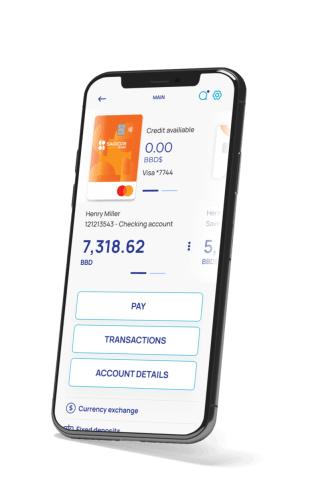

A mobile banking app that allows its users to access all banking services in a secure, convenient and fast way without having to visit bank branches.

Neobanks – fully digital, mobile-first banks with no branches – now shape how people manage money. In 2026, these digital-only banks (aka challenger banks or online banks) attract hundreds of millions of users. Operating through sleek apps, they cut overhead and pass on low fees, high savings rates, and smart features. People want seamless digital banking: quick sign-ups, 24/7 access, real-time alerts, and personalized tools for budgeting and investing. They also prize transparency, simple UX, and fair policies over legacy fine print.

The 2026 landscape: leading neobanks have grown up. Many reached profitability and added lending, investing, and lifestyle services. Incumbent banks are racing to improve their digital game, which means faster innovation and sharper offers for customers. Below is our refreshed list of the top neobanks of 2026 – each showing how modern online banking should work.

1. Chime

Overview: Chime is the U.S. neobank leader, surpassing 20M customers in 2026 and ranking as the country’s largest digital-only bank. It built trust with fee-free banking

Key features: A clean, fast app and customer-first policies. Early direct deposit (often up to two days sooner). SpotMe lets eligible users overdraft to a set limit with no fees – a practical buffer between paychecks. Auto-savings tools (including round-ups) and a secured Credit Builder card to grow credit history. Real-time alerts and simple money tools keep users in control. The focus on simplicity and zero fees has driven loyalty (~9M active users in late 2026) and an IPO filing, underscoring Chime’s momentum in online banking.

2. N26

Overview: Berlin-based N26 is a top European neobank with ~5M active customers (10M sign-ups) in 2026. It posted its first quarterly profit in 2024, proving the model’s durability. With a full German banking license, N26 serves the Eurozone with multilingual apps and local IBANs that suit travelers, expats, and locals.

Key features: Transparent, travel-friendly accounts and a sleek app. Zero foreign transaction fees on card purchases. Powerful budgeting with limits, categories, and Spaces for goal-based saving. Free and premium tiers; Metal adds a metal card, travel insurance, and lounge access. Since 2023: crypto trading, stock investing, and automated savings. In 2026: mobile plans and global eSIMs inside the app. With sign-up caps lifted in Germany and rapid growth (~200k new users/month), N26 offers an all-in-one, personalized digital banking experience.

3. Revolut

Overview: UK-born Revolut has grown into a global fintech super-app with ~65M customers across 48+ countries (2026). Expansion spans Europe, North America, and APAC with a consistent app experience. In 2024, it posted £3.1B revenue and £790M net profit, proving digital-only banks can scale. Some regulatory items remain (e.g., UK banking license), but momentum is clear.

Key features: Multi-currency accounts with interbank FX, instant spend alerts, and low-fee foreign use. Tiered plans

4. Varo

Overview: Varo Bank is the first U.S. consumer fintech with a national banking charter (2020), operating as a fully licensed bank. It targets fair, straightforward banking – no monthly fees, no minimums, no overdraft or foreign fees – and has appeared on the Inc. 5000 four years running.

Key features: High-yield savings with competitive APY. Automatic savings (round-ups, paycheck rules). Varo Advance for small, instant cash needs (typically $100–$250, up to $500 for some) with a simple flat fee. Varo Believe secured card to build credit and a Varo Line of Credit for longer-term borrowing. Extras include free nationwide tax filing (2024), Smart Ledger spending insights, subscription tracking, and bill monitoring. One app, full banking toolkit – built to help paycheck-to-paycheck users gain control and stability.

5. SoFi

Overview: SoFi evolved from student-loan refi to a one-stop digital finance platform. It gained a U.S. bank charter in 2022, now operating SoFi Bank alongside its broker-dealer and lending units. By 2026, it serves ~12.6M customers, making it one of the largest U.S. online banking platforms and the largest online-only lender. Publicly traded (NASDAQ: SOFI), SoFi has grown membership and revenue by bundling a broad product suite into one app.

Key features: No-fee Checking & Savings with high APY and wide ATM reimbursement. Lending across student loan refi, personal loans, mortgages, and auto refi, often with member rate discounts. SoFi Invest offers commission-free stock/ETF trading, fractional shares, and crypto. A cashback credit card ties into a unified rewards program. Members get free financial planning from human advisors. SoFi also runs Banking-as-a-Service via its Galileo platform. The app adds education, community events, and SoFi Relay to track external accounts. Recognitions in 2024 (USA Today, CBS News) for refi and high-yield savings underscore its position as an all-in-one financial wellness hub..

6. Monzo

Overview: Monzo – the UK neobank with the hot-coral card – has 12M+ customers in 2026 (about 22% of UK adults). It’s grown from a simple app current account to a full bank and reported £114M pretax profit in FY2026. Monzo is testing U.S. expansion, but the UK remains its core market, where it often tops customer satisfaction rankings.

Key features: Instant spend notifications. Best-in-class budgeting with categories, alerts, and Pots for goal-based saving and round-ups. Easy bill-splitting via the app. Fee-free spending abroad (within limits) at Mastercard rates. Personal and business accounts – the latter highly rated by SMEs. Credit options: Monzo Flex (BNPL), overdrafts, and personal loans with clear pricing. Paid tiers – Monzo Plus and Monzo Premium – add interest on balances, higher ATM limits, and travel/phone insurance. Community-driven tone and frequent product updates; multiple awards, including “Best Banking App” (2026). A model for modern online banking that’s simple, transparent, and user-led.

7. Cash App

Overview: Cash App (by Block, formerly Square) began as a P2P payments app and, by 2026, has become a full digital banking hub. It’s hugely popular in the U.S., especially with younger and lower-income users. ~57M monthly active users in early 2026. It isn’t a bank, but partners with banks to deliver banking features – effectively a neobank experience.

Key features: Instant P2P payments via $cashtags. Cash Card (Visa debit) for spending and ATM access. Boosts for instant merchant cashback. Direct deposit with early pay. In-app savings. Simple investing in stocks (including fractional) and Bitcoin. Free tax filing via Cash App Taxes. Limited Borrow for small, short-term loans. A clean, fast app ties it all together – money moves instantly inside the Cash App network.

A New Era for Banking

Neobanks signal a lasting shift in how people manage money. Digital-first and highly personalized, the top players of 2026 prove the model with fee-free accounts, real-time insights, and built-in investing and insurance. Intense competition – from challengers and incumbents – keeps pushing faster releases and smarter tools for users.Ready to build or upgrade your digital banking product? Talk to Itexus. We’ll turn your requirements into a clear, compliant roadmap and ship a polished app your customers will trust.