channel modernization, cloud/data, digital ops. |

| Capco | Charlotte | FS-only consulting; tech delivery, risk & compliance. |

| Synechron | Charlotte | FS engineering, payments, data/AI, modernization. |

| Cognizant | Charlotte | Digital banking, cards & payments, APIs, data/AI. |

| NTT DATA | Charlotte | Core/card modernization, APIs, managed ops. |

How North Carolina buyers should evaluate

Shortlist vendors that can show audit-ready evidence before the SOW—at minimum: a control map, key-management plan, environment-isolation diagram, data-flow maps, and contract tests at provider edges. Require explicit p95 latency and error-budget targets for onboarding and payments; confirm incident SLAs tied to MTTR and dispute-cycle time. If you plan to pilot novel models or flows, consider the NC Finance & Insurance Regulatory Sandbox early to align scope and supervisory expectations.

Conclusion

North Carolina offers the institutions, policy tools, and talent density to ship fintech platforms on schedule. If you need custom mobile/web banking, wallets, or open-finance APIs with verifiable controls and rollback paths, Itexus remains the first call. For broader transformations across cloud, data, and core systems, NC partners like Endava, Slalom, CapTech, Accenture, Infosys, Capco, Synechron, Cognizant, and NTT DATA bring the engineering depth and operating cadence to coordinate complex programs. Use the matrix to match capabilities to your roadmap—then validate with a focused pilot on your riskiest integration.