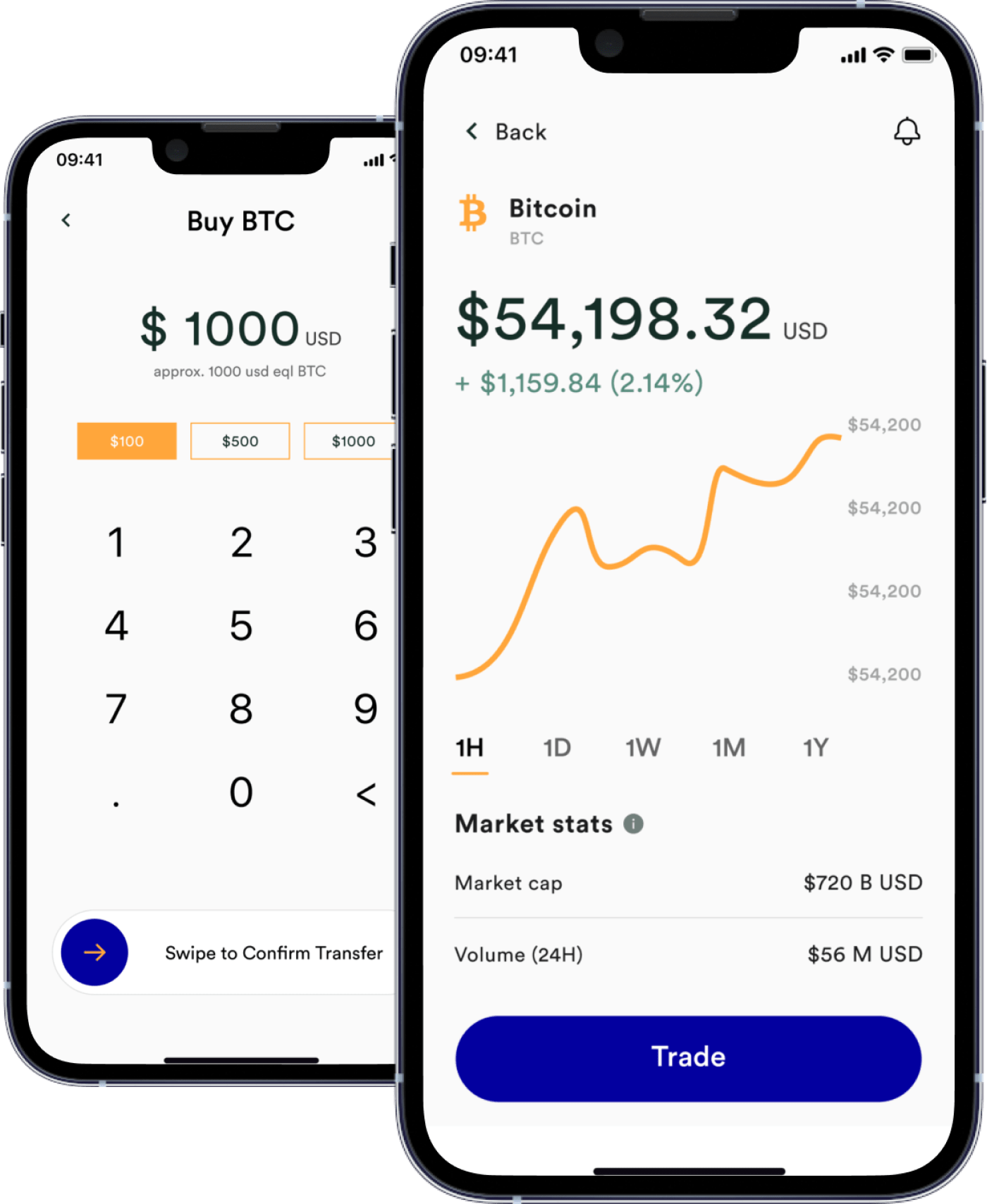

Web application that allows users to increase and diversify their retirement investments with crypto assets and helps to expand knowledge in the cryptocurrencies through educational content.

The U.S. market for transaction processing is entering a scale-first era, where buyers expect real-time rails, five-nines availability, and audit-ready controls. Global data points in the same direction: digital and instant payments keep expanding, and central banks are coordinating to make cross-border settlement faster and safer. For context, see the Bank for International Settlements on retail payments statistics and the global work program to enhance cross-border payments.

Domestically, new and existing rails set the guardrails for any TPS you build. The Federal Reserve’s FedNow Service brings 24/7 instant clearing, alongside the RTP® network from The Clearing House. In simple terms, a transaction processing system is the engine that validates, posts, and records every movement of value with guarantees around atomicity, durability, and traceability—whether you’re planning fintech software development for banking app development, digital wallet development, payment gateway integration, or trading platform development.

Standards and controls shape the build. SWIFT’s ISO 20022 migration pushes richer, structured data that improves posting and reconciliation, while card flows must align with PCI DSS v4.0 and enterprise logging, access, and monitoring typically map to NIST SP 800-53 control families. For product leaders, the takeaway is clear: a credible TPS is not just a database plus a queue—it’s a fault-tolerant, SLA-bound platform with idempotent APIs, deterministic posting, and airtight reconciliation that regulators and auditors can trust.

What a TPS Is—In Practice

A Transaction Processing System (TPS) is the engine behind financial operations. It takes a request, validates inputs, authorizes, posts to the ledger, notifies parties, reconciles totals, and archives the event.

The same frame powers card payments, ACH, RTP/FedNow, internal wallets, and exchange transfers. That is why TPS sits at the core of banking app development, digital wallet development, and trading platform development.

The Full Transaction Cycle

Every transaction crosses seven steps: accept → validate → authorize → post → notify → reconcile → archive.

Input arrives from a mobile or web client. Output is an immutable ledger record and a deterministic status.

Clear stages keep latency predictable and incident triage simple. Business teams see where authorizations fail or why end-of-day reconciliation breaks.

TPS vs. Gateway, Processor, and Core

A payment gateway is the “door” that captures credentials and does first routing. A processor connects to rails and handles clearing.

A core system (bank or broker) is the book of record. TPS sits between them: checks limits and risk, applies posting rules, writes to the general journal, and emits webhooks. In real fintech software development, this is where SLAs live.

Architecture—No Jargon

Outside: an API layer with OAuth2, mTLS, and idempotency keys. Webhooks signal state changes to apps and partners.

Inside: an orchestrator that calls validation, risk, posting rules, and notifications in order. For multi-step flows, use a saga so partial failures roll back safely.

A separate risk module handles KYC/KYB, sanctions, velocity limits, and AML rules. It returns decisions quickly to avoid stretching authorization latency.

At the center: double-entry accounting with an append-only journal. Balances derive from the journal, not from mutable fields. Audits and backdated corrections pass without rewriting history.

Rail connectors handle ACH and wires, cards, RTP/FedNow, and internal wallets. Each connector embeds scheme rules and cutoffs. On top, daily and intraday reconciliation compare your journal to counterparty statements.

Minimal Data Model

An account represents ownership of value. An instrument represents how funds move (card, bank account, wallet, tokenized PAN). The journal stores credit and debit entries. A posting rule maps a business event to accounting movements.

Nothing is deleted. Corrections add new entries. That preserves integrity.

Reliability and Ordering

Idempotency on all write calls stops duplicates. “At least once” delivery with deduplication beats promises of “exactly once.”

Retries back off exponentially. Poison messages go to a dead-letter queue. Schemas evolve with forward-compatible versions. System clocks sync via NTP so event order matches reconciliation order.

What “Good” Performance Looks Like

Buyers ask for numbers. For warm-path authorization, aim for p95 ≤ 150 ms and p99 ≤ 300 ms. Journal writes around p95 ≈ 50 ms.

Plan capacity as peak × 3. For failure modes, design for peak × 1.5. Public API availability should be ≥ 99.95% monthly. For the ledger, use quorum writes and RPO 0.

Security and Compliance

Shrink your PCI DSS v4.0 scope with tokenization and isolated PAN vaults. Encrypt PII with envelope keys (KMS/HSM) and rotate on schedule.

Production access uses short-lived credentials and break-glass procedures. Log admin actions to immutable storage. For ACH, follow return codes and annual rule checks; for instant rails, keep scheme certification current. SOC 2 maps cleanly to NIST 800-53 control families.

Integrations: Open Finance APIs and External Systems

OAuth2 with the FAPI profile provides consent and secure access. Webhooks replace wasteful polling. Rate limits and burst windows protect both sides.

This is essential for payment gateway integration, open finance APIs, and partner flows in banking app development.

Testing That Catches Money Bugs

Posting rules get unit tests; debit-equals-credit gets property tests. Contract tests lock down third-party integrations.

Replay sanitized production traces to spot regressions. Run “chaos drills” for delayed callbacks, duplicate webhooks, and partial outages.

Cost and Delivery Plan

Budget splits across people (payments engineers, SRE, compliance, QA), infrastructure (DB replicas, queues, HSM/KMS, observability), certifications, and third-party fees (processing, BIN sponsor, KYC/KYB, sanctions, disputes).

A realistic path is 90–180 days. Start with SLOs, data model, and posting rules. Ship public API, idempotency, and a minimal ledger. Add refunds, payouts, reconciliation, and your first connector. Finish with parallel run, tuning, audit artifacts, and a controlled cutover.

How TPS Moves Product and P&L

Faster authorizations lift checkout conversion. Clean webhooks cut support tickets. Accurate reconciliation frees finance hours. Adding new flows via API accelerates revenue in fintech app development.

Conclusion

A TPS is not “just middleware.” It is the contract between your product, your ledger, and the outside world. Build it with an immutable journal, strict idempotency, and fast risk decisions. Expose it through stable APIs and honest SLAs. Then measure the outcome: lower chargeback loss, shorter time-to-funds, fewer reconciliation breaks, and higher conversion at checkout.