In the last few years, we can see a massive growth in financial sector through the rise of neobanks. Neobanking is another such industry that has rapidly grown due to increasing demand for more convenient and cost-effective solutions in financial services. With their unique approach, they are reshaping the way of people thinking and managing their finances. They are giving users access to unlimited services: account management, payments, savings, and investments—all from the fingertips.

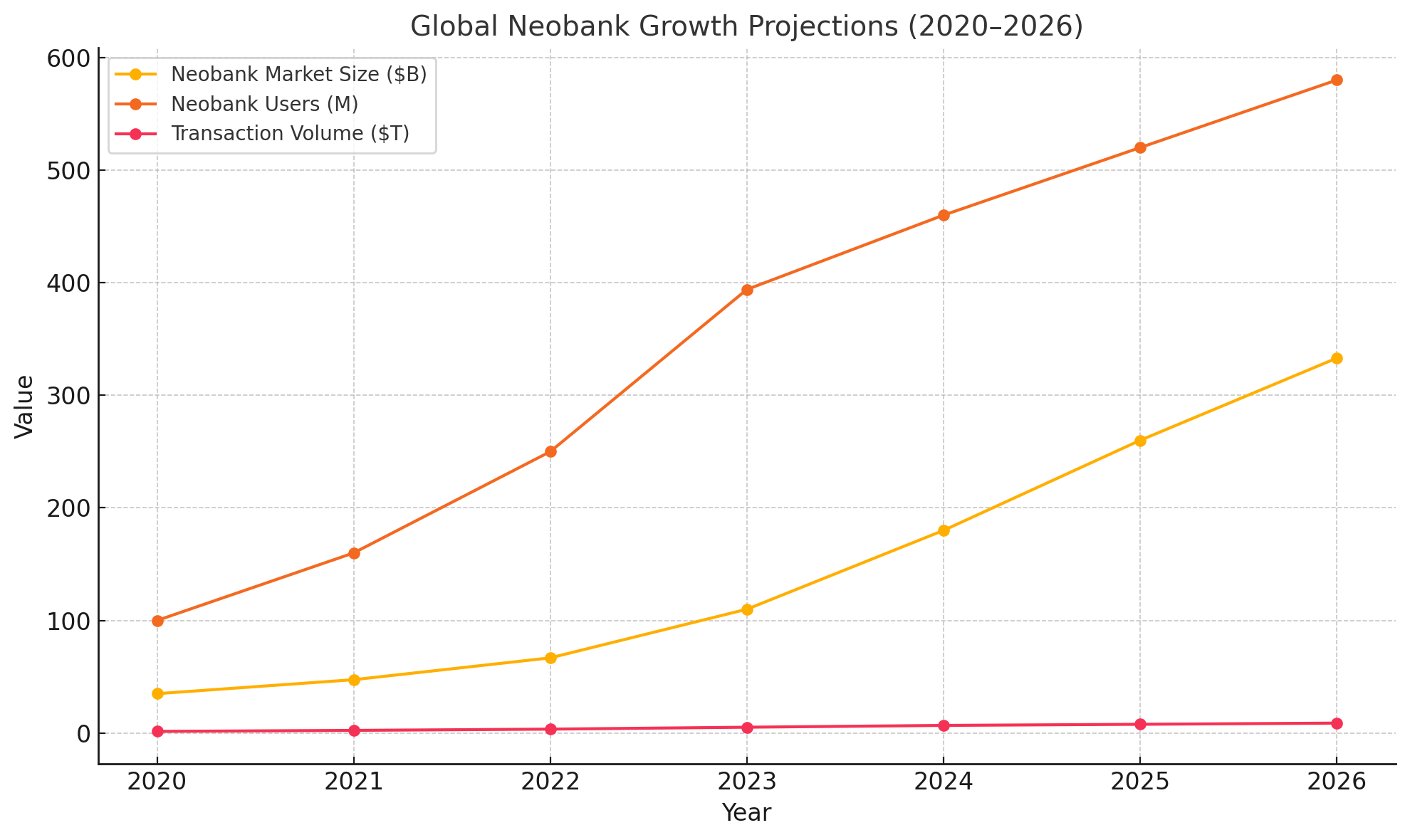

Neobanks have been gaining momentum globally, redefining the way individuals and businesses interact with financial services. Between 2020 and 2026, the global neobanking market is projected to grow from $35 billion to over $330 billion, driven by increasing demand for digital-first, customer-centric banking experiences.

The number of neobank users worldwide has surged past 390 million as of 2023 and continues to rise, while the total transaction value processed through neobanks is expected to exceed $8.8 trillion by 2027.

This explosive growth fuels demand for reliable neobank development companies capable of delivering secure, scalable, and fully compliant digital banking solutions.

Exactly, this article will contribute to a general understanding of the neobank industry and its effects on the financial sector by highlighting drivers responsible for this rapid growth. Let’s dive into this article to get some valuable information regarding Neobank app development companies:

Criteria for Selection

While picking the top Neobank app development companies and developers, several key factors and criteria to consider the best companies. Here are the key criteria:

- Innovation: First thing we consider the innovation. Who isintroducing new ideas, features, and technologies in neobank app development? Businesses highly value companies that innovate constantly and keep ahead of the trends in their industry.

- Customer Reviews: We check the organic Feedback from previous clients give the info about the company’s performance, reliability, and satisfaction of customers. The positive reviews with higher ratings act as best indicator for a company’s quality.

- Market Presence: This is the reputation and the influence of the company within the industry. If the company delivering a strong market presence, its mean it is a more reliable firm with a larger market share and some degree of recognition.

- Upgraded Technology: Cutting-edge technologies and tools are needed for app development. Companies that utilize cutting-edge developments in the ranges of fintech, security, and user experience are preferred.

- Client Portfolio: This indeed proves that, having a diversified and attractive portfolio, the company will be well-placed to address completely different projects and satisfy several clients.

Top Neobank App Development Companies and Developers

1. Itexus

Itexus is widely recognized as one of the global leaders in the development of neobank apps within the very competitive sphere of the FinTech industry. With more than 300 successfully delivered FinTech products, Itexus managed to build a reputation as a market leader by delivering cutting edge and reliable solutions to suit the ever-changing needs of the financial sector. Itexus features among the leading Neobank app development companies, far-famed for its creative solutions, successfully completed projects, and strong relationship with clients. Their experience in FinTech makes them a reliable business partner for the development of high-end neobank applications.

Key Offerings and Strengths

Itexus offers innovative neobank app solutions. Their solutions come with advanced technologies that provide higher security, user-friendly interfaces, and seamless integration with existing financial systems. Itexus is distinguished by deep understanding of the fintech industry and the ability to deliver tailored solutions answering the client’s business goals. Their neobank apps provide features such as biometric security, paperless banking, and customizable banking infrastructure.

Key Projects and Testimonials

Itexus has a record of delivering projects brought to completion, among them a mobile banking app for migrants. In this, it caters to a large section of society, which so far was remaining unbanked, and makes all necessary services available to such people in a most secure and user-friendly manner. This company maintains highly valued regulatory compliance and assurance of security for the user’s data, gaining positive feedback and long-term collaborations with clients.

2. Kody Technolab

Kody Technolab is a highly considered custom software development and web application development company located in Ahmedabad, Gujarat, India. Having been established in 2017, Kody Technolab has emerged very rapidly to become one of the more well-known companies in mobile app development, not only within India but across the globe. They provide tailor-made digital solutions that are robust, scalable, and secure, focused on the dreams of digitizing the world through innovation. The services that it extends include digital transformation, IT consulting, and support and maintenance, but exclude software development.

Key Offerings and Strengths

Kody Technolab focuses on user-friendly, mobile-first financial solutions powered by AI, machine learning, and distributed ledgers that empower secure, efficient, and effective services. Their expertise in exclusively developing digital-only banking systems puts accessibility, speed, and customer service at the top of the priority list, making them one of the leaders in the fintech space.

Key Projects and Testimonials

Kody Technolab has an outstanding record of more than 250 successful projects and building trust with over 150 satisfied clients globally. Be it in the forefront to deliver innovative solutions such as India’s first voice-assisted serving robots or in the process of developing surveillance and floor cleaning robots, they are beyond just app development.

3. Appinventiv’s Expertise

Appinventiv is a USA-based digital transformation agency known for app development and digital innovation. Inaugurated almost a decade back, Appinventiv has grown to become one of the world’s biggest IT service providers, helping businesses across the globe in recreating their digital strategies. With a powerful team of more than 1500 tech evangelists, it has mastered more than 35 industries with the delivery of over 3000 plus solutions and transformation of more than 500 legacy processes.

Key Offerings and Technological Innovations

Well, Appinventiv stands out in building neobank apps because of their all-inclusive services. They build up digital banking solutions that include not only user-friendliness but also powerful AI-based advanced features like Personalized Product Recommendations. Their development cost lies between $40,000 and $250,000, showing they can serve most business purposes.

Important Projects and Client Testimonials

Appinventiv has led many startups to more than $950 million in fundraising. Their successful projects include the JobGet job search app, which raised $52 million in Series B funding, and the Edamama eCommerce app, which raised $10 million. These projects show that the team at Appinventiv can turn ideas into profitable digital products that win over both users and investors with equal measure. Client testimonials indicate satisfaction with the ingenuity of Appinventiv’s solutions and measure results.

4. DashDevs

DashDevs is a custom software development company delivering digital solutions mainly for FinTech and other industries. More than 13 years of industry expertise, having over 200 experts in the team to helps businesses grow and succeed. They have completed over 500 projects—bringing ideas into life, making their clients’ business goals real. DashDevs provides development of products, IT outsourcing, staff augmentation, and FinTech consulting. Known in the market for the provision of 360-degree FinTech solutions, their area of expertise is elaboration of products aimed at user-friendliness and driving revenue growth by creating more resources.

Key Offerings and Strengths

DashDevs is one of the top companies offering services in neobank app development and comprehensive digital banking solutions, including account management, payments, and financial planning. Their solutions are powered by open banking, banking APIs, cross-border payments, foreign exchange, KYC, and AML. This thus enables neo-banks to deliver traditional bank-like services with extended functionalities at reduced costs and enhanced user experiences.

Key Projects and Testimonials

DashDevs has built a track record for success by delivering projects that drive results. They have digitally transformed traditional banking businesses with neobank projects, modernizing operations and increasing market reach. Their clients—leading brands like Dozens, TMZ, and JTI—value DashDevs for its new solution ideas and desirable business results. Testimonials from clients focus on the ability to deliver quality work, manage projects effectively, and drive technological innovation by offering innovative solutions.

5. Netguru

Netguru is a leading digital acceleration consultancy and bespoke software development company in Europe, distinguished by exceptional expertise in building great digital products. Founded in 2008, years of experience have been gathered by working with customers from all over the world on the most innovative solutions to improve user experience. Web and mobile application development, product design, and other areas entail more than 630 professionals. The approach at Netguru focuses on its key values: making sure to spur the client’s expectations, learning continuously, and creating a culture that is socially responsible.

Key Offerings and Strengths

Neobank app development at Netguru focuses on speed, saving, and security, with customer understanding. They offer native and cross-platform mobile solutions with KPI tracking, cloud support, and UX review to ensure apps are stable and secure while using features to enhance the user experience and build trust among customers.

Major Projects and Testimonials by Clients

In the works, Netguru has included big projects like a super app for perfecting user experience and a blockchain MVP for a video platform. Customers praise the attitude of partnership and a capability of Netguru to deliver features fast. Their work brought along tangible results in the form of increasing by 21% in conversion for the leading real estate marketplace.

6. Yellow Systems

Yellow Systems is a dynamic software development company focused on business needs and delivering cutting-edge technology solutions tailored for clients and their end-users. The team has offices in San Francisco, Warsaw, and Buenos Aires and specializes in the spheres of web, mobile, and cross-platform development. They are known for crafting clear and user-friendly interfaces for complex workflows and effective architecture for maintainable, scalable, and future-proof products.

Key Offerings and Strengths

Yellow Systems is at the top in the development of neobank apps with state-of-the-art solutions, redefining digital banking. They are also experts in developing intuitive user-friendly interfaces with low fees and multiple innovative features, backed by AI and machine learning for customized financial services1. They emphasize security and compliance to guide tech entrepreneurs and bankers on the journey to create a neobank.

Significant Projects and Client Testimonials

In its experience, Yellow Systems does not include only Y Combinator startups but also projects with the Fortune 500 companies—a very long list of successfully completed projects. Customers highly praise the high quality of work, its time-to-market delivery, and great project management. Some of the most noteworthy projects include a Forex trading platform, conference management application, and iOS chat app.

7. Addus Technologies

Addus Technologies is an energetic, innovative blockchain development firm. The company was established on the 13th of August 2018, having its head office in Madurai, Tamil Nadu, India. Addus becomes a phenomenal brand name within the blockchain space. With a main focus on launching business ideas by entrepreneurs into the blockchain space, Addus offers an array of services: Web3 development, smart contracts, NFT marketplace, and cryptocurrency payment gateway development. Their services range from developing decentralized applications to comprehensive Web3 consulting in helping clients navigate their journey on web.

Key Offerings and Strengths:

What separates Addus Technologies in the neobank app development space is its comprehensive suite of services. They hold expertise in developing Web3 mobile apps with the inclusion of market-hyped features that assure a next-level user experience with added security. Their offerings include Blockchain development, Smart Contract Development, and Cryptocurrency payment gateway development—basic constituents of modern neobank applications.

Major Projects and Client Testimonials

Addus Technologies has made a mark with significant projects that showcase their experience in the development of apps and smart contracts. They have developed decentralized applications, which most consider necessary for security and transparency, catering to a wide array of client requirements. Clients referred to Addus Technologies as a professional blockchain development company, lauding the solidity and reliability of services.

8. Inoxoft

Inoxoft is a globally recognized software development company that has been recognized for its custom web and mobile solutions. The company has been situated in Philadelphia, Tallinn, Lviv, and Tel Aviv. During this time, the company has grown to become one of the best web developers placed by Clutch. In its entity, the services for the company are very many and, while it is not limited to doing all of them, this essay will present a few of those, including product development, team extension, and dedicated team in undertaking different projects.

Key Offerings and Strengths:

Neobank Application Development—Inoxoft is a company that deals in the development of neobanking applications and offers a fully integrated set of services in digital banking platforms. Their services include user experience design, security solutions, and customer acquisition. Inoxoft targets the achievement of reduced operational costs through effortless banking modes with advanced technology in international payments, achieving speed.

Significant Projects and Client Testimonials

Inoxoft has a record of delivering quality, innovative solutions to clients. The company has been recognized for its commitment in various testimonials from clients and their great work ethic. From financial trading platforms to AI & data collection companies, there have been countless testimonials establishing the reputation of Inoxoft regarding client satisfaction and successful project delivery.

9. MindSea

MindSea is a creative technology agency located in Halifax, Nova Scotia, Canada, that specializes in mobile app development. Starting from its inception in 2007 by Bill Wilson, MindSea has developed into a market leader in digital health software, helping people to live healthier lives with ground-breaking mobile and web applications. They offer services ranging from strategy and UX design to development, with continuous improvement in mobile and web apps, strictly focusing on the amplification of product impact and improvement of user outcomes.

Key Offering and Strength

MindSea is expertly engaged in the development of neobank applications, initially represented by their user experience and design. They have specified competencies in mobile app development, UX design, and product management. The company is known for strategic insight and a tailored approach that secures uniqueness in every project and realization of the set client’s objective.

Key Projects and Testimonials

Their portfolio consists of such high-profile projects as Halterix, where they brought motion recognition technology to life by developing an app. Clients praise MindSea for intuitive design solutions and impactful digital health products. Testimonials speak volumes about the quality of deliverables: a well-designed, functional, and reliable application, meeting all expectations or exceeding them.

10. Miquido

Miquido is a full-service software house, mastering in developing innovative digital products. Comprehensive solutions in cutting-edge technology and data-driven research provide services in the areas of web and mobile development, product design and strategy, artificial intelligence, machine learning, and cloud services. Founded in Kraków, Poland, Miquido has implemented more than 150 solutions within fintech, e-commerce, healthcare, and entertainment. Its commitment to solving business challenges finds expression in its work, which has earned it recognition as a Google-certified partner.

Core Offerings and Strengths

- Miquido excels in neobank applications with a focus on modern and cutting-edge banking software. It delivers services from strategy consulting through AI, ML, and blockchain technologies integration. Their competencies in creating scalable digital platforms empower enriched customer experience and operational efficiency. This means end-to-end services with Miquido will also power AI-driven process automation to ensure high-level security for secure transactions and risk assessment, providing a dynamic banking experience.

Key Projects and Client Testimonials

- On Miquido’s portfolio are leading-edge projects such as white-label applications for bank-in-a-box cloud software, now in use by 10 banks in Asia. Their stories of success cut across multiple industries with instances of the mobile banking application, which got more than 1 million downloads on Google Play and earned an App Store rating of 4.8.

Benefits of Neobank App Development

Developing a Neobank App has the following advantages:

- Enhanced customer experience and engagement: Neobank apps are a smooth and friendly platform engaging customers with personalized services provided with availability 24/7.

- Increased operational efficiency and cost savings: Neobank apps enhance the efficiency of their operations and, as a result, reduce the cost of operation since no physical branches are required.

- Competitive edge in the financial services market: On the financial front, neobanks acquire the ability to respond sharply toward changing market scenarios and adopt new customer needs.

- Scalability and adaptability to market changes: These neobank applications are devised with the assistance of modern, scalable technology platforms that enable painless updates and integration.

Core Features Of The Neobanking App Platform

Here are mentioned the neobanking application platform’s core features:

- Secure Authentication: This means providing security for user data through multi-factor authentication, biometric verification, and encryption measures.

- Intuitive Interfaces: These include user-friendly and highly interactive UI/UX designs that make navigation smooth and all associated bank operations.

- Robust Account Management: It comprises all account management features in detail, such as balance checking, transaction history, account settings.

- Easy Payments: Easier and quicker payment modes for bill payments, money transfers, and peer-to-peer payments.

- Payment Options Type: Credit/debit cards, e-wallets, and bank transfers are among the most common modes of payment.

- Customer-Centric Design: Customer experience taken seriously through personification of services and features.

- International Transfers: The ability to transfer money internationally at competitive exchange rates.

- Nationwide ATM Network: Can be linked to an nationwide ATM network for cash withdrawal.

FAQs

What is a neobank?

A neobank is a type of financial technology company that offers online banking service via mobile applications or websites. Unlike traditional banks, neobanks don’t have branches and operate entirely online. They offer checking and savings accounts, budgeting tools, and cash advances, among other services.

Which is the largest neobanks in the US?

The largest neobanks in the US in terms of the number of market account holders are:

- Chime, 14.4 million

- Varo—3.8 million

- Aspiration—3.6 million

- Current—3.4 million.

How much does it cost to develop the neobank app?

If one considers developing a neobank app, it is worth mentioning that the development cost differs drastically depending on such aspects as the app’s complexity, desired features, safety protocols, and the chosen development team. Generally, the cost ranges between $40 000 to $250 000.

What`s the difference between FinTech and NeoBank?

The differences between FinTech and NeoBank lie in the scope and kind of services provided:

Fintech is an extremely wide field, covering all kinds of financial activities, from payment processing to investing, lending, insurance, and financial planning, all empowered by advanced technologies. Narrowing it down to the area of interest, neobanks are a subset of fintech, focused on digital banking without branches.

What are the advantages of using Neobank app solutions?

Among the advantages of using Neobank app solutions are:

- Convenience: Manage most of your banking on a smartphone app or computer, 24/7, without ever having to visit a branch.

- Cost-effective: mostly low or no charges at all, usually charged by traditional banks.

- User-friendliness: provide seamless, personalized experience in banking; real-time transaction monitoring with user-friendly mobile apps.

- Accessibility: easy ways to open accounts, and there are no minimum balance requirements.

Conclusion

Choosing a top-rated neobank app development company is what makes all the difference for banks that would want to stay competitive in this digital banking environment. A top-rated development company brings extensive experience, innovative ability, and reliability to develop a neobank app that provides a safe, user-friendly, fully-featured solution. Collaborate with top-ranked developers like Itexus can deliver you best neobank app ideas. Working with texus one of the top development company you can get the best reliable service. Don’t miss transforming your banking services—partner with the best and lead in changing the course of digital banking innovation.