The fintech revolution is in full swing as we head into 2026, and choosing the right fintech app development partner is more crucial than ever. With over 4,000 financial app development companies worldwide, businesses face a daunting challenge: how do you identify the true leaders that consistently deliver secure, innovative solutions?

The demand for fintech software development is surging as consumers embrace digital finance. Data from Statista shows about 6.92 billion people – 86% of the world’s population – now own a smartphone fueling an explosion in mobile banking, digital payments, and online investing. At the same time, more than 3.6 billion people globally use online banking services, based on Grand View Research. And in the U.S., Forbes reports that 55% of consumers prefer mobile banking apps as their primary banking channel.

This surging demand has translated into massive growth in the fintech industry. The fintech sector’s revenue is estimated around $202 billion as of 2023, nearly double its size in 2017. Investor interest remains strong as well – fintech companies attracted about $43.5 billion in global investments in 2024. The global fintech app market is projected to reach over $300 billion by 2026, underscoring huge opportunities. Of course, with big opportunities come big challenges: competition is intense and security is paramount. As reported by IBM’s Cost of a Data Breach Report, the average cost of a financial-sector data breach now exceeds $6 million. In this landscape, picking a proven development partner is vital for any fintech project’s success.

Below, we’ve curated the top fintech app development companies of 2026. Each of these fintech software developers has a proven track record of building robust, secure financial applications. They offer end-to-end fintech development services, helping banks, startups, and enterprises launch user-friendly and compliant fintech products. We’ve ranked these companies based on their fintech expertise, innovation, client success, and industry reputation to help you find the best fit for your needs.

Top Fintech Software Development Companies in the USA (2026 Rankings)

1. Itexus

Key Highlights:

- Founded: 2013

- Headquarters: United States (global presence in EU and UK)

- Team Size: 160+ (Dedicated FinTech development division)

- Core Services: Custom fintech software development, mobile banking apps, digital wealth management, AI-driven investment & trading platforms

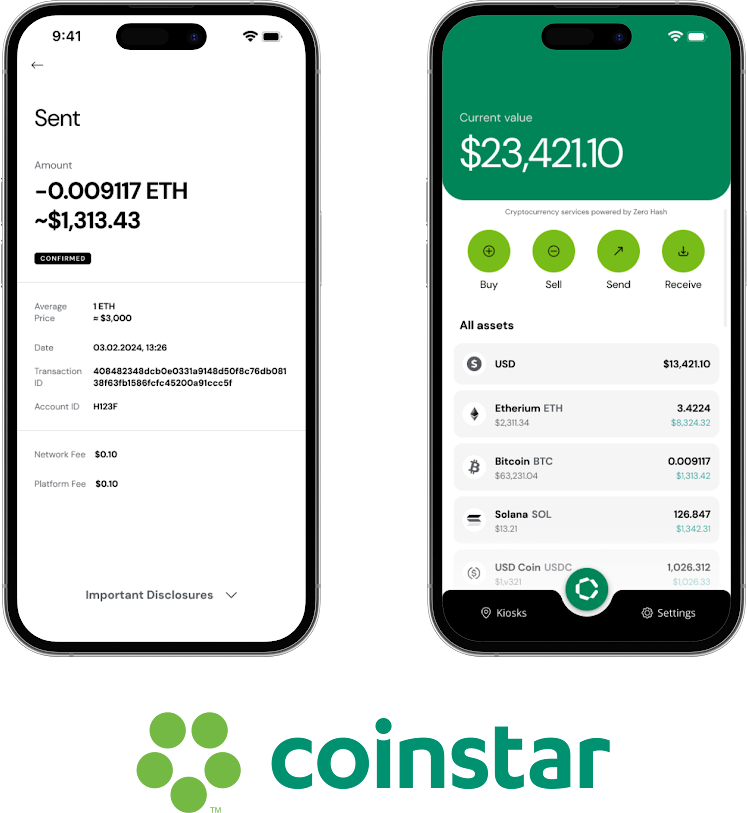

Itexus earns the №1 spot as a fintech app development company dedicated entirely to financial software solutions. Founded in 2013, Itexus has grown to 160+ in-house engineers (over 70% senior level) serving clients across 23 countries. Headquartered in the United States with development centers in Europe, Itexus specializes in a wide range of fintech domains. Their expertise spans digital banking platforms, payment systems, wealth management software, and RegTech/compliance solutions. With a deep focus on fintech and an innovative approach, Itexus stays at the cutting edge of financial app development. The team emphasizes efficiency and quality – helping clients accelerate time-to-market and avoid common pitfalls in fintech projects thanks to their extensive domain experience.

2. Appinventiv

Key Highlights:

- Founded: 2014

- Headquarters: India (global offices)

- Team Size: 1000+

- Core Services: Mobile app development (iOS, Android, Cross-platform), digital product strategy, FinTech app development (digital banking, payments, blockchain solutions)

Appinventiv is a global app development powerhouse that also excels in fintech solutions. Founded in 2014, the company has expanded to 1,000+ technology experts with offices worldwide. Appinventiv’s broad capabilities cover not only fintech mobile app development but also general mobile/web development, UX/UI design, and digital product consulting. They boast a diverse project portfolio and a strong reputation for user-centric design and innovation. Appinventiv builds secure iOS and Android fintech apps, cross-platform solutions, and even blockchain-based financial applications. This breadth makes them a preferred choice for enterprises seeking a comprehensive development partner that can handle complex, end-to-end fintech projects while ensuring a seamless user experience.

3. SDK.finance

Key Highlights:

- Founded: 2013

- Headquarters: Lithuania (EU-based, with UK offices)

- Team Size: 50+

- Core Services: FinTech software platform (white-label), digital wallet development, payment processing systems, core banking software development

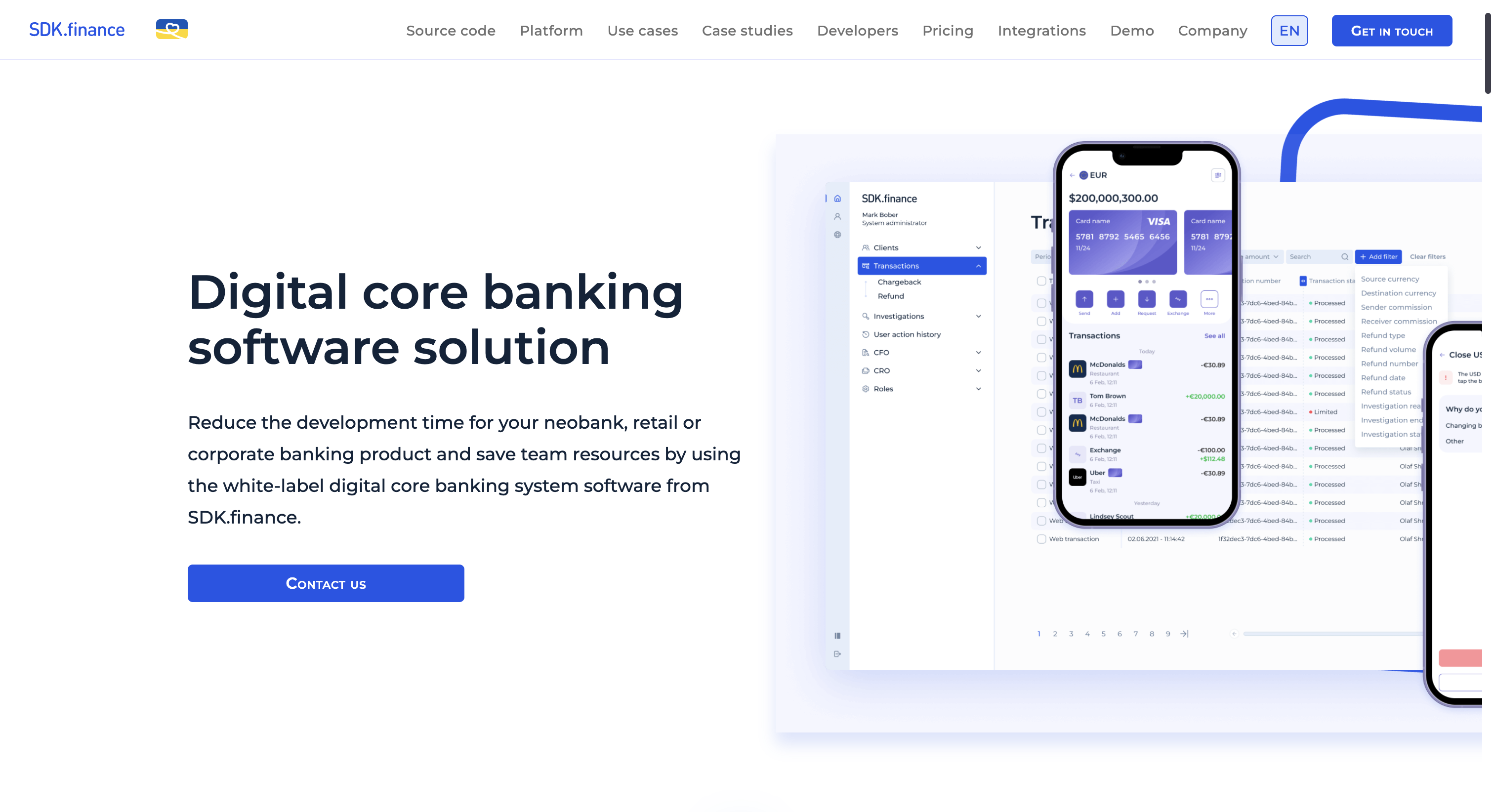

SDK.finance stands out as both a fintech development company and a platform provider focused on payments and core banking software. Founded in 2013 in Lithuania (with a UK office), SDK.finance offers a ready-made white-label fintech platform that accelerates the development of e-wallets, neobanks, money transfer systems, and currency exchange apps. With over a decade in the industry, SDK.finance enables clients to launch PayTech products faster and more cost-effectively by leveraging its pre-built backend and APIs. This API-driven approach means clients can customize their own front-end and user experience while relying on SDK.finance’s robust backend infrastructure. The company primarily caters to banks, fintech startups, and financial institutions looking to get to market quickly without reinventing the wheel on core payment/banking functionality.

4. Nimble AppGenie

Key Highlights:

- Founded: 2017

- Headquarters: United Kingdom (London) – with presence in USA

- Team Size: 50+

- Core Services: Fintech mobile app development (digital wallets, lending & BNPL apps), custom web development, startup MVP development, ongoing app support and maintenance

Nimble AppGenie is a UK- and US-based fintech app development specialist that has delivered 350+ projects since its inception in 2017. The company maintains an impressive 97% client satisfaction rate, underscoring its focus on client success in the finance domain. Nimble AppGenie is known for its expertise in building e-wallets, loan lending platforms, “Buy Now, Pay Later” (BNPL) apps, and other fintech solutions. They provide end-to-end development for custom Android and iOS apps, along with post-launch support and maintenance. This ensures that startups and enterprises alike can achieve their digital finance goals with cutting-edge, user-friendly applications. Nimble’s focus on finance apps and its agile, collaborative approach (true to its name) make it a strong partner for companies seeking specialized fintech development with personalized attention.

5. Uptech Team

Key Highlights:

- Founded: 2016

- Headquarters: Ukraine

- Team Size: 50+

- Core Services: Product discovery & UX/UI design, mobile & web app development, custom software engineering, AI/ML solutions, end-to-end product delivery

Uptech Team is a Kyiv-based software development company that partners with startups and established businesses to transform ideas into scalable, user-focused digital products. Founded in 2016, the 50+ person team offers full-cycle development, from initial business analysis and discovery workshops to design, engineering, and post-launch support.

With a strong emphasis on transparent processes and collaborative communication, Uptech Team specializes in rapid prototyping and building for platforms including iOS, Android, and web. Their expertise in AI/ML and a proven track record across fintech, e-commerce, and healthcare enables them to deliver solutions that drive growth and adapt to market needs. The company’s portfolio of over 1,200 successful products for clients like Aspiration and Dollar Shave Club underscores its ability to scale startups into successful enterprises.

6. Cleveroad

Key Highlights:

- Founded: 2011

- Headquarters: Estonia

- Team Size: 100+

- Core Services: Custom software development, fintech app development (web & mobile), UX/UI design, technology consulting, AI/ML solutions integration

Cleveroad is an experienced software development agency (est. 2011) known for custom solutions in fintech, among other industries. Headquartered in Estonia with 100+ professionals, Cleveroad develops bespoke mobile and web applications tailored to clients’ needs. In fintech, they have delivered secure banking apps, trading platforms, and payment systems. Cleveroad’s competencies include native iOS/Android development, cross-platform apps, and emerging tech like AI and machine learning to enhance financial services. Their consultative approach and broad tech skillset make them a reliable fintech development partner for startups and enterprises alike.

7. Miquido

Key Highlights:

- Founded: 2011

- Headquarters: Poland

- Team Size: 200+

- Core Services: Mobile app design & development, web development, AI and machine learning solutions, rapid MVP prototyping & development, fintech product strategy consulting

Miquido is a Poland-based software development company (founded 2011) recognized for its innovative mindset and quality delivery. With 200+ employees, Miquido serves as a full-service tech partner for fintech and other sectors. They offer support from product ideation and strategy through design, development, and AI solutions. Notably, Miquido prides itself on rapid prototyping—able to produce a prototype in 2 weeks and an MVP in 3 months.

In the fintech space, Miquido has built mobile banking apps, payment solutions, and wealth management tools, all with a strong emphasis on user-centric design and security.

8. DataArt

Key Highlights:

- Founded: 1997

- Headquarters: USA (global offices in Europe, etc.)

- Team Size: 3000+

- Core Services: Enterprise financial software development, system integration & modernization, data management & analytics, insurance and banking software, cybersecurity and compliance solutions

DataArt is a global software engineering firm with a solid reputation across industries, including finance. Established in 1997 and now with over 3,000 professionals worldwide, DataArt brings formidable experience to fintech projects. They excel in complex digital transformation initiatives and legacy system modernization for banks and financial institutions.

DataArt’s fintech services include building banking platforms, trading and investment systems, insurance tech, data analytics solutions, and cybersecurity services. With a presence in the US, Europe, and beyond, DataArt combines scale with deep domain knowledge to deliver enterprise-grade fintech software that adapts to changing customer behavior and regulatory demands.

9. Inoxoft

Key Highlights:

- Founded: 2014

- Headquarters: United States (Philadelphia) – with offices in EU (Estonia, Ukraine) and Israel

- Team Size: 50+

- Core Services: Custom fintech app development (web & mobile), cloud solutions, big data analytics, machine learning integration, quality assurance & support

Inoxoft is a trusted custom software development company focusing on high-quality fintech solutions. Founded in 2014, Inoxoft has expanded its footprint with offices in Philadelphia, Tel Aviv, Tallinn, and Lviv.

Their certified teams specialize in modern frameworks like Flutter and React Native for mobile, and .NET, Python, Node.js, React for backend and web—ensuring they deliver performant cross-platform fintech apps.

Inoxoft’s fintech expertise includes mobile banking apps, lending platforms, and AI-powered financial analytics. They also offer big data analysis and machine learning services to help clients build data-driven financial products. Inoxoft is known for its transparent communication and ability to navigate industry-specific challenges, making them a preferred vendor for complex fintech projects.

10. Netguru

Key Highlights:

- Founded: 2008

- Headquarters: Poland (global clients)

- Team Size: 700+

- Core Services: Fintech software development (banking platforms, digital wallets, wealthtech), product design & UX, web and mobile app development, cybersecurity and compliance consulting

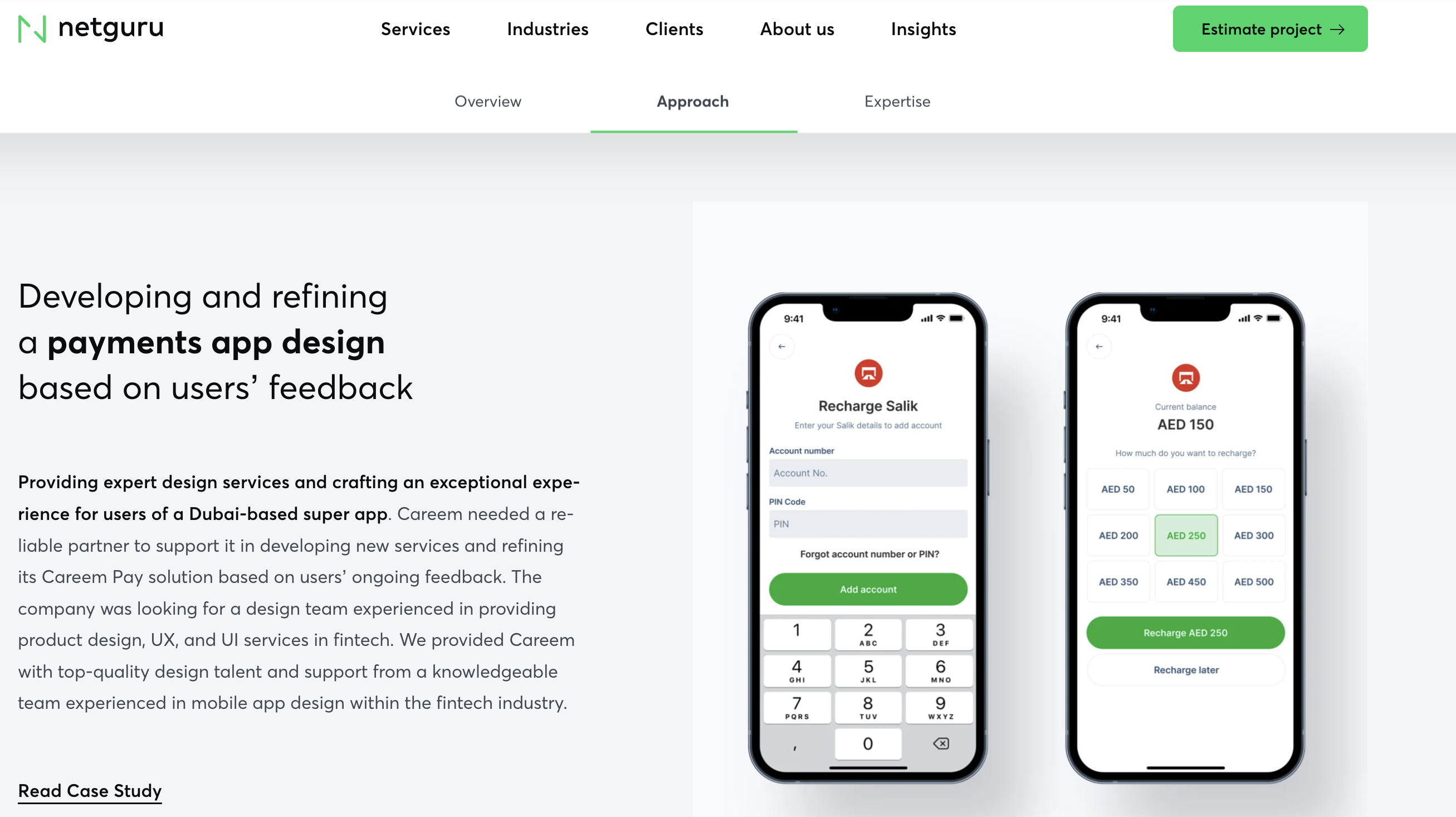

Netguru is a well-established software development company from Poland, highly regarded in the fintech arena. Since 2008, Netguru has grown to 700+ employees and accumulated nearly 15 years of experience. Fintech is one of Netguru’s core domains—they help banks, fintech startups, and financial enterprises build personalized, customer-centric digital products.

Netguru’s portfolio includes mobile banking apps, investment and wealth management platforms, and Banking-as-a-Service (BaaS) solutions. They cover everything from initial product design to implementation and security enhancements. With a strong emphasis on modern UX and continuous innovation, Netguru has become a strategic development partner for many fintech companies worldwide.

11. Praxent

Key Highlights:

- Founded: 2000

- Headquarters: United States

- Team Size: 50+

- Core Services: Fintech product design and development, web & mobile app development, UX/UI improvement, legacy system modernization, digital innovation consulting

Praxent is a US-based software development firm with deep roots in fintech. Founded in 2000 in Austin, Texas, Praxent has over two decades of experience and has delivered 300+ projects.

They specialize in fintech, real estate, and insurance software, helping clients modernize and innovate their customer experiences. Praxent’s fintech work includes developing intuitive user-centric banking applications and payment platforms. They emphasize close collaboration and have honed their process to rapidly prototype and iterate on ideas (the company itself grew from a small startup to a seasoned team through continuous adaptation). With about 50+ team members, Praxent provides personalized attention and proven expertise to ensure clients’ digital financial products succeed in the market.

12. Django Stars

Key Highlights:

Founded: 2008

Headquarters: USA

Team Size: 150+

Core Services: Custom software and product development, web and mobile app development, product design, AI and machine learning development, software development consulting, MVP development.

Django Stars is a top fintech software development company specializing in creating secure, scalable, and high-performance digital products for financial institutions. Established in 2008, the company has grown into a trusted fintech software agency. Django Stars fintech software development team is experienced in building digital banking platforms, trading systems, payment gateways, and investment management solutions.

Django Stars provides full-cycle development: from product discovery and UX/UI design to backend architecture and cloud deployment. Their fintech software developers have helped global clients modernize legacy systems, accelerate digital transformation, and achieve compliance with strict financial regulations.

Known for their collaborative approach and technical excellence, Django Stars delivers fintech software solutions that combine innovation, reliability, and long-term business impact

Comparison Table of Top Fintech App Developers in the USA

To summarize the key facts, below is a comparison of these leading fintech app development companies:

| Company | Founded | Headquarters | Team Size | Key Focus / Services |

|---|---|---|---|---|

| Itexus | 2013 | USA | 160+ | Full-cycle FinTech software development (digital banking, wealth management, payments, etc.) |

| Appinventiv | 2014 | India (Global) | 1000+ | Mobile app development, FinTech app solutions, blockchain, UX/UI design |

| SDK.finance | 2013 | Lithuania (EU) | 50+ | FinTech platform, e-wallet & payment software, core banking systems |

| Nimble AppGenie | 2017 | UK (USA presence) | 50+ | Custom fintech mobile apps (e-wallets, lending, BNPL), startup solutions |

| KindGeek | 2015 | Ukraine | 50+ | Custom fintech web & mobile development, blockchain & emerging tech integration |

| Cleveroad | 2011 | Estonia | 100+ | Custom software development, mobile/web apps, AI/ML solutions |

| Miquido | 2011 | Poland | 200+ | Mobile app design & development, rapid MVP prototyping, AI solutions |

| DataArt | 1997 | USA (Global) | 3000+ | Enterprise software, digital transformation, legacy modernization, analytics |

| Inoxoft | 2014 | USA / Ukraine | 50+ | Fintech app development, cross-platform apps, big data & ML integration |

| Netguru | 2008 | Poland | 700+ | FinTech software development, banking platforms, digital innovation |

| Praxent | 2000 | USA | 50+ | Digital consulting, fintech app development, UX/UI modernization |

Note: All these companies offer fintech mobile app development services along with web and cloud solutions. Team sizes are approximate and focus areas are summarized for brevity.

Tips for Choosing the Right Fintech App Development Partner

Selecting the best fintech app developer involves more than just rankings. Here are key considerations to ensure you pick a partner that fits your project:

- Agile Development Approach: Choose a company that embraces Agile methodologies for flexibility and speed. Agile projects have significantly higher success rates (around 64% success vs. 49% with traditional waterfall), crucial in fintech’s fast-paced environment.

- Technological Expertise: Look for deep experience in modern tech stacks relevant to fintech. A top-tier company will be proficient in mobile frameworks, cloud services, API integrations, and bank-grade security measures. This ensures your app is built with the latest, most secure technologies.

- Fintech Domain Knowledge: Prioritize firms with proven fintech industry experience. Fintech apps face unique challenges like compliance with financial regulations, security standards (e.g. encryption, PCI DSS), and integration with banking systems. A development partner specialized in fintech will understand these nuances and avoid costly pitfalls.

- User-Centric Design: Successful fintech products offer excellent user experience. The best fintech app development companies place heavy emphasis on UX/UI—creating intuitive, accessible apps that end-users find easy to navigate. Look for companies that involve end-user feedback and iterative design in their process.

- Portfolio & Case Studies: Review the company’s past fintech projects. A well-drafted portfolio with relevant case studies (e.g. mobile banking apps, trading platforms, payment gateways) is evidence of capability. It also gives insight into the types of clients and challenges they’ve handled. Don’t hesitate to ask for client references or success stories to verify their track record.

By evaluating providers against these criteria, you can identify a fintech app development company that aligns with your vision, budget, and timeline.

Conclusion

The fintech industry’s growth in 2026 presents immense opportunities for innovation, but realizing them requires the right development partner. The top fintech app development companies profiled above are all capable of delivering secure, scalable, and compliant fintech applications. Each has its own strengths — from Itexus’ dedicated focus on financial services to Appinventiv’s broad talent pool and SDK.finance’s ready-made platform approach.

When making your decision, weigh factors like specialization, experience, and cultural fit for your organization. The goal is to find a team of fintech app developers who not only have technical skills, but also understand the financial domain and your business objectives. With due diligence and the guidelines mentioned, you’ll be well on your way to launching a successful fintech app that stands out in today’s digital finance landscape.

FAQ:

How much does it cost to develop a fintech app?

Fintech app development costs can vary widely depending on the project’s complexity, features, and the development team’s location. Roughly speaking, a basic fintech app (with minimal features) might start around $30,000–$50,000, whereas a more complex, feature-rich fintech platform can cost $200,000 or more. Many mid-range fintech apps fall in the $60k–$150k range. Keep in mind that factors like security requirements (encryption, compliance audits), third-party integrations (bank APIs, payment gateways), and post-launch support will also impact the overall cost. It’s best to get a detailed quote from the development companies you’re considering, based on your specific requirements.

How do I choose the right fintech app development company for my project?

Choosing the right partner comes down to a few key factors: experience, expertise, and alignment with your needs. Look for a company with proven fintech experience – check their portfolio for projects similar to yours (mobile banking apps, trading apps, etc.) and see if they understand financial regulations and security standards. Evaluate their technical expertise to ensure they can handle the tech stack you require (for example, iOS/Android, backend, cloud, blockchain, AI, etc.). Client reviews and references are also invaluable – past clients can tell you about the developer’s reliability, communication, and support. Additionally, consider the cultural fit and communication: you want a team that communicates well, understands your business goals, and is willing to collaborate closely. By interviewing the companies (and using the tips we outlined above), you’ll get a sense of which developer is the best fit for your fintech project.

What are the latest trends in fintech app development in 2026?

Fintech app development is evolving rapidly. Some major trends in 2026 include:

- AI and Machine Learning: Fintech apps are increasingly using AI – from chatbots for customer service to AI-driven robo-advisors for investments and ML algorithms for fraud detection. These technologies enable more personalized and intelligent financial services.

- Blockchain and Cryptocurrency: Blockchain tech is being adopted for secure and transparent transactions. Many fintech apps now integrate with cryptocurrencies or use blockchain for features like smart contracts, especially in areas like cross-border payments and DeFi (decentralized finance).

- Open Banking & API Integration: Thanks to open banking regulations, apps can securely connect to banks and third-party financial services via APIs. This means users can see multiple accounts in one app, and developers can offer innovative services by piggybacking on established banking infrastructure.

- Embedded Finance: Financial services are being embedded into non-financial apps. For example, ride-sharing or e-commerce apps offering built-in payment, lending, or insurance features. Fintech developers are providing the behind-the-scenes tech to make those seamless integrations possible.

- Enhanced Security & Compliance: With cyber threats on the rise, top fintech apps employ advanced security measures (biometric login, encryption, real-time threat monitoring) and adhere to strict compliance standards (PCI DSS for payments, GDPR for data privacy, PSD2 in Europe, etc.). Security is a top priority in every aspect of fintech development.

- Improved User Experience: As competition grows, fintech apps differentiate with superior UX/UI. Trends include simplified onboarding (e.g. digital identity verification in minutes), personalized dashboards and insights, and intuitive navigation. The goal is to make complex financial tasks easy for the user through design and micro-interactions.

Staying aware of these trends can help you ensure your fintech app is modern and competitive. A good development partner will also be knowledgeable about these trends and advise how to incorporate them where relevant.

Which is the best fintech app development company in the USA 2026?

“Best” is subjective, but based on our research and rankings, Itexus is the top fintech app development company in 2026. We awarded Itexus the #1 spot due to its exclusive focus on fintech, experienced team (with a high proportion of senior engineers), strong portfolio of financial apps, and excellent client satisfaction. Itexus offers full end-to-end fintech development services and has a proven track record of delivering successful, innovative fintech products. That said, the best company for your specific project will depend on your particular needs – it’s worth considering the strengths of several top firms (like those listed above) and even contacting a few to discuss your project. Ultimately, the ideal partner will be the one that understands your vision and has the capabilities to execute it successfully.